Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Let’s face it – life can throw some curveballs. Whether it’s a job loss, unexpected bills, or a natural disaster, financial struggles can happen to anyone. But here’s the good news. If you’re a homeowner feeling the squeeze, there’s a lifeline that many people don’t realize is still available: mortgage forbearance.

What Is Mortgage Forbearance?

As Bankrate explains:

“Mortgage forbearance is an option that allows borrowers to pause or lower their mortgage payments while dealing with a short-term crisis, such as a job loss, illness or other financial setback . . . When you can’t afford to pay your mortgage, forbearance gives you a chance to sort out your finances and get back on track.”

A common misconception is that forbearance was only accessible during the COVID-19 pandemic. While it did play a significant role in helping homeowners through that crisis, what many people don’t know is that forbearance is still a tool to support borrowers in times of need. Today, it remains a vital option to help homeowners in certain circumstances avoid delinquency and, ultimately, foreclosure.

The Current State of Mortgage Forbearance

Forbearance continues to serve as a valuable safety net for homeowners facing temporary financial challenges. While the overall rate of forbearance has seen a slight increase recently, it’s important to understand what’s driving this change and how it fits into the broader picture.

According to Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA):

“The overall mortgage forbearance rate increased three basis points in November and has now risen for six consecutive months.”

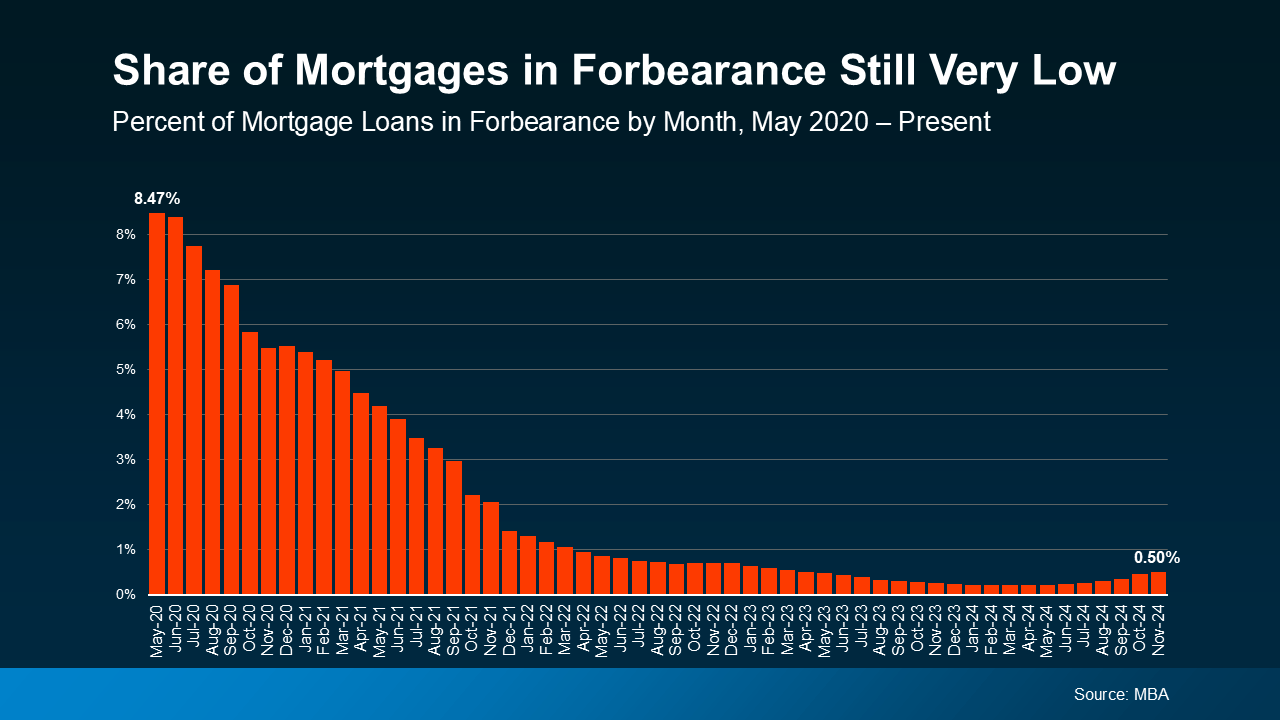

This may seem concerning at first glance, but let’s break it down. The graph below, going all the way back to 2020, puts things into perspective:

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

While the share of mortgages in forbearance has significantly declined since its peak in mid-2020, there has been a slight but notable increase in recent months. This uptick is largely tied to the effects of two recent hurricanes — Helene and Milton.

Natural disasters like these often create temporary financial hardships for homeowners, making forbearance a crucial safety net during recovery. In fact, 46% of borrowers in forbearance today cite natural disasters as the reason for their financial struggles.

Even with the most recent uptick, the share of mortgages in forbearance is nowhere near pandemic levels, and, thankfully, reflects a very small portion of homeowners overall.

Why Forbearance Matters

Forbearance can help borrowers avoid the spiral of missed payments and foreclosure. It provides breathing room to address challenges and plan next steps. And while most homeowners today are not in a position to need forbearance, thanks to strong equity and foundations of the current housing market, it is an option for the few who do need it.

If you or a homeowner you know is facing financial difficulties, the first step is to contact your mortgage lender. They can walk you through the forbearance process and help you understand your options. Keep in mind that forbearance is not automatic — you need to apply and discuss the terms with your lender.

In tough times, knowing your options can bring peace of mind. Forbearance isn’t just a financial tool — it’s a lifeline. And while the recent increase in forbearance rates might make headlines that give you pause, the truth is this option is working exactly as it should: helping those who need it most get through difficult moments without losing their homes.

Mortgage Forbearance: A Helpful Option for Homeowners Facing Challenges

Life has a knack for throwing unexpected challenges our way. From job losses to unforeseen medical bills or even the aftermath of natural disasters, financial hurdles can emerge seemingly overnight. For those who own a home, these challenges can feel even more daunting. When you’re struggling to afford to pay your mortgage, it might feel like there’s no way out. But rest assured, there is a solution designed to help during such tough times: mortgage forbearance.

What Is Mortgage Forbearance?

Mortgage forbearance is a financial lifeline, granting borrowers the ability to pause or reduce their mortgage payments temporarily. This option is especially valuable during short-term crises, such as the loss of a job, a significant illness, or other financial struggles. By offering a reprieve from full payment obligations, it enables homeowners to regroup, reassess their finances, and devise a strategy to move forward.

A common misconception is that mortgage forbearance was only relevant during the COVID-19 pandemic. While it indeed provided critical support during that time, it remains a viable option for homeowners today. In fact, the forbearance process continues to be a valuable safety net for homeowners navigating temporary financial difficulties, shielding them from the threat of foreclosure.

Why Mortgage Forbearance Matters

The primary purpose of mortgage forbearance is to help homeowners avoid falling into a spiral of missed payments and eventual foreclosure. When utilized appropriately, it can serve as a bridge to better days, giving you breathing room to rebuild financial stability. Here’s why it’s so essential:

- It prevents credit score damage that comes with prolonged delinquencies.

- It protects homeowners from losing their homes during periods of short-term crisis.

- It provides time to explore alternative financial options, such as refinancing or assistance programs.

In today’s current housing market, where many homeowners hold strong equity, forbearance offers the chance to safeguard these investments while avoiding financial disaster.

The Current State of Mortgage Forbearance

According to the Mortgage Bankers Association (MBA), the mortgage forbearance rate has seen minor fluctuations over the past year. While the current levels are nowhere near those seen during the height of the COVID-19 pandemic, there has been a slight uptick in recent months. This increase is largely attributed to natural disasters, such as hurricanes Helene and Milton, which created temporary financial hardships for many families.

Currently, 46% of mortgages in forbearance are linked to natural disasters. This statistic underscores the role of mortgage forbearance as a critical safety measure, especially in disaster-prone areas. Beyond natural disasters, economic shifts and unexpected personal crises also contribute to the need for forbearance, making it a versatile tool for managing diverse financial challenges.

How Forbearance Works

The forbearance process is designed to be straightforward yet adaptable to a variety of situations. It typically involves:

- Contacting Your Mortgage Lender: The first step is to reach out to your mortgage lender. Open communication is key to finding a solution tailored to your needs.

- Discussing the Terms With Your Lender: This is where you’ll negotiate the specifics of your forbearance agreement, including the duration and terms of reduced or paused payments.

- Planning for Repayment: Forbearance isn’t debt forgiveness. You’ll need to decide how to address the payments you missed once the forbearance period ends. Options may include lump-sum repayment, spreading the missed payments over time, or modifying the loan terms.

It’s crucial to keep detailed records and stay in close contact with your lender throughout the process to ensure clarity and mutual understanding.

Benefits of Mortgage Forbearance

One of the most significant advantages of mortgage forbearance is its ability to preserve your home while providing time to rebuild your finances. Here are some additional benefits:

- Protection Against Foreclosure: By pausing payments, you reduce the risk of falling into foreclosure.

- Preservation of Equity: Many homeowners today have strong equity in their homes, thanks to the current housing market. Forbearance helps safeguard this equity.

- Flexibility: Whether you need a few months of reduced payments or a complete pause, the forbearance process can be customized to meet your needs.

- Emotional Relief: The peace of mind that comes with knowing you won’t lose your home during a crisis is invaluable.

Mortgage Forbearance and West Palm Beach Homeowners

For those in West Palm Beach, where the housing market is dynamic and competitive, understanding your financial options is crucial. Working with a West Palm Beach mortgage broker can help you navigate the intricacies of mortgage forbearance and explore other options, such as affordable West Palm Beach home loans or West Palm Beach refinancing options.

Additionally, if you’re a first-time homebuyer or exploring opportunities in the local market, tools like West Palm Beach mortgage calculators and expert advice from local mortgage lenders in West Palm Beach can make a world of difference. For businesses, consulting with a commercial mortgage broker in West Palm Beach ensures that you’re making informed decisions tailored to your unique needs.

The availability of property loan advice in West Palm Beach and mortgage preapproval in West Palm Beach can further empower you to make confident, well-informed choices about your financial future.

Practical Steps for Homeowners Facing Financial Challenges

If you’re feeling the financial squeeze, here’s what you can do to safeguard your home:

- Evaluate Your Financial Situation: Take a hard look at your income, expenses, and savings to determine what you can realistically manage.

- Contact Your Mortgage Lender: Proactively reaching out to your mortgage lender is critical. The sooner you communicate, the more options you’ll have.

- Research Local Resources: For those in West Palm Beach, resources like property loan advice in West Palm Beach and mortgage preapproval in West Palm Beach can help you better understand your financial standing.

- Leverage Professional Guidance: Whether it’s a West Palm Beach mortgage broker or a financial advisor, having an expert in your corner can make navigating these challenges far less overwhelming.

- Plan for Recovery: Use the time granted by forbearance to build a solid financial recovery plan, ensuring long-term stability once payments resume.

Dispelling Myths About Forbearance

It’s important to address some common misconceptions about mortgage forbearance:

- Myth 1: Forbearance Means You’re in Financial Ruin: The reality is that forbearance is a proactive measure to manage financial struggles. It’s a tool, not a sign of failure.

- Myth 2: Forbearance Will Ruin Your Credit: While it’s true that forbearance is noted on your credit report, it’s not the same as missing payments outright.

- Myth 3: Forbearance Is Only for Large-scale Crises: While the COVID-19 pandemic highlighted its importance, forbearance is available for a variety of short-term challenges.

- Myth 4: You’ll Owe a Lump Sum Immediately After: Repayment options are often flexible and designed to accommodate your financial situation.

Bottom Line

When financial storms hit, knowing your options can make all the difference. Mortgage forbearance isn’t just a financial tool—it’s a lifeline designed to help homeowners weather temporary hardships. By understanding the forbearance process and taking proactive steps, you can protect your home, your equity, and your future.

Whether you’re a West Palm Beach resident exploring affordable West Palm Beach home loans or seeking the best mortgage rates in West Palm Beach, remember that you’re not alone. The housing market—and the professionals within it—are here to support you every step of the way.

Take action today and empower yourself with the knowledge and resources needed to secure your home and financial well-being.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice