The Majority of Veterans Are Unaware of a Key VA Loan Benefit

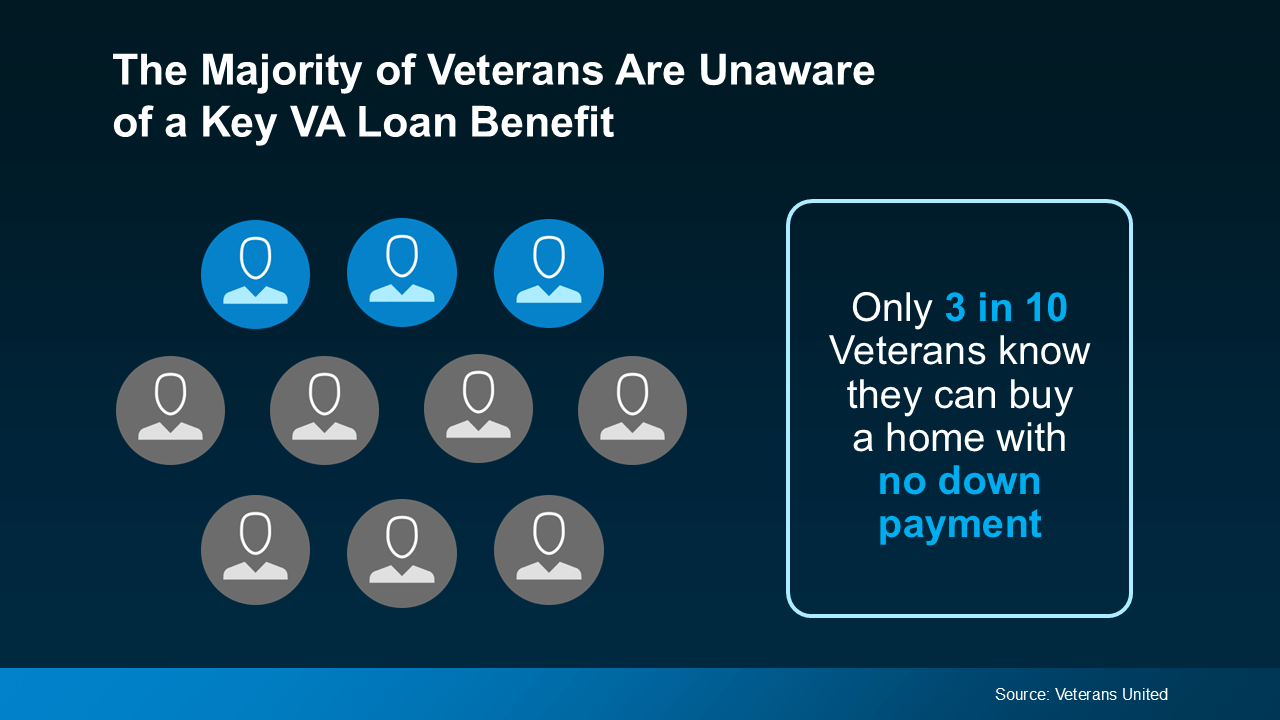

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

The Advantages of VA Home Loans

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all, making it simpler to get started on your homebuying journey.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re ready to finalize the sale.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans

- don’t require PMI, even with lower down payments. This means lower monthly payments, which adds up to big savings over time.

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

For nearly 80 years, VA home loans have been a cornerstone in helping Veterans achieve the dream of homeownership. Yet, despite this program’s longevity and profound impact, a surprising majority of Veterans remain unaware of its most significant advantage: the ability to purchase a home with no down payment. This overlooked benefit has the potential to revolutionize your homebuying journey, opening the door to the American Dream for thousands who might otherwise believe homeownership is beyond their reach.

The Power of VA Loans

The Department of Veterans Affairs created VA loans to honor the service of America’s heroes, providing them with the means to make homeownership a reality. Unlike conventional loans, VA home loans are specifically tailored to the needs of those who have served, offering unique loan benefits that set them apart from other lending options.

The most notable advantage is the option for 0% down. Veterans can buy a home without spending years saving for a hefty down payment, allowing them to focus on finding a property that fits their family’s needs and budget. This feature not only accelerates your path to homeownership but also ensures that life-changing plans don’t have to be put on hold.

Breaking Down the Benefits

Here’s a closer look at why VA home loans are considered a game-changer for Veterans:

1. No Down Payment

One of the greatest perks of this program is that Veterans can buy a home with no down payment. Unlike conventional mortgages, which often require a significant upfront investment, VA loans allow Veterans to skip this step entirely. This benefit levels the playing field, ensuring that service members and their families can begin their homebuying journey without financial barriers.

2. Limited Closing Costs

The Department of Veterans Affairs places strict limits on the types of closing costs borrowers must pay, making the process more affordable. By minimizing these expenses, VA loans help keep more money in your pocket, allowing you to focus on what matters most: achieving your homebuying goals.

3. No Private Mortgage Insurance (PMI)

Unlike many other loan programs, VA loans do not require Private Mortgage Insurance (PMI), even if you opt for 0% down. This translates to lower monthly payments and significant savings over time.

4. Competitive Interest Rates

VA loans often come with lower interest rates compared to conventional loans, making them an attractive option in today’s competitive housing market.

Expert Real Estate Professionals Are Key

Navigating the housing market can feel overwhelming, especially for first-time buyers. This is where expert real estate professionals play an essential role. A local agent with experience in VA home loans can guide you through the process, ensuring you understand the full range of loan benefits available to you. Additionally, working with a trusted lender or a West Palm Beach mortgage broker can help simplify the financial aspects, offering personalized advice and access to Affordable West Palm Beach home loans.

Whether you’re a seasoned buyer or exploring first-time home buyer loans in West Palm Beach, having a knowledgeable team by your side can make all the difference in achieving your homebuying goals.

Exploring Options in West Palm Beach

For those considering homeownership in South Florida, the vibrant community of West Palm Beach offers countless opportunities. With access to local mortgage lenders in West Palm Beach, buyers can secure some of the best mortgage rates in West Palm Beach.

For those looking to refinance, West Palm Beach refinancing options provide flexible solutions, while tools like West Palm Beach mortgage calculators make it easy to budget for your dream home. Whether you need property loan advice in West Palm Beach or are exploring options with a commercial mortgage broker in West Palm Beach, the area’s robust resources make it an ideal place to settle down.

Tips for a Successful Homebuying Journey

- Get Preapproved: Begin by securing a mortgage preapproval in West Palm Beach. This step not only clarifies your budget but also strengthens your position in a competitive market.

- Choose the Right Team: Partner with expert real estate professionals, including a local agent and trusted lender, to ensure a seamless experience.

- Understand Your Eligibility: Confirm your eligibility for VA loans through the Department of Veterans Affairs, and explore all available options to maximize your benefits.

- Leverage Calculators: Utilize tools like West Palm Beach mortgage calculators to estimate your monthly payments and plan effectively.

Embracing the American Dream

At its core, owning a home is about more than just securing a roof over your head; it’s about building stability, creating memories, and investing in your future. For Veterans, VA home loans are a testament to the nation’s gratitude, offering a pathway to make homeownership a reality without the traditional hurdles of down payments, closing costs, or Private Mortgage Insurance (PMI).

With the guidance of expert real estate professionals, the support of a trusted lender, and access to resources like Affordable West Palm Beach home loans, the dream of owning a home is within reach for every eligible Veteran.

Let’s ensure every Veteran knows about these incredible benefits. It’s time to embrace the opportunity, take the first step, and secure your piece of the American Dream.

Overcoming Common Misconceptions About VA Home Loans

Despite the impressive advantages, there are still many misconceptions surrounding VA loans that prevent Veterans from taking full advantage of this program. Let’s address some of these misunderstandings to clear the path for Veterans to achieve the dream of homeownership.

Misconception 1: VA Loans Are Hard to Qualify For

Many believe that eligibility for a VA home loan is overly complex or out of reach. However, the process is straightforward, with the Department of Veterans Affairs setting clear and achievable guidelines. Service members, Veterans, and even some eligible surviving spouses may qualify. Consulting with a West Palm Beach mortgage broker or trusted lender can help you navigate the requirements and secure your loan.

Misconception 2: VA Loans Can Only Be Used Once

Another myth is that once you’ve used a VA loan, you can’t take advantage of the program again. In reality, VA loans are reusable, allowing eligible Veterans to utilize their benefits multiple times throughout their lives. This flexibility makes VA home loans an invaluable resource for those who might move frequently or wish to upgrade their home as their needs change.

Misconception 3: VA Loans Are Only for Single-Family Homes

While many people use VA loans to purchase traditional single-family homes, the program also supports a variety of property types. From condos to multi-family units, eligible Veterans can buy a home that suits their unique circumstances. For those in South Florida, consulting with local mortgage lenders in West Palm Beach can uncover options tailored to your specific goals.

The Role of Refinancing for Veterans

Life is full of unexpected changes, and sometimes the terms of your initial mortgage no longer meet your needs. That’s where West Palm Beach refinancing options come into play. Refinancing a VA loan can lower your interest rate, reduce your monthly payments, or even allow you to tap into your home’s equity for other financial goals.

The VA’s Interest Rate Reduction Refinance Loan (IRRRL) is designed specifically for Veterans and offers a streamlined process with minimal paperwork and no appraisal requirement in most cases. Exploring West Palm Beach refinancing options with a commercial mortgage broker in West Palm Beach or a trusted lender can help you make the most of your benefits.

Leveraging Tools to Simplify the Process

Modern technology has made the home-buying and refinancing processes more transparent and accessible than ever. For buyers in South Florida, West Palm Beach mortgage calculators provide a simple way to estimate your costs, from monthly payments to total loan expenses. These tools can be invaluable in planning for your purchase and ensuring your finances align with your goals.

Why West Palm Beach Is an Ideal Location

West Palm Beach is more than just a destination; it’s a community rich in opportunity. For Veterans looking to plant roots in a vibrant area, the city offers:

- Affordable West Palm Beach home loans to accommodate a range of budgets.

- Competitive rates from local mortgage lenders in West Palm Beach.

- Access to both residential and commercial mortgage broker services.

From first-time buyers exploring first-time home buyer loans in West Palm Beach to seasoned investors seeking property loan advice in West Palm Beach, this city provides the tools and resources to succeed in the competitive housing market.

Steps to Take Today

If you’re a Veteran or know someone who served, spreading awareness about VA home loans can transform lives. Here’s how to get started:

- Check Your Eligibility: The Department of Veterans Affairs provides resources to confirm if you qualify for a VA loan.

- Connect with Experts: Partner with expert real estate professionals, including a local agent and trusted lender, to guide you through the process.

- Educate Yourself: Use tools like West Palm Beach mortgage calculators to understand the costs and benefits of homeownership.

- Act Quickly: The sooner you begin your homebuying journey, the sooner you can take advantage of the program’s incredible perks, including no down payment and competitive interest rates.

A Lasting Legacy of Support

As one of the most impactful programs offered by the federal government, VA loans have already helped millions of Veterans achieve financial stability through homeownership. Yet, the program’s full potential can only be realized if more Veterans are made aware of the benefits.

Whether you’re in West Palm Beach exploring first-time home buyer loans, refinancing your existing mortgage, or seeking property loan advice in West Palm Beach, the resources and support are there to help you succeed. Let’s honor the service of our nation’s heroes by ensuring they have the tools to make homeownership a reality and secure their place in the American Dream.

Closing Thoughts

The journey to owning a home can feel daunting, but with the right information and support, it’s more achievable than ever. For Veterans, VA home loans represent a powerful opportunity to bypass the traditional hurdles of down payments and other financial barriers. With expert real estate professionals, trusted lenders, and the vibrant offerings of West Palm Beach, the dream of homeownership is no longer just a possibility – it’s a promise waiting to be fulfilled.

Let’s ensure every Veteran knows the incredible advantages of VA loans. Together, we can make the dream of buying a home a reality for those who have given so much to our country.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today