How Do Climate Risks Affect Your Next Home?

Climate change is impacting where people buy homes. As the experts at the National Association of Realtors (NAR) explain:

“Sixty-three percent of people who have moved since the pandemic began say they believe climate change is—or will be—an issue in the place they currently live.”

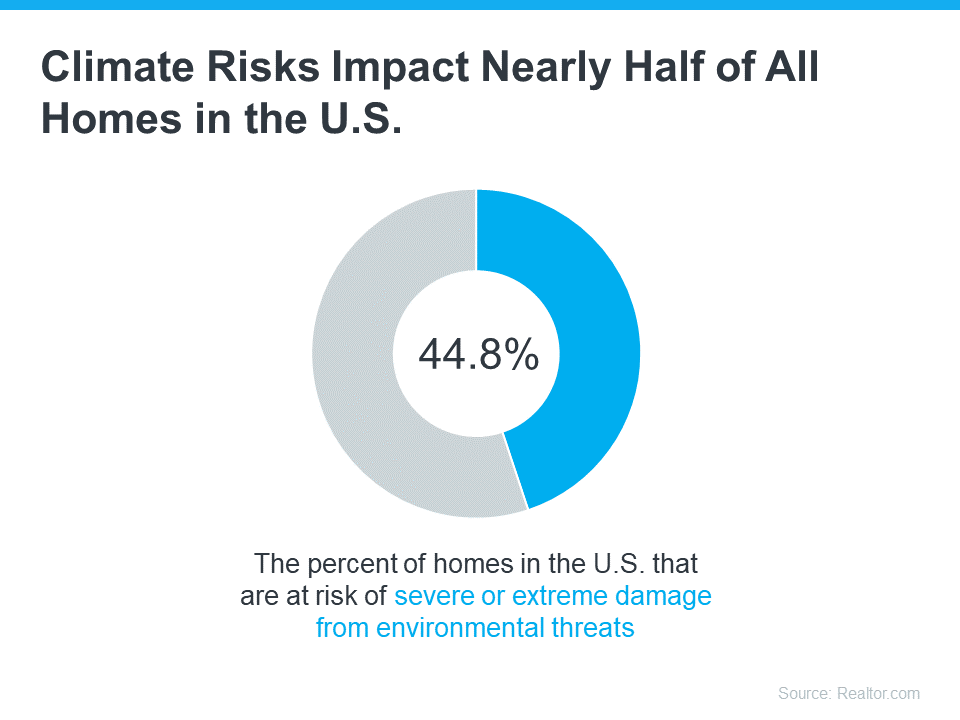

If you’re planning to move, climate change is something you might want to consider, no matter where you are. A recent study from Realtor.com helps put the growing impact climate change is having on real estate into perspective (see below):

So, how can you be sure your investment is safe from the elements?

For starters, work with a local real estate agent to understand the likelihood of your future home being exposed to hazards like wind, floods, and wildfires. Your agent will know the area and be able to tell you about the risks you’ll most likely face.

Beyond that, there are two important factors to think about: the quality of the home you want to buy and the insurance you’ll need to protect it.

A Home Built to Last

If you’re planning to be in your home for many years, you want to know it’s going to last. One way to think ahead is to work with your real estate agent to ensure the home you buy can withstand environmental hazards. They’re up to date on the most common building and remodeling techniques—like a secondary water barrier on the roof or noncombustible, fire-resistant exterior walls—used to protect homes from the effects of climate change.

And if the home you’re interested in doesn’t have the features you’re looking for, they can help you determine what you may be able to negotiate in the contract or what work it might require in the future.

Insurance To Protect It

Once you’re confident the home you’re looking at is well built, the next step is finding out what it’s going to take to insure it. As Selma Hepp, Chief Economist at CoreLogic, says:

“. . . homeowners are going to become increasingly more aware of risks of living in some areas as it becomes prohibitively expensive or very difficult to obtain hazard insurance.”

In areas where climate risks are having a bigger impact, the right home insurance can make a big difference. And the price of that insurance is an important factor when thinking about your budget and the true cost of buying and protecting your home. Get an insurance quote early in the process because you may want to compare multiple quotes and it can take several weeks to get them.

While this may feel like a lot to consider, don’t worry. An agent can help. Your real estate agent will be your go-to resource on the homebuying process, what to look for and consider, and how climate change may affect your next home. With the right planning and an agent’s expert advice, you can make this happen. Homeownership is worth it. And with a great agent by your side, you can make sure the home you find is the right fit.

Climate change is an important factor to think about when buying a home. After all, your home is a huge investment, and you want to be ready for anything that might affect it. Let’s chat so you can find the perfect home.

How Climate Risks Affect Your Next Home: Building a Resilient Future

Congratulations! You’ve decided to take the plunge and buy a home. It’s an exciting time, fraught with endless possibilities – picturing movie nights in the living room, hosting backyard barbecues, and finally having a space to truly call your own. But in today’s world, there’s a new wrinkle in the homebuying process: climate change.

Yes, you read that right. Climate change isn’t just about polar bears and melting glaciers (although those are important too). It’s also having a profound impact on real estate. Rising sea levels, increased wildfires, and more frequent extreme weather events are all forcing us to rethink where and how we build our lives.

But fear not, intrepid homebuyer! This doesn’t have to be a downer conversation. Instead, let’s reframe it as an opportunity to be proactive and buy a home that’s built to last. By understanding the potential risks and taking some smart steps, you can find a place that will not only be your haven but also a resilient investment for the future.

An Agent Can Help You Navigate the New Landscape

Gone are the days when location was simply about proximity to work and good schools. Now, you need to consider the climate risks associated with the area. This is where your real estate agent becomes your ultimate wingman (or wingwoman). A good agent with an agent’s expert advice will have a deep understanding of the local climate trends and how they might affect your future home.

They can help you assess flood risks, wildfire zones, and drought vulnerability. They can also point you towards areas where communities are actively implementing climate-resilient building practices and infrastructure upgrades. Finding the perfect home is about more than granite countertops and a walk-in closet; it’s about finding a place that will be safe and secure for years to come.

Climate Risks Affect Your Next Home: A Breakdown of the Big Threats

So, what exactly are we talking about when we say climate risks? Here’s a quick rundown of the major threats:

- Rising Sea Levels: Coastal areas are particularly vulnerable to rising sea levels, which can lead to increased flooding, erosion, and property damage.

- Increased Wildfires: Warmer temperatures and drier conditions are creating a perfect storm for wildfires, putting homes in fire-prone areas at greater risk.

- Extreme Weather Events: From hurricanes and tornadoes to floods and droughts, the frequency and intensity of extreme weather events are on the rise.

Buying a Home and Protecting Your Investment

Now that you’re aware of the potential threats, let’s talk about how to buy a home and protect yourself. Here are some key strategies:

- Work With Your Real Estate Agent: As mentioned earlier, your real estate agent is your best friend in this process. Leverage an agent’s expert advice to understand the specific climate risks in your desired location.

- The Home You Buy Matters: Don’t just fall in love with curb appeal. Look for homes built with climate-resilient features like elevated foundations in flood zones or fire-resistant roofing materials.

- The Right Home Insurance: Buying a home also means getting the right home insurance. Standard homeowner’s insurance may not cover all climate-related risks. Talk to your insurance agent about flood insurance or additional wildfire coverage, if necessary.

A Home Built to Last: Investing in Resilience

Beyond these initial steps, consider ways to make your home more resilient in the long run. Here are some ideas:

- Waterproofing: Invest in waterproofing measures like basement waterproofing or French drains to protect your home from flooding.

- Landscaping for Fire Safety: If you live in a fire-prone area, create a firebreak around your property by clearing flammable vegetation.

- Solar Power: Not only will solar panels reduce your reliance on the grid, but they can also provide backup power in case of a weather-related outage.

Buying and Protecting Your Home: A Long-Term Vision

Buying a home is a significant investment, and it’s crucial to think long-term. By factoring in climate risks during your search, you’re not just buying a house; you’re investing in a secure and resilient future for yourself and your loved ones.

Remember:

- There’s no need to be discouraged by climate change. Instead, view it as an opportunity to be proactive and make informed decisions.

- Your real estate agent is your partner in navigating the new landscape of climate-resilient

Beyond the Basics: Uncommon Considerations for the Climate-Conscious Homebuyer

While the tips above provide a solid foundation, let’s delve a little deeper into some uncommon terminology that might pique your interest as a discerning homebuyer:

- Urban Heat Island Effect: This phenomenon describes how cities tend to be significantly hotter than surrounding rural areas. Look for homes with features that mitigate this effect, such as green roofs or strategically placed trees.

- Xeriscaping: This type of landscaping uses drought-tolerant plants, reducing your reliance on precious water resources.

- Passive House Design: These super-insulated and airtight homes minimize energy consumption for heating and cooling, making them not only environmentally friendly but also cost-effective in the long run.

The Future of Real Estate: Innovation and Adaptation

The good news is that the real estate industry is starting to take notice of climate change. Climate-resilient building practices and technologies are emerging at a rapid pace. Here are a few examples:

- Flood-resistant building materials: These innovative materials can withstand water damage, minimizing repair costs after a flood event.

- Community microgrids: These localized power grids can provide backup power during outages, ensuring essential services remain operational.

- Living shorelines: These nature-based solutions use vegetation and natural materials to protect coastlines from erosion caused by rising sea levels.

Working with a Local Real Estate Agent: Your Climate Champion

While these cutting-edge solutions are exciting, they might not be readily available everywhere just yet. That’s where your local real estate agent comes in once again. A forward-thinking agent will be up-to-date on the latest climate-resilient developments in your area and can help you find a home that incorporates these features.

Finding the Perfect Home: Balancing Your Needs with the Future

Ultimately, the goal is to find a home that not only meets your current needs but is also well-positioned for the challenges of tomorrow. Don’t be afraid to ask questions! An agent’s expert advice can be invaluable in understanding a property’s vulnerability to specific climate risks.

Buying a Home: A Collaborative Effort

Remember, buying a home in a changing climate is a collaborative effort. Work with your real estate agent, talk to your mortgage lender about West Palm Beach mortgage options that consider potential climate risks, and don’t hesitate to consult with experts like environmental engineers or home inspectors. West Palm Beach mortgage brokers can also help you navigate the financial aspects of buying a home in a climate-conscious way.

Building a Resilient Future: One Home at a Time

By taking these steps, you’re not just securing a place for yourself; you’re contributing to a more resilient future for your community. Climate change may present challenges, but it also presents an opportunity to build smarter, more sustainable homes and communities. So, buy a home with confidence, knowing you’ve made a well-informed decision for your future and the planet.

Beyond the Physical: The Financial Landscape of Climate-Conscious Homes

We’ve covered a lot of ground on the physical aspects of climate-resilient homes, but let’s not forget the financial implications. Here’s how climate change can affect your wallet as a homeowner:

- Insurance Costs: Homes in high-risk areas may face higher insurance premiums due to increased flood, fire, or wind damage risks.

- Property Values: Climate-resilient features can actually enhance the value of your home, making it more attractive to future buyers.

- Resiliency Retrofits: While upfront costs might be higher, investing in climate-resilient upgrades like storm shutters or floodproofing can save you money in the long run by preventing costly repairs after a disaster.

West Palm Beach Mortgage Options and Climate Considerations:

As you explore West Palm Beach mortgage options, it’s wise to factor in climate risks. A good West Palm Beach mortgage broker can help you understand how these risks might impact your loan terms or eligibility, especially if you’re considering a property in a high-risk zone.

First-Time Home Buyer Loans and other mortgage programs might have specific requirements related to flood insurance or other climate-related considerations. West Palm Beach mortgage calculators can be a helpful tool to estimate potential costs associated with different mortgage options while factoring in potential climate risks.

Buying a Home: A Smart Investment

By making informed decisions about climate risks during the homebuying process, you’re not just protecting your home; you’re also protecting your investment. A climate-resilient home is likely to be more stable in value and less susceptible to damage, making it a smarter financial decision in the long run.

The Takeaway: Knowledge is Power

The key takeaway here is knowledge. Educate yourself on the climate risks associated with your desired location and the potential financial implications. An agent’s expert advice combined with consultations with financial experts like mortgage brokers can empower you to make informed decisions that benefit your wallet and your well-being.

Embrace the Challenge: Building a Sustainable Future

Climate change presents challenges, but it also presents opportunities. By embracing climate-conscious homebuying practices, we can collectively contribute to a more sustainable future. Imagine a world where homes are not just sanctuaries but also bastions of resilience, designed to withstand the changing environment and minimize our collective impact on the planet.

Buying a Home with Confidence:

So, take a deep breath and embark on your homebuying journey with confidence. Remember, you’re not alone. There’s a network of professionals – real estate agents, mortgage brokers, environmental experts – all ready to support you in finding a home that’s a perfect fit for your needs and a responsible choice for the future. Buying a home can be an incredibly rewarding experience, and with the right approach, it can also be a step towards a more sustainable and climate-resilient tomorrow.

Beyond Borders: A Glimpse into the Future of Climate-Conscious Communities

We’ve focused on the individual homeowner, but the impact extends beyond the walls of your home. Climate-resilient communities are the future, and here’s a glimpse of what that might look like:

- Green Infrastructure: Imagine walkable neighborhoods with green spaces that not only enhance aesthetics but also act as natural flood barriers and promote biodiversity.

- Renewable Energy Integration: Communities powered by solar panels, wind turbines, and geothermal energy will be the norm, reducing reliance on fossil fuels and lowering carbon footprints.

- Sustainable Transportation: Public transportation networks optimized for efficiency, coupled with bike lanes and pedestrian walkways, will encourage a healthier, less car-dependent lifestyle.

Finding a Home in a Climate-Conscious Community:

While these futuristic visions are inspiring, some communities are already taking concrete steps towards climate resilience. When working with your real estate agent, inquire about initiatives in your desired area. An agent’s expert advice can help you identify neighborhoods that prioritize sustainability and have plans in place to mitigate climate risks.

Buying a Home: Contributing to a Larger Movement

By choosing a climate-conscious community, you’re not just buying a house; you’re becoming part of a larger movement. You’re joining forces with like-minded individuals who are committed to building a more sustainable future for themselves and generations to come.

The Power of Collective Action:

Imagine the collective impact of countless individuals making climate-conscious choices. It can be a powerful force for change, paving the way for a future where communities are not just resilient but also thriving in harmony with the environment.

Buying a Home: A Catalyst for Positive Change

Buying a home is a significant milestone, and it can also be a catalyst for positive change. By prioritizing climate resilience during your search, you’re sending a powerful message. You’re demonstrating your commitment to a sustainable future, not just for yourself but for the entire community.

The Final Word: Building a Legacy

In conclusion, buying a home in the face of climate change is not just about bricks and mortar; it’s about building a legacy. Your future home can be a testament to your foresight, a symbol of your commitment to a sustainable future. It can be a place of comfort, security, and a haven for generations to come. So, embark on your homebuying journey with confidence, knowing that you’re making a responsible choice for your family, your community, and the planet.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice