What Lower Mortgage Rates Mean for Your Purchasing Power

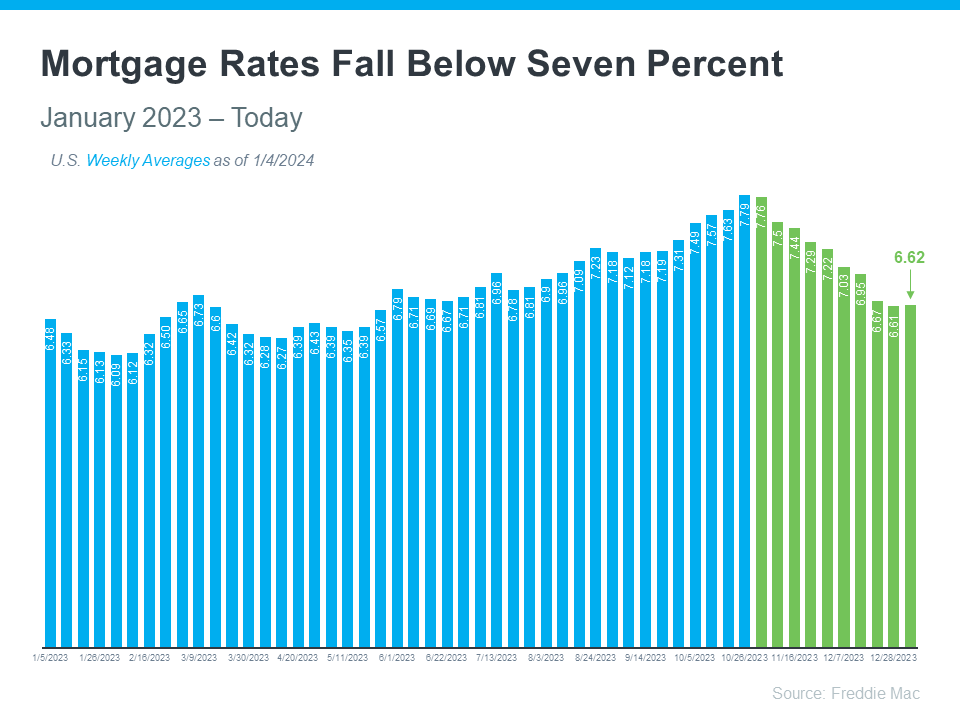

If you want to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Affect Your Search for a Home

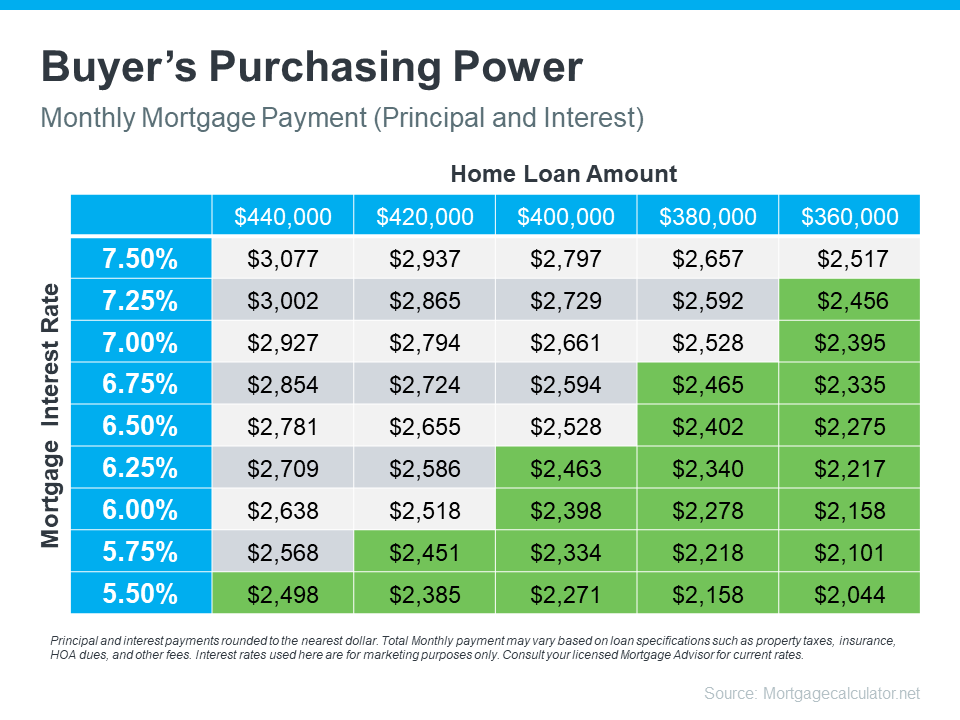

Understanding the connection between mortgage rates and your monthly home payment is crucial for your plans to become a homeowner. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. Imagine your budget allows for a monthly payment between $2,400 and $2,500. The green part in the chart shows payments in that range or lower (see chart below):

As you can see, even small changes in rates can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When you’re looking to buy a home, it’s important to get guidance from a local real estate agent and a trusted lender. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together, then adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

If you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

Unveiling the Power of Lower Mortgage Rates: A Gateway to Homeownership

In the intricate dance of real estate, the rhythm of Mortgage Rates plays a pivotal role, influencing the financial cadence of aspiring homeowners. The ebb and flow of these rates often act as a compass, guiding individuals on their journey to afford a home and metamorphose from dreamer to bona fide homeowner. In this exploration of the housing market symphony, we unravel the nuances of how lower Mortgage Rates can profoundly impact your purchasing power.

The Alchemy of 30-Year Fixed Mortgages

To comprehend the transformative potential of lower Mortgage Rates, let’s first acquaint ourselves with the maestro of home financing – the 30-year fixed mortgages. This financial instrument, akin to a steady ballad, provides borrowers with a fixed interest rate and an extended repayment period, allowing for a harmonious blend of stability and flexibility.

The Art of Becoming a Homeowner

Lower Mortgage Rates act as a benevolent force, extending a welcoming hand to those aspiring to become a homeowner. Picture this: you’ve been eyeing that charming suburban abode, and suddenly, the stars align, and Mortgage Rates take a dip. The alchemy begins. What seemed like a distant dream now sparkles with attainability.

The ability to afford a home is not merely a financial triumph; it’s a significant life milestone. Lower Mortgage Rates effectively broaden the gateway to homeownership, making it accessible to a more extensive spectrum of individuals. As the interest rates decrease, the burden on your financial shoulders lightens, allowing you to stretch your budget further and delve into real estate opportunities that may have seemed elusive before.

Navigating the Landscape: Explore Different Mortgage Options

In this dynamic real estate panorama, it’s crucial to don the explorer’s hat and embark on a quest to explore different mortgage options. Lower Mortgage Rates beckon you to traverse the diverse terrains of fixed-rate mortgages, adjustable-rate mortgages, and other financial landscapes.

Consider the scenario where you’re evaluating mortgage options with the sagacity of a seasoned cartographer. Lower Mortgage Rates can influence your decision-making compass, making previously uncharted territories appear more enticing. It’s not merely about the numbers; it’s about the financial journey itself, and how the rhythm of Mortgage Rates can shape the path you choose.

The Guiding Star: Your Local Real Estate Agent

As you navigate this labyrinth of homeownership aspirations, your North Star could very well be a trusted and knowledgeable local real estate agent. Think of them as the astute navigators who can interpret the celestial map of Mortgage Rates, steering you towards the most opportune moments to set sail into the real estate sea.

Your local real estate agent, armed with insights into the local market, can be a valuable ally in deciphering the impact of Mortgage Rates on your purchasing power. Their expertise transforms complex financial jargon into a conversational melody, helping you make informed decisions that resonate with your homeownership goals.

The Symphony of Savings: Buy a Home Wisely

In the orchestra of real estate, the crescendo of opportunity rises when you decide to buy a home. Lower Mortgage Rates act as a harmonizing force, orchestrating a symphony of savings that resonate long after the ink has dried on the closing documents.

Imagine this scenario: you’ve identified the perfect dwelling, and the allure of lower Mortgage Rates sways you towards sealing the deal. The long and short of it is that your monthly mortgage payments could be considerably more palatable, leaving you with surplus funds to enhance your lifestyle or channel into investments that amplify your financial portfolio.

Unraveling the Threads of Financial Empowerment

The interplay of short and long sentences in this financial narrative mirrors the ebb and flow of the real estate market. In the realm of homeownership, where every word matters, the impact of lower Mortgage Rates reverberates through the nuanced fabric of your financial journey.

It’s not merely about securing a roof over your head; it’s about the empowerment that comes with wise financial decisions. Lower Mortgage Rates act as catalysts, unraveling threads of financial freedom and fortifying your position as a homeowner.

Conclusion: The Overture to Your Homeownership Symphony

In the grand symphony of life, the quest to afford a home and become a homeowner holds a special place. Lower Mortgage Rates emerge as the overture, setting the tone for a harmonious journey into the realm of homeownership. As you explore different mortgage options guided by your trusted local real estate agent, the symphony of savings unfolds, allowing you to buy a home with newfound financial prowess.

So, let the rhythm of lower Mortgage Rates be the melody that accompanies your venture into the world of real estate, turning the pages of your homeownership saga with each dip in interest rates. As the curtains rise on this financial performance, may your purchasing power dance in tandem with the opportune cadence of the market, creating a crescendo of financial empowerment that echoes through the halls of your home.

Navigating the Seas of Opportunity: Riding the Wave of Mortgage Rates

As we delve deeper into the intricate tapestry of homeownership, let’s cast our gaze upon the seas of opportunity that lower Mortgage Rates unfurl. Picture yourself as a savvy sailor, steering the helm towards a brighter financial horizon.

The Financial Tides: Understanding Mortgage Rates

To navigate these seas effectively, it’s essential to comprehend the dynamics of Mortgage Rates. These rates, influenced by economic currents and financial winds, dictate the cost of borrowing. A decrease in these rates translates to a favorable tailwind, propelling you towards your goal to afford a home with greater ease.

As you ride the wave of lower Mortgage Rates, the financial seas become more navigable. Monthly mortgage payments shrink, and the shores of affordability stretch farther, enticing you to explore neighborhoods and properties that may have seemed beyond reach when interest rates were less favorable.

Crafting Your Financial Compass

Crafting a reliable financial compass involves more than just understanding lower Mortgage Rates; it requires a strategic approach to buy a home with prudence and foresight. Think of this as a financial quest where each decision shapes the contours of your homeownership journey.

Consider the various mortgage options as waypoints on your expedition. Fixed-rate mortgages, with their stable interest rates, may be your steadfast allies in the face of market fluctuations. On the other hand, adjustable-rate mortgages, akin to nimble sailors adjusting to changing winds, offer flexibility that aligns with your risk tolerance.

The Symphony of Affordability: Mortgage Rates in Action

As we spotlight the tangible impact of lower Mortgage Rates on affordability, imagine the scenario where a 1% decrease in interest rates transforms your financial landscape. The monthly mortgage payment on a $300,000 home could see a significant reduction, putting hard-earned dollars back into your pocket.

This symphony of affordability is not merely about numbers; it’s about the real-world possibilities that lower Mortgage Rates unlock. The ability to allocate saved funds towards home improvements, investments, or even that dream vacation amplifies the resonance of your financial symphony.

Embracing Financial Resilience: A Homeownership Overture

As the overture to homeownership unfolds, the theme of financial resilience emerges as a leitmotif. Lower Mortgage Rates are not just transient notes in this symphony; they represent a crescendo of financial empowerment and resilience.

Building Equity: The Heartbeat of Homeownership

Beyond the immediate savings on monthly payments, lower Mortgage Rates contribute to the accumulation of home equity. Each mortgage payment becomes a building block, increasing your stake in your property. This equity, a testament to your financial prudence, can be leveraged for future investments, renovations, or as a safety net in times of need.

A Tapestry Woven with Opportunity

In this tapestry woven with opportunity, the interplay of short and long sentences mirrors the rhythmic fluctuations of the financial markets. Lower Mortgage Rates are the unseen hands shaping the fabric of your homeownership narrative, infusing it with threads of opportunity and financial well-being.

A Harmonious Finale: Your Homeownership Symphony

As we approach the finale of this homeownership symphony, the echoes of lower Mortgage Rates reverberate through the corridors of financial empowerment. Your journey to become a homeowner is not merely a transaction; it’s a transformative experience orchestrated by the harmonious interplay of economic factors, strategic decisions, and the guiding hand of your local real estate agent.

In the grand finale, your purchasing power stands as a testament to your financial acumen. Lower Mortgage Rates have not only opened the doors to homeownership but have also equipped you with the tools to navigate the ever-changing seas of the real estate market. As the curtains descend on this financial performance, may your homeownership symphony continue to resonate, creating a lasting melody of prosperity and accomplishment.

The Bottom Line: Lower Mortgage Rates, Your Symphony of Opportunity

In the grand composition of homeownership, lower Mortgage Rates emerge as the conductor, orchestrating a symphony of opportunity and financial empowerment. As you navigate the intricate notes of the real estate market, these lower rates become the harmonious melody that transforms aspirations into reality.

Affording a home is not just about the bricks and mortar; it’s a financial journey where each decision shapes your path. Lower Mortgage Rates act as the steady rhythm, making the once-daunting prospect of homeownership more accessible. They broaden your gateway to becoming a homeowner, allowing you to explore different mortgage options with confidence.

Picture yourself as the protagonist in this financial saga, guided by the sagacity of a trusted local real estate agent. Their expertise, coupled with lower Mortgage Rates, becomes the North Star steering you through the seas of opportunity. Together, you craft a financial compass that points towards prudent decisions and strategic choices.

In the symphony of savings, the ability to buy a home becomes not just a transaction but a transformative experience. Lower Mortgage Rates trim the financial sails, allowing you to ride the wave of affordability. As interest rates decrease, your purchasing power swells, creating a harmonious blend of financial prudence and homeownership aspirations.

This homeownership overture extends beyond the immediate, echoing in the realms of equity building and financial resilience. Lower Mortgage Rates contribute to the heartbeat of homeownership, allowing you to accumulate equity and fortify your financial foundation.

In the grand finale, as the curtains descend on your homeownership symphony, the echoes of lower Mortgage Rates linger. Your journey to become a homeowner is not just a financial accomplishment; it’s a testament to your ability to navigate the seas of opportunity with grace and acumen. May the melody of prosperity and accomplishment resonate through the halls of your new home, a testament to the transformative power of lower Mortgage Rates.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today