Why Did More People Decide To Sell Their Homes Recently?

Homeowners typically slow down their moving plans as the summer months wrap up, and as a result, fewer homes are listed for sale in the fall. It’s a predictable, seasonal trend in real estate. But this year, mortgage rates came down at the same time the number of homes on the market usually starts to decline. So, what happened? More homeowners decided to sell, so more homes came to the market.

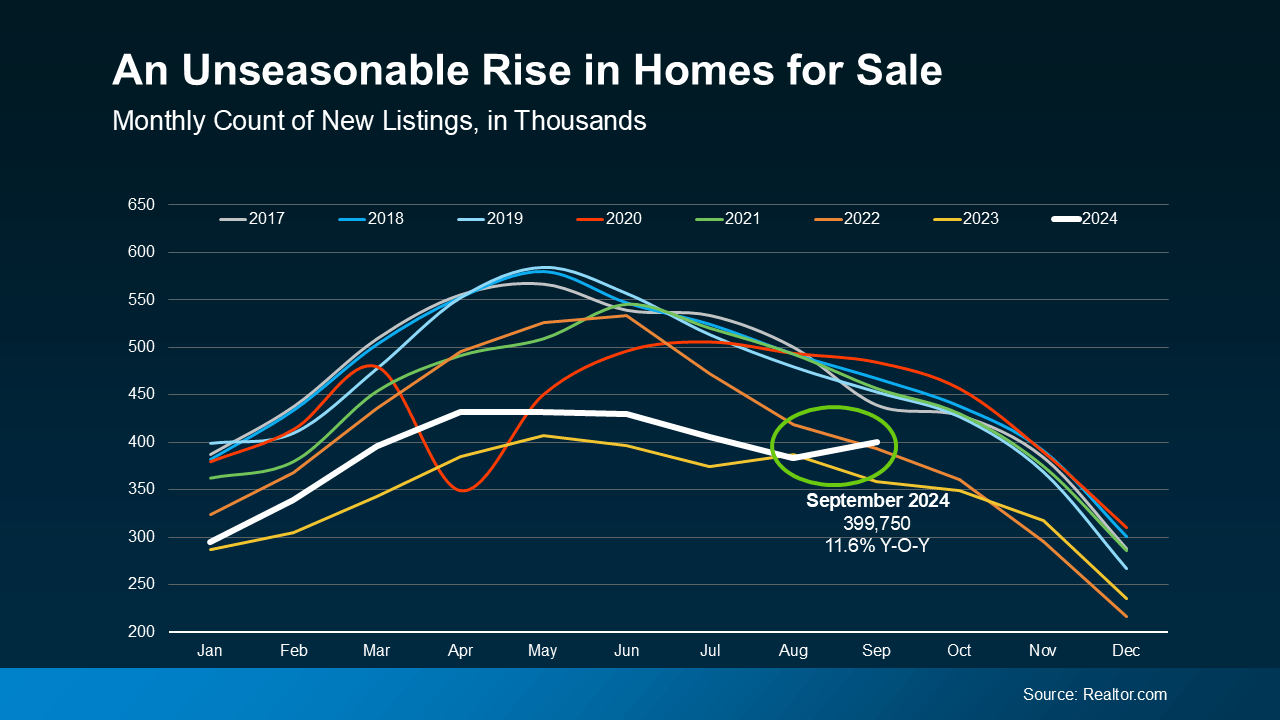

The most recent data from Realtor.com reveals that in September, the number of homes put up for sale increased by 11.6% compared to this time last year.

As the green circle in the graph below shows, the typical September decline in homes coming to the market didn’t happen – that number actually went up (see graph below):

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

Ralph McLaughlin, Senior Economist at Realtor.com, explains why there was an unseasonable rise:

“This sharp increase is largely due to the decline in mortgage rates in mid-August, enticing homeowners to sell.”

So, as rates came down at the end of the summer, more people jumped into the market and decided to make their move.

What Does This Mean If You’re Looking To Buy a Home?

It means more fresh options to choose from than you’ve had in a while – not the ones that have been sitting around, unsold.

But keep in mind, mortgage rates have been volatile lately, ticking up slightly in recent weeks, which could limit the number of people who feel comfortable with the idea of selling in the months ahead. And in this market, it’s mortgage rates that are largely driving homeowner decisions.

Why Buy Now, Rather Than Wait?

Whether you’re looking for a starter home, an upgrade, or hoping to downsize, you have more homes to choose from right now. And if you can find what you’re looking for, know that these new, fresh options won’t be on the market forever. So, staying on top of what’s available in your local area with a trusted agent is key.

And remember, one month doesn’t make a trend. So, what does that mean going forward? Whether more homeowners than normal continue to put their houses on the market will largely depend on what happens with mortgage rates and the economic factors that impact them, like inflation, employment, and the reactions by the Federal Reserve.

With that in mind, now might be your moment, while more homes are available – if you’re ready, willing, and able to buy this fall.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“The rise in inventory – and, more technically, the accompanying months’ supply – implies home buyers are in a much-improved position to find the right home and at more favorable prices.”

As rates came down at the end of the summer, sellers started to trickle back into the market, which means buyers have more choices right now. Let’s connect to make sure you have a trusted advisor to help you navigate the new options before they’re all scooped up.

Why Did More People Decide To Sell Their Homes Recently?

The real estate market has witnessed significant changes recently, and homeowners decided to sell their properties for several compelling reasons. The surge in activity isn’t random but follows shifting economic conditions, personal priorities, and the pursuit of financial opportunities. Whether buyers are looking for a starter home or sellers are capitalizing on favorable trends, understanding why more homes are available helps make sense of the evolving housing landscape. Below, we dive into the core motivations behind why more homes came to the market and explore the factors influencing the increase in houses on the market.

1. Shifting Economic Conditions: The Influence of the Federal Reserve

A pivotal factor in this recent wave of listings is the economic climate. The Federal Reserve plays a central role in shaping borrowing costs, and its decisions around interest rates affect homeowners directly. When the Federal Reserve hikes or lowers rates, it creates ripple effects on mortgage rates—making it either more affordable or more expensive to buy a home. During periods when rates rise, many homeowners see an opportunity to lock in profits by selling before demand wanes. Others may decide to downsize, especially as housing affordability tightens.

Additionally, some homeowners may have secured low-interest mortgages during past rate dips. Now, as they outgrow their homes or relocate, selling allows them to leverage the equity they’ve built to find the right home that suits their evolving needs.

2. Increased Inventory: More Homes To Choose From Right Now

Another reason more homes are available is tied to a loosening of supply constraints. For years, buyers faced an inventory drought, especially in high-demand areas. But as more homes came to the market, buyers suddenly have more homes to choose from right now. This broader selection creates a more favorable environment for both buyers and sellers.

This new trend in real estate encourages activity on both sides—sellers feel motivated to list because homes are listed for sale at attractive price points, while buyers gain confidence that they won’t be locked into bidding wars. Moreover, this dynamic gives first-timers looking for a starter home a much-needed advantage.

3. Personal Priorities Have Changed

The COVID-19 pandemic led to a seismic shift in how people view their homes. The increase in remote work, coupled with changing lifestyle preferences, means that many homeowners decided to sell properties that no longer suit their needs. Some seek larger homes with home offices, while others downsize to simplify life.

For families looking to relocate to warmer climates, West Palm Beach mortgage broker services have become indispensable. These professionals help connect sellers and buyers by providing property loan advice in West Palm Beach and offering insights into the best mortgage rates in West Palm Beach. Sellers relocating to the area often explore affordable West Palm Beach home loans to take advantage of regional opportunities.

4. Unlocking Equity and Seizing Opportunities

Many homeowners are driven by financial goals. After years of rising property values, selling has become a strategic move for those ready to capitalize on built-up equity. These funds can be reinvested into new ventures, additional properties, or retirement savings. For buyers eager to enter the market, working with a trusted agent is key to navigating such dynamic conditions.

In areas like West Palm Beach, where competition remains high, buyers and sellers alike turn to local mortgage lenders in West Palm Beach to secure favorable terms. For those who already own property in the area, West Palm Beach refinancing options provide a way to restructure existing debt. Sellers, in particular, see this as an opportunity to lower payments on new properties they might acquire after the sale.

5. Mortgage Rates Drive Decisions

The ebb and flow of mortgage rates has also impacted how quickly homes are listed for sale. When rates are low, buyers rush to find the right home and lock in affordable financing. But when rates climb, it motivates homeowners to sell before higher borrowing costs dampen demand. Prospective sellers recognize that waiting too long could reduce their chances of fetching top dollar.

First time home buyer loans in West Palm Beach are particularly sensitive to these shifts. Even a small increase in mortgage rates can make a significant difference in monthly payments. That’s why consulting with a West Palm Beach mortgage broker or using West Palm Beach mortgage calculators helps buyers make informed decisions on when to act.

6. Commercial Property Sellers Are Active Too

The increase isn’t limited to residential properties. The commercial sector is experiencing similar trends, with business owners and investors leveraging the services of commercial mortgage broker in West Palm Beach to sell or refinance properties. This movement reflects how economic uncertainty pushes sellers to secure profits and reduce risks.

Similarly, some homeowners who have used their residences for part-time business purposes—like short-term rentals—are now listing their homes as the market shifts. These sellers often need pre-approvals and fast financing, making mortgage preapproval in West Palm Beach a crucial step.

7. The Importance of Having a Trusted Advisor

Selling a home is never just a financial transaction—it’s a deeply personal decision. That’s why having a trusted advisor is essential. Whether someone is relocating, downsizing, or simply cashing out, a trusted agent is key to navigating market complexities. Professional agents understand local nuances and offer invaluable insights into the number of homes on the market, ensuring sellers maximize their returns.

For those targeting properties in Florida, especially West Palm Beach, leveraging connections with West Palm Beach mortgage broker professionals ensures smooth financing. Property loan advice in West Palm Beach can help sellers transition easily, whether they’re upgrading or looking for West Palm Beach refinancing options to reinvest in new opportunities.

Conclusion: The Perfect Storm of Factors

The recent uptick in homes for sale is no accident. A confluence of factors—rising mortgage rates, changing personal priorities, and broader trends in real estate—has spurred homeowners into action. The market now offers more homes to choose from right now, and buyers who find the right home with the help of a trusted agent stand to benefit greatly.

For those eyeing Florida, West Palm Beach mortgage calculators and local mortgage lenders in West Palm Beach can provide tailored solutions to navigate the process. Whether you’re exploring first time home buyer loans in West Palm Beach or consulting a commercial mortgage broker in West Palm Beach, the key to success is preparation. With more homes are available than before, there’s no better time to make bold moves.

Now that more homes came to the market, the real estate landscape is brimming with opportunities. Sellers are seizing the moment, while buyers can rely on tools like West Palm Beach mortgage calculators and insights from a trusted advisor to secure favorable deals. With the right preparation and timing, both buyers and sellers can thrive in this exciting chapter of real estate.

8. The Role of Market Sentiment: Confidence Fuels Listings

In real estate, market sentiment—how optimistic or pessimistic people feel about buying or selling—can influence whether homes are listed for sale. Right now, many homeowners are feeling emboldened by favorable selling conditions. They know that the current number of homes on the market provides them with options for their next move, even if they aren’t staying in their current homes for long.

For sellers, it’s all about reading the moment. With more homes to choose from right now, they feel confident listing their properties, knowing they can easily find the right home to move into. In West Palm Beach, mortgage preapproval in West Palm Beach ensures they can act quickly when they spot an opportunity. Having a trusted advisor to guide them gives them even more confidence that they are making a smart decision in an evolving market.

9. First-Time Buyers Spark New Demand

The recent increase in listings is also partly due to rising demand from younger buyers, especially millennials and Gen Z professionals. Many are now financially ready to buy a home and are actively looking for a starter home. With the help of first time home buyer loans in West Palm Beach, these new entrants are driving sellers to list properties that cater to their budgets and preferences.

Programs offering affordable West Palm Beach home loans are drawing attention, especially as buyers seek ways to offset higher mortgage rates. Sellers who understand this influx of first-time buyers are more willing to list now, knowing there’s pent-up demand waiting to be met. Buyers benefit too, as more homes are available, making it easier to compare options and negotiate better deals.

10. The Influence of Local Lending: West Palm Beach as a Case Study

In regions like West Palm Beach, real estate activity is booming thanks to local lending solutions. Working with a West Palm Beach mortgage broker or exploring local mortgage lenders in West Palm Beach can make all the difference for buyers and sellers alike. Whether they are seeking the best mortgage rates in West Palm Beach or weighing West Palm Beach refinancing options, both parties benefit from financial institutions that understand the nuances of the local market.

Sellers preparing to list properties in West Palm Beach are mindful of the competitive lending environment. Buyers are drawn to mortgage preapproval in West Palm Beach, ensuring smoother transactions. Sellers who coordinate with experienced agents and brokers position themselves to take full advantage of this regional activity.

11. Renovation and Market Timing: A Perfect Match

Many homeowners decided to sell now because they’ve recently completed home renovations. With remodeling projects finished, they see this as the ideal time to maximize profits. Homes with updated kitchens, modern bathrooms, or energy-efficient upgrades appeal to a broader buyer base. As a result, houses on the market that have undergone upgrades tend to attract higher offers, giving sellers even more reason to list their properties.

Buyers love move-in-ready homes, especially if they’ve already secured financing through affordable West Palm Beach home loans. Sellers recognize that offering these upgraded homes during periods when more homes are available helps them stand out among the competition. With more homes to choose from right now, buyers are drawn to listings that require minimal additional work.

12. Moving Towards a Balanced Market

For years, the housing market has heavily favored sellers. However, with more homes came to the market, there are early signs that the market is beginning to balance. As sellers become more realistic about pricing and more homes are listed for sale, buyers have more power to negotiate.

This balance makes it crucial for sellers to have a trusted advisor by their side to navigate these changing conditions. A trusted agent is key to understanding local trends, pricing strategies, and buyer behavior. In competitive areas like West Palm Beach, having property loan advice in West Palm Beach ensures that buyers stay on track with their financial plans. Sellers benefit from this knowledge, too, by knowing how to position their listings to attract serious offers quickly.

13. The Future Outlook: What’s Next for Sellers and Buyers?

With the current trend in real estate shifting, both buyers and sellers need to stay agile. As mortgage rates fluctuate and more homes are available, sellers are keen to act quickly before conditions change again. Buyers, on the other hand, are working closely with local mortgage lenders in West Palm Beach to secure financing before rates climb further.

The near future may also see an increase in refinancing. Sellers who aren’t ready to leave the market altogether are exploring West Palm Beach refinancing options to lower interest rates or extract equity. In a fluctuating market, both refinancing and listing are smart strategies that align with personal financial goals.

Final Thoughts

In summary, the increase in homes on the market reflects a variety of motivations—from changing lifestyle needs to seizing economic opportunities. Homeowners decided to sell because they recognized the value in moving sooner rather than later, especially with mortgage rates on the rise. The presence of more homes to choose from right now has energized buyers and sellers alike, setting the stage for a dynamic real estate season.

In markets like West Palm Beach, working with the right professionals—whether it’s a West Palm Beach mortgage broker, a commercial mortgage broker in West Palm Beach, or a trusted advisor—is critical. Sellers benefit from understanding when and how to list, while buyers gain an edge with the right financial tools. With more homes came to the market, the opportunities are plentiful for those prepared to make the right moves.

For buyers looking for a starter home or sellers navigating new financial ventures, there’s no time like the present. Whether you’re leveraging first time home buyer loans in West Palm Beach or consulting a West Palm Beach mortgage calculator for better rates, the path to success lies in preparation, timing, and strategy. Now is the moment to act—because the perfect home, or the perfect sale, is just around the corner.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice