How Mortgage Rate Changes Impact Your Homebuying Power

If you’re thinking about buying or selling a home, you’ve probably got mortgage rates on your mind. That’s because you’ve likely heard that mortgage rates impact how much you can afford in your monthly mortgage payment, and you want to factor that into your planning. Here’s what you need to know.

What’s Happening with Mortgage Rates?

Mortgage rates have been trending down recently. While that’s good news for your homebuying plans, it’s important to know that rates can be unpredictable because they’re affected by many factors.

Things like the economy, job market, inflation, and decisions made by the Federal Reserve all play a part. So, even as rates go down, they can still bounce around a bit based on new economic data. As Odeta Kushi, Deputy Chief Economist at First American, says:

“The ongoing deceleration in inflation, coupled with the Federal Reserve’s recent indication of potential rate cuts [in 2024], suggests an environment supportive of modest declines in mortgage rates. Barring any unforeseen circumstances and resurgence in inflation, lowermortgage rates could be on the horizon, but the journey towards them might be slow and bumpy.”

How Do These Changes Affect You?

When mortgage rates change, it affects how much you pay each month for your home loan. Even a small rate change can make a big difference to your monthly bill.

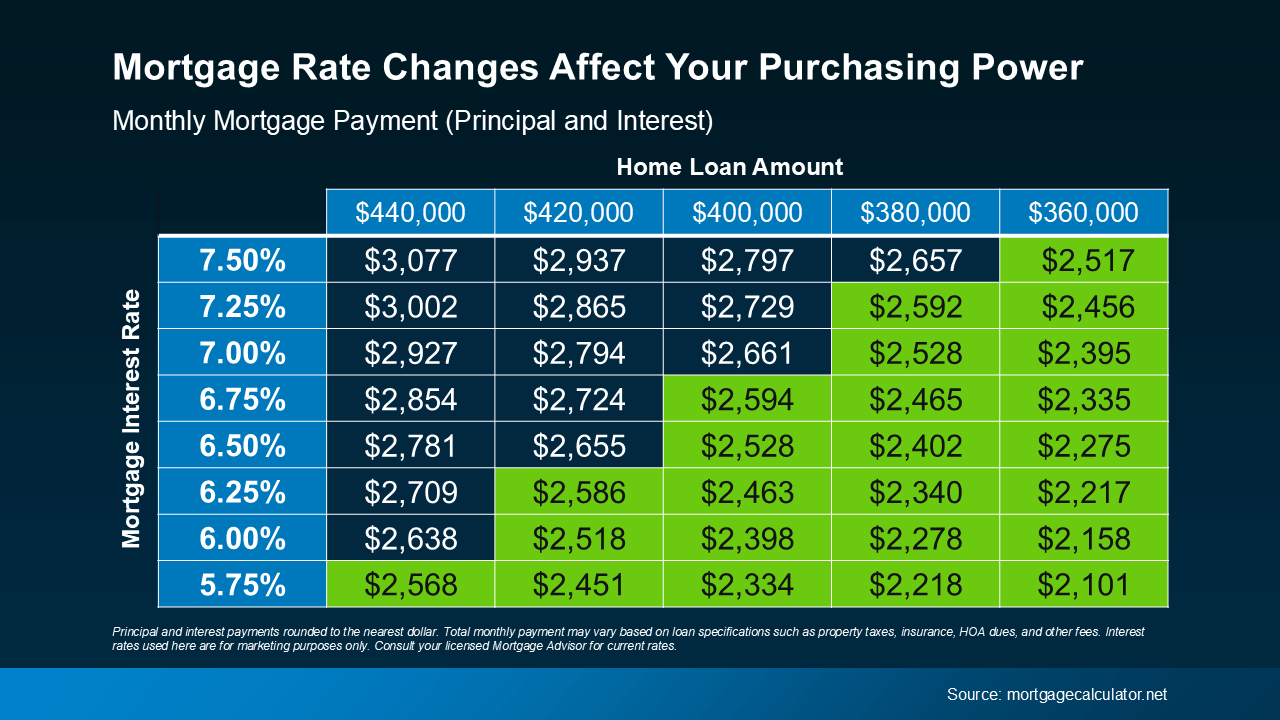

Take a look at the chart below to see how different mortgage rates impact your house payment each month for various loan amounts. Imagine you can afford a monthly payment of $2,600 for your home loan. The green part in the chart shows payments in that range or lower based on varying mortgage rates (see chart below):

Understanding how mortgage rates impact your payment helps you make better decisions.

Understanding how mortgage rates impact your payment helps you make better decisions.

How Can You Keep Track of the Latest on Rates?

Real estate agents have the expertise to help you understand what’s happening and what it means for you. They can provide tools and visuals, like the chart above, to show how rate changes impact your buying power.

You don’t need to be a mortgage expert; you just need a professional by your side. Someone who can help you make sense of the market and guide you through your homebuying or selling journey.

If you have questions about the housing market, let’s connect. That way you’ll understand what’s going on and how to navigate it.

How Mortgage Rate Changes Impact Your Homebuying Power

Understanding the Mortgage Rate Landscape

Buying or selling a home is a significant milestone in anyone’s life. It’s a decision that involves careful planning, budgeting, and keeping up with market trends. One of the most crucial factors influencing your homebuying power is the Mortgage Rate.

Mortgage Rates: A Brief Overview

Mortgage Rates are essentially the interest you pay on a loan used to purchase a home. They fluctuate over time, influenced by various economic factors such as inflation, unemployment, and Federal Reserve policies.

How Mortgage Rate Changes Affect Your Homebuying Power

When Mortgage Rates rise, the cost of borrowing increases. This means that the monthly payment required to service a loan of a given amount also goes up. Conversely, when Mortgage Rates decline, the cost of borrowing decreases, making it more affordable to purchase a home.

The Impact of Rising Mortgage Rates

- Reduced Affordability: As Mortgage Rates rise, the monthly payment for a given loan amount increases. This can make it more challenging for some homebuyers to afford their desired home.

- Increased Competition: When Mortgage Rates rise, homebuyers may become more cautious, leading to reduced demand for homes. This can sometimes result in lower home prices, but it also means increased competition among buyers.

The Impact of Falling Mortgage Rates

- Increased Affordability: When Mortgage Rates fall, the monthly payment for a given loan amount decreases. This can make it more affordable to purchase a home and may encourage more people to enter the housing market.

- Increased Demand: As Mortgage Rates fall, demand for homes often increases, leading to higher home prices. This can make it more challenging for first-time homebuyers to enter the market.

Navigating Mortgage Rate Changes

- Stay Informed: Keep track of Mortgage Rates and economic indicators that can influence them. This will help you make informed decisions about when to buy or sell.

- Consult with a Real Estate Agent: A qualified Real Estate Agent can provide valuable guidance on how Mortgage Rate changes may impact your homebuying or selling journey.

- Consider Refinancing: If you already own a home and Mortgage Rates have fallen significantly, refinancing your existing loan may save you money.

Additional Considerations

- Down Payment: A larger down payment can help you qualify for a lower Mortgage Rate.

- Credit Score: A high credit score can also improve your chances of securing a favorable Mortgage Rate.

- Loan Term: Choosing a longer loan term can result in lower monthly payments but may lead to higher overall interest costs.

Conclusion

Mortgage Rates play a significant role in determining your homebuying power. By understanding how Mortgage Rates fluctuate and how they impact your affordability, you can make more informed decisions about when to buy or sell a home.

If you’re considering buying or selling a home in West Palm Beach, Florida, our team of experienced Real Estate Agents can help you navigate the local market and find the perfect home for your needs. Contact us today to schedule a consultation.

The Impact of Mortgage Rate Changes on West Palm Beach Homebuyers

Understanding the Local Market

West Palm Beach, Florida, is a vibrant and desirable location for homebuyers. The city’s beautiful beaches, thriving economy, and cultural attractions make it a popular choice for both residents and visitors. However, like any real estate market, West Palm Beach is influenced by Mortgage Rates.

The Current Mortgage Rate Landscape in West Palm Beach

To get a sense of the current Mortgage Rate landscape in West Palm Beach, it’s essential to consult with local mortgage lenders or use online resources. These sources can provide you with up-to-date information on prevailing rates and any special offers or promotions that may be available.

Tips for Homebuyers in West Palm Beach

- Shop Around for the Best Rate: Don’t settle for the first Mortgage Rate you encounter. Compare offers from multiple lenders to find the best deal.

- Consider a Pre-Approval: Getting pre-approved for a loan before starting your home search can give you a better idea of what you can afford and make you a more competitive buyer.

- Be Patient: If you’re struggling to find a home within your budget, consider waiting for Mortgage Rates to decline or exploring other options, such as renting or purchasing a less expensive property.

The Role of Real Estate Agents in West Palm Beach

A qualified Real Estate Agent can be invaluable in helping you navigate the West Palm Beach housing market. They can provide expert advice on pricing, negotiation, and the local market trends. Additionally, they can assist you in finding Mortgage Rates that align with your financial goals.

Conclusion

Mortgage Rates play a significant role in influencing homebuying decisions in West Palm Beach. By understanding how Mortgage Rates fluctuate and how they impact your affordability, you can make more informed choices about when to buy or sell a home.

If you’re considering buying or selling a home in West Palm Beach, our team of experienced Real Estate Agents can help you navigate the local market and find the perfect property for your needs. Contact us today to schedule a consultation.

The Impact of Mortgage Rate Changes on West Palm Beach Home Sellers

While Mortgage Rates primarily affect homebuyers, they can also have an indirect impact on home sellers. When Mortgage Rates rise, it can influence the number of potential buyers in the market and, consequently, the demand for homes.

The Effect of Rising Mortgage Rates on Home Sellers

- Reduced Buyer Pool: As Mortgage Rates rise, fewer buyers may be able to afford their desired home. This can lead to a decrease in demand for homes, potentially resulting in longer selling times.

- Price Adjustments: In a competitive market, sellers may need to adjust their asking prices to attract buyers. However, it’s essential to strike a balance between pricing your home competitively and ensuring a fair return on your investment.

Strategies for Sellers in a Rising Mortgage Rate Environment

- Staging Your Home: A well-staged home can make a positive impression on potential buyers and increase its appeal.

- Pricing Strategically: Consult with your Real Estate Agent to determine a competitive yet realistic asking price.

- Consider Incentives: In some cases, offering incentives such as seller concessions or interest rate buy-downs can help attract buyers.

The Effect of Falling Mortgage Rates on Home Sellers

- Increased Demand: When Mortgage Rates fall, it can lead to increased demand for homes, potentially resulting in multiple offers and higher selling prices.

- Faster Sales: In a seller’s market, homes may sell quickly, sometimes even above their asking price.

Strategies for Sellers in a Falling Mortgage Rate Environment

- Act Quickly: If you’re planning to sell your home, it’s often advisable to list it as soon as possible to capitalize on rising demand.

- Negotiate Wisely: Be prepared to negotiate with buyers, but don’t be afraid to hold out for the best offer.

Conclusion

Mortgage Rates can significantly influence the dynamics of the housing market, both for buyers and sellers. By understanding how Mortgage Rates affect demand and pricing, you can make more informed decisions about when to buy or sell a home.

If you’re considering buying or selling a home in West Palm Beach, our team of experienced Real Estate Agents can help you navigate the local market and achieve your real estate goals. Contact us today to schedule a consultation.

The Impact of Mortgage Rate Changes on West Palm Beach Refinancing

For homeowners who already have an existing mortgage, Mortgage Rate changes can also impact their financial situation. Refinancing involves replacing your current mortgage with a new one, often with a different interest rate or term.

When to Consider Refinancing

- Lower Mortgage Rates: If Mortgage Rates have fallen significantly since you obtained your current loan, refinancing can potentially save you money on your monthly payments.

- Improved Credit Score: A higher credit score can qualify you for a lower Mortgage Rate.

- Changing Financial Circumstances: If your financial situation has improved, you may be able to qualify for a larger loan amount or a more favorable interest rate.

Types of Refinancing

- Rate and Term Refinancing: This involves replacing your current mortgage with a new loan at a lower interest rate and possibly a different term.

- Cash-Out Refinancing: This allows you to borrow additional funds against the equity in your home. The extra money can be used for home improvements, debt consolidation, or other purposes.

Factors to Consider When Refinancing

- Closing Costs: Refinancing involves closing costs, which can offset some of the potential savings from a lower interest rate.

- Prepayment Penalties: Some mortgages may have prepayment penalties, which can make refinancing less attractive.

- Loan Term: A longer loan term can result in lower monthly payments but may lead to higher overall interest costs.

Conclusion

Mortgage Rate changes can have a significant impact on both homebuyers and homeowners who already have existing mortgages. By understanding how Mortgage Rates affect your affordability and financial options, you can make more informed decisions about when to buy, sell, or refinance.

If you’re considering buying, selling, or refinancing a home in West Palm Beach, our team of experienced Real Estate Agents can help you navigate the local market and find the best solutions for your needs. Contact us today to schedule a consultation.

The Impact of Mortgage Rate Changes on West Palm Beach Commercial Real Estate

While residential real estate is significantly influenced by Mortgage Rates, commercial real estate is also affected, albeit in slightly different ways. Commercial property owners often use mortgages to finance purchases or renovations.

The Effect of Rising Mortgage Rates on Commercial Real Estate

- Increased Borrowing Costs: Higher Mortgage Rates can increase the cost of borrowing for commercial property owners, potentially reducing their profitability.

- Reduced Demand: When borrowing costs rise, businesses may be less likely to invest in new properties or expand their existing operations. This can lead to reduced demand for commercial real estate.

- Potential for Refinancing Challenges: If a commercial property owner has an existing mortgage with a variable interest rate, rising Mortgage Rates could increase their monthly payments. This may make it difficult to refinance their loan or to cover operating expenses.

The Effect of Falling Mortgage Rates on Commercial Real Estate

- Increased Investment: Lower Mortgage Rates can make it more affordable for businesses to finance property purchases or renovations. This can lead to increased demand for commercial real estate.

- Potential for Refinancing Savings: Commercial property owners with existing mortgages may be able to refinance their loans at a lower interest rate, saving them money on their monthly payments.

Strategies for Commercial Real Estate Investors

- Diversification: Investing in a variety of commercial property types can help mitigate the impact of Mortgage Rate fluctuations.

- Long-Term Perspective: Commercial real estate investments are often considered long-term holdings. Focusing on the long-term value of the property can help you weather short-term market fluctuations.

- Consult with a Commercial Real Estate Agent: A qualified commercial real estate agent can provide expert advice on market trends, financing options, and investment strategies.

Conclusion

Mortgage Rates play a significant role in the commercial real estate market. By understanding how Mortgage Rates affect borrowing costs, demand, and investment opportunities, you can make more informed decisions about your commercial real estate investments.

If you’re considering investing in commercial real estate in West Palm Beach, our team of experienced Real Estate Agents can help you navigate the local market and find the perfect property for your needs. Contact us today to schedule a consultation.

The Impact of Mortgage Rate Changes on West Palm Beach Commercial Real Estate

While residential real estate is significantly influenced by Mortgage Rates, commercial real estate is also affected, albeit in slightly different ways. Commercial property owners often use mortgages to finance purchases or renovations.

The Effect of Rising Mortgage Rates on Commercial Real Estate

- Increased Borrowing Costs: Higher Mortgage Rates can increase the cost of borrowing for commercial property owners, potentially reducing their profitability.

- Reduced Demand: When borrowing costs rise, businesses may be less likely to invest in new properties or expand their existing operations. This can lead to reduced demand for commercial real estate.

- Potential for Refinancing Challenges: If a commercial property owner has an existing mortgage with a variable interest rate, rising Mortgage Rates could increase their monthly payments. This may make it difficult to refinance their loan or to cover operating expenses.

The Effect of Falling Mortgage Rates on Commercial Real Estate

- Increased Investment: Lower Mortgage Rates can make it more affordable for businesses to finance property purchases or renovations. This can lead to increased demand for commercial real estate.

- Potential for Refinancing Savings: Commercial property owners with existing mortgages may be able to refinance their loans at a lower interest rate, saving them money on their monthly payments.

Strategies for Commercial Real Estate Investors

- Diversification: Investing in a variety of commercial property types can help mitigate the impact of Mortgage Rate fluctuations.

- Long-Term Perspective: Commercial real estate investments are often considered long-term holdings. Focusing on the long-term value of the property can help you weather short-term market fluctuations.

- Consult with a Commercial Real Estate Agent: A qualified commercial real estate agent can provide expert advice on market trends, financing options, and investment strategies.

Conclusion

Mortgage Rates play a significant role in the commercial real estate market. By understanding how Mortgage Rates affect borrowing costs, demand, and investment opportunities, you can make more informed decisions about your commercial real estate investments.

If you’re considering investing in commercial real estate in West Palm Beach, our team of experienced Real Estate Agents can help you navigate the local market and find the perfect property for your needs. Contact us today to schedule a consultation.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today