Equity Can Make Your Move Possible When Affordability Is Tight

Some Highlights

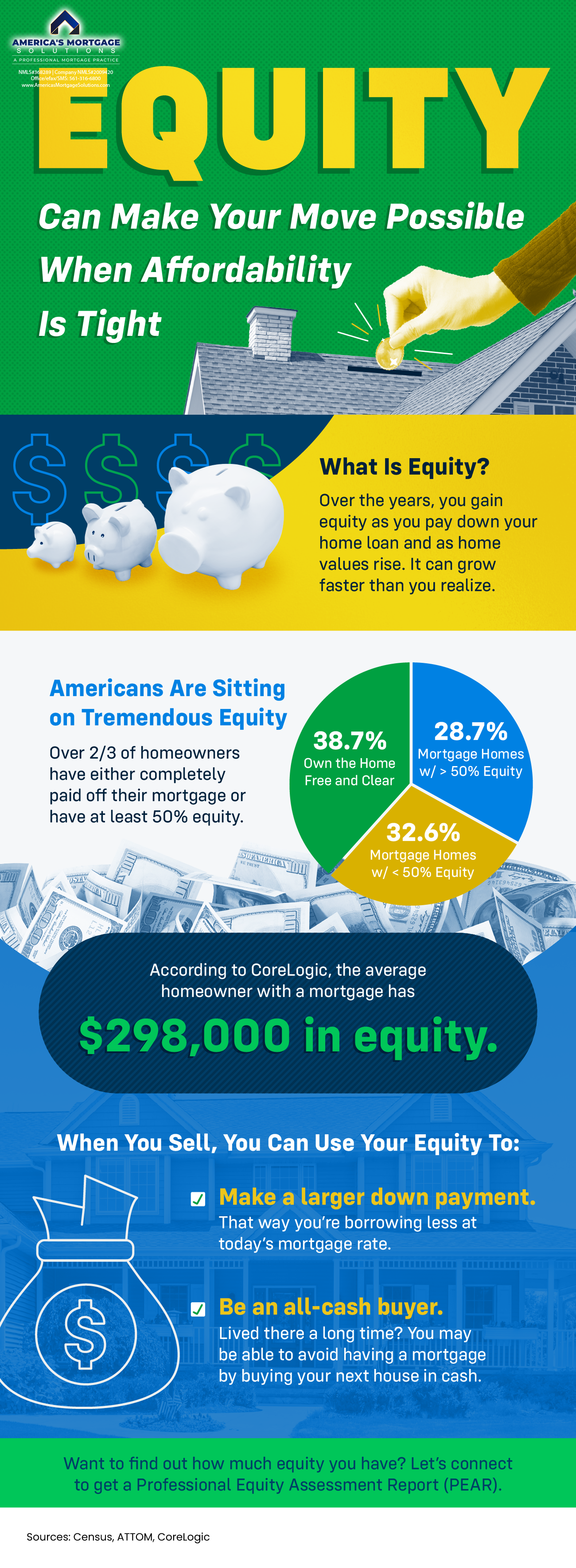

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, let’s connect for a Professional Equity Assessment Report.

Equity Can Make Your Move Possible When Affordability Is Tight

In the dynamic landscape of real estate, the journey from one home to another often involves navigating the intricate pathways of equity. Whether you’re a seasoned Homeowner or a first-time buyer, understanding the power of equity can be the key to unlocking new opportunities, especially when affordability seems to be a challenge.

The Significance of Equity

Equity is the difference between the current market value of your property and the outstanding balance on your mortgage. It’s essentially the portion of your property that you truly own. As you continue to pay down your mortgage or as the value of your property appreciates, your equity grows.

Leveraging Equity for Your Move

When contemplating a move, many individuals focus solely on the down payment required for their next home. However, overlooking the potential of the equity tied up in your current house can be a missed opportunity.

Let’s say you’re eyeing a charming property in West Palm Beach, but the down payment seems daunting. Instead of solely relying on savings or other sources, consider tapping into the equity you’ve built in your current home.

By leveraging your equity, you can potentially increase your down payment for your next home, thereby reducing the amount you need to borrow and possibly even securing better loan terms. This strategy can be particularly beneficial in areas like West Palm Beach, where Affordable West Palm Beach home loans are sought after, and Best mortgage rates in West Palm Beach can make a significant difference in your financial picture.

How Equity Facilitates Your Move

Imagine you’ve lived in your current home in West Palm Beach for several years, diligently paying down your mortgage while the property appreciates in value. Now, as you set your sights on a larger home or a different neighborhood, your equity becomes a powerful asset in making your move a reality.

Selling Your Current House

The first step in unlocking the equity in your current home is to sell it. With the guidance of a reputable West Palm Beach mortgage broker or Local mortgage lenders in West Palm Beach, you can navigate the selling process with confidence.

Once your home sells, the proceeds can be used to pay off your existing mortgage, closing costs, and other expenses associated with the sale. The remaining equity is then yours to utilize for your next move.

Financing Your Next Home

With the equity from your previous home sale in hand, you now have more flexibility when it comes to financing your next home. Whether you’re looking for First time home buyer loans in West Palm Beach or exploring West Palm Beach refinancing options, having a substantial down payment can open doors to a wider range of loan products and terms.

Moreover, working with a knowledgeable Commercial mortgage broker in West Palm Beach can help you access specialized financing solutions tailored to your unique situation. From Mortgage preapproval in West Palm Beach to Property loan advice in West Palm Beach, having expert guidance can streamline the process and ensure you make informed decisions.

Calculating Your Equity

Before diving into the housing market, it’s essential to have a clear understanding of your equity position. Utilizing West Palm Beach mortgage calculators can provide you with valuable insights into your current financial standing and help you estimate the potential equity you can extract from your home.

By crunching the numbers and exploring various scenarios, you can develop a strategic plan for leveraging your equity to facilitate your move. Whether you choose to reinvest it into your next property or use it to bolster your down payment, having a solid grasp of your equity empowers you to make informed decisions.

Conclusion

In the realm of real estate, equity is more than just a financial concept—it’s a powerful tool that can make your move possible, even when affordability seems out of reach. By recognizing the equity in your current home as a valuable asset and leveraging it strategically, you can open doors to new opportunities and achieve your homeownership goals.

Whether you’re a seasoned Homeowner looking to upgrade or a first-time buyer navigating the complexities of the housing market, don’t underestimate the role that equity can play in shaping your journey. With the support of experienced professionals, such as West Palm Beach mortgage brokers and local lenders, you can harness the potential of your equity and embark on the next chapter of your homeownership journey with confidence.

Embracing the Potential of Equity

As you embark on your homeownership journey, it’s important to recognize that equity is not a static asset but rather a dynamic force that evolves over time. By actively managing and maximizing your equity, you can unlock new possibilities and achieve your financial goals.

Strategic Home Improvements

One way to boost your equity is by investing in strategic home improvements that enhance the value of your property. Whether it’s renovating your kitchen, upgrading your bathrooms, or adding curb appeal with landscaping, these improvements can have a direct impact on your home’s market value.

By leveraging the equity in your current home to finance these improvements, you not only increase your property’s worth but also create a more attractive asset when it comes time to sell. This proactive approach to home maintenance and enhancement not only enhances your living experience but also strengthens your financial position in the long run.

Monitoring Market Trends

Another aspect of equity management involves staying attuned to market trends and fluctuations in property values. In dynamic markets like West Palm Beach, where real estate values can vary significantly, keeping a close eye on market indicators can help you make informed decisions about when to buy, sell, or refinance.

Working with a knowledgeable West Palm Beach mortgage broker who understands the local market can provide you with valuable insights and guidance. From identifying emerging neighborhoods to timing your sale for maximum profit, having a trusted advisor by your side can make all the difference in optimizing your equity position.

Diversifying Your Investments

Beyond the realm of real estate, equity can also be leveraged to diversify your investment portfolio and build long-term wealth. Whether it’s investing in stocks, bonds, or other asset classes, tapping into the equity in your home can provide you with the capital needed to explore new investment opportunities.

However, it’s essential to approach investment diversification with caution and seek advice from financial professionals who can help you assess risk and identify suitable opportunities. By striking a balance between real estate equity and other investments, you can create a robust financial strategy that withstands market fluctuations and secures your financial future.

The Future of Equity in Real Estate

As technology continues to reshape the real estate landscape, the role of equity is poised to evolve in new and exciting ways. From blockchain-powered property transactions to innovative financing solutions, advancements in technology hold the potential to democratize access to equity and revolutionize the way we buy, sell, and invest in real estate.

Moreover, as society grapples with pressing issues such as housing affordability and economic inequality, equity stands at the forefront of efforts to create more inclusive and sustainable housing solutions. By harnessing the power of equity to promote homeownership opportunities for all, we can build stronger, more resilient communities where everyone has a stake in the future.

In conclusion, equity is a multifaceted concept that extends far beyond the realm of real estate finance. It’s a powerful tool for building wealth, achieving financial freedom, and creating a more equitable society. Whether you’re a seasoned Homeowner or a first-time buyer, understanding and leveraging your equity can unlock a world of possibilities and pave the way for a brighter future. So, embrace the potential of equity and let it guide you on your journey to homeownership and beyond.

Strategic Home Improvements: Enhancing Property Value

Your home is not just a place of comfort; it’s also a valuable asset. Investing in strategic home improvements can significantly boost the value of your property and, consequently, your equity. Whether it’s modernizing your kitchen, renovating outdated bathrooms, or enhancing curb appeal with landscaping, these enhancements can make your home more appealing to potential buyers and increase its market value.

By leveraging the equity in your current home to fund these improvements, you’re essentially reinvesting in your asset. This proactive approach not only enhances your living experience but also ensures that your property remains competitive in the market when it’s time to sell.

Monitoring Market Trends: Maximizing Opportunities

In the ever-changing landscape of real estate, staying informed about market trends is essential for maximizing the potential of your equity. Markets, especially dynamic ones like West Palm Beach, can experience fluctuations in property values due to various factors such as economic conditions, demographics, and development projects.

Working closely with a knowledgeable West Palm Beach mortgage broker who has a finger on the pulse of the local market can provide invaluable insights and guidance. From identifying emerging neighborhoods with growth potential to strategically timing your sale to capitalize on market trends, having expert advice can help you make informed decisions that optimize your equity position.

Diversifying Your Investments: Building Long-Term Wealth

While real estate is a cornerstone of many investment portfolios, it’s essential to diversify your holdings to mitigate risk and maximize returns. Equity in your home can serve as a valuable source of capital for exploring other investment opportunities beyond the realm of real estate.

Whether it’s investing in stocks, bonds, mutual funds, or starting a business, tapping into your home equity can provide the financial flexibility needed to pursue new ventures. However, it’s crucial to approach investment diversification with caution and seek guidance from financial professionals who can help you assess risk and align your investments with your long-term financial goals.

The Future of Equity in Real Estate: Innovations and Opportunities

As technology continues to reshape the real estate landscape, the role of equity is evolving in unprecedented ways. Advancements such as blockchain technology, fractional ownership platforms, and digital mortgage processes are democratizing access to equity and revolutionizing traditional real estate transactions.

Furthermore, as society grapples with issues of housing affordability and economic inequality, equity is emerging as a focal point for driving positive change. Initiatives aimed at expanding access to homeownership, such as down payment assistance programs and community land trusts, are leveraging equity to create more inclusive and sustainable housing solutions.

In conclusion, equity is not just a financial concept but a dynamic force that shapes the trajectory of your homeownership journey. By embracing the potential of equity and leveraging it strategically through home improvements, market insights, and investment diversification, you can unlock new opportunities and build long-term wealth. So, whether you’re a seasoned Homeowner or a first-time buyer, harness the power of equity and let it guide you on the path to financial success and homeownership fulfillment.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today