What Is Going on with Mortgage Rates?

You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data. Here’s a quick overview of what’s happening with mortgage rates and what experts say is ahead.

Economic Factors That Impact Mortgage Rates

When it comes to mortgage rates, things like the job market, the pace of inflation, consumer spending, geopolitical uncertainty, and more all have an impact. Another factor at play is the Federal Reserve (the Fed) and its decisions on monetary policy. And that’s what you may be hearing a lot about right now. Here’s why.

The Fed decided to start raising the Federal Funds Rate to try to slow down the economy (and inflation) in early 2022. That rate impacts how much it costs banks to borrow money from each other. It doesn’t determine mortgage rates, but mortgage rates do respond when this happens. And that’s when mortgage rates started to really climb.

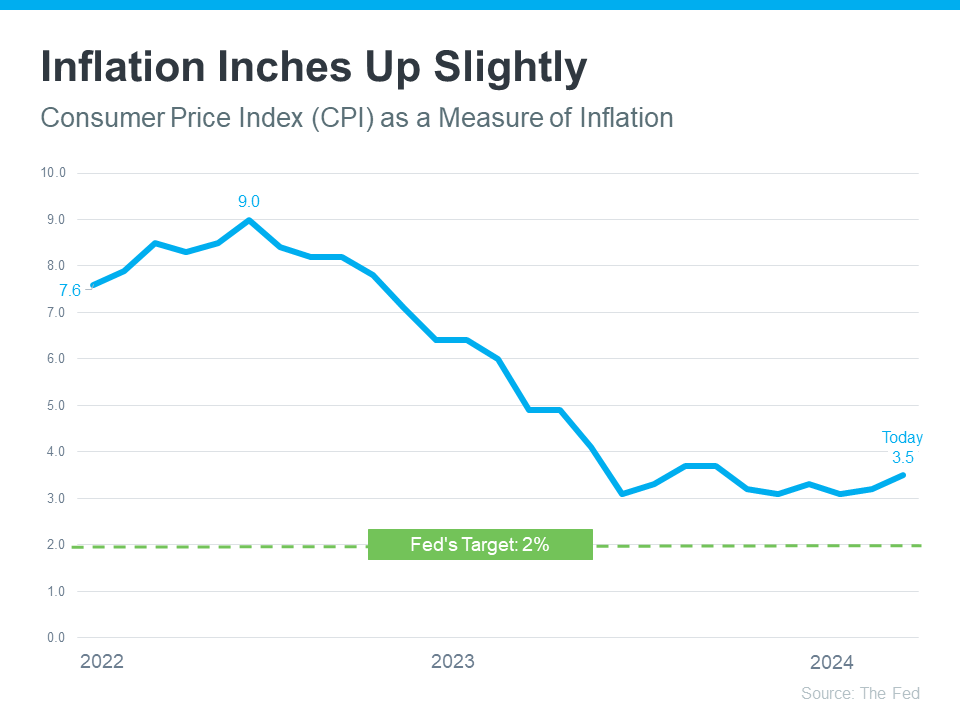

And while there’s been a ton of headway seeing inflation come down since then, it still isn’t back to where the Fed wants it to be (2%). The graph below shows inflation since the spike in early 2022, and where we are now compared to their target rate:

As the graph shows, we’re much closer to their goal of 2% inflation than we were in 2022 – but we’re not there yet. It’s even inched up a hair over the last 3 months – and that’s having an impact on the Fed’s plans. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.”

Basically, long story short, inflation and its impact on the broader economy are going to be key moving forward. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates.inflation, inflation, inflation — that’s really the hub on the wheel.”

When Will Mortgage Rates Come Down?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), said in response to the Federal Open Market Committee (FOMC) decision yesterday:

“The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.”

In the simplest sense, what this says is that mortgage rates should still come down later this year. But timing can shift as new employment and economic data come in, geopolitical uncertainty remains, and more. This is one of the reasons it’s usually not a good strategy to try to time the market. An article in Bankrate gives buyers this advice:

“ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.”

If you have questions about what’s happening in the housing market and what that means for you, let’s connect.

More info: What Is Going on with Mortgage Rates?

If you’re considering buying a house, you’ve probably been keeping a close eye on Mortgage Rates. It’s no secret that they’ve been a hot topic in the Housing Market lately. But what’s really going on? Let’s dive into the current market data and find out.

The Impact of Inflation

One of the key factors affecting mortgage rates is inflation. When inflation rises, the cost of everything goes up, including the interest rates on home loans. However, we’re currently seeing inflation come down, which could lead to more affordable mortgage rates in the future.

The Role of the Federal Funds Rate

The Federal Funds Rate also plays a significant role in determining mortgage rates. This is the interest rate at which banks lend money to each other overnight. When the Federal Reserve raises or lowers this rate, it indirectly affects mortgage rates.

Local Factors: West Palm Beach

If you’re in West Palm Beach, you’re in luck. The West Palm Beach mortgage broker scene is competitive, which means you can find some great deals. Whether you’re looking for Affordable West Palm Beach home loans or the Best mortgage rates in West Palm Beach, there’s a broker out there who can help.

First Time Home Buyer Loans in West Palm Beach

For first-time homebuyers, there are special programs available. First time home buyer loans in West Palm Beach are designed to make it easier for you to get your foot on the property ladder.

Refinancing Options

If you already own a home, you might be considering refinancing. West Palm Beach refinancing options can help you secure a lower interest rate, reduce your monthly payments, or tap into your home’s equity.

Local Mortgage Lenders

There are plenty of Local mortgage lenders in West Palm Beach who can help you navigate the mortgage process. They can provide you with a range of loan options and help you choose the one that’s right for you.

Mortgage Calculators

West Palm Beach mortgage calculators are a great tool for prospective homebuyers. They can help you figure out how much you can afford to borrow, what your monthly payments would be, and how long it would take you to pay off your mortgage.

Property Loan Advice

If you’re feeling overwhelmed by all the options, don’t worry. You can get Property loan advice in West Palm Beach from experienced professionals who can guide you through the process.

Commercial Mortgage Broker

If you’re looking to invest in commercial real estate, a Commercial mortgage broker in West Palm Beach can help. They specialize in loans for commercial properties and can help you find the best rates and terms.

Mortgage Preapproval

Finally, before you start house hunting, it’s a good idea to get a Mortgage preapproval in West Palm Beach. This will show sellers that you’re a serious buyer and can afford to buy their home.

In conclusion, while mortgage rates may seem complicated, understanding the factors that influence them can help you make informed decisions when buying a home. Whether you’re a first-time buyer or looking to refinance, there are plenty of resources available to help you navigate the mortgage landscape.

Understanding Mortgage Rates

Mortgage rates are influenced by a variety of factors, both global and local. On the global scale, economic indicators such as inflation rates and the Federal Funds Rate play a significant role. Locally, competition among lenders, housing market conditions, and even regional economic health can impact rates.

Global Factors

When inflation is high, lenders typically raise mortgage rates to compensate for the decreased purchasing power of the money they’ll be repaid in the future. Conversely, when we’re seeing inflation come down, lenders may lower mortgage rates.

The Federal Funds Rate is another key factor. While it doesn’t directly set mortgage rates, it influences them. When the Federal Reserve raises this rate, borrowing money becomes more expensive for banks, and those costs are often passed on to consumers in the form of higher mortgage rates.

Local Factors

In West Palm Beach, competition among lenders can lead to more favorable mortgage rates. Whether you’re working with a West Palm Beach mortgage broker or directly with a lender, it’s worth shopping around to find the Best mortgage rates in West Palm Beach.

Navigating the Mortgage Landscape

Whether you’re a first-time homebuyer looking for Affordable West Palm Beach home loans or a current homeowner considering your West Palm Beach refinancing options, understanding mortgage rates is crucial.

First-Time Homebuyers

For first-time homebuyers, special programs can make buying a house more affordable. First time home buyer loans in West Palm Beach often have lower down payment requirements and more flexible qualification criteria.

Current Homeowners

If you’re already a homeowner, refinancing could help you secure a lower interest rate or tap into your home’s equity. It’s worth exploring your West Palm Beach refinancing options to see if refinancing makes sense for you.

Tools and Resources

Fortunately, there are plenty of tools and resources available to help you navigate the mortgage landscape. West Palm Beach mortgage calculators can help you figure out how much you can afford to borrow and what your monthly payments might be.

If you need advice, don’t hesitate to reach out to a professional. Whether you need Property loan advice in West Palm Beach or assistance from a Commercial mortgage broker in West Palm Beach, there are experts available to guide you through the process.

The Future of Mortgage Rates

Looking ahead, the future of mortgage rates remains uncertain. However, by keeping an eye on key indicators such as inflation and the Federal Funds Rate, you can gain some insight into potential trends.

Inflation and Mortgage Rates

As we’ve discussed, inflation plays a significant role in determining mortgage rates. If we continue seeing inflation come down, this could lead to lower mortgage rates. However, if inflation begins to rise again, we could see an increase in mortgage rates.

The Federal Funds Rate and Mortgage Rates

The Federal Funds Rate is another key indicator to watch. If the Federal Reserve decides to raise this rate, it could lead to higher mortgage rates. Conversely, if the Federal Reserve lowers the Federal Funds Rate, we could see a decrease in mortgage rates.

Local Considerations: West Palm Beach

On a local level, there are several factors to consider. If you’re working with a West Palm Beach mortgage broker, they can provide you with the most up-to-date information on West Palm Beach refinancing options, First time home buyer loans in West Palm Beach, and the Best mortgage rates in West Palm Beach.

Tools and Resources

Don’t forget to utilize the tools and resources available to you. West Palm Beach mortgage calculators can help you determine how much you can afford to borrow, and Property loan advice in West Palm Beach can guide you through the mortgage process.

The Importance of Mortgage Preapproval

Before you start your home buying journey, it’s crucial to get a Mortgage preapproval in West Palm Beach. This is a letter from a lender that indicates how much they’re willing to loan you. It shows sellers that you’re serious about buying and that you have the financial means to do so.

Why Get Preapproved?

Getting preapproved can give you a competitive edge in the housing market. It shows sellers that you’re a serious buyer, which can make them more likely to accept your offer. Plus, it gives you a clear idea of how much you can afford, so you can focus your home search on properties within your budget.

Working with a Mortgage Broker

A West Palm Beach mortgage broker can be an invaluable resource when navigating the mortgage landscape. They have access to a wide range of lenders and loan products, so they can help you find the best mortgage for your needs.

Benefits of Working with a Broker

Working with a broker can save you time and money. They can compare rates from multiple lenders to ensure you’re getting the best deal. Plus, they can guide you through the application process, making it less stressful and more efficient.

Final Thoughts

Navigating the world of mortgage rates can be complex, but with the right knowledge and resources, you can make informed decisions. Whether you’re a first-time homebuyer or a seasoned homeowner looking to refinance, understanding the current state of mortgage rates and the factors that influence them can help you secure the best possible loan for your situation.

Remember, when it comes to mortgages, knowledge is power. Stay informed, ask questions, and don’t be afraid to seek advice from professionals. With the right approach, you can navigate the mortgage landscape with confidence and secure the home of your dreams. Happy house hunting!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice