Are Home Prices Going To Come Down?

Today’s headlines and news stories about home prices are confusing and make it tough to know what’s really happening. Some say home prices are heading for a correction, but what do the facts say? Well, it helps to start by looking at what a correction means.

Here’s what Danielle Hale, Chief Economist at Realtor.com, says:

“In stock market terms, a correction is generally referred to as a 10 to 20% drop in prices . . . We don’t have the same established definitions in the housing market.”

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices, which have been increasing rapidly over the last couple years, are normalizing a bit. In other words, they’re now growing at a slower pace. Prices vary a lot by local market, but rest assured, a big drop off isn’t what’s happening at a national level.

The Real Estate Market Is Normalizing

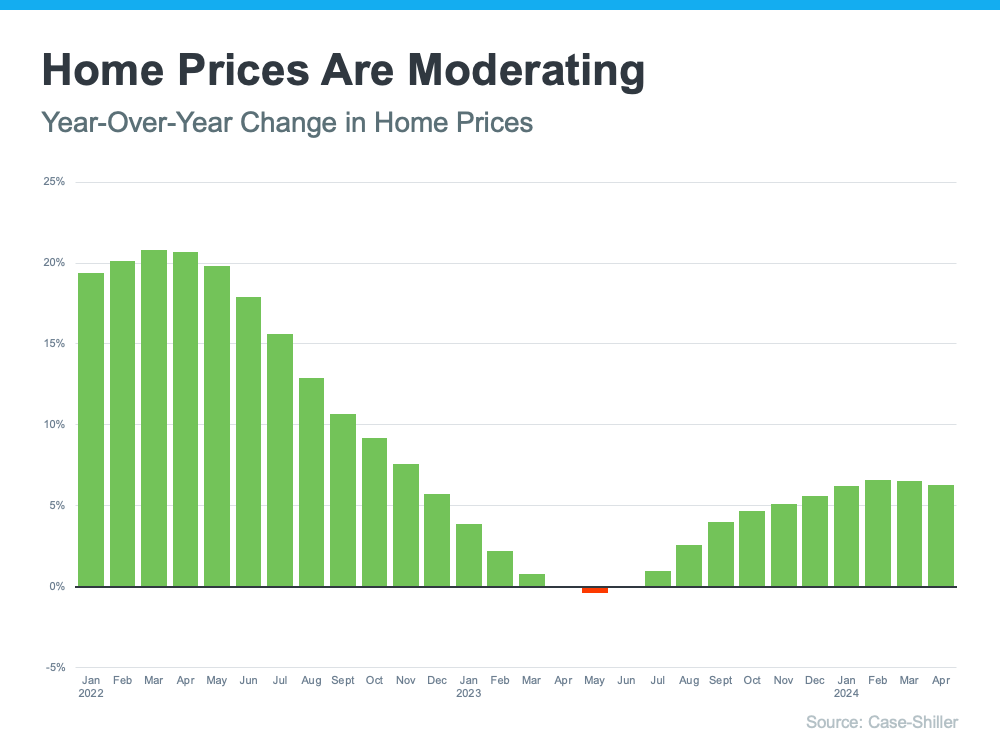

From 2020 to 2022, home prices skyrocketed. That rapid increase was due to high demand, low interest rates, and a shortage of homes for sale. But, that kind of aggressive growth couldn’t continue forever.

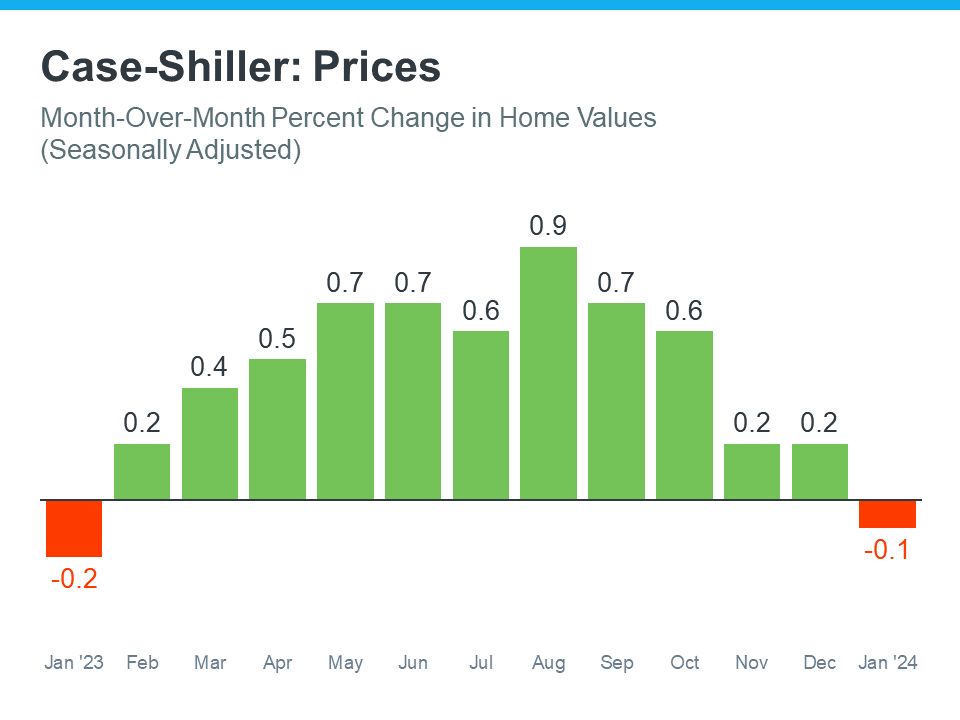

Today, price growth has started to slow down, which is a sign the market is beginning to normalize. The most recent data from Case-Shiller shows that after being basically flat for a couple of months last year, prices are going up at a national level – just not as quickly as before (see graph below):

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

The big takeaway? So far this year, there’s been a much healthier pace of price growth compared to the pandemic.

Of course, that’s what’s happening now, but you may be wondering what’s next for prices. Marco Santarelli, the Founder of Norada Real EstateInvestments, says:

“Expert forecasts lean towards a moderation in home price growth over the next five years. This translates to a slower and more sustainable pace of appreciation compared to the breakneck speed witnessed in recent years, rather than a freefall in prices.”

It’s all about supply and demand. Increasing inventory plus limited buyer demand, due to relatively high mortgage rates, will continue to ease some of the upward pressure on prices.

What This Means for You

If you’re thinking about buying a home, slowing price growth is welcome news. Skyrocketing home prices during the pandemic left many would-be homebuyers feeling priced-out.

While it’s still a good thing to know the value of the home you buy will likely continue to go up once you own it, slowing price gains are making things feel more manageable. Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help — so the dream of homeownership isn’t boarded up just yet.”

At the national level, home prices are not going down. And most experts forecast they’ll continue growing moderately moving forward. But prices vary a lot by local market. That’s where a trustedreal estate agent comes into play. If you have questions about what’s happening with prices in our area, reach out.

Are Home Prices Going To Come Down?

The age-old question on every prospective homeowner’s mind is: Are home prices about to take a nosedive? It’s a tantalizing prospect, evoking visions of snapping up a dream home at a bargain price. But let’s delve into the intricacies of the real estate market to uncover the truth behind this burning query.

The Housing Market: A Complex Tapestry

The housing market is a living, breathing organism, influenced by a myriad of factors. From Mortgage Rates to economic indicators, every thread contributes to the overall tapestry. The recent surge in home prices has undoubtedly ignited a fervent desire for a market correction. Yet, the reality is far more nuanced.

The Lure of Homeownership

For many, owning a home is the quintessential embodiment of the American Dream. The allure of building equity, creating a personal sanctuary, and achieving financial stability is undeniable. First-time home buyers are particularly keen on finding affordable entry points into the market. However, the escalating costs have made this aspiration increasingly challenging.

Factors Influencing Home Prices

Several key elements are driving home prices upward. A chronic shortage of homes for sale has created an environment of intense competition among buyers. Coupled with historically low Mortgage Rates, this perfect storm has propelled prices to unprecedented heights. Additionally, economic factors such as job growth and low unemployment rates have bolstered buyer confidence, further fueling demand.

The Local Market: A Tale of Two Cities

It’s crucial to recognize that the real estate market is not a monolithic entity. Conditions vary significantly between different regions and even within local neighborhoods. While some areas may be experiencing price stabilization or even slight declines, others are still witnessing robust growth. A trusted real estate agent can provide invaluable insights into the specific dynamics of your local market.

The Crystal Ball: Predicting the Future

Predicting the future of home prices is akin to gazing into a crystal ball. While experts offer forecasts, market trends can be fickle and unpredictable. Economic downturns, interest rate fluctuations, and changes in government policies can all impact the trajectory of prices.

A Shift in the Wind?

There are signs that the market may be cooling off. Rising Mortgage Rates have reduced purchasing power, and a slight uptick in homes for sale has introduced a measure of relief for buyers. However, it’s important to temper expectations. A significant price drop is unlikely in the near term.

Strategies for Home Buyers

If you’re determined to become a homeowner, there are strategies to navigate the challenging market. Consider expanding your search radius, exploring different property types, and getting pre-approved for a mortgage. Working with a knowledgeable West Palm Beach mortgage broker can also help you secure the best possible loan terms.

The Bottom Line

While the prospect of declining home prices is enticing, it’s essential to approach the market with realism. While conditions may vary, the overall trend suggests that prices will likely remain relatively stable or experience modest growth. For first-time home buyers, perseverance and strategic planning are key to achieving the dream of homeownership.

Remember, this is just a snapshot of the complex real estate market. Consulting with a trusted real estate agent and exploring West Palm Beach mortgage options will provide you with the most accurate and up-to-date information to make informed decisions.

Would you like to explore a specific aspect of the housing market in more detail?

The Impact of Economic Headwinds

While the allure of plummeting home prices is undeniably seductive, it’s essential to consider the broader economic landscape. A potential recession, coupled with rising interest rates, could introduce a degree of uncertainty into the market. However, history has shown that the housing market tends to be more resilient than other sectors.

The Role of Real Estate Investments

For seasoned investors, the fluctuation of home prices presents both challenges and opportunities. While a market downturn can lead to distressed property sales, it’s crucial to adopt a long-term perspective. Real Estate Investments can be a cornerstone of a diversified portfolio, providing stability and potential returns over time.

Navigating the Buyer’s Market

For those determined to purchase a home, a slight cooling of the market can be advantageous. Reduced competition and potentially lower home prices can create a more favorable buying environment. However, it’s essential to work with a trusted real estate agent to identify emerging trends and make informed decisions.

The Importance of Financial Preparedness

Regardless of market conditions, financial preparedness is paramount. Prospective homebuyers should focus on improving their credit scores, saving for a substantial down payment, and exploring various mortgage options. A consultation with a West Palm Beach mortgage broker can provide invaluable guidance on securing affordable West Palm Beach home loans.

The Future of Homeownership

While the path to homeownership may be fraught with challenges, the dream of owning a property remains a powerful motivator. By understanding the intricacies of the real estate market and making informed decisions, aspiring homeowners can increase their chances of success.

Conclusion

The question of whether home prices will decline is a complex one without a definitive answer. While the market may experience fluctuations, a significant price crash is unlikely in the near future. For buyers, sellers, and investors alike, staying informed and adaptable is key to navigating the ever-changing landscape of the real estate market.

Ultimately, the decision to buy or sell a home should be based on individual circumstances and long-term goals. Consulting with a knowledgeable real estate agent and exploring West Palm Beach mortgage options can provide the necessary guidance to make well-informed decisions.

Would you like to delve deeper into a specific aspect of the housing market, such as the impact of new construction on home prices or the potential for investment properties?

The Impact of New Construction on Home Prices

The rhythm of the real estate market is often dictated by the pulse of new construction. An influx of newly built homes can be a double-edged sword. On one hand, it can alleviate housing shortages, potentially cooling down home prices. On the other, it can introduce competition for existing homeowners and impact the overall market dynamics.

Supply and Demand Dynamics

The age-old economic principle of supply and demand holds true in the housing market. When new construction surges, the supply of available homes increases. This can lead to a more balanced market, giving buyers greater negotiating power and potentially moderating home prices. However, the impact can vary depending on factors such as the type of housing being built, the overall economic climate, and local market conditions.

The Appeal of New Construction

Newly built homes often come with a host of allurements: modern amenities, energy efficiency, and the absence of maintenance headaches. This can drive demand for new construction, even in markets with ample inventory. As a result, the prices of these homes may remain relatively stable or even appreciate, while prices for existing homes might experience a slight correction.

Location, Location, Location

The impact of new construction on home prices can also be influenced by location. In suburban areas experiencing rapid population growth, new developments can help absorb demand and prevent excessive price escalation. Conversely, in established urban neighborhoods with limited land availability, new construction may contribute to gentrification and drive up property values.

Challenges Facing Builders

While new construction can be a boon for buyers, builders face their own set of hurdles. Rising construction costs, labor shortages, and regulatory hurdles can impact the pace of development and ultimately influence the supply of new homes. These challenges can lead to higher home prices, even in markets with increased construction activity.

The Role of Government Policies

Government policies can play a significant role in shaping the real estate market. Zoning regulations, tax incentives, and infrastructure investments can either encourage or discourage new construction. For example, policies that streamline the permitting process can accelerate development and increase housing supply, potentially benefiting buyers.

Conclusion

The relationship between new construction and home prices is complex and multifaceted. While an increase in supply can generally exert downward pressure on prices, other factors such as demand, location, and economic conditions can influence the outcome. For buyers, staying informed about local market trends and considering both new and existing homes can help optimize decision-making.

Would you like to explore the potential impact of artificial intelligence on the real estate industry?

Artificial Intelligence: A Game-Changer in Real Estate

The advent of artificial intelligence (AI) is reshaping industries worldwide, and real estate is no exception. This technological marvel is poised to revolutionize the way we buy, sell, and manage properties.

AI-Powered Property Search and Valuation

Gone are the days of endless scrolling through countless property listings. AI-driven platforms can analyze vast amounts of data to match potential buyers with their ideal homes based on preferences, budget, and location. Moreover, AI algorithms can provide highly accurate property valuations, empowering both buyers and sellers with data-driven insights.

Enhancing the Agent Experience

While AI is not set to replace real estate agents, it will undoubtedly transform their roles. By automating routine tasks like scheduling appointments, managing paperwork, and conducting property research, AI frees up agents to focus on building relationships and providing exceptional client service. Additionally, AI-powered analytics can offer valuable insights into market trends and buyer preferences, enabling agents to tailor their strategies accordingly.

Virtual and Augmented Reality Experiences

AI is at the forefront of creating immersive property experiences. Virtual reality (VR) allows potential buyers to take virtual tours of homes from anywhere in the world, while augmented reality (AR) can overlay digital information onto physical spaces, providing additional context about a property. These technologies, powered by AI, are transforming the way people envision their future homes.

Predictive Analytics and Market Forecasting

AI’s ability to analyze vast datasets is invaluable for predicting market trends. By identifying patterns and correlations, AI can help real estate professionals anticipate price fluctuations, inventory levels, and buyer demand. This information can be used to make informed investment decisions and optimize property pricing strategies.

Streamlining Property Management

AI is streamlining property management operations through automation and predictive maintenance. By analyzing building data, AI can identify potential maintenance issues before they escalate, reducing costs and improving tenant satisfaction. Additionally, AI-powered chatbots can handle routine inquiries, freeing up property managers to address more complex issues.

Ethical Considerations

As with any powerful technology, the use of AI in real estate raises ethical concerns. Issues such as data privacy, algorithmic bias, and job displacement must be carefully considered. It is essential to develop ethical guidelines and regulations to ensure that AI is used responsibly and benefits all stakeholders.

Conclusion

AI is undoubtedly reshaping the real estate industry. By automating tasks, providing valuable insights, and enhancing the overall customer experience, AI is poised to create a more efficient, transparent, and personalized market. While challenges and ethical considerations must be addressed, the potential benefits of AI are undeniable.

Would you like to delve deeper into a specific aspect of AI in real estate, such as its impact on commercial real estate or the role of blockchain technology in conjunction with AI?

AI’s Impact on Commercial Real Estate

The commercial real estate (CRE) sector is undergoing a seismic shift, with AI at the epicenter. This technology is reshaping how commercial properties are valued, leased, and managed.

AI in Commercial Property Valuation

Traditional property valuation methods are labor-intensive and susceptible to human error. AI is revolutionizing this process by analyzing vast datasets, including property records, sales data, economic indicators, and even satellite imagery. These algorithms can provide more accurate and timely valuations, reducing reliance on human appraisal.

AI-Driven Commercial Leasing

AI is streamlining the commercial leasing process. Intelligent platforms can match tenants with suitable properties based on their specific requirements, such as size, location, amenities, and lease terms. Additionally, AI can analyze lease agreements to identify potential risks and opportunities, helping landlords and tenants make informed decisions.

Property Management on Autopilot

AI is transforming property management by automating routine tasks such as rent collection, maintenance requests, and tenant communication. Predictive maintenance, powered by AI, can optimize building operations by anticipating equipment failures and scheduling repairs proactively. Furthermore, AI-driven energy management systems can reduce operational costs and improve sustainability.

Investment Analysis and Portfolio Optimization

AI is becoming an indispensable tool for commercial real estate investors. By analyzing market trends, property performance, and economic indicators, AI can help investors identify promising opportunities and mitigate risks. Portfolio optimization algorithms can assist in building diversified portfolios that align with investment goals.

Challenges and Opportunities

While AI offers immense potential for the CRE industry, it also presents challenges. Data privacy, cybersecurity, and the need for skilled AI professionals are key considerations. However, the opportunities for innovation and efficiency are vast. By embracing AI, commercial real estate firms can gain a competitive edge and unlock new growth avenues.

Would you like to delve deeper into a specific area of AI in commercial real estate, such as AI in real estate investment trusts (REITs) or the role of blockchain technology in commercial property transactions?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice