How Many Homes Are Investors Actually Buying?

Are big investors really buying up all the homes today?

If you’re trying to find a house to buy, this may be something you’re wondering about. Maybe you’ve read about it or seen reels on social media saying investors buying all the homes is making it even harder to find what the average buyer is looking for. But spoiler alert – there’s a lot of misinformation out there. To clear things up, here’s the scoop on what’s really happening. A lot of the big investor activity is actually in the rearview mirror already.

The Wall Street Journal (WSJ) explains:

“Investors of all sizes spent billions of dollars buying homes during the pandemic. At the 2022 peak, they bought more than one in every four single-family homes sold, though more recently their activity has slowed as interest rates rose and supply became tighter.”

The key here is investor activity has slowed significantly, and even during the peak of investor buying, 3 out of every 4 single-family homes purchased were by regular, everyday buyers – not investors. And of the investors who bought over the past few years, most weren’t the big investors you may be hearing about. The vast majority were small mom-and-pop investors – people like your neighbors who own only a couple of homes, maybe even just their main residence and a vacation home.

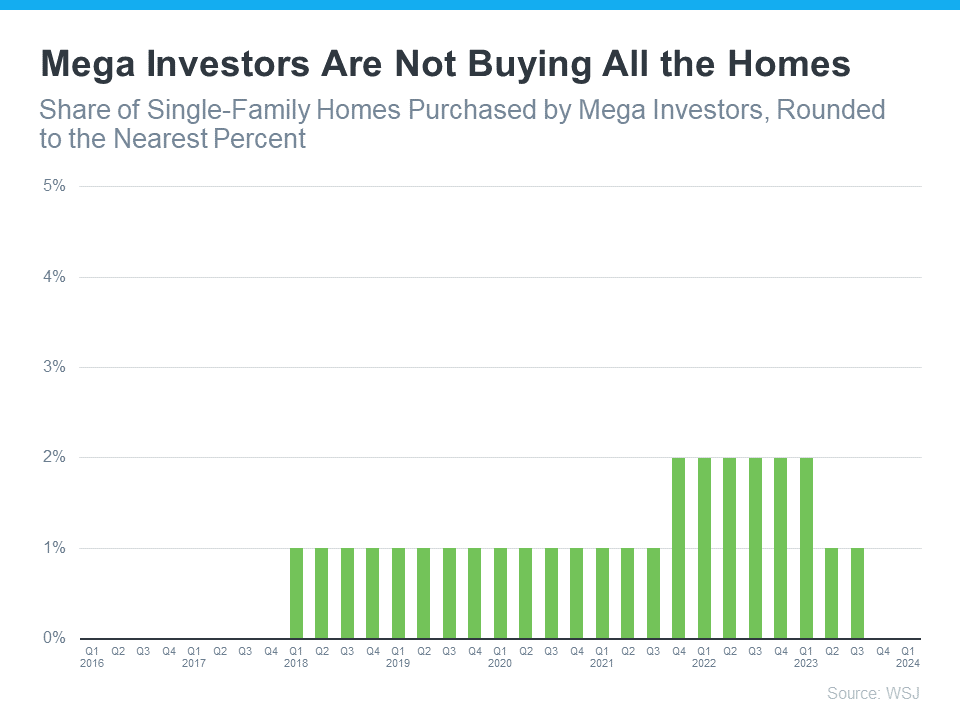

But let’s focus on the giant, mega-investor firms since that’s what is being talked about so frequently on social media right now. Mega investors are those who own 1,000+ properties. You may be surprised to see that, according to the Wall Street Journal, they don’t buy all that many homes (see graph below):

This graph tells us two things. First, institutional investors were never buying a large percentage of available homes. During the peak in 2022, they bought about 2% of available single-family homes. Second, that percentage has gotten even smaller recently (so small the number rounds down to 0%).

In an effort to understand why that percentage is trending down, private lender RCN Capital asked investors about the challenges they’re facing. Here’s what Jeffrey Tesch, CEO of RCN Capital, found out:

“Investors are already facing many challenges in today’s housing market – rising prices, limited inventory, and higher financing costs.”

Understanding these challenges is important because they show big, mega investors aren’t taking over the housing market.

So, don’t fall for everything you hear. They aren’t snatching up all the homes and making it impossible for regular people to buy.

Big investors aren’t buying all the homes out there. If you’ve got questions about what you’re hearing about the housing market, let’s chat. I can help you understand what’s really going on.

The Great Investor Grab? Demystifying Investor Activity in Today’s Housing Market

Ever dreamt of finding your perfect slice of the American pie – a charming single-family home with a white picket fence? Hold on to that dream, but be prepared to navigate the ever-shifting sands of the housing market. Whispers abound of investors buying all the homes, squeezing out everyday folks like you and me. But is this just a rumor, or is there a truth nugget buried beneath the sensational headlines? Let’s grab a metaphorical cup of joe and unpack this together.

Firstly, take a deep breath. While investors are certainly present in the market, the narrative of a complete takeover is a bit overblown. Data from a recent analysis by RCN Capital paints a more nuanced picture. At the 2022 peak, investors did buy a significant chunk – more than one in four single-family homes. However, that still leaves a whopping three out of four homes purchased by traditional, house-hunting heroes like yourself. That’s a good chunk of available homes still up for grabs!

Now, let’s delve deeper. Because within the broad investor category exists a fascinatingly diverse bunch. The big, bad “institutional investors” you might hear about – think Wall Street whales – weren’t actually major players. Even at their peak in 2022, they gobbled up a mere 2% of available single-family homes. And guess what? That number’s shrunk even smaller recently. So, can we finally put the “evil investor” stereotype to bed? Not quite.

Here’s where things get interesting. A different breed of investor has been a more prominent participant: individual investors. These are folks who might own a few rental properties, or perhaps are flipping houses. Their activity has certainly impacted the market, but it’s important to remember that they’re often injecting much-needed liquidity and keeping the wheels of the housing market turning.

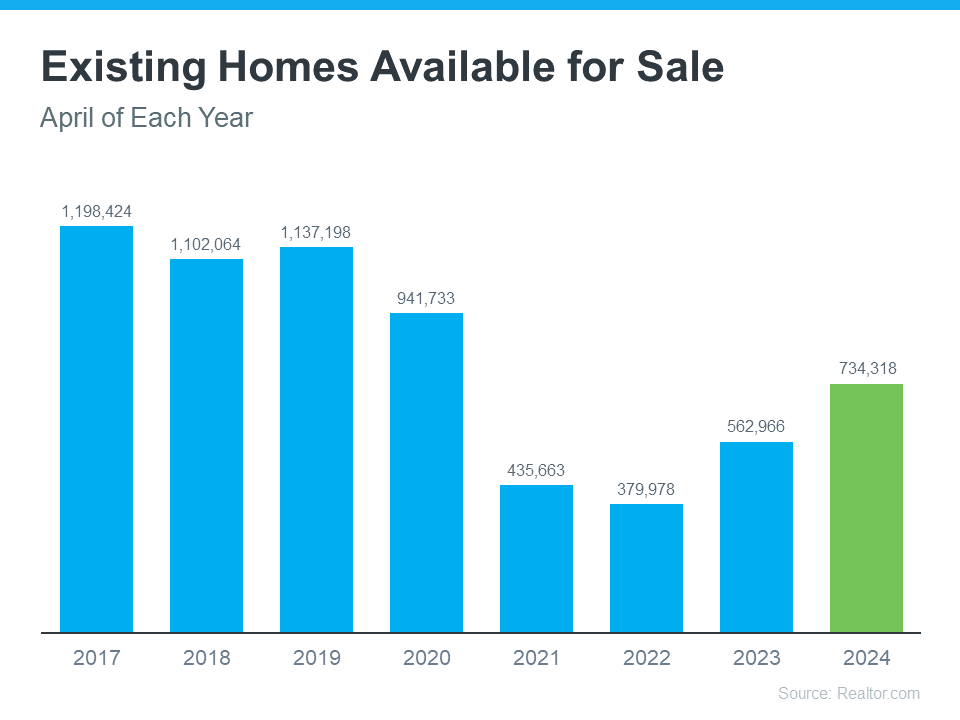

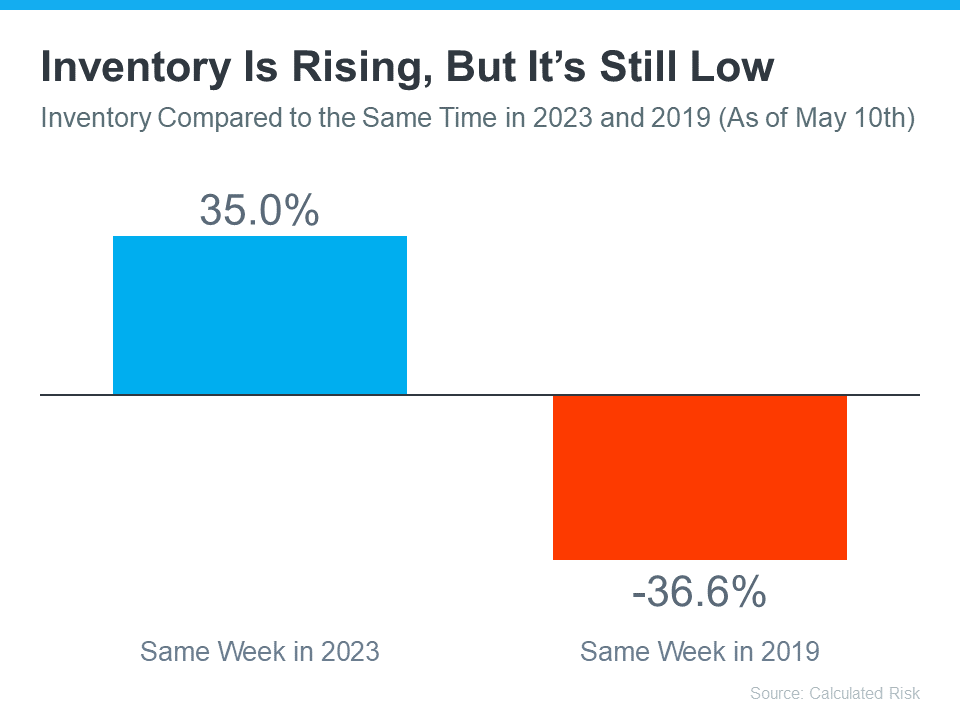

However, the landscape is undoubtedly changing. As of Q4 2022, investor home purchases have dipped a record-breaking 46% year-over-year. Rising interest rates and a tightening available single-family homes inventory have put a damper on their enthusiasm. This shift presents a potential silver lining for aspiring homeowners. With less competition from investors, finding a house to buy might become a tad less nightmarish.

But hold on to your horses. This doesn’t mean the coast is entirely clear. The overall housing market remains competitive, with todays housing market still favoring sellers in many areas. So, what’s a determined homebuyer to do? Here are some battle-tested strategies to help you navigate this dynamic landscape:

- Get Pre-Approved for a Mortgage: This is your knight in shining armor. A pre-approval from a reputable West Palm Beach mortgage broker showcases your financial muscle to sellers and strengthens your offer. Look for companies offering Affordable West Palm Beach home loans and Best mortgage rates in West Palm Beach.

- Team Up with a Stellar Real Estate Agent: Knowledge is power, my friend. A seasoned realtor can guide you through the intricacies of the market, unearth hidden gems, and help you craft winning offers.

- Be Flexible: While having a dream home wish list is fantastic, staying a tad flexible with location, size, or move-in date can open doors to unexpected opportunities.

- Act Quickly: In a fast-paced market, indecisiveness is your enemy. Be prepared to make a swift decision when you find “the one.”

Remember, even in a competitive market, buying a home is an achievable dream. By staying informed, having the right team in your corner, and approaching the search with a strategic mix of determination and flexibility, you’ll be well on your way to finding your perfect piece of paradise.

West Palm Beach Mortgage Helpers:

- First time home buyer loans in West Palm Beach

- West Palm Beach refinancing options

- Local mortgage lenders in West Palm Beach

- West Palm Beach mortgage calculators

- Property loan advice in West Palm Beach (for those considering investment properties)

- Commercial mortgage broker in West Palm Beach (if you’re looking to invest in multi-unit properties)

So, don’t be discouraged by the investor chatter. With the right preparation and a proactive approach, you can conquer the housing market and turn that dream of homeownership into a beautiful reality. Now, go forth and find your perfect haven!

Beyond the Numbers: Understanding the Investor Mindset

Numbers are powerful, but they don’t always tell the whole story. Let’s delve a little deeper and explore the motivations behind investor activity in the housing market.

One driving force is the allure of rental income. Owning single-family homes and renting them out can provide a steady stream of cash flow, particularly in areas with high demand and limited available homes. This can be a particularly attractive option for investors seeking to supplement their income or build a passive income stream for retirement.

Another factor to consider is the potential for property appreciation. Historically, real estate has proven to be a relatively stable and appreciating asset class. Investors may view single-family homes as a hedge against inflation, believing their value will increase over time. This can be especially appealing in a market with low interest rates, where the cost of borrowing money to finance a property is minimal.

However, the investor landscape isn’t a monolith. Here are some distinct investor profiles you might encounter:

-

The Fixer-Upper Flipper: These investors are on the hunt for undervalued properties that require renovations. They’ll breathe new life into the property, then sell it for a profit. While their activity can tighten available single-family homes inventory in the short term, it can also revitalize neighborhoods and bring neglected properties back to life.

-

The Long-Term Landlord: These investors are in it for the marathon, not the sprint. They acquire single-family homes with the intention of holding them for the long term, generating rental income and benefiting from potential appreciation. They often prioritize stable tenants and may be open to longer-term lease agreements.

-

The Accidental Landlord: Life throws curveballs, and sometimes homeowners find themselves in a position where they need to rent out their existing property – maybe due to a job relocation or a change in family circumstances. While not actively seeking investment opportunities, they nonetheless contribute to the rental market.

Understanding these diverse investor motivations can help dispel some of the myths surrounding their presence in the housing market. They’re not all greedy villains snatching up every available property.

Navigating the Evolving Landscape

The good news? The investor frenzy of 2022 seems to be simmering down. Rising interest rates and a tightening inventory have tempered their enthusiasm. This presents an opportunity for aspiring homeowners, but remember, the market remains dynamic. Here are some additional tips to keep you ahead of the curve:

-

Embrace Technology: Many online platforms can streamline your home search. Utilize real estate search engines, mobile apps, and agent websites to stay up-to-date on new listings and get notified when properties that match your criteria hit the market.

-

Consider All Options: While a single-family home might be your ultimate dream, don’t discount other possibilities. Townhomes, condos, and even fixer-uppers (if you’re handy or have a good contractor!) could offer more affordable entry points into the market.

-

Stay Local: Connecting with a West Palm Beach mortgage broker or realtor who has a deep understanding of the local market can be invaluable. They can provide insights into specific neighborhoods, upcoming listings, and potential investor activity in your target area.

Remember, the key is to be prepared, adaptable, and persistent. The housing market might not always be sunshine and rainbows, but with the right approach and a little bit of hustle, you can find your perfect place to call home. Now, go forth and conquer that real estate journey!

Beyond the Buyer vs. Investor Dichotomy: Finding Common Ground

So far, we’ve painted a picture of a housing market populated by two distinct groups: eager homebuyers and cunning investors. But the reality is far more nuanced. There’s a growing trend of collaboration between these seemingly opposing forces, offering a win-win scenario for all parties involved.

Here are some innovative approaches blurring the lines:

-

Lease-to-Own Agreements: This strategy allows aspiring homeowners to “test drive” a property before committing to a full purchase. They enter into a rental agreement with an option to buy at a predetermined price in the future. This can be particularly attractive for first-time buyers who need time to save for a down payment or improve their credit score.

-

Investor-backed Flips: This creative partnership pairs an investor’s financial muscle with a homeowner’s sweat equity. The investor provides the capital to purchase a fixer-upper, while the homeowner takes the lead on renovations. Once the property is revitalized, it’s sold for a profit, with both parties sharing the spoils.

-

Crowdfunding Platforms: These online platforms allow everyday investors to pool their resources to invest in real estate projects. This can be a way for individual investors to participate in the market without the burden of directly managing a property. Additionally, it could open doors for homeowners seeking alternative financing options for renovations or repairs.

These innovative approaches demonstrate that cooperation between buyers and investors can create a more dynamic and inclusive housing market. It’s not always a zero-sum game; there’s potential for mutually beneficial arrangements that cater to diverse needs and financial realities.

The Future of Housing: A Collaborative Ecosystem?

Predicting the future is a tricky business, but here are some educated guesses about where the housing market might be headed:

-

Rise of the Sharing Economy: The concept of shared living arrangements, co-living spaces, and even co-ownership models might gain traction, particularly in high-cost areas. This could provide more affordable housing options for millennials and Gen Z.

-

Technological Advancements: Expect continued innovation in the prop-tech (property technology) space. AI-powered tools might enhance the home search process, while virtual reality tours could provide immersive experiences for long-distance buyers.

-

Focus on Sustainability: As environmental concerns rise, energy-efficient homes and sustainable building practices might become the norm. Investors and developers alike might prioritize properties that cater to this growing demand for eco-conscious living.

The housing market will undoubtedly continue to evolve, but one thing remains constant: the fundamental human desire for a place to call home. By fostering collaboration, embracing innovation, and prioritizing sustainability, we can create a future housing ecosystem that caters to the needs of both buyers and investors, ensuring a healthy and vibrant marketplace for generations to come.

Beyond the Coasts: A Look at Regional Variations

While this discussion has focused on national trends, it’s important to remember the housing market is a mosaic, with significant variations across different regions. Here’s a quick glimpse into how investor activity might differ depending on your location:

-

Sun Belt Boomtowns: Fast-growing areas like Phoenix, Austin, and Orlando have historically attracted a higher concentration of investor activity due to their booming populations and potential for rental income. However, with rising interest rates and a potential cool-down in these markets, investor activity might moderate.

-

Rust Belt Renaissance: Certain cities in the Midwest and Northeast that experienced population decline in the past might see a resurgence of investor interest. These areas often boast a lower cost of entry and potentially higher rental yields, making them attractive for buy-and-hold investors.

-

Coastal Squeeze: Coastal metropolises like Los Angeles, New York City, and Miami have long grappled with limited available single-family homes and high overall housing costs. While investor activity remains a factor, these markets are likely more driven by strong underlying demand and competition among traditional homebuyers.

A Word of Caution: Don’t Demonize Investors Entirely

Remember, investors aren’t a monolithic entity. While some might prioritize quick flips and potentially contribute to rising prices, others play a vital role in the housing ecosystem:

-

Increased Liquidity: Investors can inject much-needed cash flow into the market, especially when traditional lenders are more cautious. This can help keep properties moving and prevent market stagnation.

-

Revitalization Efforts: Investors who purchase distressed properties and renovate them contribute to neighborhood improvement. This can attract new residents and businesses, ultimately increasing property values for everyone.

-

Rental Market Options: Investors who provide rental properties cater to a diverse group of renters, including young professionals, students, and those who aren’t yet ready to buy. This rental stock provides much-needed housing options in areas with limited availability.

The key takeaway? Investors can be a double-edged sword. While their presence can impact available homes and pricing, they also play a role in market stability and offer valuable housing options for renters.

Conclusion: Knowledge is Power in the Housing Market

So, the next time you hear whispers about investors snatching up all the homes, take a deep breath. The reality is more complex. While investor activity is a factor, it’s just one piece of the puzzle. By staying informed about market trends, understanding investor motivations, and adopting a strategic approach, you can navigate the housing market with confidence and increase your chances of finding your dream home.

Remember, the journey to homeownership might have its twists and turns, but with the right knowledge and a proactive approach, you can turn that dream into a beautiful reality. Now, go forth empowered and ready to conquer the exciting world of real estate!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice