What Mortgage Rate Do You Need To Move?

If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you. They may even be why you’ve put your plans on hold for now. When rates climbed near 8% last year, some buyers found the numbers just didn’t make sense for their budget anymore. That may be the case for you too.

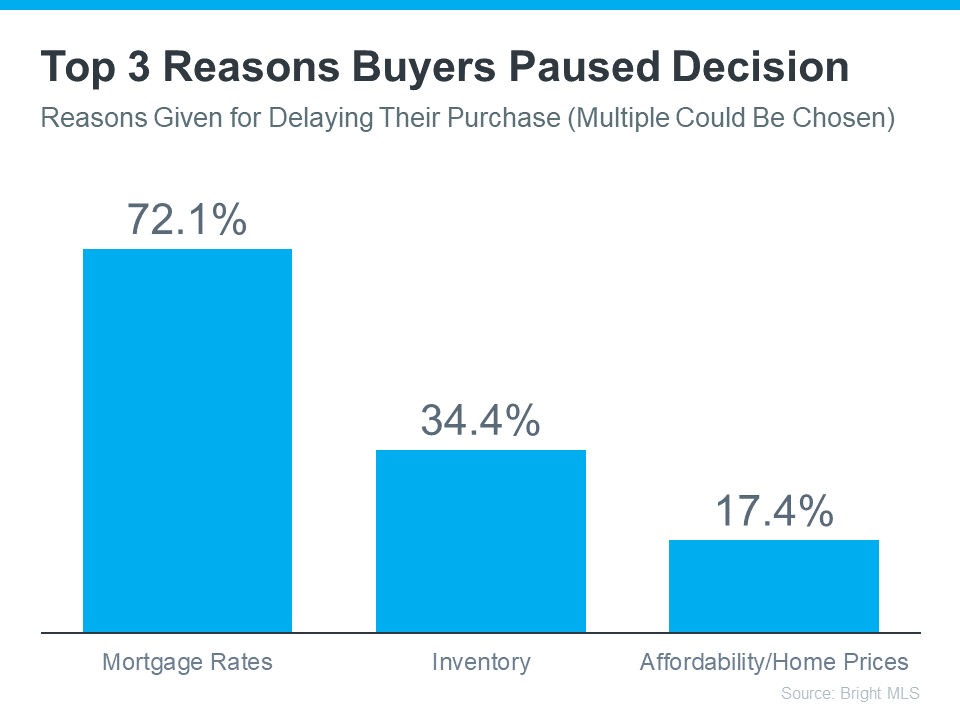

Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below):

David Childers, CEO at Keeping Current Matters, speaks to this statistic in the recent How’s The Market podcast:

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

That’s because mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility in rates, the longer-term projections show rates should continue to drop this year, as long as inflation gets under control. Experts even say we could see rates below 6% by the end of 2024. And that threshold would be a gamechanger for a lot of buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead. If your plans were delayed, there’s light at the end of the tunnel again. That means it may be time to start thinking about your move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

The exact percentage where you feel comfortable kicking off your search again is personal. Maybe it’s 6.5%. Maybe it’s 6.25%. Or maybe it’s once they drop below 6%.

Once you have that number in mind, here’s what you do. Connect with a local real estate professional. They’ll help you stay informed on what’s happening. And when rates hit your target, they’ll be the first to let you know.

If you’ve put your plans to move on hold because of where mortgage rates are, think about the number you want to see rates hit that would make you ready to re-enter the market.

Once you have that number in mind, let’s connect so you have someone on your side to let you know when we get there.

What Mortgage Rate Do You Need To Move?

Embarking on the journey of buying a home is akin to setting sail on the vast, ever-changing sea of the real estate market. It’s a voyage filled with excitement, anticipation, and, admittedly, a fair share of complexity. Central to navigating these waters successfully is understanding the pivotal role of Mortgage Rates. These rates, much like the wind in our sails, can either propel us swiftly towards our dream home or challenge us to chart a more strategic course.

The Quintessence of Mortgage Rates

In the grand tapestry of buying a home, Mortgage Rates emerge as both a lighthouse and a compass. They illuminate the path to affordability and guide potential homeowners towards making informed decisions. Whether you’re looking to buy a home for the first time or considering the leap into another investment, the rate at which you borrow could very well dictate the trajectory of your journey.

The Symphony of the Market

Imagine, if you will, the real estate market as a vast, intricate symphony. Each instrument — from the local real estate professional to the West Palm Beach mortgage broker — plays a critical role in the harmony of buying a home. In this symphony, Mortgage Rates are the rhythm that keeps the melody flowing smoothly. They fluctuate with the market’s ebbs and flows, influenced by broader economic indicators and policies.

Setting Sail with the Right Rate

So, what Mortgage Rate do you need to move? The answer is as nuanced as the market itself. The best rate is one that aligns with your financial landscape, your dreams, and your timeline. Here’s where a local real estate professional becomes invaluable, helping you navigate through the options to find a rate that’s just right for you.

West Palm Beach: A Beacon for Homebuyers

The sunny shores of West Palm Beach offer a unique backdrop for buying a home. With its vibrant community and picturesque settings, it’s no wonder many are drawn to this coastal gem. However, the allure of the location is matched by the complexity of finding Affordable West Palm Beach home loans. This is where the expertise of a West Palm Beach mortgage broker becomes crucial, offering insights into the Best mortgage rates in West Palm Beach.

A Primer for the First-Time Homebuyer

If you’re a First time home buyer in West Palm Beach, the ocean of options might seem daunting. From West Palm Beach refinancing options to Local mortgage lenders in West Palm Beach, the choices are as vast as they are varied. Utilizing West Palm Beach mortgage calculators and seeking Property loan advice in West Palm Beach can illuminate the path to finding a rate that doesn’t just meet your needs but exceeds your expectations.

The Commercial Voyage

For those charting a course in the commercial sphere, a Commercial mortgage broker in West Palm Beach can provide the compass you need. Whether it’s navigating Mortgage Rates for a new venture or exploring refinancing options for an existing property, professional advice is key.

The Gateway to Your New Home: Mortgage Pre-Approval

Mortgage pre-approval in West Palm Beach stands as the golden ticket to buying a home. It not only provides a clear picture of what you can afford but also signals to sellers that you are a serious buyer. In a competitive market, this can be the distinction that sets you apart.

The Art of the Deal

Understanding Mortgage Rates and securing the best possible rate is akin to mastering the art of the deal. It requires patience, research, and the willingness to seek expert advice. With the guidance of Local mortgage lenders in West Palm Beach and a comprehensive understanding of West Palm Beach refinancing options, you can secure a rate that turns your dream of buying a home into reality.

Navigating the Future

As we look towards the horizon, the landscape of Mortgage Rates will continue to evolve. For those looking to buy a home, staying informed and connected with a local real estate professional will be key to navigating these changes. Whether you’re searching for Affordable West Palm Beach home loans or seeking the Best mortgage rates in West Palm Beach, the journey towards homeownership is a rewarding voyage.

In the grand journey of buying a home, understanding and securing the right Mortgage Rate is crucial. It’s a process that requires insight, patience, and the right partners. Whether you’re embarking on this journey for the first time or looking to navigate the waters of refinancing, the right advice and tools can illuminate the path to your dream home. So, set your sights on the horizon, chart your course with care, and let the adventure of homeownership begin.

The Role of Expert Guidance in Your Home Buying Voyage

Embarking on the journey of buying a home without a seasoned navigator at your side can be likened to setting sail without a compass. This is where the invaluable expertise of a local real estate professional and a knowledgeable West Palm Beach mortgage broker comes into play. These experts are not just guides; they are your allies, equipped with the knowledge and experience to help you secure Affordable West Palm Beach home loans and navigate the complexities of the market. They can demystify the process, ensuring you understand every nuance of your loan options, from First time home buyer loans in West Palm Beach to sophisticated West Palm Beach refinancing options.

Leveraging Technology for Smarter Decisions

In today’s digital age, technology plays a pivotal role in the home buying process. West Palm Beach mortgage calculators are one such tool that can provide a clear picture of what you might expect in terms of monthly payments, interest rates, and loan terms. These digital calculators, along with online platforms for Mortgage pre-approval in West Palm Beach, streamline the initial steps towards homeownership, making it easier for buyers to understand their purchasing power and budgetary constraints.

The Importance of Mortgage Pre-Approval

In the competitive real estate markets like West Palm Beach, Mortgage pre-approval in West Palm Beach is more than just a step in the process; it’s a strategic advantage. This pre-approval not only affirms your financial readiness to potential sellers but also places you a step ahead in the bidding process. It’s a testament to your seriousness as a buyer and your readiness to proceed, making your offer more attractive in a sea of potential buyers.

The Commercial Horizon

For those venturing into the commercial real estate realm, the guidance of a Commercial mortgage broker in West Palm Beach becomes even more critical. These professionals specialize in navigating the intricate details of commercial financing, offering tailored advice and solutions that align with your business objectives. Whether it’s acquiring a new property or refinancing an existing one, their expertise can prove invaluable in securing favorable Mortgage Rates and terms.

Building Your Dream with the Right Loan

At the heart of buying a home lies the dream of creating a personal haven or launching a business venture. Securing the right Mortgage Rate is fundamental to making this dream a reality. It’s not just about finding a rate; it’s about understanding how this rate fits into your broader financial landscape. With the support of Local mortgage lenders in West Palm Beach, buyers can explore a range of loan products and rates, ensuring they make a choice that best suits their long-term goals.

A Future-Proof Strategy

As we gaze into the future, the importance of a well-thought-out strategy in securing a mortgage cannot be overstated. The real estate market and Mortgage Rates are in constant flux, influenced by economic indicators, government policies, and market dynamics. A proactive approach, coupled with ongoing advice from local real estate professionals, can help you stay ahead of the curve, ensuring you’re well-positioned to adjust your strategy as the market evolves.

Conclusion: Charting Your Course to Homeownership

The journey to buying a home in West Palm Beach, with its sunny skies and welcoming communities, is an exciting adventure filled with opportunities and challenges. Understanding and securing the right Mortgage Rate is a critical step in this voyage. With the expertise of Local mortgage lenders in West Palm Beach and a comprehensive approach to exploring your options, you can navigate the complexities of the market with confidence. Whether you’re a first-time homebuyer or looking to refinance, remember that the right partnership and preparation can turn the dream of homeownership into reality. Chart your course with care, leverage the tools and expertise at your disposal, and set sail towards your new home with optimism and excitement. The journey ahead is bright, and the best is yet to come.

Embracing the Adventure: Beyond the Mortgage Rate

As you journey towards buying a home, it’s crucial to look beyond just the Mortgage Rate and understand the broader narrative of homeownership. This adventure is not merely about securing a loan with the best interest rate; it’s about crafting a lifestyle, building a future, and creating a space that reflects your personal aspirations. The vibrant landscapes of West Palm Beach, with its blend of urban sophistication and serene beachfronts, offer a canvas on which to paint your life’s next chapter.

The Human Element: The Value of Personal Relationships

In the digital age, where algorithms and automated services often dictate interactions, the value of personal relationships in the home buying process cannot be overstressed. Partnering with a local real estate professional or a West Palm Beach mortgage broker provides a human touch that technology cannot replicate. These experts not only guide you through the maze of Mortgage Rates and loan options but also understand the emotional and psychological aspects of buying a home. Their insights and personal commitment can make the journey less daunting and more rewarding.

Sustainable Homeownership: Planning for the Long Haul

Securing the right Mortgage Rate is just the beginning. Sustainable homeownership involves planning for the future, taking into account changes in lifestyle, family dynamics, and financial stability. West Palm Beach refinancing options offer a pathway to adapt your mortgage to fit changing circumstances, ensuring that your home continues to be a source of security and comfort. Engaging with local mortgage lenders in West Palm Beach for Property loan advice can help you anticipate and prepare for these shifts, making your homeownership journey resilient in the face of life’s inevitable changes.

The Community Tapestry: Becoming Part of Something Bigger

Buying a home in West Palm Beach means more than just acquiring property; it’s about becoming part of a community. This region, known for its cultural diversity, rich history, and vibrant social fabric, offers myriad opportunities for engagement and contribution. Whether through local events, community projects, or neighborhood initiatives, homeowners can find immense fulfillment in weaving themselves into the tapestry of their new community. This sense of belonging and participation adds a profound layer of value to the homeownership experience.

The Joy of Home: Creating Your Personal Oasis

Ultimately, the essence of buying a home lies in the joy of turning a house into a personal oasis. This process involves more than selecting the right Mortgage Rate or navigating West Palm Beach refinancing options. It’s about envisioning your life within the walls of your new home, from the morning light streaming through the windows to the laughter filling the living spaces. Your home becomes a reflection of your journey, your dreams, and your essence. It’s a sanctuary where memories are created, where personal growth unfolds, and where the heart truly resides.

Charting Your Own Path: The Unique Journey of Each Buyer

Every homebuyer’s journey is unique, shaped by individual dreams, circumstances, and aspirations. Whether you’re a First time home buyer in West Palm Beach or someone exploring Commercial mortgage options, the path to homeownership is yours to define. With the right partners by your side — from Local mortgage lenders to real estate professionals — you can navigate this journey with confidence, making informed decisions that reflect your personal vision for the future.

In Conclusion: The Voyage Home

The voyage towards buying a home is one of the most significant journeys one can undertake. It’s a journey marked by challenges, learning, and growth. As you navigate the waters of Mortgage Rates, West Palm Beach refinancing options, and the myriad choices that come with buying a home, remember that this journey is about more than just financial transactions. It’s about creating a space where your life unfolds, where dreams take root, and where the future is built, one day at a time. In the heart of West Palm Beach, amidst its sun-kissed shores and vibrant communities, your dream home awaits. With optimism, preparation, and the right guidance, you’re not just moving to a new house; you’re moving towards a new chapter in your life’s story.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today