How Home Equity Can Help Fuel Your Retirement

If retirement is on the horizon, now’s the time to start thinking about your next chapter. And you probably want to make sure you’re set up to feel comfortable financially to live the life you want in retirement.

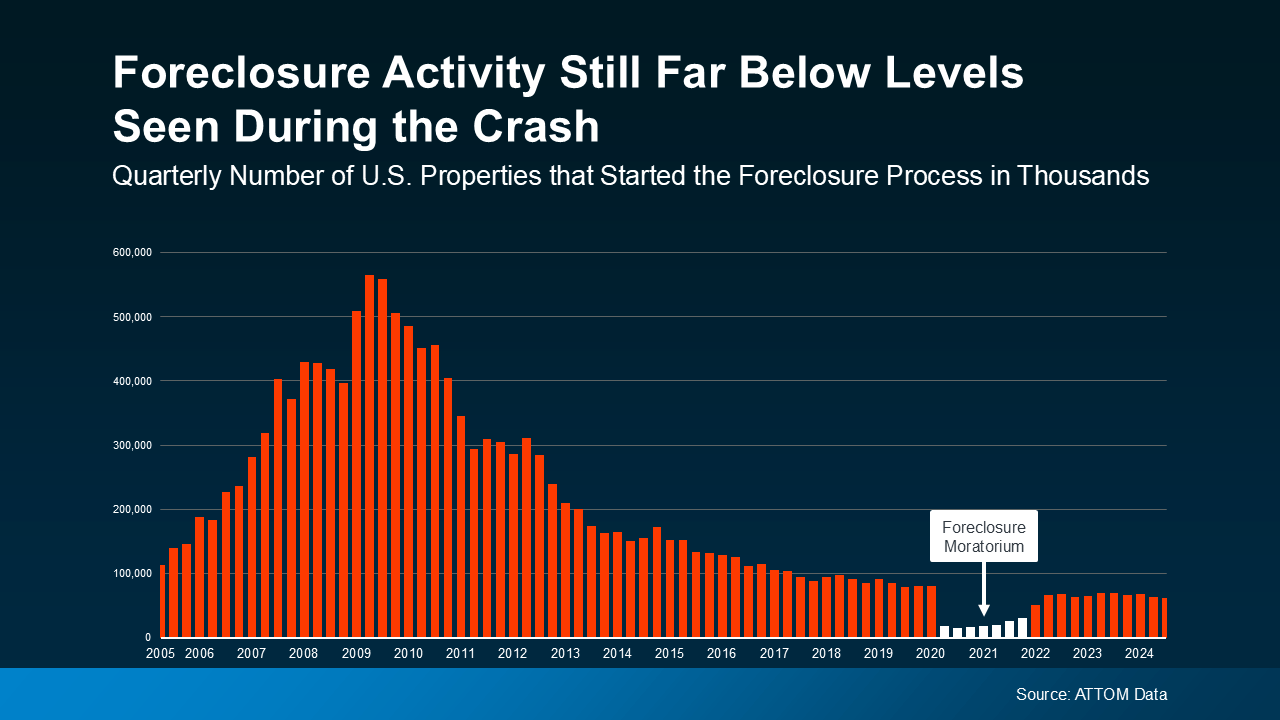

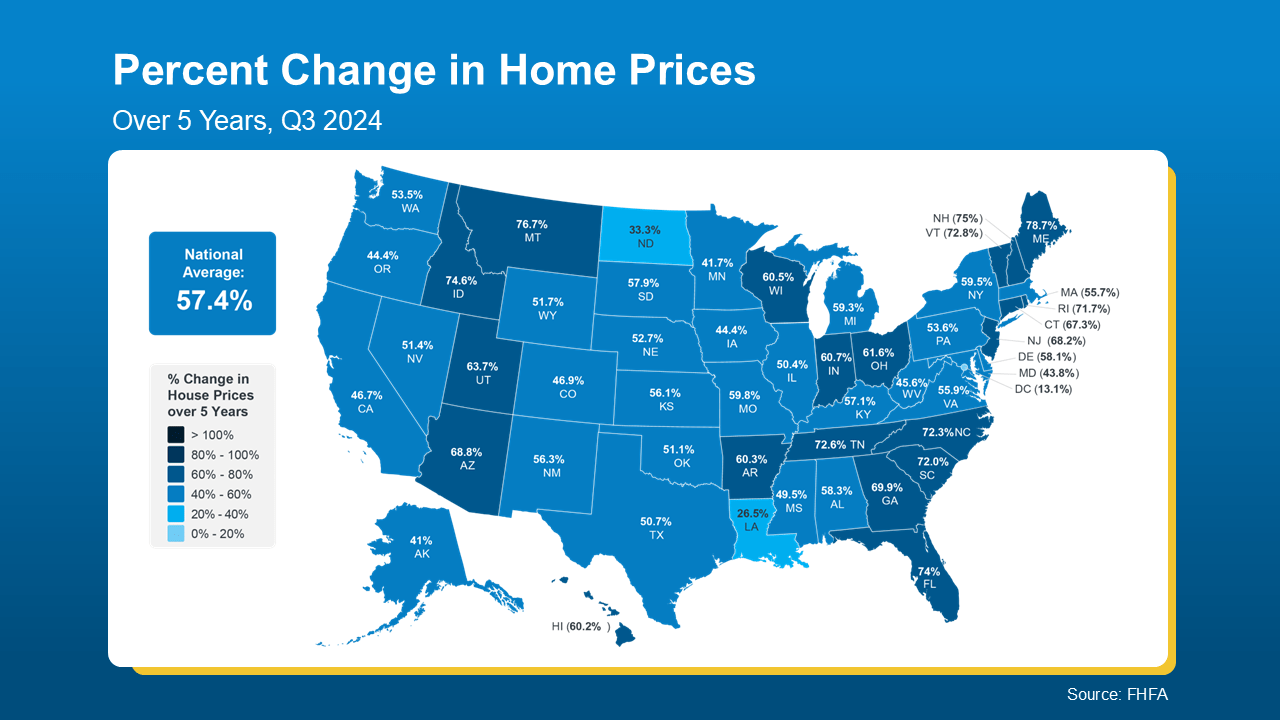

What you may not realize is you likely have a hidden goldmine of cash you’re not thinking about — and that’s your home. Data from the Federal Housing Finance Agency (FHFA) shows that home values have gone up nearly 60% over the last 5 years alone (see graph below):

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

And that appreciation gave your net worth a big boost. According to Freddie Mac, over the same five-year period:

“ . . . Boomer overall wealth increased by $19 trillion, or $486,000 per household, half of which is due to house price appreciation.”

So if you’ve been in your house ever longer than that, chances are you have even more equity in your home. If you want to have access to more of the wealth you’ve built up throughout the years, it’s worth thinking about selling your house to downsize.

Why Downsizing Might Be the Right Move

Selling now so you can downsize into a smaller home, or maybe one in a more affordable area, could free up your home equity so you can use a portion of it to help you feel confident retiring. Whether you want to travel, spend more time with family, or just feel financially secure, accessing the equity in your home can make a huge difference. As Chase says:

“Retirement is an exciting time. Selling your home to take advantage of the equity or to downsize to a more affordable home can open up additional options for your future.”

Here are just a few of the ways a smaller home can fuel your retirement:

1. Cut Your Cost of Living

Data from the AARP shows the number one reason adults 50 and older move is to reduce their cost of living. Downsizing to a smaller house or relocating to a more affordable area can help you lower your monthly expenses — like utilities, property taxes, and maintenance costs.

2. Simplify Your Life

A smaller home often means less upkeep and fewer responsibilities. That can free up your time and energy to focus on the things that matter most in your retirement.

3. Boost Your Financial Flexibility

Selling your current house gives you access to your equity, turning it into cash you can use however you like. Whether it’s investing, paying off debt, or creating a financial cushion, it can open up new opportunities for your future.

The First Step Toward Your Next Chapter

If you think you may be interested in downsizing, working with a real estate agent is your next step. Your agent will help you understand how much equity to have and how you can use it. But they’ll do more than that. They’ll also help you navigate the entire process of selling your current home and finding a new one, so you can transition smoothly into a new home and a new phase of life.

If you’re planning to retire in 2025, now may be the perfect time to downsize and unlock the equity you’ve built up in your home. Let’s start planning your move now, so you’re set up to make every day feel like a Saturday.

How Home Equity Can Help Fuel Your Retirement

Retirement is a long-awaited milestone—an opportunity to embrace a lifestyle change filled with freedom, relaxation, and new experiences. But as you step into this next chapter, ensuring financial security is paramount. Fortunately, there’s a reservoir of hidden wealth you may not have fully considered: the equity in your home.

For decades, your home has been more than just a place to live; it has been a crucial asset in your wealth portfolio. With house price appreciation on the rise, the net worth of homeowners has surged significantly. According to Freddie Mac, homeowners have experienced a considerable increase in their overall wealth, largely due to rising home values. This provides a golden opportunity to unlock the equity you’ve built up in your home and utilize it strategically for retirement.

The Power of Home Equity in Retirement Planning

Your home is more than just four walls; it’s a financial tool that can be leveraged in numerous ways. Whether you’re looking to downsize into a smaller home, relocate to a more affordable home, or explore West Palm Beach refinancing options, your home equity can play a pivotal role in shaping your retirement.

Here’s how you can take advantage of the equity in your home to fuel your golden years:

1. Selling Your House to Downsize and Reduce Expenses

Selling your home can be a strategic move if you’re looking to simplify your life and cut down on expenses. Downsizing to a smaller house allows you to transition into a home that requires less maintenance, offers lower property taxes, and minimizes utilities.

According to data, the primary reason adults over 50 move is to lower their cost of living. Selling your current house and purchasing a more affordable home can significantly reduce monthly expenditures, leaving more room in your budget for travel, hobbies, and financial investments.

Additionally, maintenance costs can be significantly reduced when moving into a more manageable property. A smaller home often means fewer repairs, lower utility bills, and a decrease in the overall effort needed to maintain the property. This makes day-to-day living easier and ensures that your financial resources are preserved for more important things, like enjoying your retirement.

2. Boosting Financial Flexibility with a Home Sale

One of the most compelling reasons for selling now is the increased financial flexibility it provides. The equity in your home can be converted into liquid assets, giving you access to funds that can be used for investment, healthcare, or even leisure activities. By working with a real estate agent, you can determine how much equity to have available and how best to allocate it for your future.

With extra capital in hand, you can better prepare for unexpected expenses, invest in markets that yield returns, or even set aside money for family members. Some retirees also choose to reinvest their funds into rental properties, creating an ongoing income stream to sustain their retirement lifestyle.

3. Using Home Equity for Debt Payoff

Retirement should be about financial freedom, not financial stress. If you still carry a mortgage, credit card balances, or other significant debts, selling your home can be a game-changer. By using your home equity for debt payoff, you eliminate monthly payments, reduce financial burdens, and create a more sustainable retirement plan.

Without the weight of ongoing debt, you can allocate your funds towards things that truly matter—whether it’s traveling the world, helping grandchildren with college tuition, or simply enjoying your retirement with complete peace of mind.

4. Exploring Mortgage and Refinancing Options

If you’re not ready to move but still want to leverage your home’s value, there are numerous options available:

- West Palm Beach mortgage broker services can help you explore the best financing solutions tailored to your needs.

- Affordable West Palm Beach home loans can be an option for those considering purchasing a smaller, more manageable property.

- Best mortgage rates in West Palm Beach ensure that you get the most cost-effective financing terms.

- First-time home buyer loans in West Palm Beach can be beneficial for those looking to transition into a new home.

- Local mortgage lenders in West Palm Beach can offer personalized advice on loan structures.

- West Palm Beach mortgage calculators help estimate potential savings and costs.

- Property loan advice in West Palm Beach ensures you make informed decisions based on current market conditions.

- Commercial mortgage broker in West Palm Beach services can assist if you’re considering investing in income-generating real estate.

- Mortgage preapproval in West Palm Beach streamlines the home-buying process, ensuring you secure the best financing available.

By exploring these options, retirees can make educated decisions about whether refinancing or accessing home equity is the right move for them.

5. Investing in Your Future

Once you unlock the equity you’ve built up in your home, the possibilities for future planning are endless. Whether it’s creating a diversified investment portfolio, setting up an emergency fund, or gifting money to loved ones, home equity can provide a financial cushion that ensures long-term stability.

For many retirees, financial security means having a mix of income sources—pensions, Social Security, and investments. Home equity can serve as a bridge, supplementing these income sources and ensuring a worry-free retirement.

6. Enhancing Your Retirement Lifestyle

Retirement is about more than just money—it’s about quality of life. With fewer financial constraints, you can truly embrace your newfound freedom. Imagine traveling the world, indulging in new hobbies, or simply enjoying time with family without financial worry. Selling your home and accessing home equity can help you craft the retirement of your dreams.

Additionally, moving to a community that better suits your needs can enhance social engagement, improve mental well-being, and provide access to better healthcare facilities. Many retirees choose to relocate to areas with favorable climates and vibrant senior communities, enhancing their overall lifestyle.

The Role of a Real Estate Agent in Your Transition

Navigating the complexities of selling a home, purchasing a new one, or refinancing can be daunting. A professional real estate agent can provide guidance on market trends, help you determine how much equity to have, and ensure you get the best deal possible. Their expertise in pricing, staging, and marketing your home can make the process seamless and stress-free.

Conclusion

Retirement is the beginning of a new home and a new phase of life. By strategically leveraging your home equity, you can enhance your financial security, reduce your cost of living, and create a future filled with possibilities. Whether you choose to downsize into a smaller home, explore West Palm Beach refinancing options, or work with a West Palm Beach mortgage broker, your home’s value can be the key to unlocking a fulfilling and stress-free retirement.

Now is the time to take action, seize new opportunities, and make every day feel like a Saturday. By planning ahead and leveraging your home equity wisely, you can ensure that your retirement years are as comfortable, fulfilling, and financially secure as possible.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice