Is a Multi-Generational Home Right for You?

Ever thought about living in the same house with your grandparents, parents, or other loved ones? You’re not alone. A lot of people are choosing to buy multi-generational homes where everyone can live together. Let’s check out why they think it’s a good idea to see if it might be a good fit for you, too.

Why People Are Choosing Multi-Generational Living

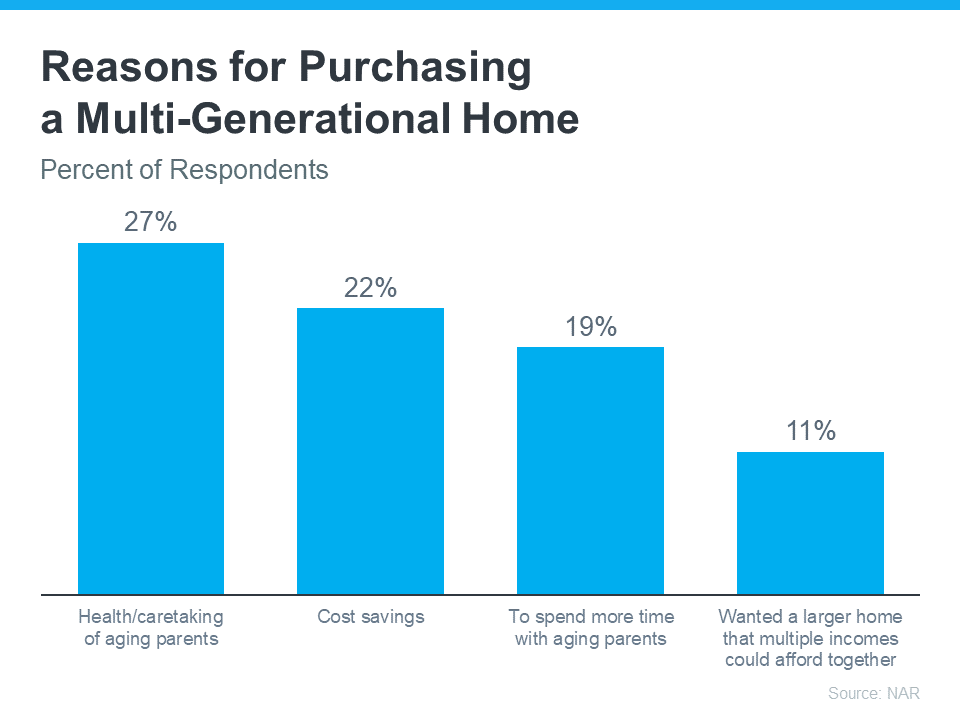

According to the National Association of Realtors (NAR), here are just a few key reasons buyers opted for multi-generational homes over the past year (see graph below):

Two of the top reasons had to do with aging parents. 27% of buyers chose multi-generational homes so they could take care of their parents more easily. And 19% did it to spend more time with them. A lot of older adults want to age in place, and living in a home with loved ones can help them do just that. If your parents are hoping to do the same, but need a bit of help, a multi-generational home may be worth considering.

But buying a multi-generational home isn’t just about being close or taking care of the people you love—it can save you money, too. 22% of buyers say they picked a multi-generational home to cut down on costs, and 11% needed a bigger house multiple incomes could afford together.

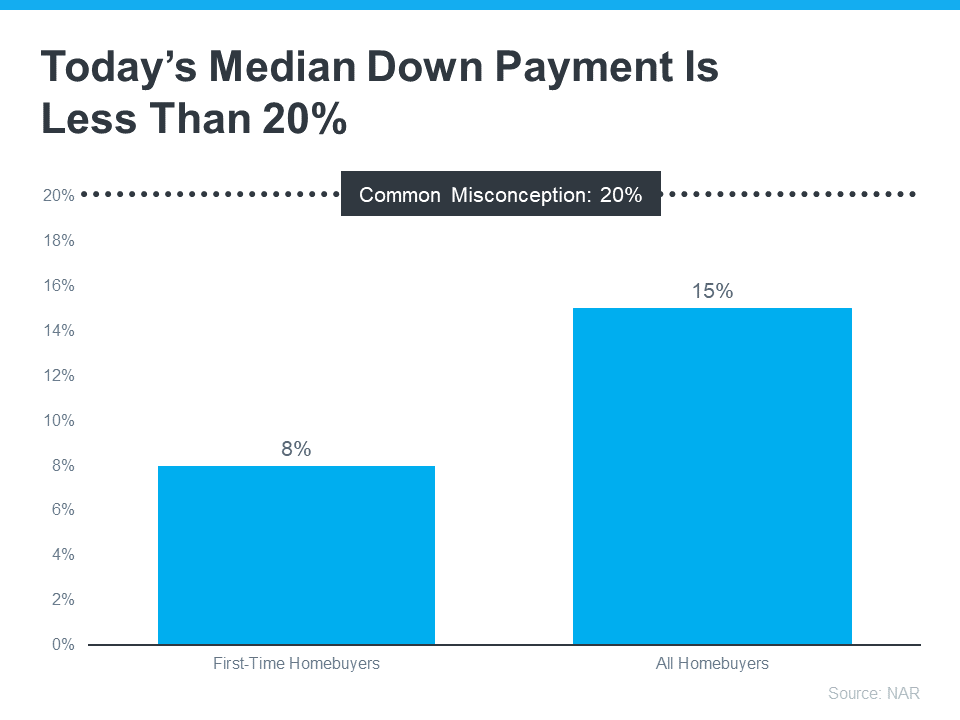

Sharing costs like the mortgage and utilities can make b. This is especially helpful for first-time homebuyers who might find it challenging to buy a place on their own in today’s market.

As Axios explains:

“Financial concerns and caregiving needs are two of the major reasons people live with their parents (and parents’ parents).”

How an Agent Is Key in Finding the Right Home for You

Looking for the perfect multi-generational home is a bit trickier than finding a regular house. You’ve got more people, which means more opinions and needs to think about. It’s kind of like putting together a puzzle where all the pieces need to fit perfectly.

If you’re into the idea of living with loved ones and want all the benefits that come with it, team up with a local real estate agent who can help you out.

Bottom Line

Whether you’re looking to save money or want to take care of your loved ones, buying a multi-generational home might be a good idea for you. If you want to find out more, let’s talk.

Is a Multi-Generational Home Right for You?

In today’s market, finding a regular house can be quite the journey, especially if you’re considering the option of a multi-generational home. But fear not! With the right guidance and a keen understanding of your needs, this unique housing arrangement might just be the perfect fit for you and your family.

The Agent Is Key in Finding the Right Home for You

When it comes to buying a multi-generational home, having a knowledgeable and experienced local real estate agent by your side is essential. They can help navigate the complexities of the housing market and pinpoint properties that meet your specific criteria. Whether you’re a seasoned homeowner or first-time homebuyer, their expertise can make all the difference in your search for the perfect multi-generational home.

Multi-Generational Homes: A Growing Trend

In recent years, multi-generational homes have surged in popularity as families seek innovative solutions to housing challenges. These homes, designed to accommodate multiple generations under one roof, offer a range of benefits, from shared living expenses to enhanced familial bonds. As more individuals recognize the advantages of this arrangement, the demand for multi-generational homes continues to rise.

Exploring Your Options

Before diving into the world of multi-generational living, it’s essential to consider your specific needs and preferences. Are you looking for a spacious property with separate living quarters for each generation, or would you prefer a single-family home with adaptable spaces? By clarifying your priorities, you can narrow down your search and focus on properties that align with your vision.

Financial Considerations

One of the most significant advantages of buying a multi-generational home is its potential for cost savings. By sharing expenses such as mortgage payments, utilities, and maintenance costs, families can significantly reduce their financial burden. Additionally, multi-generational living can offer long-term financial stability, as it allows family members to pool their resources and build equity together.

Mortgage Solutions for Multi-Generational Homes

When it comes to financing a multi-generational home, working with a reputable West Palm Beach mortgage broker is key. They can provide valuable insight into affordable West Palm Beach home loans and help you secure the best mortgage rates in West Palm Beach. Whether you’re exploring first-time home buyer loans or refinancing options, a local mortgage lender can guide you through the process and ensure you find the right financing solution for your needs.

Lifestyle Benefits

Beyond the financial advantages, multi-generational living offers a host of lifestyle benefits. From shared childcare responsibilities to increased social support, living with multiple generations can enrich your daily life and foster stronger familial bonds. Additionally, having grandparents, parents, and children under one roof can create a sense of community and belonging that is unmatched by traditional living arrangements.

Designing for Comfort and Privacy

One common concern with multi-generational homes is the balance between communal living and individual privacy. Fortunately, modern home designs offer innovative solutions to this dilemma, with features such as separate entrances, private living areas, and flexible floor plans. By working with a skilled architect or builder, you can create a home that meets the unique needs of each family member while promoting harmony and cohesion.

Emotional Considerations

While multi-generational living can offer numerous benefits, it’s essential to recognize that it’s not without its challenges. Adjusting to a shared living arrangement requires open communication, flexibility, and a willingness to compromise. Family dynamics, personal boundaries, and cultural differences may also come into play, requiring patience and understanding from all parties involved.

Building Stronger Relationships

Despite these challenges, many families find that multi-generational living strengthens their relationships and deepens their bonds. By sharing daily experiences, celebrating milestones together, and supporting one another through life’s ups and downs, family members can forge connections that endure a lifetime. Ultimately, the decision to pursue multi-generational living is a deeply personal one that should be made with careful consideration and thoughtful planning.

Conclusion

In conclusion, multi-generational homes offer a compelling housing solution for families seeking affordability, flexibility, and intergenerational connections. By working with a knowledgeable local real estate agent and exploring your financing options with a trusted West Palm Beach mortgage broker, you can find the perfect multi-generational home to suit your unique needs. Whether you’re a first-time homebuyer or a seasoned homeowner, embracing the benefits of multi-generational living can lead to a richer, more fulfilling lifestyle for you and your loved ones.

Exploring Your Options

When considering whether a multi-generational home is right for you, it’s essential to explore all available options in today’s market. From sprawling suburban estates to cozy urban dwellings, there are multi-generational homes to suit every taste and lifestyle. Working closely with your local real estate agent, you can identify properties that meet your criteria and align with your long-term goals.

Customizing Your Search

As you embark on your search for the perfect multi-generational home, be sure to communicate your preferences and priorities to your real estate agent. Whether you’re drawn to specific neighborhoods, architectural styles, or amenities, your agent can tailor their search to align with your vision. By leveraging their expertise and industry connections, you can streamline the home-buying process and focus on properties that have the potential to become your dream home.

Planning for the Future

In addition to meeting your immediate housing needs, a multi-generational home can provide a solid foundation for the future. As your family grows and evolves, your home should adapt to accommodate changing circumstances and lifestyles. With thoughtful planning and strategic design choices, you can create a space that fosters harmony, flexibility, and longevity for generations to come.

Consulting with Professionals

When designing or renovating a multi-generational home, it’s advisable to seek input from professionals who specialize in this type of living arrangement. From architects and interior designers to contractors and builders, assembling a skilled team can ensure that your vision is brought to life with precision and expertise. By collaborating with professionals who understand the unique dynamics of multi-generational living, you can avoid common pitfalls and maximize the potential of your home.

Embracing Community

Beyond the walls of your multi-generational home, there lies a vibrant community waiting to be explored and embraced. Whether you’re settling into a bustling urban neighborhood or a tranquil suburban enclave, connecting with your neighbors and getting involved in local activities can enhance your overall quality of life. From neighborhood gatherings to community events, there are countless opportunities to forge meaningful connections and create lasting memories with those around you.

Finding Your Tribe

In a multi-generational home, your immediate family members are not the only ones who play a significant role in your daily life. Extended family members, neighbors, and friends can also contribute to the rich tapestry of experiences that define your home environment. By cultivating a sense of belonging and inclusivity within your community, you can create a supportive network of individuals who enrich your life in myriad ways.

Conclusion

In conclusion, multi-generational living offers a wealth of benefits for families seeking a more interconnected and sustainable lifestyle. From financial savings to enhanced social support, the advantages of sharing a home with multiple generations are clear. By working with experienced professionals such as your local real estate agent and West Palm Beach mortgage broker, you can navigate the complexities of the housing market and find the perfect multi-generational home for your unique needs.

As you embark on this exciting journey, remember to prioritize open communication, mutual respect, and a spirit of collaboration. By embracing the opportunities and challenges of multi-generational living, you can create a home environment that nurtures and empowers each member of your family. So why wait? Start exploring your options today and discover the joys of multi-generational living for yourself!

Navigating the Financial Landscape

When it comes to multi-generational living, understanding the financial implications is crucial. From mortgage financing to ongoing expenses, it’s essential to develop a comprehensive plan that aligns with your budget and long-term goals. By working closely with a reputable West Palm Beach mortgage broker, you can explore a variety of financing options and secure a loan that suits your unique circumstances.

Exploring Mortgage Solutions

Whether you’re a first-time homebuyer or a seasoned homeowner, navigating the mortgage landscape can be daunting. Fortunately, there are numerous loan programs available to assist with the purchase of a multi-generational home. From conventional mortgages to government-backed loans, your mortgage broker can help you evaluate the pros and cons of each option and determine the best course of action for your situation.

Maximizing Your Investment

In addition to providing a comfortable living space for your family, a multi-generational home can also serve as a sound investment opportunity. By leveraging the equity in your home, you can access additional funds for home improvements, education expenses, or other financial goals. With the guidance of a knowledgeable West Palm Beach mortgage broker, you can explore refinancing options and unlock the full potential of your home’s value.

Planning for the Future

As you contemplate the financial aspects of multi-generational living, it’s essential to consider the long-term implications for your family’s financial well-being. From retirement planning to estate management, thoughtful financial planning can help safeguard your assets and provide peace of mind for future generations. By working with trusted advisors and staying informed about market trends, you can make informed decisions that support your family’s financial stability and prosperity.

Embracing the Journey

Ultimately, the decision to pursue multi-generational living is a deeply personal one that requires careful consideration and thoughtful planning. While there may be challenges along the way, the rewards of sharing a home with multiple generations can far outweigh the obstacles. From stronger family bonds to shared memories and experiences, multi-generational living offers a unique opportunity to create a supportive and nurturing environment for you and your loved ones.

Seizing the Opportunity

As you embark on this journey, remember that you are not alone. With the support of your local real estate agent and West Palm Beach mortgage broker, you can navigate the complexities of the housing market and find the perfect multi-generational home for your family. By embracing the opportunities and challenges of multi-generational living, you can create a home environment that fosters growth, connection, and fulfillment for generations to come.

Conclusion

In conclusion, multi-generational living is a viable housing option for families seeking affordability, flexibility, and intergenerational connections. By working with experienced professionals and carefully considering your financial options, you can navigate the complexities of the housing market and find a multi-generational home that meets your needs. Whether you’re a first-time homebuyer or a seasoned homeowner, embracing the benefits of multi-generational living can lead to a richer, more fulfilling lifestyle for you and your loved ones. So why wait? Start exploring your options today and discover the joys of multi-generational living for yourself!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |