Single Women Are Embracing Homeownership

In today’s housing market, more and more single women are becoming homeowners. According to data from the National Association of Realtors (NAR), 19% of all homebuyers are single women, while only 10% are single men.

If you’re a single woman trying to buy your first home, this should be encouraging. It means other people are making their dreams a reality – so you can too.

Why Homeownership Matters to So Many Women

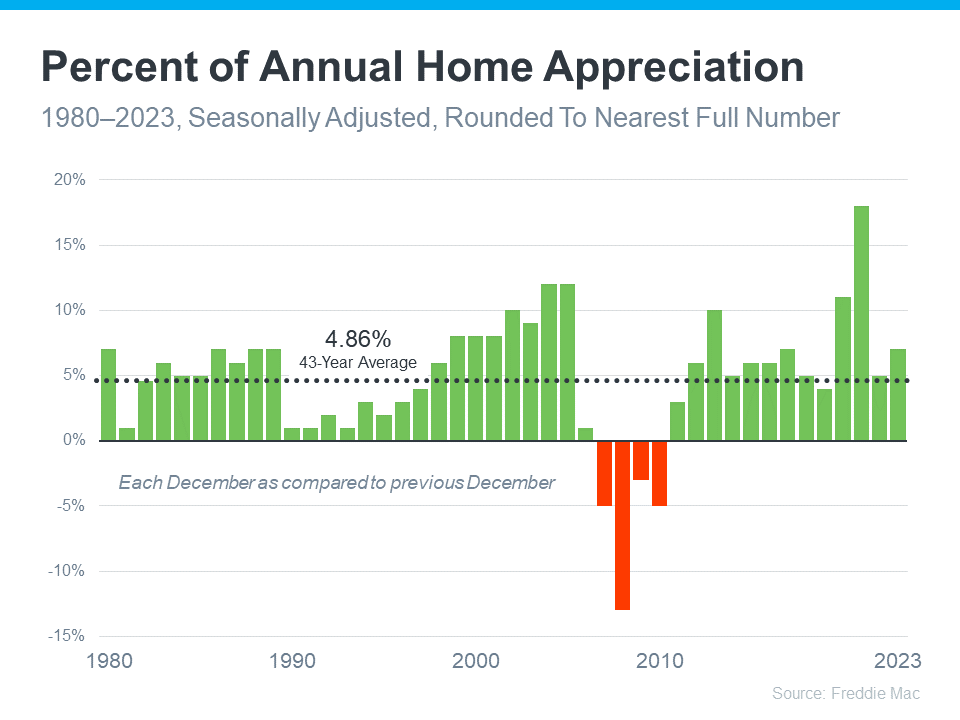

For many single women, buying a home isn’t just about having a place to live—it’s also a smart way to invest for the future. Homes usually increase in value over time, so they’re a great way to build equity and overall net worth. Ksenia Potapov, Economist at First American, says:

“. . . single women are increasingly pursuing homeownership and reaping its wealth creation benefits.”

The financial security and independence homeownership provides can be life-changing. And when you factor in the personal motivations behind buying a home, that impact becomes even clearer.

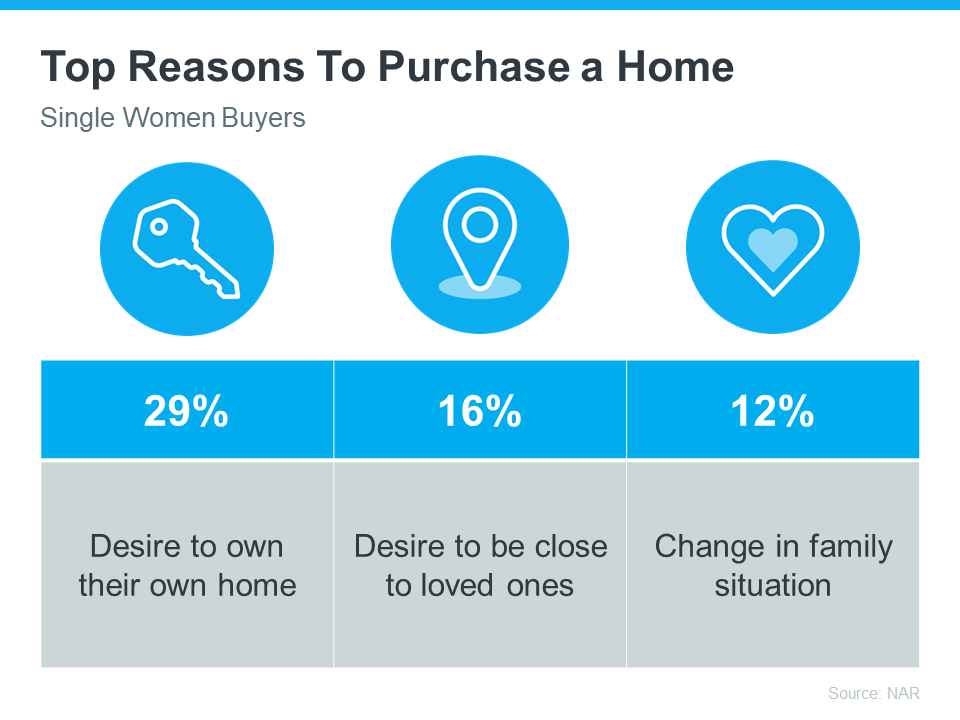

The same report from NAR shares the top reasons single women are buying a home right now, and the reality is, they’re not all financial (see chart below):

If any of these reasons resonate with you, maybe it’s time for you to buy too.

Work with a Trusted Real Estate Agent

If you’re a single woman looking to buy a home, it is possible, even in today’s housing market. You’ll just want to be sure you have a great real estate agent by your side.

Talk about what your goals are and why homeownership is so important to you. That way your agent can keep what’s critical for you up front as they guide you through the buying process. They’ll help you find the right home for your needs and advocate for you during negotiations. Together, you can make your dream of homeownership a reality.

Bottom Line

Homeownership is life-changing no matter who you are. Let’s connect today to talk about your goals in the housing market.

Single Women Are Embracing Homeownership: A Trend Shaping Today’s Housing Market

In today’s housing market, a remarkable trend is unfolding: single women are buying a home at unprecedented rates, reshaping the landscape of homeownership. According to recent statistics, 19% of all homebuyers are single women, a figure that underscores the growing influence and purchasing power of this demographic.

Why Homeownership is So Important

For a single woman trying to buy your first home, navigating the buying process can feel daunting. However, with the right guidance and resources, you can make your dream of homeownership a reality. Beyond the pride of owning a property, there are compelling reasons why homeownership is so important.

Homeownership is not just about having a place to call your own; it’s also a great way to build equity and secure your financial future. Instead of paying rent with no return, investing in a property allows you to accumulate wealth over time, providing stability and security for years to come.

Home Buying Tips for Single Women

If you’re a single woman contemplating a home purchase, here are some Home Buying Tips to help you navigate the process smoothly:

- Know Your Budget: Before you start house hunting, get pre-approved for a mortgage. Consult with your agent or a reputable West Palm Beach mortgage broker to understand your borrowing capacity and explore Affordable West Palm Beach home loans tailored to your financial situation.

- Define Your Needs: Determine what you’re looking for in a home, considering factors such as location, size, amenities, and budget. With a clear vision in mind, you can find the right home for your needs amidst the myriad of options available in the market.

- Research the Market: Familiarize yourself with today’s housing market trends and best mortgage rates in West Palm Beach. Stay informed about West Palm Beach refinancing options and Local mortgage lenders in West Palm Beach to make informed decisions throughout the buying process.

- Attend Open Houses: Take advantage of open houses and property viewings to explore different neighborhoods and get a feel for various housing options. Don’t hesitate to ask questions and seek Property loan advice in West Palm Beach from experts in the field.

- Stay Flexible: Be prepared to adjust your expectations and priorities as you explore the market. Remember that buying a home is a significant investment, and sometimes compromises may be necessary to find the perfect property within your budget.

Empowering Single Women in Real Estate

As more single women embrace homeownership, the real estate industry is adapting to meet their needs. From specialized First time home buyer loans in West Palm Beach to tailored Commercial mortgage broker services, there’s a range of resources available to support single women on their homeownership journey.

West Palm Beach mortgage calculators can be valuable tools for single women buying a home, helping them estimate monthly mortgage payments and assess affordability. Additionally, working with a knowledgeable West Palm Beach mortgage broker can provide invaluable insights and guidance throughout the purchasing process.

Closing Thoughts

In conclusion, the surge of single women buying a home signifies a significant shift in the housing market landscape. With access to Affordable West Palm Beach home loans and Property loan advice in West Palm Beach, single women are empowered to take charge of their financial futures and achieve the dream of homeownership.

Whether you’re a seasoned investor or a first-time homebuyer, the journey to homeownership is an exciting adventure filled with opportunities and possibilities. By leveraging the expertise of local mortgage lenders in West Palm Beach and staying informed about West Palm Beach refinancing options, you can embark on this journey with confidence and enthusiasm.

Let’s embrace this transformative trend and celebrate the empowerment of single women in real estate. Together, we can build a future where homeownership is accessible to all, regardless of gender or marital status.

Navigating the Buying Process with Confidence

For single women embarking on the journey of buying a home, it’s essential to have a solid understanding of the buying process and the support of a trusted agent. Your agent serves as your advocate, guiding you through each step of the transaction and ensuring your interests are prioritized.

From mortgage pre-approval to negotiating offers and conducting inspections, your agent is there to provide expert advice and assistance at every turn. With their expertise and guidance, you can navigate the buying process with confidence, knowing that you have a knowledgeable ally by your side.

Unlocking Opportunities in West Palm Beach

For single women considering homeownership in West Palm Beach, the possibilities are endless. With its vibrant culture, beautiful beaches, and thriving real estate market, West Palm Beach offers a wealth of opportunities for those looking to put down roots.

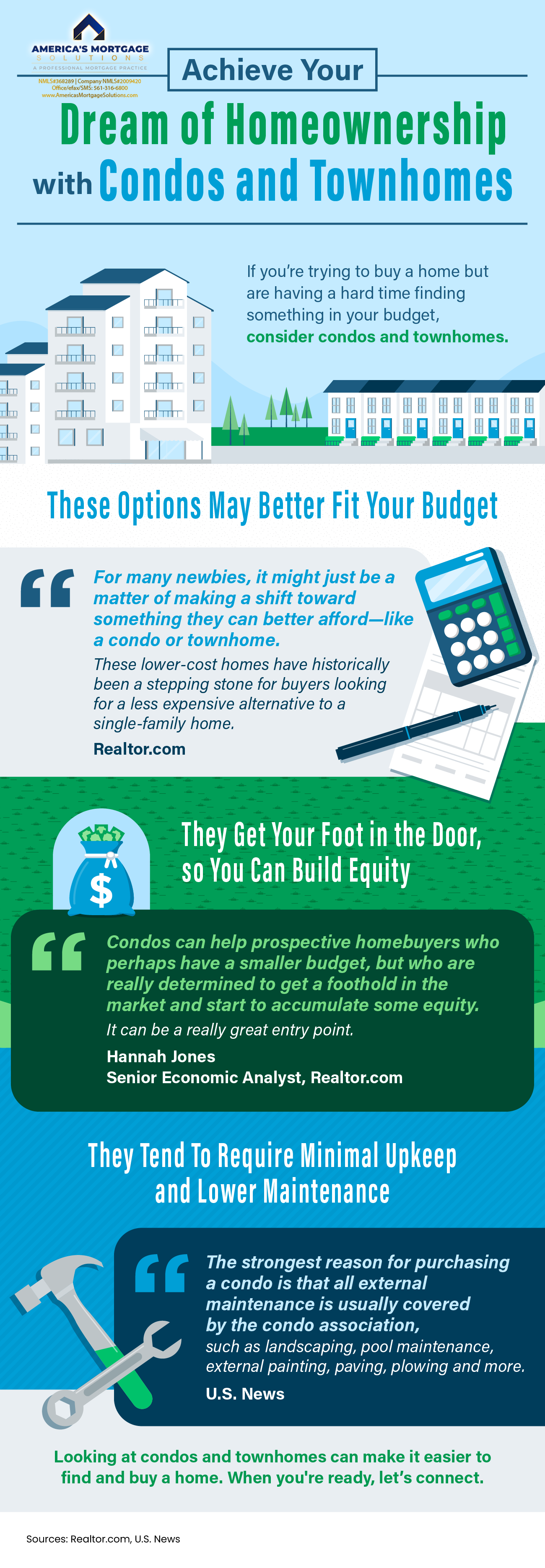

Thanks to local mortgage lenders in West Palm Beach and West Palm Beach mortgage calculators, single women can explore various financing options and determine the affordability of properties in their desired neighborhoods. Whether you’re interested in a cozy condo downtown or a spacious single-family home in the suburbs, West Palm Beach has something for everyone.

Building Wealth Through Real Estate

Investing in real estate is not just about finding a place to live; it’s also a powerful wealth-building strategy. For single women entering the world of homeownership, purchasing property represents a significant financial milestone that can pave the way for future prosperity.

By taking advantage of West Palm Beach refinancing options and commercial mortgage brokers in West Palm Beach, single women can leverage their properties to access additional capital for investments or other financial goals. Whether you’re looking to expand your real estate portfolio or start a new business venture, homeownership can serve as a springboard for building wealth and achieving long-term financial success.

Embracing the Future of Homeownership

As single women continue to play a prominent role in the housing market, it’s essential to recognize and celebrate their contributions. From first-time homebuyers to seasoned investors, single women are reshaping the real estate landscape and driving innovation in the industry.

With access to first-time homebuyer loans in West Palm Beach and property loan advice, single women have the resources and support they need to make informed decisions and achieve their homeownership goals. Whether you’re a recent graduate, a career professional, or a retiree, homeownership offers a path to stability, security, and financial independence.

Conclusion: Empowering Single Women in Real Estate

In conclusion, the rising trend of single women buying a home reflects a broader cultural shift towards gender equality and financial independence. By empowering single women to pursue homeownership and providing them with the tools and resources they need to succeed, we can create a more inclusive and equitable housing market for all.

Whether you’re a West Palm Beach mortgage broker, a local real estate agent, or a single woman dreaming of owning your own home, let’s work together to build a future where everyone has the opportunity to achieve the dream of homeownership. Together, we can create a world where no one is limited by their gender or marital status and where homeownership is within reach for all who aspire to achieve it.

Looking Ahead: The Future of Single Women in Real Estate

As we look to the future, it’s clear that single women will continue to play a significant role in shaping the housing market and driving demand for affordable West Palm Beach home loans. With a growing emphasis on financial literacy and empowerment, single women are increasingly taking control of their financial futures and seizing opportunities in real estate.

To support this trend, it’s essential for West Palm Beach mortgage brokers and local mortgage lenders to provide tailored solutions and personalized guidance to single women buyers. By understanding their unique needs and circumstances, these professionals can help single women navigate the buying process with confidence and achieve their homeownership goals.

Furthermore, initiatives aimed at promoting financial education and homeownership among single women can help bridge the gap and ensure that all individuals have equal access to the benefits of property ownership. Whether through workshops, seminars, or online resources, providing single women with the knowledge and tools they need to succeed in real estate is key to fostering a more inclusive and equitable housing market.

Final Thoughts: A Bright Future Awaits

In conclusion, the rise of single women buying a home marks a significant shift in the real estate landscape—one that is characterized by empowerment, independence, and opportunity. By embracing homeownership, single women are not only investing in their future but also shaping the future of real estate for generations to come.

With access to first-time home buyer loans in West Palm Beach, affordable mortgage rates, and expert guidance from local professionals, single women can navigate the buying process with confidence and achieve their dreams of homeownership. As we celebrate this transformative trend, let us continue to support and empower single women in their journey towards financial security and prosperity.

Together, we can build a future where homeownership is attainable for all, regardless of gender, marital status, or socioeconomic background. Let us embrace the opportunities that lie ahead and work towards a world where everyone has the chance to make their dream of homeownership a reality.

Celebrating Diversity in Homeownership

In the mosaic of today’s housing market, diversity in homeownership is not only desirable but essential. Single women are a vital and growing segment of this diverse tapestry, bringing unique perspectives, aspirations, and experiences to the table.

As we celebrate the empowerment of single women in real estate, it’s important to recognize that their journey is as varied as the homes they choose to call their own. Some may be first-time homebuyers, eagerly stepping onto the property ladder for the first time. Others may be seasoned investors, expanding their portfolios and securing their financial futures.

Regardless of where they are in their homeownership journey, single women are making their mark on the housing market and reshaping the way we think about property ownership. By embracing the principles of inclusivity and equality, we can create a real estate landscape that reflects the rich diversity of our communities and ensures that everyone has the opportunity to thrive.

Empowering Single Women Through Education and Support

While the path to homeownership may not always be smooth, single women have access to a wealth of resources and support to help them navigate the buying process successfully. From West Palm Beach mortgage calculators to property loan advice, there are tools and professionals available to provide guidance and assistance every step of the way.

Additionally, organizations and initiatives aimed at empowering single women in real estate play a crucial role in fostering a supportive and inclusive housing market. By offering educational workshops, mentorship programs, and networking opportunities, these initiatives help single women build the skills, knowledge, and confidence they need to achieve their homeownership goals.

A Collaborative Approach to Real Estate

Ultimately, the journey to homeownership is not one that single women must undertake alone. By partnering with trusted professionals such as local mortgage lenders in West Palm Beach and reputable real estate agents, single women can access the expertise and guidance they need to make informed decisions and secure the home of their dreams.

Moreover, fostering a spirit of collaboration and cooperation within the real estate industry can further enhance the experience of single women buyers. By working together to address challenges, share best practices, and advocate for the needs of single women in real estate, we can create a more supportive and inclusive environment for all.

In Conclusion: A New Era of Homeownership

In conclusion, the rise of single women buying a home represents a new era of homeownership—one that is defined by empowerment, diversity, and collaboration. As single women continue to assert their presence in the housing market, it’s essential that we recognize and celebrate their contributions and provide them with the tools and support they need to succeed.

By embracing the principles of inclusivity, equality, and collaboration, we can create a real estate landscape where everyone has the opportunity to achieve the dream of homeownership, regardless of gender, marital status, or socioeconomic background. Together, let’s build a future where the doors to homeownership are open to all who dare to dream.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |