Two Reasons Why the Housing Market Won’t Crash

You may have heard chatter recently about the economy and talk about a possible recession. It’s no surprise that kind of noise gets some people worried about a housing market crash. Maybe you’re one of them. But here’s the good news – there’s no need to panic. The housing market is not set up for a crash right now.

Real estate journalist Michele Lerner says:

“Ahousing market crash happens when home values plummet due to a lack of demand for homes or an oversupply.”

With that definition in mind, here are two reasons why this just isn’t on the horizon.

1. Demand for Homes Is Higher than Supply

One of the biggest reasons the housing market crashed back in 2008 was an oversupply of homes. Today, though, it’s a very different story.

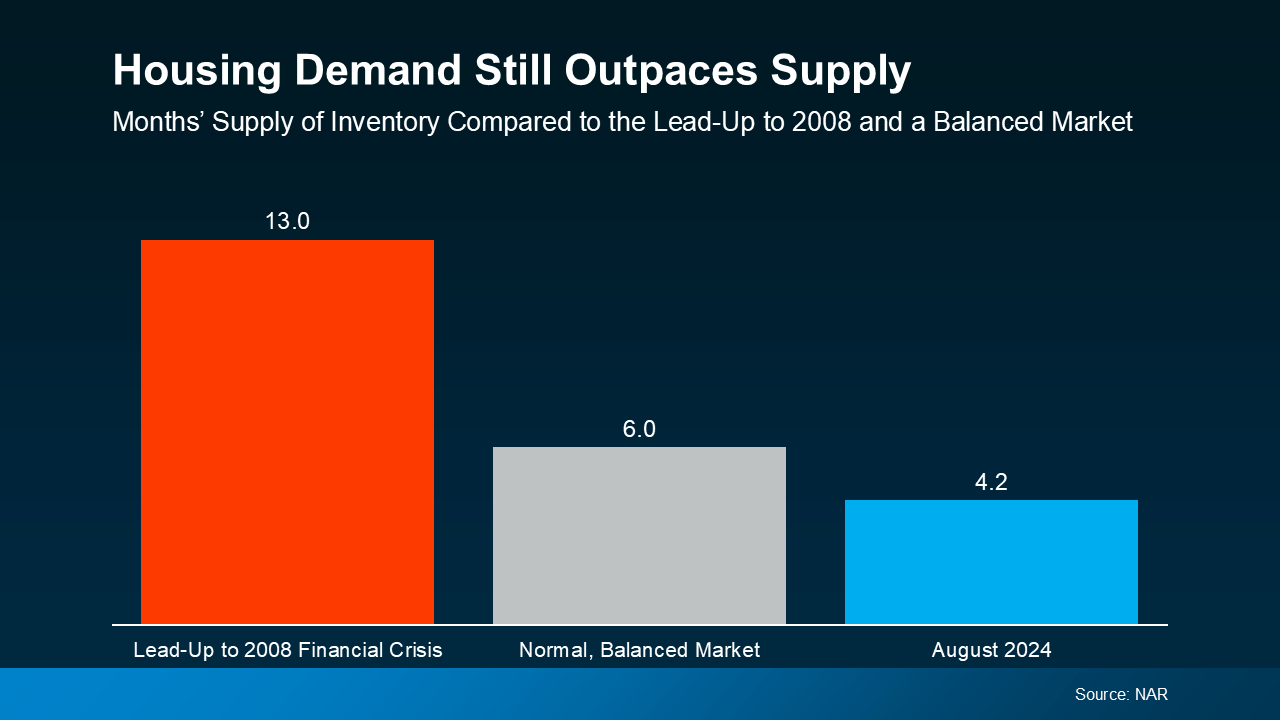

It’s a general rule of thumb that a market where supply and demand are balanced has a six-month supply of homes. A higher number means supply outpaces demand, and a lower number means demand outpaces supply. The graph below uses data from NAR to put today’s situation into context:

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

The graph compares housing supply during three different periods of time. The red bar shows there were 13 months of supply before the 2008 crisis, which was far too much. The gray bar shows a balanced market with six months of supply, for context. And the blue bar shows there are only 4.2 months of supply today.

Put simply, there are more people who want to buy homes than there are homes available to buy right now. So, demand is greater than supply. When that happens, home prices stay steady or rise – the opposite of a housing market crash.

It’s important to note that inventory levels differ from market to market. Some areas may be more balanced, while a few could have a slight oversupply, which can impact prices locally. However, most markets continue to experience a shortage of homes.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We simply don’t have enough inventory. Will some markets see a price decline? Yes. [But] with the supply not being there, the repeat of a 30 percent price decline is highly, highly unlikely.”

2. Unemployment Is Still Low

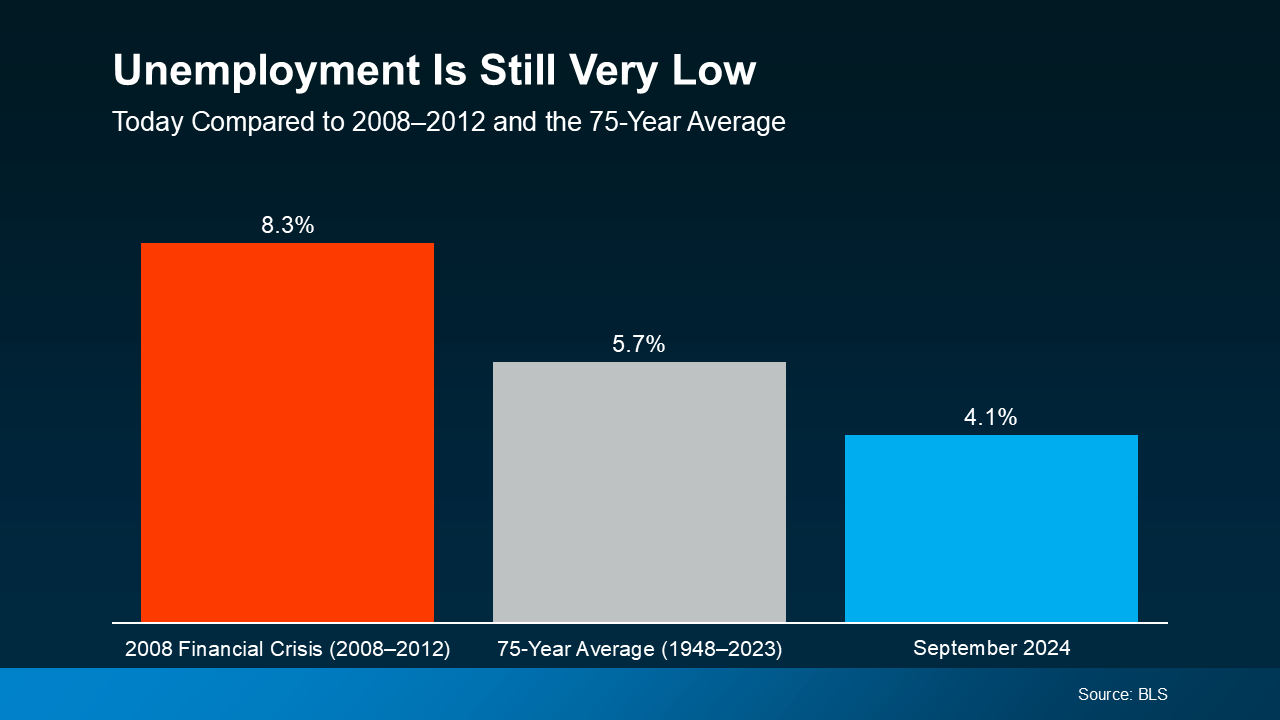

When people are unemployed, they’re more likely to have trouble making their mortgage payments and may be forced to sell or face foreclosure. That was a big problem during the 2008 financial crisis. Today, the employment situation is much more stable (see graph below):

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Again, this graph shows three different periods of time, but this one is the unemployment rate. The red bar represents the 2008 financial crisis when unemployment was very high at 8.3%. The gray bar shows the 75-year average of 5.7%. And the blue bar shows the unemployment rate today, and it’s much lower at just 4.1%.

Right now, people are working, earning an income, and making their mortgage payments. That’s one reason why the wave of foreclosures that happened in 2008 isn’t going to happen again this time. Plus, since so many people are employed right now, many are actually in a position to buy a home, and this demand keeps upward pressure on prices.

Today’s Housing Market Is Stronger than in 2008

While it’s understandable to be concerned when you hear talk of a recession and economic uncertainty, but know this: the housing market is in a much better place than it was in 2008. According to Rick Sharga, Founder and CEO at CJ Patrick Company:

“Literally everything is different about today’s housing market dynamics than the conditions that led to the housing crisis.”

Demand for homes still outpaces supply, and unemployment remains low. And these are two key factors that will help prevent the housing market from crashing any time soon.

The housing market is doing a lot better than it was in 2008, but it’s important to remember that real estate is very local.

So, it’s always a good idea to stay informed about our specific market. If you have any questions or want to discuss how these factors are playing out in our area, feel free to reach out.

Two Reasons Why the Housing Market Won’t Crash

There’s a lot of chatter circling the internet these days. Many people are asking, “Is the housing market on the brink of collapse?” If you’ve been following the ebb and flow of real estate trends, you’ve likely heard predictions ranging from wildly optimistic to doomsday gloom. But here’s the thing: today’s housing market is not the same as it was in 2008. In fact, there are clear and compelling reasons why a housing market crash is highly unlikely. Sure, there are peaks and valleys, but the notion that we’re headed for a catastrophic nosedive just doesn’t hold up.

So, what are these reasons? Let’s dive deep into the top two.

1. The Supply and Demand Dynamic is Entirely Different

One of the core principles of economics is supply and demand. When there’s a high demand and a low supply of homes, prices go up. When there’s too much supply and not enough demand, prices go down. But right now, in today’s housing market, the issue is not a surplus of homes; it’s actually a shortage. The homes available to buy right now are at an all-time low, particularly in sought-after areas. This imbalance creates upward pressure on home prices.

Back in 2008, things were quite different. There was a massive oversupply of homes, partly driven by lax lending practices and speculative building. Today, regulations are tighter, and builders are cautious, meaning we’re not seeing a flood of inventory hitting the market. There are simply not enough homes being built to meet the demand, especially in growing metro areas.

Consider an area like West Palm Beach. It’s booming, and the demand for housing is strong. Buyers are flocking to the region, attracted by its amenities, job growth, and lifestyle. This isn’t the case of speculative buying like in the mid-2000s. These are people who want to buy homes and live in them. And yet, despite the demand, there isn’t an overwhelming number of homes on the market. The West Palm Beach mortgage broker community has their hands full with buyers, yet there simply aren’t enough properties to meet demand. It’s a prime example of the current shortage issue across the country.

This limited supply of homes acts as a buffer against a crash. When demand remains strong and there aren’t enough properties to go around, prices won’t plummet. In fact, we’re seeing the opposite in many areas, with home prices continuing to rise due to bidding wars and the competitive nature of the market. Buyers are scrambling to secure properties, driving values up instead of down.

Not only is the supply of homes keeping prices elevated, but home values are also bolstered by the changing behavior of homeowners. During the 2008 crash, a huge wave of foreclosures hit the market. But today’s homeowners are in a much more stable financial position. Home equity is at historic highs. People aren’t sitting in homes they can’t afford, waiting for the inevitable bank repossession. They’ve locked in favorable mortgage rates and have far more equity than their counterparts did in the previous crash.

For instance, homeowners who locked in rates with the best mortgage rates in West Palm Beach have little incentive to sell or foreclose when their current monthly payments are manageable. Their finances are more stable, and the fear of a wave of foreclosures similar to 2008 is largely unfounded. Even in areas where unemployment has ticked up, the impact hasn’t been severe enough to trigger a mass sell-off of homes. The unemployment rate today is far lower than during the Great Recession, and many sectors, particularly tech and remote work industries, are thriving.

Moreover, the types of mortgages being issued today are far more conservative. The days of no-document loans and subprime lending are long gone. Buyers now must go through rigorous checks to get approved for loans. In fact, the mortgage preapproval in West Palm Beach process has become so stringent that only financially stable individuals can secure financing. This means fewer risky loans and far fewer defaults on payments, further insulating the market from a crash.

The tight supply of homes and the strong financial standing of current homeowners are major reasons why we won’t see a repeat of 2008. The demand for housing is still high, and with limited inventory, there’s a natural floor under home values that will prevent a massive decline.

2. Lending Practices Have Radically Changed

Another key reason the market is stable: lending practices are nothing like they were in the early 2000s. The lead-up to the previous housing market crash was driven by irresponsible lending. Banks were issuing mortgages to people who couldn’t realistically afford the homes they were buying. Exotic loan products, like adjustable-rate mortgages with balloon payments, were all too common. Many of these homeowners were sitting on time bombs, just waiting for their mortgage payments to skyrocket.

Fast forward to today, and you’ll see a much more measured, responsible approach to lending. The regulations put in place after the 2008 crash, like the Dodd-Frank Act, were specifically designed to prevent the kind of reckless lending that led to the crisis. Banks are now far more careful about who they lend to and under what terms. In places like West Palm Beach, local mortgage lenders in West Palm Beach have tightened their criteria for approving loans. The emphasis is on ensuring borrowers have the means to repay, rather than pushing for volume.

Take the process of buying a home in West Palm Beach, for example. Whether you’re looking at first-time home buyer loans in West Palm Beach or considering West Palm Beach refinancing options, you’ll notice that lenders are diligent in making sure borrowers are in a solid financial position. Gone are the days when anyone with a pulse could secure a mortgage. Instead, today’s buyers must go through comprehensive financial scrutiny, including income verification, credit checks, and debt-to-income ratio assessments.

And if you’re considering investment properties or larger commercial deals, the oversight is even more meticulous. The requirements for a commercial mortgage broker in West Palm Beach are stringent. Investors must prove they can carry the financial burden, and banks are wary of funding speculative projects.

But it’s not just tighter lending practices that make today’s market safer. The structure of mortgages has also changed. Many homeowners who locked in low fixed rates have mortgages that are far more stable and predictable. With interest rates remaining relatively low, many have chosen to refinance, securing even better deals. The affordable West Palm Beach home loans available today are structured in a way that reduces the financial risk to homeowners. The West Palm Beach mortgage calculators that borrowers use to determine their monthly payments offer a clear and realistic picture of their financial commitment.

Additionally, many buyers are choosing to put down larger down payments, giving them a stronger equity position in their homes. This means that even if home prices were to drop slightly, most homeowners would still have positive equity, preventing the kind of widespread underwater mortgages that drove the last housing market crash.

The lending landscape has also evolved to make it easier for buyers to understand their options. There are more resources available today, from property loan advice in West Palm Beach to online calculators and budgeting tools, all designed to help buyers make informed decisions. This increased transparency and education further reduces the risk of a crash.

Even as mortgage rates fluctuate, buyers are able to lock in favorable terms and avoid the kind of financial traps that were common during the last crisis. Whether you’re dealing with a West Palm Beach mortgage broker or a lender in another region, the rules of the game have changed dramatically. These changes ensure that buyers are far less likely to end up in over their heads.

Conclusion: Stability, Not a Crash

In summary, the housing market isn’t about to collapse. The supply of homes remains tight, and demand is still high, particularly in areas like West Palm Beach. Tighter lending standards and more responsible financial behavior from both buyers and lenders have created a far more stable environment than what we saw in 2008.

Home prices may fluctuate slightly in the short term, but the idea that the market will crash is not supported by the current data. With limited inventory and strong equity positions, today’s homeowners are in a far better financial position than those in the past. The market, while competitive, is not fragile.

If you’re thinking of buying or selling, now is a great time to consider your options. Working with a West Palm Beach mortgage broker, you can explore affordable West Palm Beach home loans, best mortgage rates in West Palm Beach, or even look into West Palm Beach refinancing options if you’re a current homeowner. The future may be uncertain, but one thing’s for sure: the housing market isn’t going to crash anytime soon.

The Role of Economic Fundamentals in Market Stability

One of the most critical, yet often overlooked, aspects of today’s housing market is the role that economic fundamentals play in maintaining stability. The housing market doesn’t exist in a vacuum; it’s deeply intertwined with broader economic trends, from employment levels to consumer spending patterns. When we dig deeper into these underlying factors, it becomes even clearer why a housing market crash is improbable.

A key metric to consider is the unemployment rate. During the 2008 crisis, unemployment soared, reaching levels that hadn’t been seen in decades. With millions of people out of work, many struggled to keep up with their mortgage payments, leading to widespread foreclosures. This created a vicious cycle where homes were dumped on the market, further depressing home values.

But the unemployment rate today is much lower than it was during the Great Recession. Despite recent economic challenges, particularly following the pandemic, employment levels have remained relatively strong. Industries are adapting, and the labor market is resilient, especially in regions that are seeing growth in sectors like technology, healthcare, and finance. West Palm Beach, for instance, has experienced steady job growth, attracting professionals who want to buy homes in the area.

The stability of employment is directly connected to the housing market. When people have jobs and a steady income, they are far more likely to stay current on their mortgage obligations. And with fewer homeowners falling behind on payments, the risk of a wave of foreclosures is greatly diminished. It’s a simple, but crucial, equation: stable jobs equal stable housing markets.

Furthermore, the Federal Reserve has taken a more proactive role in managing the economy. Interest rates, which play a significant role in the housing market, are being carefully monitored and adjusted to prevent economic overheating or sharp downturns. As a result, we haven’t seen the wild fluctuations in interest rates that characterized the lead-up to the 2008 crisis. Homebuyers today, especially those locking in best mortgage rates in West Palm Beach, are benefiting from historically low rates, which help keep mortgage payments affordable.

And while there are always concerns about inflation, the Fed’s intervention has helped keep inflation in check, preventing it from eroding purchasing power to a point where consumers are unable to afford homes. This controlled approach to interest rates and inflation has a stabilizing effect on the housing market, ensuring that home prices remain sustainable rather than inflated by speculation or reckless borrowing.

Buyers Are More Informed and Cautious

Another important distinction between the current market and the pre-2008 landscape is the behavior of buyers themselves. In the years leading up to the last housing market crash, many homebuyers were incentivized to purchase homes they couldn’t realistically afford. Whether it was through subprime mortgages or the allure of fast profits from “flipping” properties, buyers entered the market with risky intentions. This led to a large number of defaulted loans when the market turned, pushing even more inventory into the market and driving home values down.

Today’s buyers, on the other hand, are more cautious and better informed. They’re not simply chasing after properties because they expect quick profits. Instead, buyers are looking for long-term stability. This is especially true for first-time home buyer loans in West Palm Beach, where buyers are using online tools like West Palm Beach mortgage calculators to thoroughly assess their financial situations before making a decision. These calculators provide transparency on how much home a buyer can truly afford, factoring in their income, expenses, and other financial commitments.

Moreover, prospective buyers are receiving better property loan advice in West Palm Beach and beyond. Mortgage lenders, brokers, and real estate professionals are working together to ensure that buyers understand the full scope of their financial responsibilities. The era of “blind” home buying, where people jumped into properties without understanding the implications of adjustable-rate mortgages or balloon payments, is largely over. With tools and resources readily available, today’s buyers are savvier and more prepared to handle the responsibilities of homeownership.

This cautious, informed approach is yet another reason the housing market won’t see the kind of rampant defaults and foreclosures that triggered the last crash. Buyers are more financially prepared, and they’re taking on homes they can afford—not stretching beyond their means.

The West Palm Beach Market: A Microcosm of National Trends

West Palm Beach serves as a perfect example of how local markets reflect broader national trends. The region’s housing market is strong, driven by a combination of low inventory, high demand, and a booming economy. In West Palm Beach, mortgage preapproval is a competitive process, as buyers are eager to lock in their place in this growing market. And while interest rates may fluctuate, there are still plenty of affordable West Palm Beach home loans for those looking to purchase, particularly first-time buyers and families looking to settle down.

Local markets like West Palm Beach also benefit from a diversity of homebuyers. It’s not just families and retirees moving in—there’s a growing interest from investors seeking properties for vacation rentals, as well as professionals relocating for jobs. The demand for housing in such areas is multifaceted, which adds layers of insulation against a potential downturn. Investors are playing the long game, banking on the area’s continued growth rather than flipping properties for quick profits as seen in the lead-up to the 2008 crisis.

Additionally, West Palm Beach offers an array of refinancing options for current homeowners, enabling them to take advantage of low interest rates and reduce their monthly payments. This financial flexibility strengthens homeowners’ positions, making it less likely that they will default on their loans, even if economic conditions were to tighten. The availability of West Palm Beach refinancing options means that homeowners have the ability to adapt their finances to changing market conditions, further solidifying the area’s housing stability.

For those looking to invest or upgrade their properties, working with a commercial mortgage broker in West Palm Beach has become a more attractive proposition. The city’s commercial real estate sector is also thriving, with businesses and developers flocking to the region, fueling both residential and commercial growth. This expansion bolsters the overall market, as job creation and economic activity go hand-in-hand with housing demand.

Foreclosure Fears Are Overblown

One of the lingering fears in the market is the idea of a looming wave of foreclosures that could destabilize housing prices. But this fear is largely overblown. While it’s true that there was a temporary spike in mortgage forbearance during the pandemic, the vast majority of those homeowners have exited forbearance and resumed making payments. Unlike 2008, when millions of borrowers were underwater on their loans, today’s homeowners are sitting on significant equity. Even if they were forced to sell, they would likely walk away with a profit, rather than a foreclosure.

Additionally, the federal government has introduced numerous safeguards to prevent a foreclosure crisis. Programs are in place to help struggling homeowners renegotiate their terms or extend their payment periods, avoiding foreclosure altogether. In West Palm Beach, for example, many homeowners took advantage of these programs, using West Palm Beach refinancing options to lower their monthly payments and secure more favorable loan terms.

The result is a market that’s far less vulnerable to a foreclosure-driven collapse. Homeowners today have the tools and resources to navigate financial difficulties without resorting to default. And because of the continued demand for homes, even distressed properties are quickly snapped up by investors or homebuyers looking for deals.

Final Thoughts: A Resilient Market

The housing market is in a much stronger position than it was during the last crash. Tight supply, responsible lending, stable employment, and cautious buyers all contribute to a market that’s resilient in the face of economic fluctuations. While home prices may not rise at the dizzying rates seen over the past few years, they’re unlikely to crash.

In areas like West Palm Beach, the market continues to be buoyed by strong demand, low inventory, and a robust local economy. West Palm Beach mortgage brokers are busy helping buyers secure financing, while local mortgage lenders in West Palm Beach continue to provide competitive rates. Whether you’re a first-time buyer, an investor, or looking to refinance, the opportunities are there.

For now, the housing market remains a safe and secure investment. If you’ve been on the fence about whether to buy a home, rest assured that the foundations of the market are solid. There may be bumps along the road, but a catastrophic crash? Not on the horizon.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today