Housing Market Forecast for the 2nd Half of 2024

Some Highlights

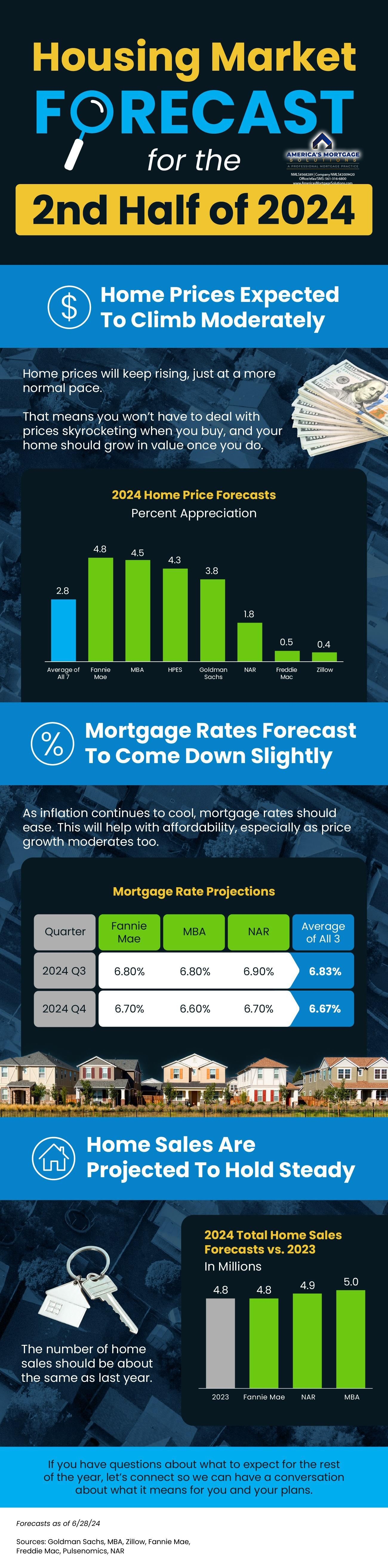

- Wondering what the second half of the year holds for the housing market? Here’s what expert forecasts say.

- Home prices are expected to climb moderately. Mortgage rates are forecast to come down slightly. And, home sales are projected to hold steady.

- If you have questions about what to expect for the rest of the year, let’s connect so we can have a conversation about what it means for you and your plans.

Buckle Up Buttercup: A Look at the Housing Market’s Second Half in 2024

Hey there, house hunters and home sellers! Let’s talk about the elephant in the living room – the housing market. We all know it’s been a wild ride these past few years, and with whispers of a potential slowdown swirling, you might be wondering what the crystal ball holds for the rest of 2024. Well, fret no more, because buckle up – we’re about to dive into the Housing Market Forecast for the second half, packed with insights from expert forecasts to guide your real estate decisions.

Home Prices Expected To Climb Moderately:

Let’s address the big one first: home prices. Now, according to the soothsayers of the housing market (read: economists), prices are expected to continue their upward trajectory, though at a more moderate pace compared to the scorching hot days of the pandemic. Why? The answer lies in a simple equation: supply and demand. We still have a dearth of houses available, folks. It’s a seller’s market, but without the breakneck bidding wars of yesteryear.

Home Sales Are Projected To Hold Steady:

So, what about home sales? Here’s some good news – expert forecasts predict them to hold steady. This means a continuation of a healthy market, with a balance between buyers and sellers. More houses are trickling onto the market, thanks to pent-up sellers finally taking the plunge, which should entice some of you eager buyers out there.

Mortgage Rates Forecast To Come Down Slightly:

Now, let’s talk about the lifeblood of buying a home – that magical (sometimes maddening) number we call the mortgage rate. While rates have indeed ticked up from their historic lows, experts predict a slight downward trend in the coming months. This could be a game-changer, particularly for first-time homebuyers, making that dream home a smidge more affordable.

West Palm Beach: Your Local Housing Market Navigator

Of course, national trends can only paint part of the picture. The real estate landscape varies significantly across regions. If you’re setting your sights on the charming West Palm Beach area, fret not! Here are some local resources to illuminate your path:

- West Palm Beach mortgage broker: Finding the right financial partner is crucial. A local mortgage broker can guide you through the loan labyrinth and secure the best mortgage rates in West Palm Beach.

- Affordable West Palm Beach home loans: Worried about affordability? Don’t sweat it! There are a variety of affordable West Palm Beach home loan options available, tailored to first-time homebuyers and others seeking budget-friendly solutions.

- First-time home buyer loans in West Palm Beach: Taking that exciting first step onto the property ladder? Let a knowledgeable lender help you navigate the world of first-time home buyer loans in West Palm Beach.

- West Palm Beach refinancing options: Thinking about refinancing your existing mortgage? Explore the West Palm Beach refinancing options available and potentially unlock some savings.

- Local mortgage lenders in West Palm Beach: Building a strong relationship with a local mortgage lender is key. They can offer personalized advice and guide you through the entire loan process.

- West Palm Beach mortgage calculators: Use these handy online tools to estimate your monthly payments and get a feel for what you can afford.

- Property loan advice in West Palm Beach: Need some expert guidance on navigating the complexities of property loans? Seek advice from a qualified professional in the West Palm Beach area.

- Commercial mortgage broker in West Palm Beach: Looking to invest in commercial real estate? A commercial mortgage broker in West Palm Beach can help you secure the financing you need.

- Mortgage preapproval in West Palm Beach: Getting pre-approved for a mortgage is a crucial step in the home buying journey. This demonstrates your financial strength to sellers and streamlines the offer process.

So, You Ask, What Does This All Mean for You?

The housing market in the second half of 2024 is poised to be a period of stability. Home prices are likely to continue rising, but at a gentler pace. Home sales are expected to remain steady, and mortgage rates might even dip slightly. This creates a balanced market for both buyers and sellers.

For Buyers:

- Do your research: West Palm Beach is a vibrant market. Familiarize yourself with different neighborhoods and price points.

- Get pre-approved for a mortgage: This shows sellers you’re a serious contender and helps you stay competitive.

- Be patient: Don’t get discouraged if your dream home doesn’t pop up right away. The right property will come along, so stay focused and act quickly when you find it.

- Consider a buyer’s agent: A knowledgeable real estate agent can be your guiding light in this competitive market. They can advocate for your needs, negotiate on your behalf, and help you navigate the complexities of the buying process.

For Sellers:

- Price your home competitively: While the market still favors sellers, an inflated price tag could deter potential buyers. Get a comparative market analysis (CMA) from a qualified realtor to determine the right price point.

- Make your home sparkle: Boost your curb appeal with some minor cosmetic improvements and stage your home to showcase its potential.

- Work with a reputable realtor: An experienced realtor can leverage their network and marketing expertise to attract qualified buyers and get you the best possible price for your property.

Remember: The housing market is a dynamic beast, and unforeseen circumstances can always arise. However, by staying informed, making well-considered decisions, and seeking professional guidance when needed, you can navigate the journey towards your real estate goals in the exciting second half of 2024!

Beyond the Basics: Unpacking the Nuances of the Market

While the national forecast paints a broad picture, it’s important to consider some emerging trends that could influence specific segments of the market:

- The Rise of Remote Work: With more and more people embracing remote work opportunities, location independence is becoming a reality. This could fuel demand in previously overlooked suburbs and exurban areas, potentially impacting housing prices and inventory levels in these regions.

- The Multigenerational Mortgage: As housing affordability remains a challenge, we might see a rise in multigenerational mortgages. This allows families to combine their buying power to purchase a larger property that accommodates multiple generations under one roof.

- The Impact of Inflation: Inflation is a hot topic these days, and its ripple effects could be felt in the housing market. Rising construction costs could lead to a slowdown in new home builds, further tightening inventory and potentially pushing prices up in certain areas.

A Word on Affordability:

Let’s face it, affordability remains a significant concern for many potential buyers. While rising interest rates might cool things down a bit, it’s important to explore all available options. Government programs, down payment assistance initiatives, and creative financing solutions offered by local lenders can help bridge the affordability gap, especially for first-time homebuyers.

The Takeaway: Knowledge is Power

The housing market, like any complex system, is influenced by a multitude of factors. By staying informed about national trends, local market dynamics, and emerging themes, you’ll be well-equipped to make informed decisions. Remember, the key is to plan, prepare, and seek professional guidance from qualified real estate agents and mortgage lenders. With the right approach, the second half of 2024 can be a rewarding time to embark on your real estate journey, whether you’re a seasoned seller or a wide-eyed first-time buyer. So, buckle up, do your research, and get ready to make your move!

Don’t Forget the Fun: Must-Haves for Your Real Estate Toolkit

Now, let’s inject a dose of excitement into this whole process! Here are some essential tools to add to your real estate arsenal and make your home buying or selling journey a breeze:

- Real estate apps: Technology is your friend! Download some user-friendly real estate apps that allow you to browse listings, track market trends, and even get virtual tours of properties from the comfort of your couch.

- Online mortgage calculators: Play with different scenarios using these handy online tools. Estimate your monthly payments, see how much house you can afford, and get a feel for the financial implications of your real estate decisions.

- Open houses: These events are a fantastic way to get a feel for different neighborhoods, styles of homes, and price points. Mingle with realtors, ask questions, and get a sense of the local market firsthand.

- Real estate blogs and podcasts: Stay ahead of the curve by subscribing to informative real estate blogs and podcasts. Gain valuable insights from industry experts and learn valuable tips and tricks for navigating the market.

Remember, buying or selling a home is a significant life event. But with the right knowledge, resources, and a dash of enthusiasm, it can also be an incredibly rewarding experience. So, go forth, explore, and conquer the exciting world of real estate in the second half of 2024!

West Palm Beach Spotlight: Unveiling Local Gems

While national trends offer valuable insights, for those setting their sights on the sunny shores of West Palm Beach, here’s a deeper dive into the local market:

- A Seller’s Paradise (with Nuances): West Palm Beach continues to be a seller’s market, with multiple offers on desirable properties. However, remember – pricing it right is crucial. An inflated price tag can deter buyers in this interest-rate sensitive market.

- Inventory on the Rise (Slowly): Good news for buyers! Inventory levels are gradually increasing, offering more options to choose from. However, the competition for desirable properties in prime locations can still be fierce.

- Location, Location, Location: West Palm Beach boasts diverse neighborhoods, each with its own unique charm and price point. Do your research! Explore vibrant downtown areas, established communities, and up-and-coming neighborhoods to find the perfect fit for your lifestyle and budget.

Local Resources at Your Fingertips:

Remember, we mentioned those amazing local resources earlier? Let’s revisit them in the context of the West Palm Beach market:

- West Palm Beach mortgage broker: Finding the right local mortgage broker who understands the nuances of the West Palm Beach market is key. They can help you secure the most competitive rates and navigate the loan process seamlessly.

- Affordable West Palm Beach home loans: Don’t let affordability concerns hold you back! Explore various loan options specifically designed for first-time homebuyers or those seeking budget-friendly solutions.

- Local mortgage lenders in West Palm Beach: Building a relationship with a local lender familiar with the West Palm Beach market allows them to tailor their recommendations to your specific needs and financial situation.

Embrace the West Palm Beach Lifestyle:

Beyond the bricks and mortar, West Palm Beach offers a vibrant lifestyle waiting to be explored. From pristine beaches and world-class shopping to a thriving arts scene and delectable culinary delights, this city has something for everyone. Factor this into your decision-making process – after all, your home is more than just an address; it’s a gateway to a new way of life.

So, are you ready to write your own West Palm Beach real estate story in the second half of 2024? With the right knowledge, local resources, and a dash of West Palm Beach sunshine, your dream home could be closer than you think!

Beyond the Sunshine: Risks and Considerations for West Palm Beach

While West Palm Beach paints a picture of paradise, it’s important to approach any real estate decision with a clear head. Here are some additional factors to consider:

- Rising Insurance Costs: Florida grapples with a volatile weather system. Be prepared for potentially higher homeowners insurance premiums, particularly for properties in flood-prone areas.

- Competition Heats Up in Luxury Market: The luxury market in West Palm Beach is a competitive beast. While high-end properties are still in demand, expect multiple offers and potentially drawn-out bidding wars for the most coveted estates.

- Rising Property Taxes: Property taxes in West Palm Beach are trending upwards. Factor this into your long-term financial calculations when considering a home purchase.

Mitigating the Risks: Strategies for Success

Now, let’s not dwell on the potential pitfalls! Here are some proactive strategies to navigate the West Palm Beach market with confidence:

- Work with a Savvy Local Agent: An experienced West Palm Beach real estate agent can guide you through the intricacies of the market, identify red flags on properties, and negotiate on your behalf to secure the best possible deal.

- Conduct Thorough Property Inspections: Don’t be blinded by the beach views! Always have a qualified inspector assess the property for any underlying issues that could translate into costly repairs down the road.

- Understand Flood Zones: West Palm Beach is no stranger to flooding. Research flood zone maps and consider purchasing flood insurance, especially if the property you’re eyeing is in a high-risk zone.

West Palm Beach: A Calculated Leap of Faith

Buying a home in West Palm Beach is an investment in both property and lifestyle. By acknowledging the potential risks and employing smart strategies, you can transform this decision from a leap of faith into a calculated move towards your dream home.

So, what are you waiting for? Start exploring the possibilities, tap into the local resources we’ve highlighted, and unlock the door to your West Palm Beach story!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today