Here’s What a Recession Could Mean for the Housing Market

Recession talk is all over the news, and the odds of a recession are rising this year. And that leaves people wondering what would happen to the housing market if we do go into a recession.

Let’s take a look at some historical data to show what’s happened in housing for each recession going all the way back to the 1980s.

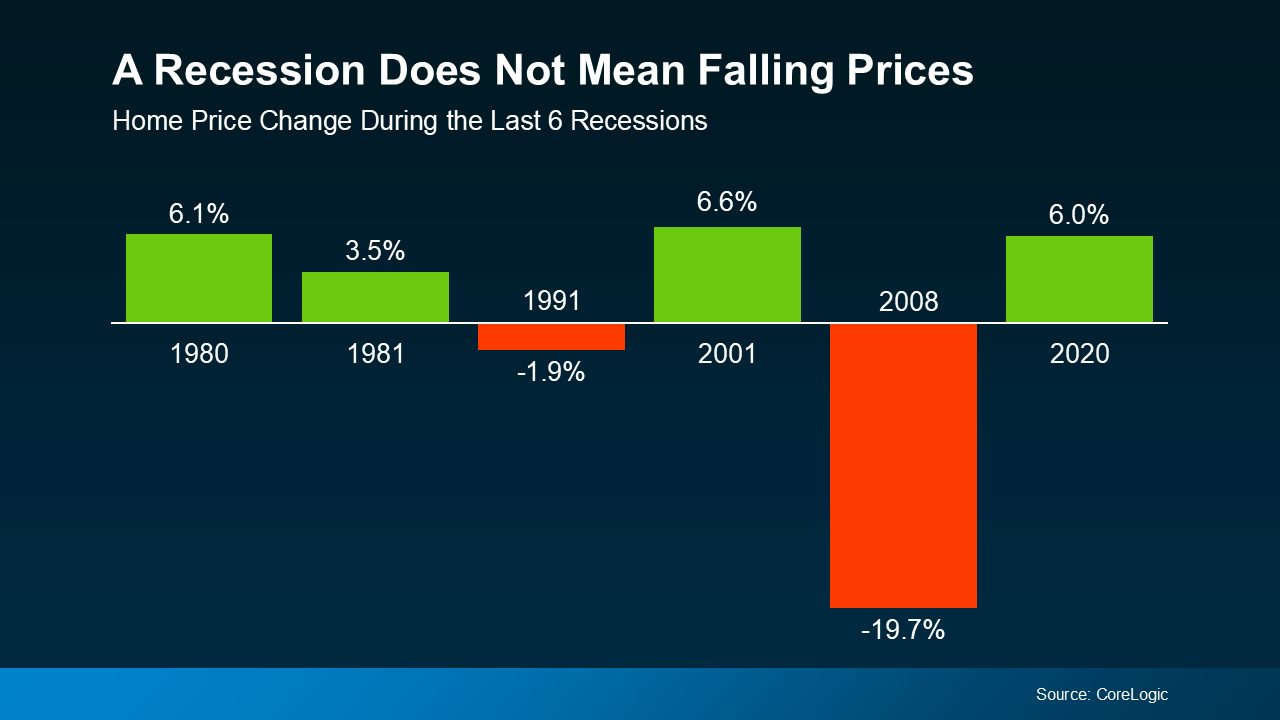

A Recession Doesn’t Mean Home Prices Will Fall

Many people think that if a recession hits, home prices will fall like they did in 2008. But that was an exception, not the rule. It was the only time we saw such a steep drop in prices. And it hasn’t happened since.

In fact, according to data from CoreLogic, in four of the last six recessions, home prices actually went up (see graph below):

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

So, if you’re thinking about buying or selling a home, don’t assume a recession will lead to a crash in home prices. The data simply doesn’t support that idea. Instead, home prices usually follow whatever trajectory they’re already on. And right now, nationally, home prices are still rising at a more normal pace.

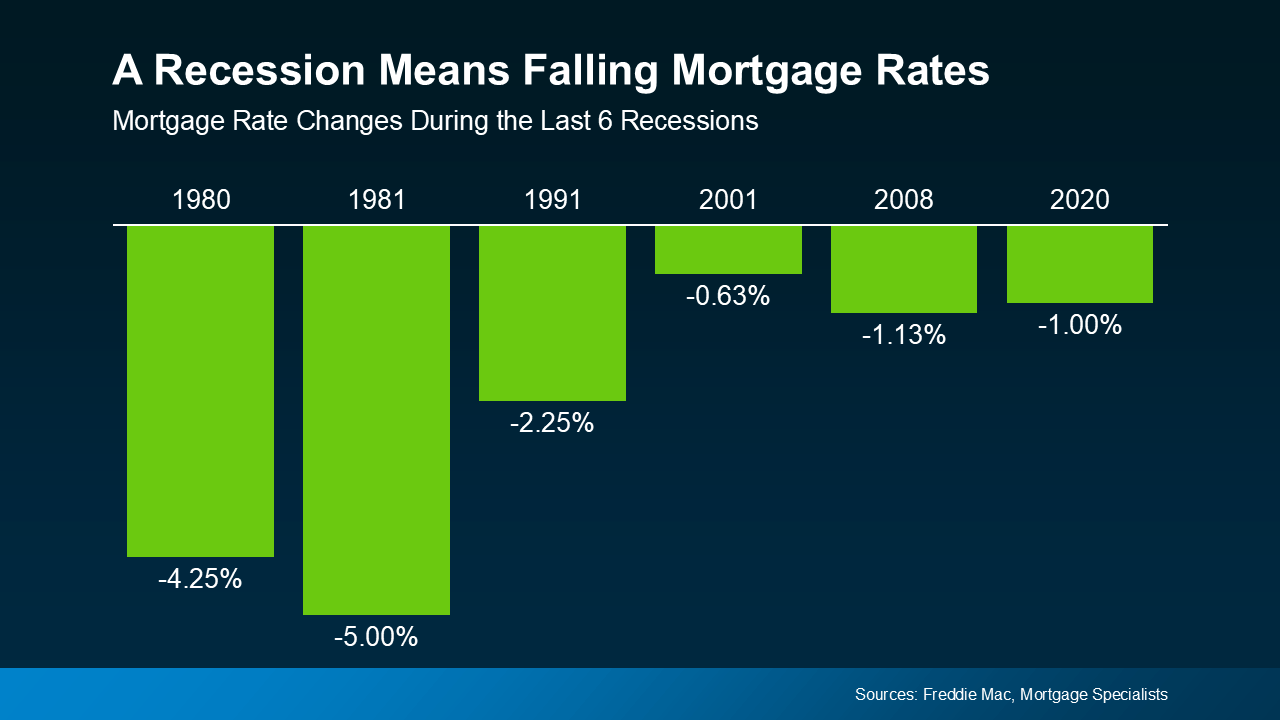

Mortgage Rates Typically Decline During Recessions

While home prices tend to stay on their current path, mortgage rates usually drop during economic slowdowns. Again, looking at data from the last six recessions, mortgage rates fell each time (see graph below):

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

So, a recession means mortgage rates could decline based on the data. While that would help with affordability, don’t expect the return of a 3% rate.

The answer to the recession question is still unknown, but the odds have gone up. But that doesn’t mean you have to wonder about the impact on the housing market – historical data tells us what usually happens.

When you hear talk about a possible recession, what concerns or questions come to mind about buying or selling a home?

Here’s What a Recession Could Mean for the Housing Market

The word recession often evokes a mix of fear and uncertainty, especially for those who are thinking about buying or selling a home. With so much economic chatter about an impending economic slowdown, it’s only natural to wonder how the housing market might be impacted. Will home prices tumble? Will mortgage rates skyrocket or plummet? Will it be a buyer’s paradise or a seller’s nightmare?

To understand the potential impact, let’s turn to historical data and analyze key real estate trends that emerge during past downturns, including the infamous 2008 Recession and 2008 Housing Crash. We’ll also explore how local factors play a role, particularly in vibrant markets like West Palm Beach, where securing affordable West Palm Beach home loans or working with a West Palm Beach mortgage broker can make all the difference.

Does a Recession Automatically Mean Falling Home Prices?

There’s a common assumption that a recession causes home prices to plummet. But the reality? That’s not always the case.

The 2008 Housing Crash is often used as the prime example of a market downturn, but that was an outlier caused by risky lending practices, over-leveraging, and financial institutions failing to manage risk. Looking at the broader picture, in four out of the last six recessions, home prices actually increased. According to CoreLogic, past historical data shows that the housing market doesn’t necessarily crash every time the economy slows down.

So, if you’re thinking about buying or selling a home, don’t assume doom and gloom. Instead, focus on local real estate trends and keep an eye on the best mortgage rates in West Palm Beach if you’re in the area.

Mortgage Rates During a Recession: A Silver Lining?

One of the most consistent patterns in past economic slowdowns is the behavior of mortgage rates. Historically, mortgage rates tend to decline during recessions as the Federal Reserve lowers interest rates to stimulate economic activity.

For homebuyers, this presents an opportunity. Lower mortgage rates can increase affordability, making it easier to secure first time home buyer loans in West Palm Beach or explore West Palm Beach refinancing options to take advantage of better terms.

If you’re looking to make a move, consider getting a mortgage preapproval in West Palm Beach to lock in a favorable rate before the market shifts.

Buying A Home During a Recession: Opportunity or Risk?

A recession can create unique opportunities for those looking at buying a home. Sellers may become more motivated, leading to potential price negotiations. Additionally, lower mortgage rates improve affordability, making it an attractive time for those seeking affordable West Palm Beach home loans.

However, buyers should proceed with caution. During uncertain times, employment stability is crucial. Before diving into homeownership, use West Palm Beach mortgage calculators to ensure your finances align with long-term goals.

Selling A Home in a Recession: Challenges and Strategies

If you’re selling a home during a recession, you might need to be more strategic. While demand doesn’t necessarily vanish, buyers may become more hesitant. Competitive pricing, home staging, and working with a knowledgeable West Palm Beach mortgage broker can make all the difference in securing a quick and profitable sale.

Sellers should also pay close attention to local real estate trends. The key to selling successfully in a housing market slowdown is understanding what buyers are looking for and positioning your home accordingly.

How West Palm Beach Buyers and Sellers Can Navigate a Recession

West Palm Beach remains a dynamic real estate market, offering a mix of luxury properties and more affordable options. If you’re navigating this market, consider leveraging local expertise through a commercial mortgage broker in West Palm Beach or seeking property loan advice in West Palm Beach to ensure you’re making informed decisions.

Additionally, staying informed about local mortgage lenders in West Palm Beach can give buyers and investors an edge when securing financing. Whether you’re looking for a dream home, an investment property, or refinancing options, working with experienced professionals is crucial.

Final Thoughts

A recession is a complex economic event, but it doesn’t necessarily spell disaster for the housing market. While challenges may arise, there are also opportunities—whether in the form of lower mortgage rates, increased affordability, or a chance to negotiate a great deal.

For those in West Palm Beach, securing the best mortgage rates in West Palm Beach or working with a trusted West Palm Beach mortgage broker can provide the guidance needed to navigate the market confidently.

Whether you’re buying a home, selling a home, or simply weighing your options, the key is to stay informed, consult experts, and make decisions based on sound financial planning rather than fear.

As history has shown, the housing market is resilient. And with the right strategy, you can turn economic uncertainty into a real estate opportunity.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

To schedule a time to talk with me just click here:

To schedule a time to talk with me just click here:

Apply for a mortgage now at

Apply for a mortgage now at  561-861-3987 or

561-861-3987 or Call me directly

Call me directly  561-861-3987

561-861-3987

or to BUY

or to BUY  , SELL

, SELL  , LEASE

, LEASE  , INVEST

, INVEST  , or BUILD your DREAM HOME

, or BUILD your DREAM HOME  or OFFICE

or OFFICE  , we’ve got you covered! From residential properties

, we’ve got you covered! From residential properties  to commercial real estate & development

to commercial real estate & development  , we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks

, we provide expert solutions tailored to your needs. Enhance your waterfront property with custom docks  , seawalls

, seawalls

. Need disaster cleanup? Our heavy-duty grapple trucks

. Need disaster cleanup? Our heavy-duty grapple trucks

are ready for storm damage

are ready for storm damage

, fallen debris removal

, fallen debris removal

, and rapid response cleanup

, and rapid response cleanup

. We also specialize in luxury financing for yachts

. We also specialize in luxury financing for yachts  , aircrafts

, aircrafts  , RVs

, RVs  , and exotic cars

, and exotic cars  . Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors

. Looking for insurance & financial solutions? We offer homeowners & commercial insurance, life insurance, estate planning, and access to top real estate attorneys, CPAs, and financial advisors  . Call us TODAY

. Call us TODAY

, no matter your NEED

, no matter your NEED  or GOAL

or GOAL  !

!

Christian Penner Personal Site:

Christian Penner Personal Site: Christian Penner’s LinkTree:

Christian Penner’s LinkTree: Helpful Resources & Websites:

Helpful Resources & Websites: Rate Ranges & Trends:

Rate Ranges & Trends: Service Level Agreement (SLA):

Service Level Agreement (SLA): HomeBot Dashboard:

HomeBot Dashboard: Search Homes on HomeBot:

Search Homes on HomeBot: HomeBot App:

HomeBot App: HomeBot Android App:

HomeBot Android App: KCM Video Blog – Market Updates:

KCM Video Blog – Market Updates: KCM Blog – Real Estate News & Trends:

KCM Blog – Real Estate News & Trends: Advanced Search:

Advanced Search: Off-Market Homes:

Off-Market Homes: AMS Google Review:

AMS Google Review:

Privacy Policy & Disclosures:

Privacy Policy & Disclosures:

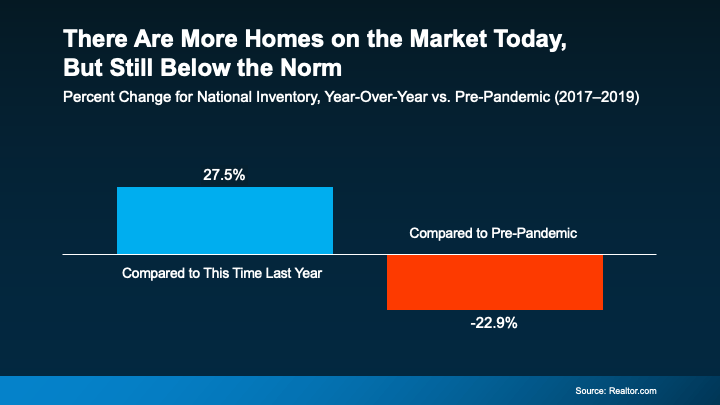

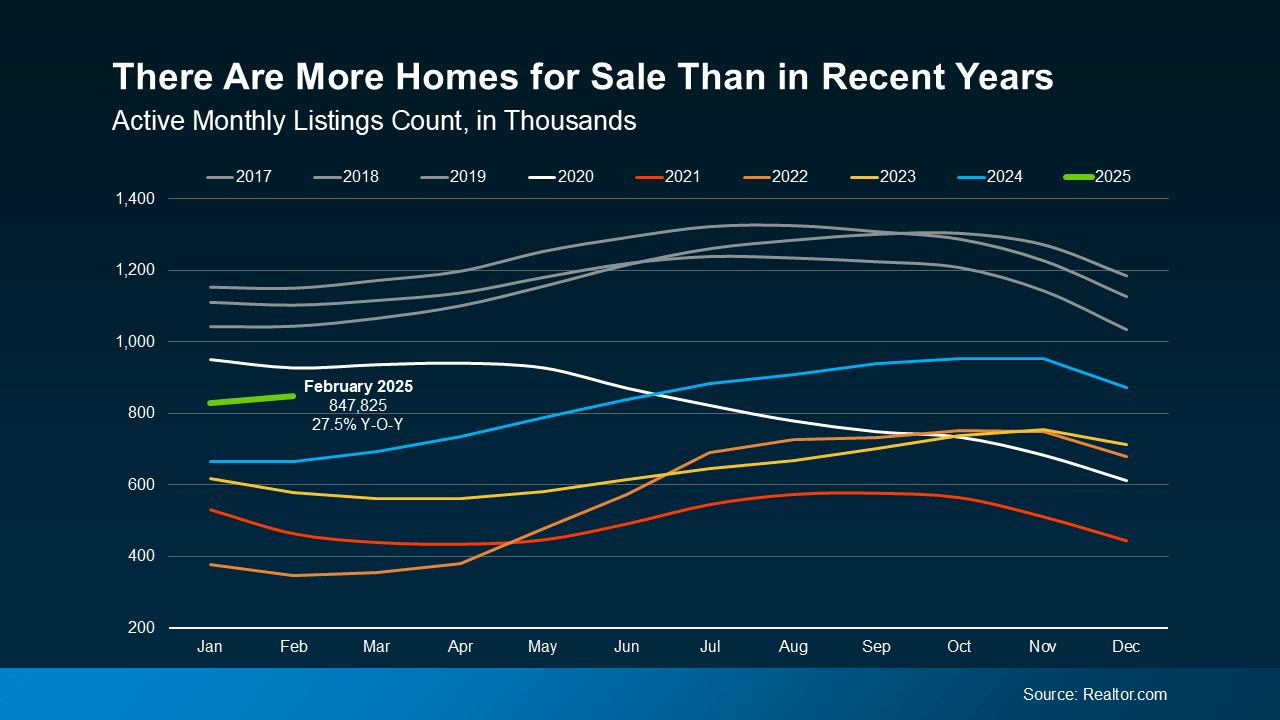

Buyers: This means you have more choices, and you can be more selective.

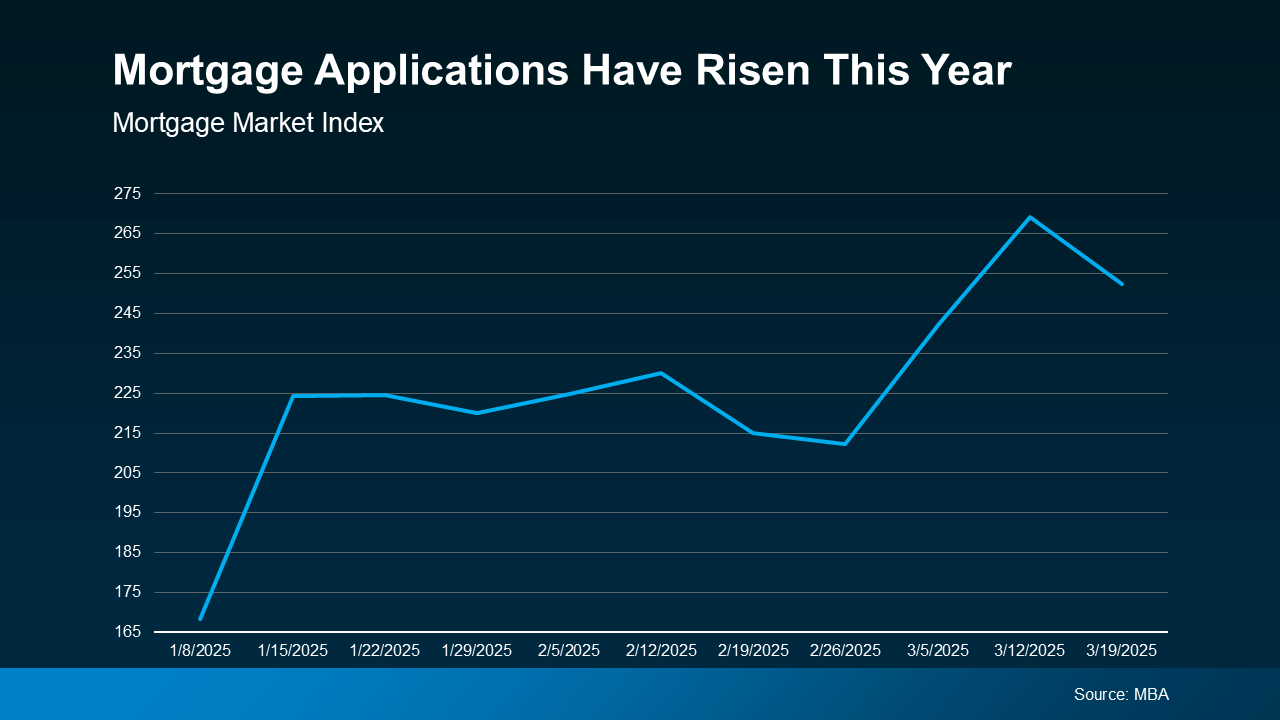

Buyers: This means you have more choices, and you can be more selective. Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.

Buyers: Acting sooner rather than later could be a smart move before your competition heats up even more.