Questions You May Have About Selling Your House

There’s no denying mortgage rates are having a big impact on today’s housing market. And that may leave you with some questions about whether it still makes sense to sell your house and make a move.

Here are three of the top questions you may be asking – and the data that helps answer them.

1. Should I Wait To Sell?

If you’re thinking about waiting to sell until after mortgage rates come down, here’s what you need to know. So are a ton of other people.

And while mortgage rates are still forecasted to come down later this year, if you wait for that to happen, you may be dealing with a lot more competition as other buyers and sellers jump back in too. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

2. Are Buyers Still Out There?

But that doesn’t mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. And here’s the data to prove it.

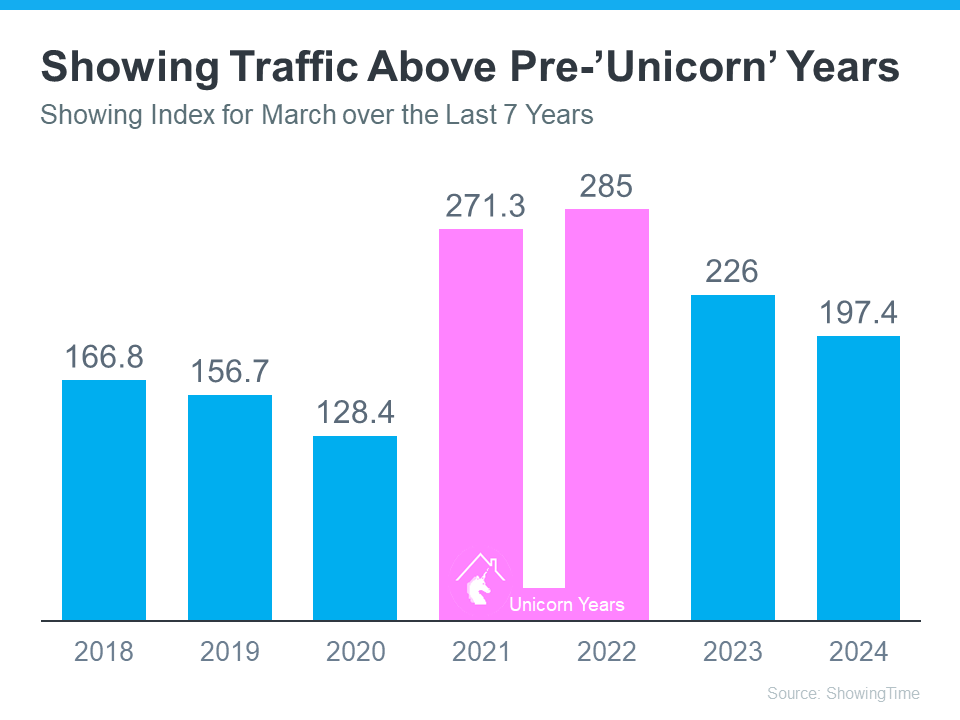

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

You can see demand has dipped some since the ‘unicorn’ years (shown in pink). That’s in response to a lot of market factors, like higher mortgage rates, rising prices, and limited inventory. But, to really understand today’s demand, you have to compare where we are now with the last normal years in the market (2018-2019) – not the abnormal ‘unicorn’ years.

When you focus on just the blue bars, you can get an idea of how 2024 stacks up. And that gives you a whole new perspective.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

And if you’re worried about how you’ll afford your next move with today’s rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. And that equity can make a big difference when you buy your next home. You may even have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today’s housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If you’ve had these three questions on your mind and they’ve been holding you back from selling, hopefully, it helps to have this information now. A recent survey from Realtor.com shows more than 85% of potential sellers have been considering selling for over a year. That means there are a number of sellers like you who are on the fence.

But that same survey also talked to sellers who recently decided to take the plunge and list. And 79% of those recent sellers wish they’d sold sooner.

If you want to talk more about any of these questions or need more information, let’s connect.

Selling Your Sunshine State Sanctuary: Unveiling the Mysteries of the West Palm Beach Housing Market

So, you’ve decided to trade the palm whispers for fresh horizons. Maybe it’s a growing family yearning for a backyard or a career calling from a distant city. Whatever your reason, selling your West Palm Beach home is the first step to your next adventure. But before you dive headfirst into open houses and bidding wars, let’s address the swirling questions that inevitably accompany “About Selling Your House.”

Is the West Palm Beach Housing Market Right for Sellers?

The West Palm Beach housing market has a well-deserved reputation for sunshine and steady growth. It’s a seller’s market more often than not, with earned housing equity a common theme in conversations with past sellers I’ve spoken to. The number of sellers is typically lower than the buyer demand, leading to potentially quicker sales and potentially higher home prices.

But the market isn’t static. Understanding the current climate is crucial. Mortgage rates can influence buyer activity. While historically low rates might have fueled bidding wars, a slight rise can create a more balanced market. A West Palm Beach mortgage broker can give you a personalized snapshot of current rates and pre-qualify you, making you an attractive candidate to potential buyers.

Should You Spruce Up or Sell As-Is?

Curb appeal is undeniable in the Sunshine State. A well-maintained lawn and a splash of color on the front door can make a world of difference. However, extensive renovations might not always translate to a dollar-for-dollar return on investment. Consult with a local realtor to determine the sweet spot between minor cosmetic improvements and unnecessary remodeling.

The Power of Presentation: How to Make Your West Palm Beach Home Shine

First impressions matter. Here are some impactful, yet budget-friendly ways to showcase your house to sell:

- Declutter and depersonalize: Pack away family photos and excessive furniture to create a sense of spaciousness.

- Natural light is your friend: Open blinds and curtains to bathe the interior in warm sunlight.

- Minor repairs with a major impact: Fix leaky faucets, chipped paint, and squeaky doors.

- Stage it for success: Strategically rearrange furniture to highlight the flow of the home. Consider renting furniture if yours doesn’t quite fit the space.

Finding the Perfect West Palm Beach Realtor: Your Guide Through the Maze

Selling a house can feel like navigating a labyrinth. A skilled realtor is your Ariadne’s thread, guiding you through the process with expertise and a calming presence. Look for someone with a proven track record in your neighborhood, experience with your specific property type, and a communication style that meshes with yours.

Negotiating Like a Pro: Getting Top Dollar for Your West Palm Beach Abode

Negotiations can be a dance, and a skilled realtor can help you waltz your way to a successful outcome. Here are some tips to keep in mind:

- Be prepared to walk away: Having a realistic bottom line and the willingness to walk away if necessary strengthens your position.

- Respond promptly: Time is of the essence. Timely responses show your seriousness and can give you an edge over other sellers.

- Consider all offers: Don’t be blinded by the highest initial offer. Analyze contingencies and closing timelines to find the offer that best suits your needs.

**Financing Your Next Move: Buy My Next Home

Selling your West Palm Beach home is just the first chapter. The next chapter involves buying your next home. Mortgage pre-approval is a powerful tool that demonstrates your financial strength to potential sellers. Utilize a West Palm Beach mortgage broker to explore affordable West Palm Beach home loans and secure the best mortgage rates in West Palm Beach. Whether you’re a first-time home buyer or a seasoned mover, there are loan options to fit your circumstances. West Palm Beach refinancing options can also be explored to potentially unlock additional equity from your current sale.

Local Knowledge is Key: West Palm Beach Resources at Your Fingertips

The West Palm Beach housing market has its own unique quirks and customs. A local realtor can provide invaluable insights to help you navigate the process seamlessly. They can also connect you with a network of reliable professionals like inspectors, appraisers, and local mortgage lenders who understand the specific nuances of the West Palm Beach market.

West Palm Beach Mortgage Calculators can also be a helpful tool to estimate potential mortgage payments and explore different loan options. Don’t hesitate to seek out property loan advice from qualified professionals to ensure you’re making informed decisions throughout the process.

Conquering the Closing Table: The Final Frontier of Selling Your West Palm Beach Home

The “for sale” sign has vanished, replaced with a “sold” sign – congratulations! But before you pop the champagne corks, there’s one final hurdle: closing. This can feel like a whirlwind of paperwork and legalese, but with proper preparation, you can cross the closing table with confidence.

Understanding Closing Costs:

Closing costs encompass various fees associated with the sale of your property. These can include:

- Realtor commissions (typically a percentage of the selling price)

- Title insurance

- Pro-rated property taxes

- Escrow fees

A West Palm Beach mortgage broker or your realtor can provide you with a detailed breakdown of estimated closing costs. Don’t be afraid to ask questions – transparency is key!

Preparing for Closing:

- Gather your documentation: Proof of ownership, social security number, tax returns, and any homeowner association (HOA) documents will likely be needed.

- Review the closing disclosure: This document outlines all closing costs and adjustments. Ensure you understand each line item before signing.

- Schedule a final walkthrough: This is your last chance to ensure the property is in the agreed-upon condition.

Pro Tip: Consider using a West Palm Beach mortgage calculator to factor in closing costs when determining your net proceeds from the sale.

Beyond the Sale: A Smooth Transition to Your Next Chapter

Selling your West Palm Beach home marks the end of one chapter and the exciting beginning of another. Here are some additional considerations to ensure a smooth transition:

- Forwarding mail: Update your address with the post office and relevant institutions to avoid missing important documents.

- Utilities: Schedule disconnection of utilities at your current residence and connection at your new one.

- Moving logistics: Research reputable movers and secure their services well in advance, especially during peak seasons.

- Taxes: Consult a tax advisor to understand the tax implications of selling your home.

Selling your West Palm Beach home can be a rewarding experience, filled with the bittersweet emotions of goodbyes and the thrill of new beginnings. By demystifying the process, arming yourself with the right tools (like a skilled realtor and a West Palm Beach mortgage broker), and staying organized, you can navigate this transition with confidence. Now go forth, sunshine seeker, and turn the “Buy My Next Home” dream into a reality!

Appendix: A Treasure Trove of Resources for West Palm Beach Sellers

Congratulations! You’ve devoured this guide and hopefully feel empowered to tackle the West Palm Beach housing market. But remember, knowledge is a never-ending journey. Here’s a treasure trove of resources to keep you informed and confident throughout the selling process:

- West Palm Beach Realtors Association: Connect with a network of experienced realtors who specialize in your specific area.

- Florida Bar: Find a qualified real estate attorney to answer legal questions and ensure a smooth closing.

- Federal Housing Administration (FHA): Explore government-backed loan options for your buy your next home endeavor, especially if you’re a first-time home buyer.

- Consumer Financial Protection Bureau (CFPB): Gain valuable insights on mortgages, including West Palm Beach refinancing options and how to shop for the best mortgage rates in West Palm Beach.

- West Palm Beach County Property Appraiser: Access important information on your property’s assessed value.

Bonus Tip: Don’t underestimate the power of online communities! Local Facebook groups or online forums can be a goldmine for recommendations on everything from reliable movers to reputable home inspectors.

Remember, selling your West Palm Beach home is a significant undertaking. But with the right preparation, a dash of patience, and a network of trusted resources, you can transform this transition into a springboard for your next exciting adventure. Now, go forth and conquer that “for sale” sign!

Frequently Asked Questions: Unveiling the Mysteries of Selling Your West Palm Beach Abode

Selling your West Palm Beach home can stir up a whirlwind of questions. Here, we’ll shed light on some commonly asked queries to empower you throughout the process:

Q: How long will it take to sell my house?

A: The timeframe can vary depending on several factors, including the current market conditions, the property’s condition and location, and your asking price. Generally, a well-priced home in a seller’s market might sell within weeks, while a more unique property or a buyer’s market could take longer. Consulting with a local realtor can provide you with a more accurate estimate based on current market trends.

Q: Should I sell during the holidays?

A: Traditionally, the spring and summer months are considered the peak selling seasons. However, the West Palm Beach market often experiences year-round activity due to its sunny climate and constant influx of new residents. Discuss the pros and cons with your realtor to determine the best timing strategy for your specific situation.

Q: What happens if there are multiple offers on my house?

A: Multiple offers are a good sign, indicating strong buyer interest. Your realtor will guide you through the process of evaluating each offer, considering factors like price, contingencies, and closing timelines. You’re not obligated to accept the highest initial offer – the one that best suits your needs might be the better choice.

Q: Can I sell my house myself (FSBO – For Sale By Owner)?

A: It’s certainly possible, but it requires significant effort and market knowledge. You’ll be responsible for tasks typically handled by a realtor, such as marketing, showings, and negotiations. Weigh the potential cost savings against the time commitment and potential challenges before deciding to go the FSBO route.

Q: What if I need to sell my house quickly?

A: Open communication with your realtor is key. Discuss strategies to expedite the sale, such as strategic pricing or offering incentives to buyers willing to close quickly. Be prepared to be flexible on some aspects to attract a broader pool of potential buyers.

Remember: Selling your West Palm Beach home is a significant milestone. By addressing these questions and seeking guidance from trusted professionals, you can navigate this process with confidence and unlock the door to your next exciting chapter.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice