Why There Won’t Be a Recession That Tanks the Housing Market

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.”

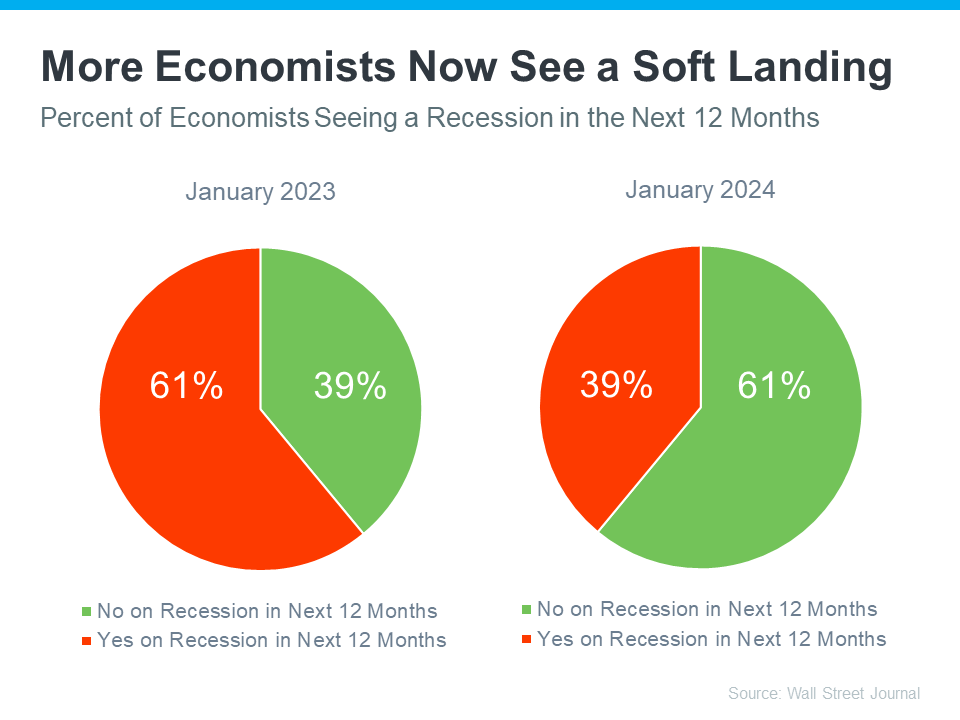

That might be why a recent survey from the Wall Street Journal shows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

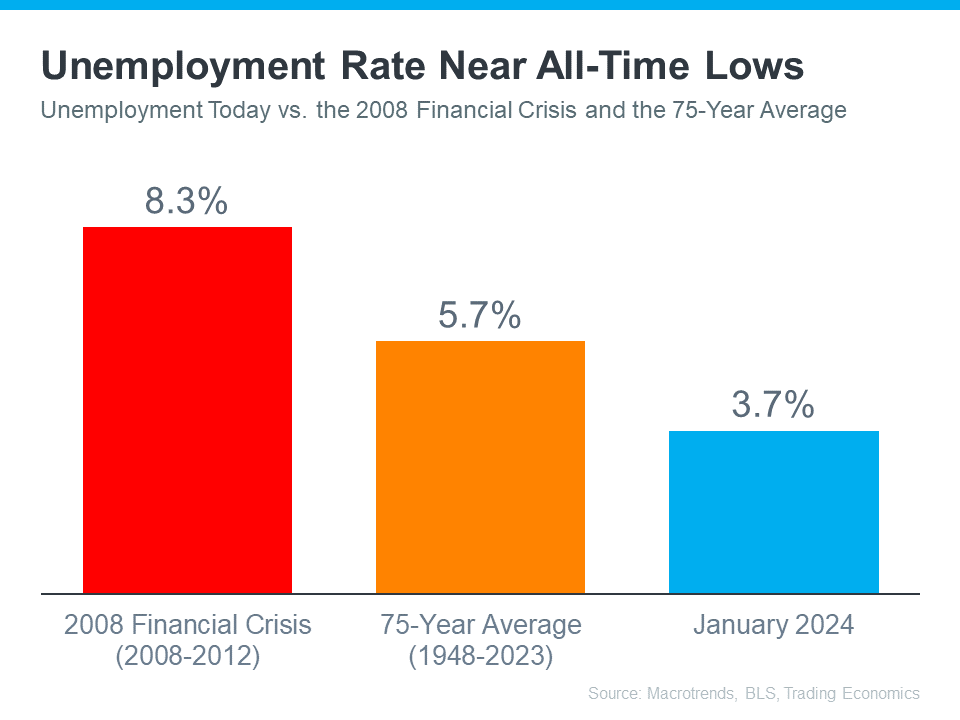

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

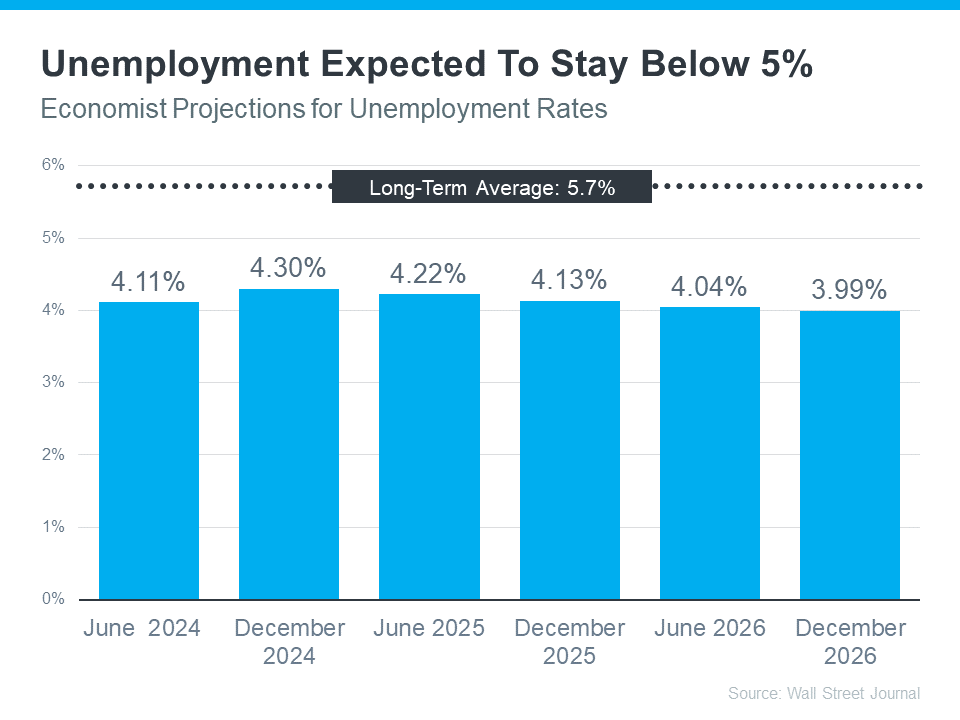

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures that would impact the housing market in a big way.

Bottom Line

Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash.

Why There Won’t Be a Recession That Tanks the Housing Market

In the kaleidoscope of economic forecasts, the specter of a recession looms large, casting shadows of doubt over various sectors. Yet, when it comes to the housing market, particularly in vibrant locales like West Palm Beach, the future looks not just bright but resilient. Why, you might ask, is there a prevailing confidence that the housing market will withstand the tremors of economic downturns? Let’s dive deep, armed with optimism and a treasure trove of data, to uncover the reasons why a recession won’t tank the housing market.

Economic Resilience and Unemployment Rates

One of the key indicators of economic health, the current unemployment rate, remains remarkably low, painting a picture of a robust economy. Contrary to the harbingers of doom, this rate suggests a resilience that bodes well for maintaining consumer spending and confidence – both crucial for a healthy housing market. Historical data corroborates that even when the unemployment rate inches up, it doesn’t directly precipitate a housing crisis.

The West Palm Beach Oasis

Zooming in on West Palm Beach, a tableau of opportunity and growth emerges. Here, Affordable West Palm Beach home loans and the Best mortgage rates in West Palm Beach create an inviting scenario for prospective homeowners. The First time home buyer loans in West Palm Beach are especially attractive, offering a lifeline to those dreaming of owning a piece of this Floridian paradise.

The presence of Local mortgage lenders in West Palm Beach and specialized West Palm Beach mortgage brokers ensures that buyers are not navigating these waters alone. They have allies in the form of Commercial mortgage brokers in West Palm Beach and sources of Property loan advice in West Palm Beach to guide them through the complexities of real estate transactions.

Mortgage Magic: Rates, Pre-approvals, and Refinancing

In an environment where the Mortgage pre-approval in West Palm Beach is a golden ticket, potential buyers gain a clear advantage. This process streamlines their path to homeownership, backed by West Palm Beach mortgage calculators that demystify financial commitments. Furthermore, West Palm Beach refinancing options stand as a testament to the flexibility and resilience of the local housing market, allowing homeowners to adapt to changing economic conditions.

The Predictive Power of the Housing Market

The housing market itself, a dynamic entity, has historically shown an incredible capacity to absorb economic shocks. The current landscape, with its foundation of solid demand and controlled supply, suggests that a cataclysmic downturn akin to the 2008 crisis is unlikely. In West Palm Beach, the allure of coastal living, combined with economic incentives, continues to drive demand.

Forward-looking Indicators

Predictions of a recession in the next year often overlook the forward-looking indicators that signal strength in the housing market. Innovations in financial products, such as those found in West Palm Beach, not only make homeownership more accessible but also more sustainable in the long run.

The Conclusion of Doom?

So, why won’t there be a recession that tanks the housing market? The answer lies in the amalgamation of economic resilience, strategic financial planning, and the inherent strength of locales like West Palm Beach. Here, Affordable West Palm Beach home loans, Best mortgage rates in West Palm Beach, and a robust array of West Palm Beach refinancing options create a buffer against the tempests of economic uncertainty.

In the end, it’s not just about surviving potential recessions but thriving through them. The housing market, with its deep roots in community and personal dreams, stands as a beacon of hope and stability. West Palm Beach exemplifies this spirit, with its blend of beautiful landscapes, economic opportunities, and a support system designed to foster homeownership.

Final Thoughts

As we navigate the uncertainties of the future, the lessons of the past and the innovations of the present offer a roadmap. The Housing Market in West Palm Beach, buoyed by Commercial mortgage brokers, Local mortgage lenders, and an array of First time home buyer loans, remains a shining example of resilience and opportunity.

So, let’s set aside the doomsday predictions and embrace a view of the future where the housing market, particularly in West Palm Beach, continues to flourish. After all, in the heart of Florida’s sunshine, the prospect of homeownership remains not just a dream but a tangible, achievable reality for many.

As we pivot towards a deeper understanding of the symbiotic relationship between the economy and the housing market, it becomes evident that one does not simply operate in isolation from the other. The vitality of the housing market in West Palm Beach is, in many ways, a microcosm of the larger resilience seen across the nation. This resilience is not accidental but a result of strategic foresight, innovative financial products, and a community-centric approach to real estate.

The Role of Innovation and Advice

The real estate sector has always been a bastion of innovation, adapting to changing economic landscapes with remarkable agility. In West Palm Beach, the availability of Property loan advice in West Palm Beach serves as a critical resource for navigating the complexities of the market. This advice, paired with cutting-edge West Palm Beach mortgage calculators, empowers buyers and sellers to make informed decisions.

Building Communities, Not Just Houses

The emphasis on First time home buyer loans in West Palm Beach highlights a commitment to building communities, not just constructing houses. These loans, often coupled with Mortgage pre-approval in West Palm Beach, ensure that the dream of homeownership is accessible to a broader segment of the population. It’s a testament to the belief that a vibrant community is the bedrock of a robust housing market.

Economic Indicators and Market Stability

While the current unemployment rate and predictions of a recession in the next year might stir concerns, it’s essential to consider these indicators in the broader context of market stability. The unemployment rate, though a critical metric, is just one of many factors that influence the housing market’s health. In West Palm Beach, the stability of the housing market is supported by a diversified economy and the availability of Affordable West Palm Beach home loans, which together buffer against economic fluctuations.

A Closer Look at Mortgage Dynamics

The dynamics of mortgages in West Palm Beach, including the Best mortgage rates in West Palm Beach and West Palm Beach refinancing options, reflect a market that is responsive and adaptable. These financial mechanisms allow for the recalibration of loans to meet changing economic conditions, ensuring that homeownership remains sustainable over the long term. The role of the West Palm Beach mortgage broker and Commercial mortgage broker in West Palm Beach cannot be understated in this process, as they guide clients through the maze of options available.

The Forecast: Sunny with a Chance of Growth

Looking ahead, the forecast for the housing market in West Palm Beach, and indeed for much of the country, is overwhelmingly positive. The combination of a solid economic foundation, innovative financing options, and a commitment to community development suggests that fears of a market crash are largely unfounded. Instead, what we see is a housing market ripe with opportunity, supported by Local mortgage lenders in West Palm Beach and an array of financing options designed to make homeownership a reality for many.

Embracing the Future with Confidence

In conclusion, the narrative that a recession will tank the housing market overlooks the nuanced interplay of economic factors, market dynamics, and the human element of community building. West Palm Beach stands as a beacon of what is possible when all these factors align. With Affordable West Palm Beach home loans, First time home buyer loans in West Palm Beach, and a robust support system for homeowners, the city is poised for continued growth and prosperity.

As we look towards the future, let’s do so with confidence, grounded in the knowledge that the housing market, especially in places as dynamic and vibrant as West Palm Beach, is built on a foundation strong enough to weather economic storms. The dream of homeownership, far from being quashed by the specter of a recession, continues to thrive, offering a beacon of hope and stability in uncertain times.

The resilience of the housing market, particularly in West Palm Beach, is not merely a product of economic indicators or financial mechanisms; it’s also about the people and the dreams that animate this vibrant community. The fabric of West Palm Beach is woven with aspirations of homeownership, investment, and growth, underpinned by a robust infrastructure of support and advice. This ecosystem is designed to weather storms, be they economic downturns or shifts in the market dynamics.

Harnessing Technology and Innovation

The digital age has brought with it a plethora of tools and technologies aimed at demystifying the home buying process. West Palm Beach mortgage calculators and online platforms for Mortgage pre-approval in West Palm Beach are prime examples of how technology is making it easier for buyers to navigate the market. These innovations are not just about convenience; they represent a deeper shift towards transparency and empowerment for buyers and sellers alike.

The Power of Education and Empowerment

Education plays a pivotal role in strengthening the housing market. By providing prospective buyers with Property loan advice in West Palm Beach and insights into First time home buyer loans in West Palm Beach, the community is building a knowledgeable base of homeowners. This empowerment goes a long way in ensuring that individuals make decisions that are not just good for them personally but also contribute to the overall health of the housing market.

Sustainable Growth: A Balancing Act

As West Palm Beach continues to attract attention for its Affordable West Palm Beach home loans and desirable living conditions, the question of sustainable growth comes to the fore. Ensuring that development is balanced and inclusive remains a priority. This includes a focus on not just Commercial mortgage brokers in West Palm Beach but also on maintaining a diversity of housing options to cater to a broad spectrum of needs and incomes.

The Role of Community in Real Estate

At its core, the housing market is about more than just transactions; it’s about community building. The relationship between Local mortgage lenders in West Palm Beach and the community exemplifies this dynamic. These lenders, along with West Palm Beach mortgage brokers, play a critical role in helping individuals realize their dreams of homeownership, thereby contributing to the fabric of the community.

Looking Ahead: Optimism Anchored in Reality

The future of the housing market in West Palm Beach is bright, buoyed by a combination of economic resilience, strategic planning, and community support. While the specter of a Recession looms on the horizon, the structures in place provide a formidable defense against the kind of market tanking seen in previous economic downturns.

The dialogue around the Housing Market and potential recession in the next year often misses the nuanced realities of local markets like West Palm Beach. Here, the blend of Best mortgage rates in West Palm Beach, comprehensive support systems, and a community-focused approach offers a model for other markets to emulate.

Final Reflections: The Journey Continues

As we reflect on the reasons why a recession won’t tank the housing market, particularly in places like West Palm Beach, it’s clear that the answer lies in a complex interplay of factors. From Affordable West Palm Beach home loans to the robust network of West Palm Beach refinancing options, the ecosystem is designed for resilience and growth.

But beyond the numbers and the financial products, it’s the human element— the dreams, the aspirations, and the community spirit—that truly fortifies the housing market against potential downturns. West Palm Beach exemplifies this spirit, standing as a testament to what is possible when a community comes together to support its members in pursuit of their dreams of homeownership.

In the end, the story of the housing market in West Palm Beach is one of optimism, resilience, and collective endeavor. It’s a narrative that looks beyond the immediate challenges to the endless possibilities that lie ahead. As we continue on this journey, the lessons learned and the strategies employed in West Palm Beach offer valuable insights for markets nationwide, demonstrating that even in the face of economic uncertainty, the dream of homeownership remains within reach.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |