What’s Really Happening with Mortgage Rates?

Are you feeling a bit unsure about what’s really happening with mortgage rates? That might be because you’ve heard someone say they’re coming down. But then you read somewhere else that they’re up again. And that may leave you scratching your head and wondering what’s true.

The simplest answer is: that what you read or hear will vary based on the time frame they’re looking at. Here’s some information that can help clear up the confusion.

Mortgage Rates Are Volatile by Nature

Mortgage rates don’t move in a straight line. There are too many factors at play for that to happen. Instead, rates bounce around because they’re impacted by things like economic conditions, decisions from the Federal Reserve, and so much more. That means they might be up one day and down the next depending on what’s going on in the economy and the world as a whole.

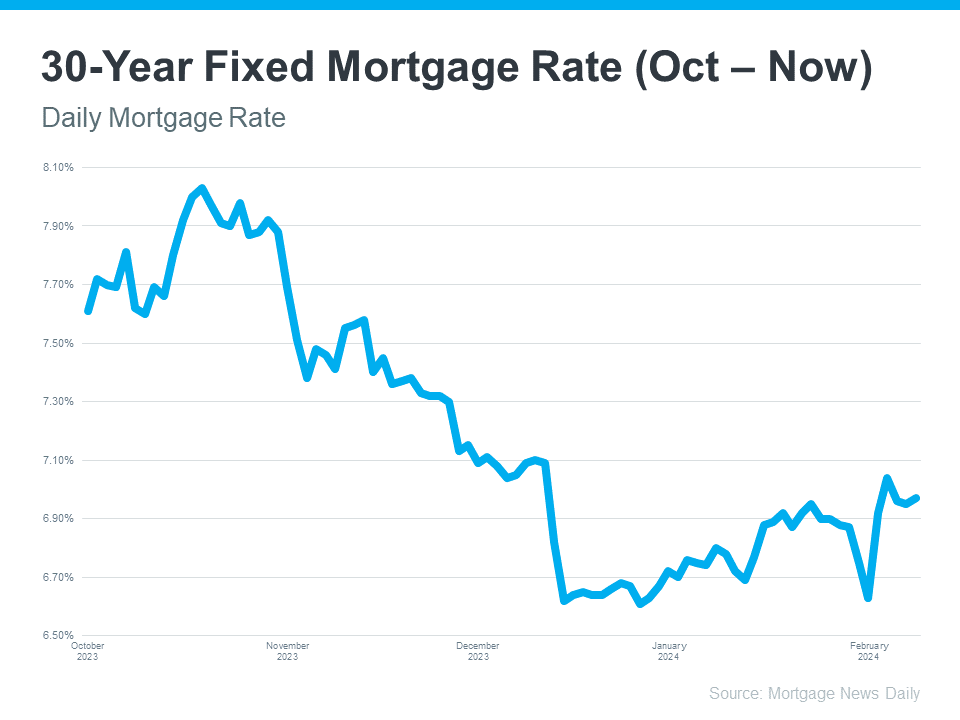

Take a look at the graph below. It uses data from Mortgage News Daily to show the ebbs and flows in the 30-year fixed mortgage rate since last October:

If you look at the graph, you’ll see a lot of peaks and valleys – some bigger than others. And when you use data like this to explain what’s happening, the story can be different based on which two points in the graph you’re comparing.

For example, if you’re only looking at the beginning of this month through now, you may think mortgage rates are on the way back up. But, if you look at the latest data point and compare it to the peak in October, rates have trended down. So, what’s the right way to look at it?

The Big Picture

Mortgage rates are always going to bounce around. It’s just how they work. So, you shouldn’t focus too much on the small, daily changes. Instead, to really understand the overall trend, zoom out and look at the big picture.

When you look at the highest point (October) compared to where rates are now, you can see they’ve come down compared to last year. And if you’re looking to buy a home, this is big news. Don’t let the little blips distract you. The experts agree, overall, that the larger downward trend could continue this year.

Let’s connect if you have any questions about what you’re reading or hearing about the housing market.

Unraveling the Mortgage Rate Mystery: A Deep Dive into the Housing Market

The housing market is an ever-evolving landscape, and for potential homeowners, deciphering the nuances of 30-year fixed mortgage rates can feel akin to navigating a labyrinth of financial intricacies. In this blog post, we embark on a journey to unravel the mystery behind mortgage rates, exploring the factors that influence them and shedding light on what’s truly happening beneath the surface.

The Dance of Mortgage Rates

The Basics of 30-Year Fixed Mortgage Rates

Let’s start by demystifying the cornerstone of many homeownership dreams – the 30-year fixed mortgage rate. This financial term, often tossed around in real estate conversations, refers to the interest rate charged on a 30-year loan with a stable interest rate throughout its term. This stability provides borrowers with a predictable monthly payment, a crucial factor in long-term financial planning.

The 30-year fixed mortgage rate has long been a popular choice among homebuyers due to its balance of affordability and predictability. It acts as a financial anchor in the stormy seas of economic fluctuations, offering a steady ship for those navigating the turbulent waters of real estate.

Peering into the Housing Market Crystal Ball

Now, let’s cast our gaze upon the ever-shifting landscape of the housing market. It’s a realm where demand and supply perform an intricate dance, influencing property values, sales, and, inevitably, mortgage rates.

Recent years have witnessed the housing market swaying like a pendulum, responding to a multitude of factors – from economic shifts to global events. As we delve into the current state of affairs, it’s crucial to recognize that the housing market and mortgage rates share an intricate symbiosis.

Decoding the Factors Influencing Mortgage Rates

Economic Indicators: The Puppet Masters

Picture the 30-year fixed mortgage rate as a marionette, its strings pulled by the puppet masters of economic indicators. These indicators, such as inflation rates, unemployment figures, and GDP growth, cast a shadow that ripples through the financial landscape.

In times of economic prosperity, where the GDP is robust, and unemployment rates are low, the puppet masters smile favorably upon mortgage rates. Lowering rates becomes a strategic move to stimulate the housing market further. Conversely, during economic downturns, the puppet masters may tighten their grip, leading to an upswing in mortgage rates.

Federal Reserve’s Balancing Act

Enter the Federal Reserve, the maestro orchestrating the financial symphony. This influential entity holds the power to conduct interest rates in a ballet that affects everything from credit card APRs to our focal point – 30-year fixed mortgage rates.

The Federal Reserve’s decisions, often shrouded in mystery for the average consumer, have a direct impact on the interest rates offered by lenders. A delicate balancing act is required to foster economic growth while preventing inflationary spirals that could threaten the stability of the housing market.

Global Dynamics: A Ripple Effect

In our interconnected world, global events send ripples that echo through the housing market. Trade tensions, geopolitical crises, or unforeseen global pandemics can stir turbulence, influencing the trajectory of mortgage rates.

Investors, ever watchful for signs of economic shifts, may alter their investment portfolios based on these global dynamics. This, in turn, affects the demand for mortgage-backed securities, a key player in determining 30-year fixed mortgage rates.

The Current Landscape: What’s Really Happening with Mortgage Rates?

A Tug of War Between Inflation and Economic Growth

As we find ourselves in the midst of economic uncertainties, the tug of war between inflation and economic growth plays a pivotal role in shaping mortgage rates. The Federal Reserve, in its bid to curb inflation, may lean towards adjusting interest rates upward.

This move can potentially lead to an uptick in 30-year fixed mortgage rates. However, it’s crucial to note that the Federal Reserve’s actions are a delicate dance, aiming to strike a balance that promotes sustainable economic growth without letting inflation run rampant.

Pandemic Aftermath: An Unprecedented Influence

The echoes of the global pandemic still reverberate through the housing market. The aftermath has created a unique set of circumstances, with governments worldwide implementing fiscal policies to stabilize economies. The impact of these policies intertwines with the dance of mortgage rates.

Historically low-interest rates emerged as a strategy to stimulate economic recovery during the pandemic’s darkest days. As we navigate the post-pandemic era, the question arises: will these low rates persist, or are we on the cusp of a shift that could redefine the landscape of 30-year fixed mortgage rates?

Supply and Demand Dynamics

In the microcosm of the housing market, the principles of supply and demand exert their influence. Low housing inventory and high demand can create a seller’s market, potentially pressuring mortgage rates upwards.

Conversely, an oversupply of homes and weakened demand may lead to a buyer’s market, exerting downward pressure on 30-year fixed mortgage rates. The delicate equilibrium between supply and demand becomes a key determinant in the ever-evolving saga of mortgage rates.

Navigating the Waters: What Homebuyers Should Consider

Seizing Opportunities in a Fluctuating Market

For prospective homebuyers, understanding the dynamics of 30-year fixed mortgage rates becomes paramount. It’s not just about securing a low rate but also about timing – a strategic dance with the ever-changing rhythms of the housing market.

Monitoring economic indicators, staying informed about Federal Reserve decisions, and being attuned to global events can empower homebuyers to make informed decisions. A proactive approach may involve seizing opportunities when mortgage rates dip, aligning with periods of economic downturn or global uncertainties.

Long-Term Perspective: Beyond the Immediate Horizon

While the allure of low 30-year fixed mortgage rates is undeniable, a wise homebuyer looks beyond the immediate horizon. The stability offered by a fixed-rate mortgage provides a financial anchor, shielding homeowners from the unpredictability of interest rate fluctuations.

Consider your long-term financial goals and evaluate whether the current mortgage rates align with your vision. It’s a delicate balance of seizing short-term opportunities while keeping an eye on the enduring stability offered by a fixed-rate mortgage.

In Conclusion: Navigating the Ebb and Flow

In the grand tapestry of the housing market, the narrative of 30-year fixed mortgage rates weaves a story of complexity and fluidity. Economic indicators, the Federal Reserve’s maneuvers, global dynamics, and supply-demand dynamics all contribute to the ever-changing landscape.

As a prospective homeowner, staying informed and embracing a nuanced understanding of these factors empowers you to navigate the ebb and flow of the mortgage rate tide. The dance between stability and opportunity is ongoing, and by mastering the rhythm, you can make informed decisions that resonate with your long-term financial goals.

Disclaimer: The information provided in this blog post is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor for personalized guidance based on your specific circumstances.

Riding the Waves: Strategies for Mortgage Rate Mastery

Embracing Rate Locks: A Shield Against Market Volatility

In the tempest of market fluctuations, homebuyers can deploy a valuable tool known as a rate lock. This strategic move involves securing the 30-year fixed mortgage rate at the current prevailing rate for a specified period, shielding borrowers from potential rate hikes.

Rate locks provide a sense of financial security, allowing homebuyers to navigate the intricacies of the housing market with a predetermined interest rate. However, it’s crucial to time these locks wisely, considering market forecasts and potential shifts in the economic landscape.

The Refinancing Dilemma: Seizing Opportunities Amidst Change

For existing homeowners, the ebb and flow of mortgage rates present a different set of considerations. Refinancing, the act of replacing an existing mortgage with a new one, can be a strategic move to capitalize on lower interest rates.

In a climate where 30-year fixed mortgage rates are on the decline, refinancing can lead to substantial savings over the life of the loan. However, it’s essential to weigh the associated costs and consider your long-term housing plans before diving into the refinancing waters.

The Tech Evolution: Navigating Mortgage Rates in the Digital Age

The landscape of mortgage rates is not immune to the transformative effects of technology. In the digital age, online mortgage lenders and fintech platforms have disrupted traditional lending models, offering streamlined processes and competitive rates.

Homebuyers and refinancers alike can harness the power of technology to compare 30-year fixed mortgage rates from various lenders, gaining access to a broader range of options. However, amidst the convenience of digital platforms, it remains crucial to exercise due diligence and ensure the legitimacy of online lenders.

Regulatory Winds: The Impact of Government Policies

Government policies and regulatory decisions cast a shadow over the housing market and mortgage rates alike. In response to economic shifts or crises, governments may implement measures that directly influence interest rates, aiming to stimulate or stabilize the economy.

As a prudent participant in the real estate landscape, staying informed about policy changes and their potential ramifications on 30-year fixed mortgage rates becomes an integral part of your strategic toolkit.

Weathering the Storm: Financial Preparedness in Uncertain Times

In the ever-changing seascape of the housing market, financial preparedness emerges as a lighthouse guiding homebuyers and homeowners through turbulent waters. Building a robust financial foundation involves not only securing favorable mortgage rates but also crafting a comprehensive budget that accommodates potential rate fluctuations.

Consider establishing an emergency fund to weather unforeseen economic storms. This financial safety net provides a buffer against unexpected expenses, ensuring that you can continue to navigate the housing market with confidence, regardless of external economic winds.

The Horizon Ahead: Forecasting the Future of Mortgage Rates

As we peer into the horizon of the real estate landscape, attempting to forecast the future of 30-year fixed mortgage rates becomes a challenging endeavor. Economic uncertainties, global dynamics, and regulatory influences introduce an element of unpredictability.

Homebuyers and homeowners alike must adopt a flexible mindset, ready to adapt their strategies based on the evolving financial climate. Whether the tide brings lower mortgage rates ripe for refinancing or challenges that necessitate prudent financial planning, a proactive approach remains the compass guiding you through the real estate journey.

Final Thoughts: Mastering the Mortgage Rate Ballet

In conclusion, the intricate dance of 30-year fixed mortgage rates within the broader context of the housing market demands a nuanced understanding and proactive engagement. Economic indicators, the Federal Reserve’s maneuvers, global dynamics, and supply-demand dynamics all contribute to the ever-changing rhythm.

As you navigate the complex currents of real estate, consider this exploration into what’s really happening with mortgage rates as a compass guiding you through the waves. Empower yourself with knowledge, stay attuned to market dynamics, and embrace a long-term perspective that aligns with your financial goals.

In the grand ballet of homeownership, mastering the choreography of 30-year fixed mortgage rates allows you to dance confidently through the twists and turns of the real estate journey. The stage is set, the music is playing – it’s time to step into the spotlight and make informed decisions that resonate with your unique financial narrative.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |