Not a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

Even if you didn’t own a home at the time, you probably remember the housing crisis in 2008. That crash impacted the lives of countless people, and many now live with the worry that something like that could happen again. But rest easy, because things are different than they were back then. As Business Insider says:

“Though many Americans believe the housing market is at risk of crashing, the economists who study housing market conditions overwhelmingly do not expect a crash in 2024 or beyond.”

Here’s why experts are so confident. For the market (and home prices) to crash, there would have to be too many houses for sale, but the data doesn’t show that’s happening. Right now, there’s an undersupply, not an oversupply like the last time – and that’s true even with the inventory growth we’ve seen this year. You see, the housing supply comes from three main sources:

- Homeowners deciding to sell their houses (existing homes)

- New home construction (newly built homes)

- Distressed properties (foreclosures or short sales)

And if we look at those three main sources of inventory, you’ll see it’s clear this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

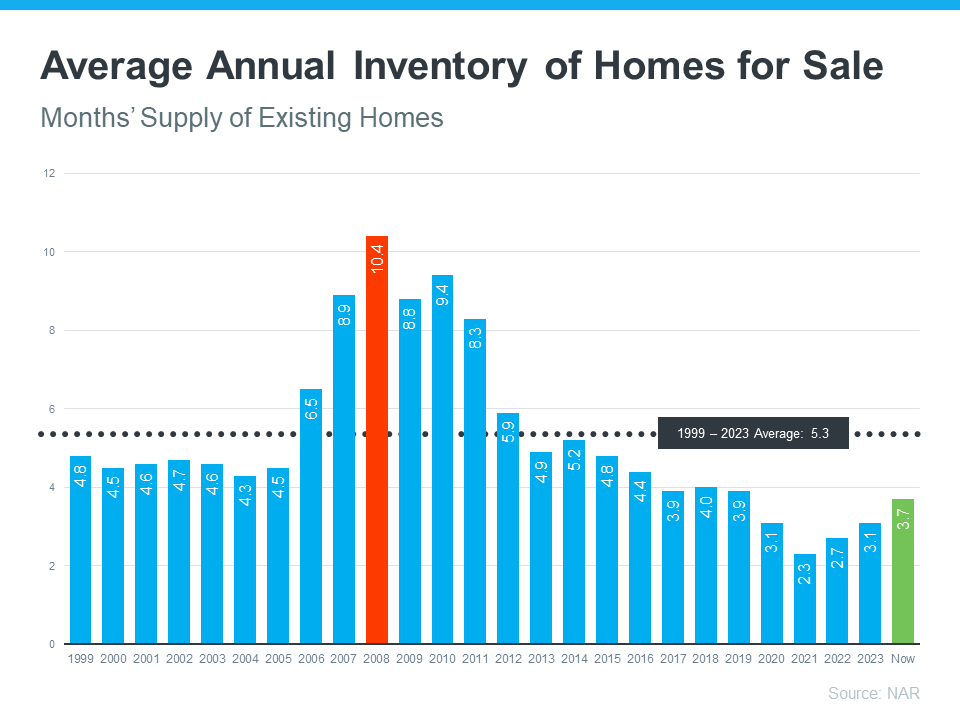

Although the supply of existing (previously owned) homes is up compared to this time last year, it’s still low overall. And while this varies by local market, nationally, the current months’ supply is well below the norm, and even further below what we saw during the crash. The graph below shows this more clearly.

If you look at the latest data (shown in green), compared to 2008 (shown in red), we only have about a third of that available inventory today.

So, what does this mean? There just aren’t enough homes available to make values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not the case right now.

New Home Construction

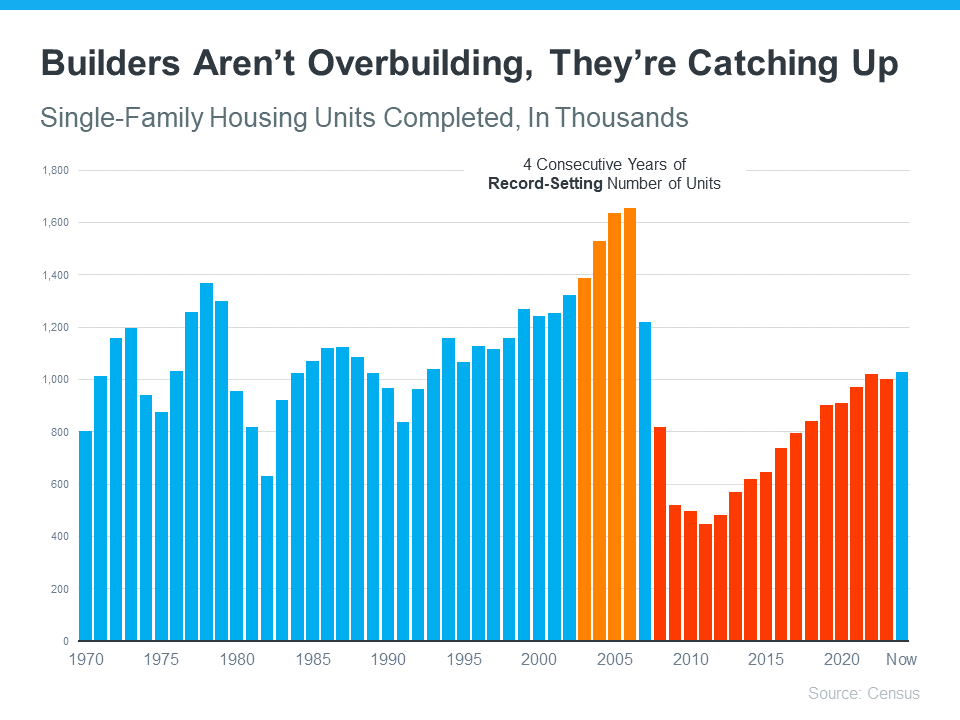

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. Even though new homes make up a larger percentage of the total inventory than the norm, there’s no need for alarm. Here’s why.

The graph below uses data from the Census to show the number of new houses built over the last 52 years. The orange on the graph shows the overbuilding that happened in the lead-up to the crash. And, if you look at the red in the graph, you’ll see that builders have been underbuilding pretty consistently since then:

There’s just too much of a gap to make up. Builders aren’t overbuilding today, they’re catching up. A recent article from Bankrate says:

“What’s more, builders remember the Great Recession all too well, and they’ve been cautious about their pace of construction. The result is an ongoing shortage of homes for sale.”

Distressed Properties (Foreclosures and Short Sales)

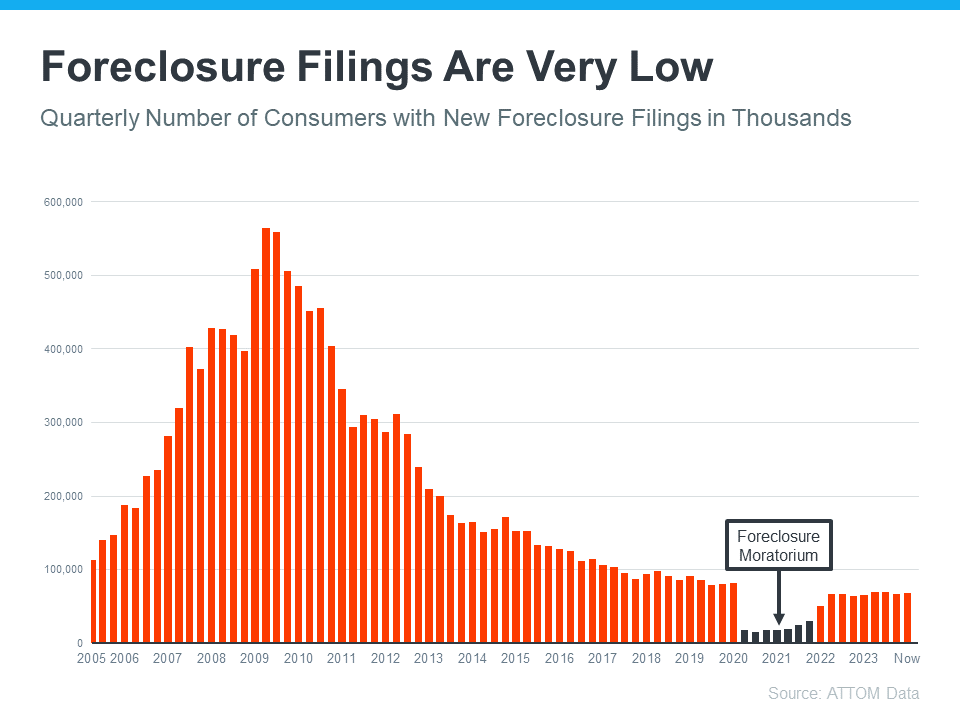

The last place inventory can come from is distressed properties, including short sales and foreclosures. During the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from ATTOM to show how things have changed since the housing crash:

This graph makes it clear that as lending standards got tighter and buyers became more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures (shown in black) and the forbearance program helped prevent a repeat of the wave of foreclosures we saw when the market crashed.

While you may see headlines that foreclosure volume is ticking up – remember, that’s only compared to recent years when very few foreclosures happened. We’re still below the normal level we’d see in a typical year.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. As Forbes explains:

“As already-high home prices continue trending upward, you may be concerned that we’re in a bubble ready to pop. However, the likelihood of a housing market crash—a rapid drop in unsustainably highhome prices due to waning demand—remains low for 2024.”

Mark Fleming, Chief Economist at First American, points to the laws of supply and demand as a reason why we aren’t headed for a crash:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

And Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“We will not have a repeat of the 2008–2012 housing market crash. There are no risky subprime mortgages that could implode, nor the combination of a massive oversupply and overproduction of homes.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing experts and inventory data tell us there isn’t a crash on the horizon.

Not a Crash: 3 Graphs That Showcase Today’s Robust Housing Inventory

Hey homebuyers and sellers! Let’s talk about the elephant in the room: the whispers of a looming housing market crash. If you’ve been reading the headlines, you might be feeling a sense of déjà vu, transported back to the harrowing days of 2008. But fear not, fellow real estate enthusiasts! Today’s market is a completely different animal, and the data proves it.

Distressed Properties vs. A Balanced Market

Remember the mountains of distressed properties that flooded the market in 2008? Foreclosures and short sales became commonplace, a direct result of subprime lending practices that put many homeowners in over their heads. Thankfully, lending standards have tightened considerably. Today’s mortgage process is far more rigorous, ensuring more qualified buyers secure loans they can comfortably manage. The result? A significantly shortage of homes for sale.

Take a look at Graph 1: it depicts the stark contrast between the foreclosure rates of 2008 and today. The red spike in 2008 is a sobering reminder of the crisis, while the current low levels paint a much more optimistic picture. This dramatic shift demonstrates a housing market on much sturdier footing.

Graph 1: Foreclosure Rates (2005-2024)

The Inventory Crunch: A Sign of Market Strength, Not Weakness

Now, let’s delve into the current housing supply. You might be surprised to learn that the very thing some perceive as a harbinger of doom – the lack of homes available – is actually a sign of a healthy market.

Graph 2 showcases the historical trend of existing home inventory. Notice how far below the pre-2008 levels our current inventory sits? This scarcity isn’t due to a lack of buyer interest; it’s a consequence of Homeowners deciding to sell their houses at a slower pace.

Graph 2: Months of Existing Home Inventory (1990-2024)

Why are people holding onto their homes? There are several factors at play. Perhaps they’re enjoying historically low mortgage rates. Maybe they’re hesitant to list their property in a market with such fierce competition from eager buyers. Whatever the reason, the result is a shortage of existing homes and a seller’s market that’s driving home prices upwards.

Building for the Future, But Not Quite Catching Up

While the existing home market simmers, the new construction sector is working hard to meet demand. Homebuilders are cranking out newly built homes, but new construction simply hasn’t been able to keep pace with buyer demand.

Graph 3 illustrates the disparity between new home construction and the overall housing market. While new construction is on the rise, it’s still far below pre-2008 levels. This inventory growth is a positive sign, but it will take time for new construction to bridge the current gap.

Graph 3: New Home Sales vs Existing Home Sales (2000-2024)

The Bottom Line: A Market on Solid Ground

So, can we definitively say there won’t be a housing market crash? While nobody can predict the future with absolute certainty, the data paints a clear picture. Today’s market is characterized by more qualified buyers, tighter lending standards, and a healthy lack of distressed properties. This robust foundation is a far cry from the shaky ground that led to the 2008 crisis.

Beyond the Headlines: A Look at the Unsung Heroes of the Housing Market

While the media often focuses on the intense competition and rising prices, there are several under-the-radar factors contributing to the current housing market’s stability. Here’s a shoutout to some of these unsung heroes:

-

The Forbearance Program’s Silent Strength: Remember the dark days of 2008 when foreclosures ravaged neighborhoods? Thankfully, the government implemented the CARES Act Forbearance Program in 2020. This program allowed struggling homeowners to temporarily pause or reduce their mortgage payments, preventing a wave of defaults and foreclosures. This crucial intervention helped millions of Americans stay in their homes and avoid financial ruin.

-

Homeowners Choosing Stability: Unlike the pre-2008 market where speculation and flipping were rampant, many homeowners today are choosing stability over quick profits. With historically low mortgage rates locking them into affordable monthly payments, many are hesitant to sell and potentially face the challenge of securing a new loan at a higher interest rate. This decision, while driven by self-preservation, also contributes to the current inventory shortage.

-

The Rise of Renovation Loans: Gone are the days when outdated kitchens or bathrooms automatically disqualified a property from buyer consideration. Today’s market is witnessing a surge in renovation loans, which allow buyers to factor in the cost of necessary upgrades into their mortgage. This trend unlocks a wider pool of potential homes for buyers and breathes new life into older properties.

-

The Responsible Lending Landscape: A significant departure from the loose lending practices of the past, today’s mortgage lenders are held to stricter regulations. This ensures that borrowers qualify for loans they can comfortably afford, preventing another subprime mortgage crisis. While stricter lending standards might make it slightly more challenging for some buyers to qualify, it ultimately protects both borrowers and lenders from financial hardship.

A Symbiotic Ecosystem: Buyers, Sellers, and the Market

The current housing market is a complex ecosystem where the actions of buyers, sellers, and various support systems all play a role. While headlines might paint a picture of a market teetering on the edge, a closer look reveals a more nuanced reality. By acknowledging the unsung heroes contributing to stability, we gain a deeper understanding of the market’s current dynamics.

The Road Ahead: Embracing Change and Opportunity

The housing market is constantly evolving, and the current climate presents both challenges and opportunities. Here’s a parting thought: instead of fearing change, embrace it as a chance to be a smarter and more informed participant in the market. Whether you’re a buyer, seller, or simply someone with a vested interest in the real estate landscape, stay curious, do your research, and leverage the resources available to you. With a proactive approach, you can navigate the current market with confidence and achieve your real estate goals.

Beyond the Bubble Talk: A Look at Long-Term Market Trends

Whew! We’ve delved into the intricacies of today’s housing market, dispelling crash myths and highlighting the unseen forces shaping the landscape. But let’s take a step back and zoom out. What does the long-term future hold for this ever-evolving market?

Here are some key trends with the potential to significantly impact the housing market in the coming years:

-

The Rise of the “Rentership” Generation: Millennials, burdened by student loan debt and entering the workforce during the 2008 crisis, have shown a demonstrably different approach to homeownership compared to previous generations. Many prioritize flexibility and are comfortable with renting for extended periods. This trend, coupled with an aging population increasingly downsizing, could lead to a continued rise in the rental market alongside a more stable ownership market.

-

The Impact of Climate Change: As the effects of climate change become more pronounced, location will play an even greater role in determining property values. Areas prone to natural disasters or with limited water resources might see a decline in desirability, while communities with a focus on sustainability and resilience could become more sought-after.

-

Technological Innovation: Technology is already transforming the real estate industry, with virtual tours, 3D printing for construction, and proptech (property technology) platforms streamlining transactions. As technology continues to advance, we can expect even more innovative solutions that will enhance efficiency, transparency, and accessibility in the housing market.

-

The Evolving Role of Government: Government policies can significantly impact the housing market. From infrastructure development and zoning regulations to affordable housing initiatives and tax incentives, the government plays a crucial role in shaping market dynamics. How these policies evolve in the future will be a key factor to watch.

A Market in Flux: Embracing Uncertainty with Optimism

The long-term trajectory of the housing market is inherently uncertain. However, by understanding these emerging trends and staying informed about policy changes, we can make educated predictions and prepare for potential shifts.

The key takeaway? Don’t get caught up in short-term market fluctuations or sensationalized headlines. The housing market, while complex and ever-changing, has historically proven its resilience. By focusing on long-term trends, responsible financial planning, and a willingness to adapt, you can position yourself to thrive in the dynamic world of real estate.

Finding Your Foothold in a Competitive Market (Even with Low Inventory)

- Get Pre-Approved for a Mortgage: This crucial step demonstrates your financial strength to sellers and positions you to act quickly when the right property pops up. Consider reaching out to a local West Palm Beach mortgage broker [West Palm Beach mortgage broker] to explore Affordable West Palm Beach home loans [Affordable West Palm Beach home loans] and secure the Best mortgage rates in West Palm Beach [Best mortgage rates in West Palm Beach].

- Work with a Real Estate Agent: A knowledgeable agent can guide you through the competitive landscape, help you craft compelling offers, and advocate for your interests throughout the buying process.

- Be Flexible: While you shouldn’t compromise on your core must-haves, being open to different locations, property types, or move-in timelines can significantly expand your options.

- Consider New Construction: While existing homes are scarce, new construction offers a fresh, modern alternative. Explore options with your agent and weigh the pros and cons of a newly built house versus a pre-existing one.

Remember, knowledge is power! Stay informed about the local market by following reputable real estate resources and consulting with your agent. With the right preparation and guidance, you can navigate today’s market and find your dream home.

West Palm Beach First-Time Homebuyer Programs

If you’re a first-time homebuyer, there might be financial assistance programs available to help you achieve your dream of homeownership. Explore First time home buyer loans in West Palm Beach [First time home buyer loans in West Palm Beach] with your chosen mortgage professional.

The Future of the Housing Market

Housing experts predict that the inventory shortage will eventually ease as new construction ramps up and more homeowners decide to sell. However, the exact timeline remains uncertain.

In the meantime, the market is expected to remain competitive, with home prices continuing to rise, albeit at a potentially slower pace. This means it’s still a great time to be a homeowner, but buyers need to be prepared to act swiftly and strategically.

The Takeaway

Don’t let the headlines about a potential crash deter you from your homeownership goals. Today’s housing market is fundamentally different from the one that led to the 2008 crisis. By educating yourself, working with the right professionals, and remaining adaptable, you can successfully navigate this market and secure your piece of the American dream.

Ready to Explore Your Options?

Whether you’re a seasoned investor or a first-time homebuyer, the West Palm Beach market offers exciting possibilities. Feel free to utilize the resources mentioned throughout this article, including:

- West Palm Beach mortgage broker [West Palm Beach mortgage broker]

- Affordable West Palm Beach home loans [Affordable West Palm Beach home loans]

- Best mortgage rates in West Palm Beach [Best mortgage rates in West Palm Beach]

- First time home buyer loans in West Palm Beach [First time home buyer loans in West Palm Beach]

- West Palm Beach refinancing options [West Palm Beach refinancing options]

- Local mortgage lenders in West Palm Beach [Local mortgage lenders in West Palm Beach]

- West Palm Beach mortgage calculators [West Palm Beach mortgage calculators]

- Property loan advice in West Palm Beach [Property loan advice in West Palm Beach]

- Commercial mortgage broker in West Palm Beach [Commercial mortgage broker in West Palm Beach]

- Mortgage preapproval in West Palm Beach [Mortgage preapproval in West Palm Beach]

By taking advantage of these resources and partnering with a knowledgeable real estate professional, you can turn your dream of homeownership into a reality!

The Final Word: Owning Your Future in a Dynamic Market

So, you’ve reached the end of this exploration of the current housing market and its intriguing future. Hopefully, you’re feeling empowered with a deeper understanding of the forces at play and the opportunities that lie ahead.

Whether you’re a seasoned investor, a first-time homebuyer, or simply someone with a curiosity about the real estate landscape, here’s a final word of encouragement: take ownership of your future in this dynamic market.

Here’s how:

- Become an Educated Consumer: Knowledge is power. Immerse yourself in reliable resources like market reports, industry publications, and educational content from reputable real estate professionals. The more you understand the market, the better equipped you’ll be to make informed decisions.

- Embrace Professional Guidance: Don’t navigate the complexities of the market alone. Partner with a qualified real estate agent who possesses a deep understanding of your local market and your specific needs. Their expertise can be invaluable in guiding you through the buying or selling process.

- Think Long-Term: Real estate is a long-term investment. While short-term fluctuations might grab headlines, don’t get swayed by fleeting market anxieties. By focusing on your long-term goals and financial objectives, you can make strategic decisions that benefit you in the years to come.

- Be Adaptable: The housing market is constantly evolving. Embrace this dynamism and be prepared to adjust your approach as needed. Stay open to new technologies, evolving market trends, and potential policy changes.

The American Dream: Still Within Reach

Despite the complexities of the current market, the dream of homeownership remains achievable for many Americans. By taking an informed, strategic, and adaptable approach, you can navigate this dynamic landscape and secure your place in the ever-evolving world of real estate.

So, don’t let the headlines deter you. With the right knowledge, guidance, and a touch of optimism, you can turn the dream of homeownership into a reality. Now, go forth and conquer the market!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today