The First Step: Getting Pre-Approved for a Mortgage

Some Highlights

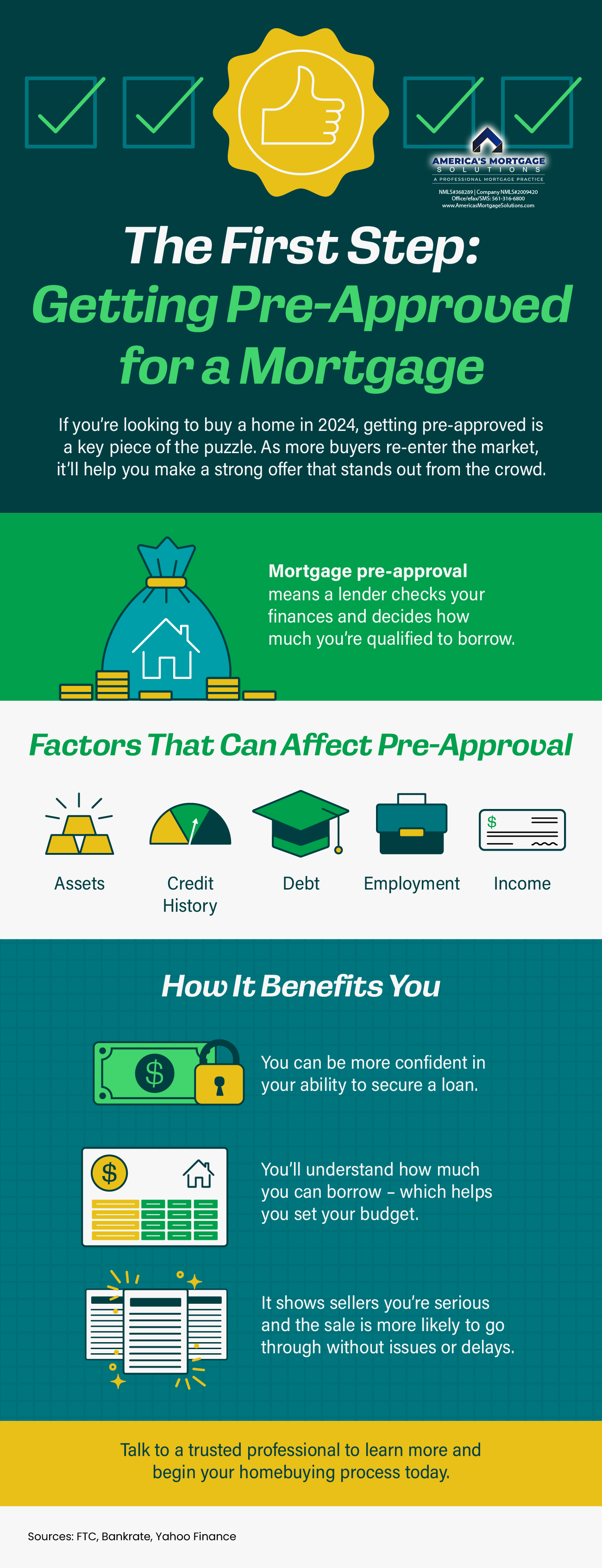

- If you’re looking to buy a home in 2024, getting pre-approved is a key piece of the puzzle. Mortgage pre-approval means a lender checks your finances and decides how much you’re qualified to borrow.

- As more buyers re-enter the market, it’ll help you make a strong offer that stands out from the crowd.

- Talk to a trusted professional to learn more and begin your homebuying process today.

Embarking on the journey to homeownership is akin to setting sail on a grand adventure, where the first and most crucial step is securing the golden key of getting pre-approved for a mortgage. This pivotal move not only charts the course but also steers you through the bustling markets of West Palm Beach, a haven for prospective homeowners. Whether you’re eyeing an affordable West Palm Beach home loan or seeking the best mortgage rates in West Palm Beach, the pre-approval process is your north star, guiding you towards your dream abode.

The Essence of Mortgage Pre-Approval

Imagine stepping into the arena of homebuying with a suit of armor; that’s what mortgage pre-approval gifts you. It’s not merely a step but a leap towards securing your future home. This essential process involves a trusted professional—a lender or a commercial mortgage broker in West Palm Beach—who examines your financial health to determine how much you’re qualified to borrow. This is not just about crunching numbers; it’s about building a bridge between your dreams and reality, ensuring you can confidently stride towards buying that dream home.

Why West Palm Beach Beckons

Nestled in the heart of Florida, West Palm Beach is a mosaic of cultural richness and natural beauty. It’s a place where the sun kisses the ocean, and the real estate market flourishes with opportunities. For those yearning to buy a home in 2024, this locale promises not just a dwelling but a paradise to call your own. From the serene neighborhoods of North Palm Beach to the vibrant streets of downtown, every corner whispers the promise of home.

The Alchemy of Securing the Best Rates

In the quest for an affordable West Palm Beach home loan, the sorcery lies in securing the best mortgage rates in West Palm Beach. This magical element can transform your homebuying journey, making your dream home more accessible. Engage with local mortgage lenders in West Palm Beach or a seasoned West Palm Beach mortgage broker who knows the lay of the land. These navigators can guide you through the tumultuous seas of rates and terms, ensuring you dock at the most favorable shores.

The Compass of Pre-Approval

Setting sail without a compass can lead you astray, and in the voyage of homebuying, getting pre-approved for a mortgage is that compass. This process illuminates your financial standing, showing you how much wind you can put in your sails. It involves a thorough check of your income, debts, and credit score, culminating in a letter that proclaims your buying power. This letter is not just a piece of paper; it’s a beacon that shows sellers you’re serious, ready, and able.

Charting Your Course with a Trusted Professional

The journey to homeownership is fraught with storms and uncertainties. Here, a trusted professional, be it a commercial mortgage broker in West Palm Beach or local mortgage lenders, becomes your lighthouse. These experts, armed with West Palm Beach mortgage calculators and knowledge of West Palm Beach refinancing options, can tailor a loan that fits your voyage perfectly. They’re not just lenders; they’re your co-captains in this journey, ensuring your path is clear and your voyage prosperous.

Navigating the Seas of the Homebuying Process

The homebuying process is an odyssey, filled with myths, legends, and truths. It starts with the golden key of pre-approval and winds through the realms of house hunting, offers, inspections, and closing. Each step is a chapter in your story, leading to the moment when you cross the threshold into your new home. Armed with home buying tips and mortgage tips, you can navigate these waters with grace, understanding that each wave brings you closer to where your heart belongs.

The Beacon for First-Time Homebuyers

For the first time home buyer loans in West Palm Beach, the beacon shines brightly, guiding you through uncharted waters. These loans, designed with you in mind, offer a lifeline, making the impossible seem possible. They come with terms that embrace your needs, offering a haven as you set sail towards homeownership. This is where dreams take flight, supported by the wings of property loan advice in West Palm Beach and the wind of opportunity that blows generously in this vibrant city.

The Final Word: A Lighthouse of Possibilities

As you stand on the brink of this exciting journey, remember that getting pre-approved for a mortgage is more than a step; it’s a declaration of your readiness to embark on the homebuying odyssey. It places you on the map, marking you as a serious contender in the eyes of sellers and real estate aficionados alike. With the golden key of pre-approval in hand, the markets of West Palm Beach await, ready to unfold in a tapestry of opportunities that beckon with open doors and welcoming hearths.

Sailing Through the Mortgage Pre-Approval in West Palm Beach

In the verdant lands of West Palm Beach, where the Atlantic’s breeze mingles with the warmth of Floridian sun, getting pre-approved for a mortgage transforms from a mere transaction into a rite of passage. This isn’t just about verifying financial credentials; it’s a step that intertwines with the fabric of your aspirations, knitting a future where your home isn’t just imagined, but awaited.

Engaging with local mortgage lenders in West Palm Beach or a West Palm Beach mortgage broker equips you with a sextant to navigate the vast oceans of mortgage options. These professionals, versed in the nuances of Florida‘s market, offer a treasure trove of mortgage tips and insights, ensuring your journey is not just successful, but enlightening.

The Treasure Map to Affordable West Palm Beach Home Loans

The quest for affordable West Palm Beach home loans is akin to seeking buried treasure, where knowledge and preparation reveal the X marking the spot. It’s here that the significance of Mortgage pre-approval in West Palm Beach shines brightest, acting as a compass pointing towards the treasures of affordability and feasibility.

This pre-approval process is more than a cursory glance at your finances; it’s a deep dive into your fiscal health, offering a clear view of what treasures lie within your reach. By understanding how much you’re qualified to borrow, you unlock the doors to homes that are not just structures, but sanctuaries that resonate with your heart’s desires.

Navigating the Homebuying Process with Precision

The homebuying process in West Palm Beach unfolds like an intricate dance, where each step, from pre-approval to closing, is choreographed with precision. Armed with the power of pre-approval, you enter this dance floor not as a novice, but as a connoisseur of home buying tips, ready to sway with confidence through the rhythms of negotiations and inspections.

This journey, enriched by the Property loan advice in West Palm Beach, steers you clear of potential pitfalls, turning obstacles into stepping stones. Whether you’re a seasoned navigator or setting sail for the first time, the guidance of a trusted professional ensures your voyage is marked by discovery, not dismay.

The Lighthouse of First-Time Home Buyer Loans in West Palm Beach

For the voyagers embarking on this journey for the first time, First time home buyer loans in West Palm Beach stand as a lighthouse, guiding ships safely to shore. These tailored loans, with their favorable terms and understanding of novice aspirations, illuminate paths previously shrouded in mist, revealing landscapes brimming with potential.

Here, in the embrace of North Palm Beach or the vibrancy of downtown, first-time buyers find not just loans, but lifelines. Supported by mortgage tips and the wisdom of commercial mortgage brokers in West Palm Beach, the dream of homeownership shifts from distant shores to immediate horizons.

The Voyage Beyond: West Palm Beach Refinancing Options

As the tides of life ebb and flow, the journey of homeownership evolves, bringing to light the need for West Palm Beach refinancing options. This facet of the voyage allows homeowners to recalibrate their sails, adjusting to the winds of change with refinancing solutions that reflect current realities and future aspirations.

Whether it’s seizing lower interest rates or altering loan terms, refinancing is a beacon for those navigating the waters of homeownership, ensuring their journey remains both rewarding and sustainable.

In Conclusion: Charting Your Course to Homeownership

As the sun sets on the horizon, casting a golden glow over West Palm Beach, the journey of getting pre-approved for a mortgage stands as the dawn of a new adventure. This initial step, emboldened by the expertise of local mortgage lenders and the strategic acumen of West Palm Beach mortgage brokers, charts a course filled with hope, opportunity, and the promise of a home.

In the heart of Florida, where dreams of homeownership flourish under sunlit skies, the path to securing your future abode is marked by preparation, guidance, and the transformative power of pre-approval. As you embark on this journey, remember that each step, from pre-approval to closing, is a milestone in the grand adventure of life, leading you to the doorstep of a place you can proudly call home.

Embarking on this voyage, the beacon of Mortgage pre-approval in West Palm Beach not only signifies your readiness but also your resilience. In a market as dynamic and diverse as West Palm Beach, this initial step empowers you, granting the clarity and confidence needed to navigate through the myriad of opportunities this splendid locale offers.

The Art of Negotiation: Empowered by Pre-Approval

Armed with your pre-approval, you’re not just a buyer; you’re a formidable participant in the art of negotiation. This empowerment stems from the concrete evidence of your financial diligence, making your offer more appealing to sellers. In the competitive realms of Florida‘s real estate, such leverage is invaluable. It speaks volumes, not just of your intent but of your capability to close the deal. The best mortgage rates in West Palm Beach then become not just a goal, but a reality within grasp, as sellers and agents recognize the seriousness and preparedness you bring to the table.

A Guiding Light: Local Mortgage Lenders and Brokers

In the quest for affordable West Palm Beach home loans, the role of local mortgage lenders in West Palm Beach and brokers morphs into that of a guiding light. These professionals, with their deep understanding of the local market dynamics and financial intricacies, illuminate the path towards finding a loan that fits not just your budget, but your dreams.

Their expertise in navigating the West Palm Beach mortgage calculators and understanding the nuances of West Palm Beach refinancing options offers a beacon of hope and clarity. They demystify the complex terms, translate the jargon, and tailor advice that aligns with your unique situation, ensuring the journey towards homeownership is both informed and insightful.

The Canvas of Homebuying: Painting Your Future

With getting pre-approved for a mortgage, you’re not just ticking a box in the homebuying process; you’re painting the canvas of your future. This pre-approval letter is the palette from which your dreams start taking color, allowing you to envisage the strokes of your life in your new home. Whether it’s a quaint cottage in North Palm Beach or a vibrant townhouse in downtown West Palm Beach, the shades and hues of your future home begin to emerge more vividly with each step you take post-pre-approval.

The Symphony of Homeownership: Harmonized by Pre-Approval

The journey to homeownership is akin to a symphony, where each movement—from pre-approval to closing—plays a critical part in the harmony of the whole. Getting pre-approved for a mortgage is the opening note that sets the tempo, creating a melody that resonates with your aspirations. It harmonizes the various elements of the homebuying process, ensuring that each step, from viewing homes to making an offer, flows with rhythm and purpose.

Anchoring Dreams: The Final Word on Pre-Approval

As the stars twinkle above the serene landscapes of West Palm Beach, reflecting upon the waters that caress its shores, the importance of getting pre-approved for a mortgage shines brighter than ever. It is the anchor that holds fast your dreams of homeownership, amidst the shifting sands of the real estate market.

In this vibrant city, where opportunity and beauty converge, mortgage pre-approval stands as a testament to your commitment to this journey. It opens doors, builds bridges, and lays the foundation upon which your home—not just a structure, but a sanctuary of memories and dreams—will stand.

As you move forward, let the insights of property loan advice in West Palm Beach, the expertise of trusted professionals, and the guiding light of first-time home buyer loans steer you towards the horizon of your dreams. In West Palm Beach, where the future is as bright as its sunlit days, your journey towards homeownership is not just a path but a celebration of aspirations, determination, and the joy of finding a place to call home.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |