How To Turn Homeownership into a Side Hustle

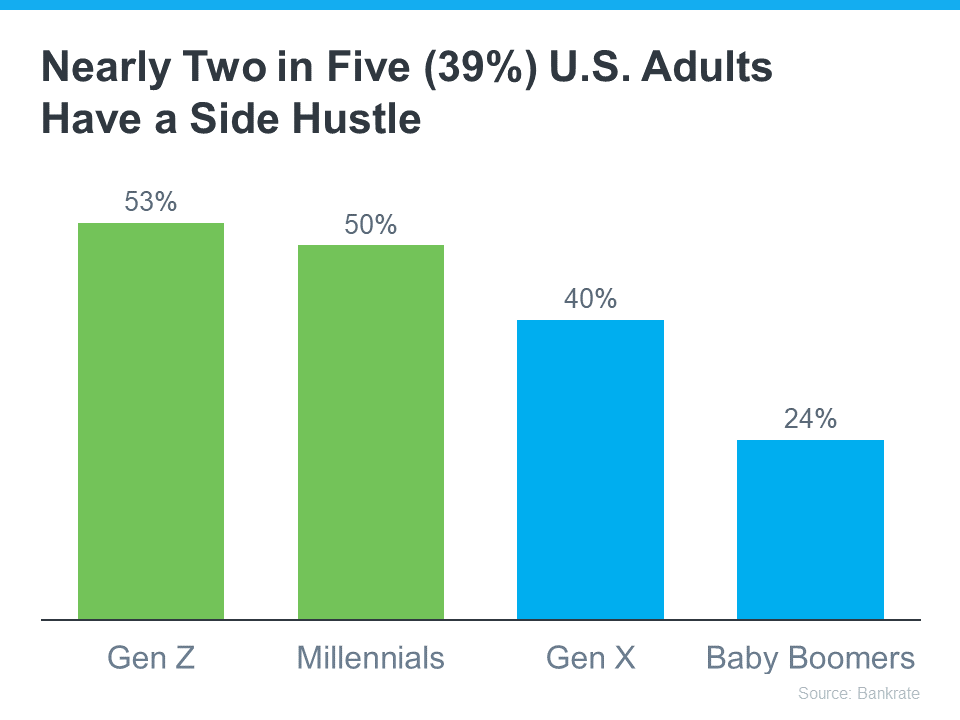

Does the rising cost of just about everything these days make your dream of owning your own home feel less within reach? According to Bankrate, many people are seeking additional income through side hustles, possibly to cope with those increasing expenses and save for a home. This trend is particularly popular with younger individuals who may be dealing with student loan debt (see graph below):

Here are two strategies that can not only make homeownership more affordable in the short term, but turn it into a lucrative side hustle that can pay off down the road.

Transforming the Challenge of a Fixer-Upper into an Opportunity

One thing you could do to help you break into homeownership is consider purchasing a fixer-upper. That’s a home that may be a bit less appealing and as a result has lingered on the market longer than normal. According to a recent article from U.S. News:

“The current state of the housing market may have you expanding your options to try to find a home that you can afford. A fixer-upper that needs some updating and a little love can feel like a welcome alternative to move-in ready houses that go off the market before you can even take a tour.”

By opting for a home that requires some work, you may see two big benefits. For starters, you may find it’s easier to find a home because you’re not looking for that perfect option. Plus, it may also help you enter the housing market at a lower price point. This strategy provides a more affordable way to become a homeowner while also offering the potential for future profits.

Yes, the home may need a little elbow grease, but investing time and effort into gradually enhancing your house not only makes it a home but also increases its future market value. So, while you enjoy the satisfaction of turning a house into a home, you’re also building equity that can be unlocked when it’s time to sell.

Renting Out a Portion of Your Home To Make It More Affordable

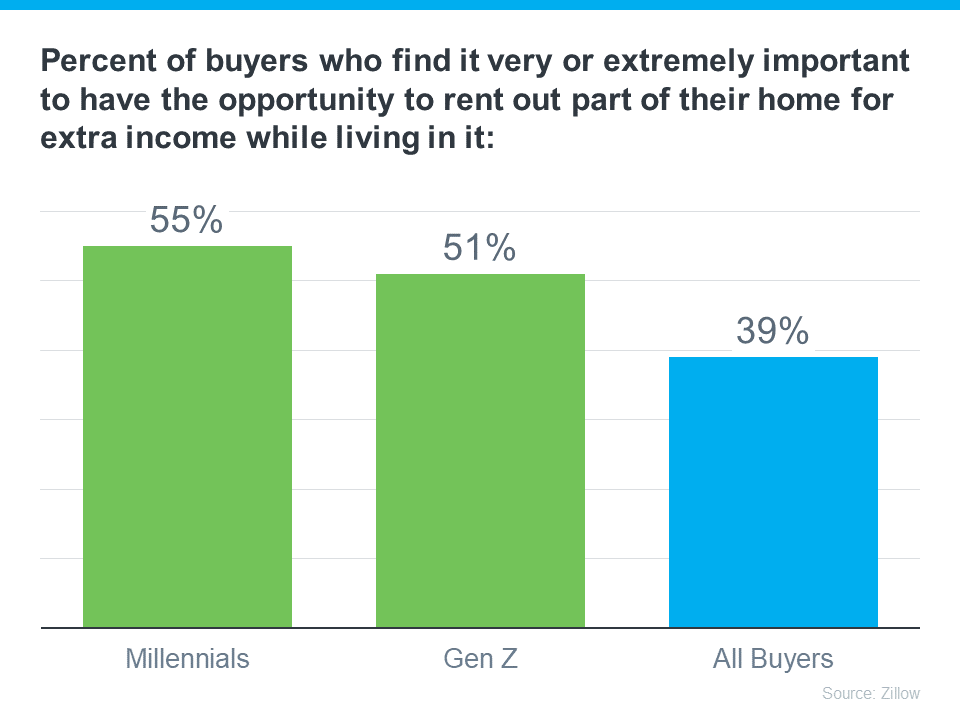

Another savvy strategy is to purchase a home with the upfront intention of renting out a portion of it. According to a recent press release from Zillow, renting out a part of their home is already very important for most young homebuyers (see graph below):

This approach serves a strong purpose. As Manny Garcia, Senior Population Scientist at Zillow, says:

“For those first-time buyers navigating the ‘side hustle culture,’ where a regular 9-to-5 might not quite cut it for homeownership dreams, rental income can step in to help . . .”

Basically, it can help you afford your monthly mortgage payments. So if you’re open to it, renting out a portion of your home not only helps with affordability, but it also positions you as an investor and turns your home into a source of income.

Bottom Line

In the face of today’s affordability challenges, both of these strategies offer more attainable paths to homeownership, especially for younger buyers. If you want to discuss these options and see how they might play out for you in our local market, let’s connect.

Unleashing the Potential: Turning Homeownership into a Lucrative Side Hustle

In a world where financial creativity knows no bounds, the concept of homeownership has transcended its traditional role as a sanctuary to live in. Homeownership is no longer just about finding a place to hang your hat; it’s about unlocking the latent potential within the four walls you call your own. In this discourse, we’ll unravel the secrets of transforming your abode into a thriving source of income, all while basking in the satisfaction of turning a house into a home.

The Strategic Entry: Make Your Dream of Owning Your Own Home a Reality

In the labyrinth of the real estate market, the dream of owning a home can often seem like a distant mirage. However, a savvy strategy is to purchase a home with the foresight of it being more than just a living space. While the burden of student loan debt may cast a shadow, there are strategic avenues that pave the way to homeownership without drowning in financial woes.

Beyond the Threshold: Affording Your Monthly Mortgage Payments

The key to a successful homeownership venture lies in your ability to afford your monthly mortgage payments without feeling the pinch. It’s a delicate dance between fiscal responsibility and realizing the full potential of your property. When you find a home that aligns with your financial capabilities, it becomes a canvas on which your financial future can be painted.

Homeownership Unleashed: Enhancing Your House for Future Gains

To ensure your investment is not just a dwelling but a dynamic asset, consider enhancing your house strategically. Every improvement not only adds to your current comfort but also increases its future market value. Think of it as sculpting your financial future in the mold of your living space.

Riding the Housing Market Wave: A Journey Beyond Ownership

The housing market, like the ocean, has its ebbs and flows. Understanding this tide can empower you to ride the waves of opportunity. As the housing market fluctuates, so does the potential of your property. This awareness can turn your humble abode into a financial powerhouse.

Renting Out a Portion of Your Home: A Calculated Move

One potent strategy is renting out a portion of your home. This move not only mitigates the financial burden but also turns your home into a source of income. Imagine the satisfaction of having your living space contribute to your bank balance. It’s a win-win that transforms your home into a dynamic asset.

Crafting Income: Strategies Offer More Attainable Paths to Homeownership

For those who view homeownership as an elusive dream due to financial constraints, consider alternative paths. Strategies offer more attainable paths to homeownership, breaking free from the conventional mold. This might involve shared ownership, co-living arrangements, or even unconventional financing models. The key is to be open to diverse avenues that align with your financial goals.

The Unseen Ally: Rental Income Steps in to Help

When the road to homeownership seems steep, rental income can step in to help. The upfront intention of renting out a portion of your property becomes a financial lifeline, allowing you to navigate the challenges of mortgage payments with ease. It’s a symbiotic relationship where your home becomes a shelter for others and a source of income for you.

Homeownership Redefined: A Source of Income and Satisfaction

In essence, the transformation of homeownership into a side hustle is not merely a financial tactic; it’s a mindset. The house you thought of as a mere dwelling becomes a dynamic force, shaping your financial future. The satisfaction derived from this transformation goes beyond monetary gains; it’s about crafting a lifestyle where your home is not just a place to live but a source of income.

The Final Brushstroke: Turning Dreams into Tangible Reality

In conclusion, the journey from aspiring homeowner to a financial maven requires a shift in perspective. Your home is not just an expense; it’s an investment waiting to be optimized. By incorporating the mentioned keywords strategically, you infuse your journey with the language of financial empowerment, turning dreams into tangible reality. So, step into the realm of creative homeownership and unlock the full potential of your abode.

Building the Foundation: The Art of Intelligent Investment

To truly master the art of turning homeownership into a side hustle, it’s crucial to recognize the power of intelligent investment. Your house, once viewed through the lens of potential income, becomes a canvas for strategic decisions. Enhancing your house goes beyond mere aesthetics; it’s about making choices that resonate with the demands of the market, ensuring your property remains a lucrative asset.

Strategic Renovations: Elevating Value and Appeal

Consider the impact of strategic renovations on your property’s market value. Upgrading the kitchen, modernizing the bathroom, or even adding a functional workspace can significantly enhance your home’s appeal. Such enhancements not only contribute to the satisfaction of turning a house into a home but also act as magnets for potential tenants, increasing the allure of your property in the rental market.

Diversification: The Key to Long-Term Success

Diversification is a buzzword in the world of finance, and it applies just as aptly to the realm of real estate. While renting out a portion of your home is a viable strategy, exploring additional income streams can fortify your financial position. This might involve investing in separate rental properties or delving into the world of short-term rentals. The key is to weave a tapestry of income sources, making your homeownership venture resilient to market fluctuations.

Monitoring the Housing Market: Navigating Peaks and Valleys

Just as a seasoned sailor monitors the seas, a wise homeowner keeps a vigilant eye on the housing market. Understanding the dynamics of supply and demand, interest rates, and regional trends arms you with the foresight needed to navigate the peaks and valleys of real estate. It transforms your approach from passive ownership to active engagement, allowing you to capitalize on market upswings and strategically time your financial moves.

A Beacon in Financial Storms: Homeownership as a Hedge

In times of economic uncertainty, the value of homeownership shines brightly as a hedge against financial storms. While other investments may waver, the tangible nature of property provides a sense of stability. This unique characteristic positions your home not just as a dwelling but as a fortress, shielding you from the turbulence of economic downturns.

Community Integration: Creating a Home-Based Ecosystem

The concept of finding a home extends beyond the physical structure; it encompasses the community surrounding it. Actively participating in your local community not only enriches your living experience but also enhances the market perception of your property. A thriving neighborhood can be a magnet for potential tenants, elevating the demand for your rental spaces.

Future-Proofing Your Investment: Adapting to Changing Times

The winds of change are constant, and the real estate landscape is no exception. To future-proof your investment, consider the evolving needs of society. If remote work becomes the norm, adapting your property to accommodate home offices can be a strategic move. Being attuned to societal shifts positions your home as a dynamic asset capable of meeting the demands of changing times.

Beyond the Transaction: Building Relationships with Tenants

In the world of property management, building strong relationships with tenants is an often-overlooked yet invaluable strategy. Happy tenants are more likely to stay longer, reducing turnover costs and contributing to the stability of your rental income. This human element transforms your property from a transactional space to a place where people feel a sense of belonging.

The Tapestry Unfolds: A Holistic Approach to Homeownership

In weaving the tapestry of homeownership as a side hustle, each thread contributes to the overall picture. It’s not merely about renting out a room or upgrading the kitchen; it’s about adopting a holistic approach that fuses financial intelligence with the personal touch of making a house a home.

As you embark on this journey, remember that turning homeownership into a side hustle is an evolving art. It requires a blend of financial acumen, market awareness, and a dash of creativity. Your home, once a static asset, becomes a dynamic force, adapting to the rhythm of your financial goals and the ever-changing melody of the housing market.

So, as you navigate this landscape, let your home be not just a structure but a symphony of possibilities. In each decision, see the potential for both personal satisfaction and financial gain. In doing so, you transform your home into not just a place to live but a cornerstone of your financial success.

The Evolving Symphony: Scaling Heights in Home-Based Entrepreneurship

As you delve deeper into the realm of home-based entrepreneurship, consider the nuances that can elevate your venture to new heights. The journey from traditional homeownership to a dynamic source of income is an ongoing symphony, with each note contributing to the melody of success.

Technological Integration: Harnessing the Power of Innovation

In the digital age, leveraging technology can be a game-changer. Explore platforms and apps that streamline property management, enhance security, and amplify your property’s online presence. Technological integration not only adds a modern touch to your property but also expands your reach in the competitive world of rentals.

Sustainable Living: A Trend That Pays Dividends

The wave of sustainability is sweeping across industries, and real estate is no exception. Consider adopting eco-friendly practices within your property. Solar panels, energy-efficient appliances, and water-saving measures not only contribute to a greener planet but also resonate with an increasing number of environmentally conscious tenants.

Financial Literacy: The Cornerstone of Wealth Building

As your home evolves into a multifaceted source of income, honing your financial literacy becomes paramount. Understand the tax implications of rental income, explore investment opportunities within the real estate market, and develop a keen eye for spotting emerging trends. Financial literacy is the cornerstone that empowers you to make informed decisions, ensuring your venture stands the test of economic fluctuations.

Creative Marketing: Crafting a Compelling Narrative

Transform your property into a brand with a compelling narrative. Renting out a portion of your home is not just a transaction; it’s an experience. Craft engaging stories about your property, highlight its unique features, and create a digital presence that captivates potential tenants. In the competitive world of rentals, a property with a story stands out amidst the sea of options.

Flexibility in Rental Models: Tailoring to Market Trends

The rental landscape is dynamic, and adapting your strategy to market trends can be a key differentiator. Consider short-term rentals, co-living arrangements, or vacation rentals based on the demand in your area. Flexibility in rental models positions your property as a versatile option, catering to a diverse range of tenants and maximizing your income potential.

Professional Property Management: A Strategic Investment

As your property portfolio expands, the complexities of management may grow. Consider investing in professional property management services to alleviate the day-to-day responsibilities. This not only frees up your time but also ensures that your properties are managed with a level of expertise that enhances their overall appeal.

Networking in Real Estate Circles: Unveiling Opportunities

Building connections within the real estate community can open doors to valuable insights and potential collaborations. Attend local events, join online forums, and engage with professionals in the field. The exchange of ideas and experiences can be a catalyst for growth, providing you with a deeper understanding of the ever-evolving real estate landscape.

The Ongoing Overture: Sustaining Success in Homeownership

As your venture gains momentum, it’s crucial to maintain the tempo of success. Homeownership has now transcended its conventional role and become a dynamic force in your entrepreneurial journey. The ongoing overture requires a delicate balance between innovation, market responsiveness, and a commitment to continuous improvement.

Regular Property Assessments: Adapting to Changing Needs

Just as a musical composition evolves over time, so does the landscape of real estate. Regularly assess your properties, considering updates and improvements that align with changing tenant needs and market trends. This proactive approach ensures that your properties remain desirable and competitive in the ever-shifting real estate symphony.

Cultivating Tenant Relationships: The Heartbeat of Stability

In the crescendo of property management, never underestimate the importance of cultivating positive relationships with your tenants. A satisfied tenant is more likely to renew their lease, reducing vacancies and providing a steady rhythm to your rental income. Regular communication and responsive maintenance create a harmonious living experience, fostering a sense of loyalty.

Scaling Responsibly: Balancing Ambition and Prudence

As the allure of success beckons, the temptation to scale rapidly may arise. However, scaling responsibly is crucial to maintaining the integrity of your venture. Consider the financial implications, market saturation, and the capacity for effective management. Scaling responsibly ensures that each new property adds value to your portfolio rather than diluting its overall performance.

Adaptive Resilience: Navigating Economic Tides

The world of entrepreneurship, including home-based ventures, is subject to economic ebbs and flows. Cultivate adaptive resilience by staying attuned to economic indicators, diversifying your investment portfolio, and having contingency plans in place. This ability to navigate economic tides positions your homeownership venture as a resilient force, capable of weathering storms and emerging stronger.

The Grand Finale: Homeownership as a Legacy

In the grand finale of this symphony of homeownership turned side hustle, reflect on the legacy you’re creating. Your home is no longer just a dwelling; it’s a testament to your entrepreneurial spirit and financial acumen. The journey from dreaming of homeownership to crafting a dynamic source of income is not merely a financial success—it’s a legacy that transcends generations.

So, as the curtain falls on this exploration, let your homeownership venture resonate as a timeless melody—a testament to the harmonious fusion of home, entrepreneurship, and the art of turning dreams into enduring legacies. The stage is set, and your home takes its bow as a multifaceted masterpiece in the ongoing symphony of success.

Read from source: “Click Me”

https://americasmortgagesolutions.com/how-to-turn-homeownership-into-a-side-hustle/

– “How To Turn Homeownership into a Side Hustle” –

The Christian Penner Mortgage Team | Cell/Text: (561) 316-6800

|

|

|

|

|

|

|

|

|

|

HomeBot: Build more wealth with your home

-

Homeowners👉https://hmbt.co/nwCdmG

-

Homebuyers👉 https://hmbt.co/G8fMT

-

Realtors 👉 https://youtu.be/wXROJXQWgug

-

Join here Realtors 👉 https://join.homebot.ai/sponsor/368289?type=real-estate-agent

Check Our Reviews:

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today