There’s No Foreclosure Wave in Sight

Some Highlights

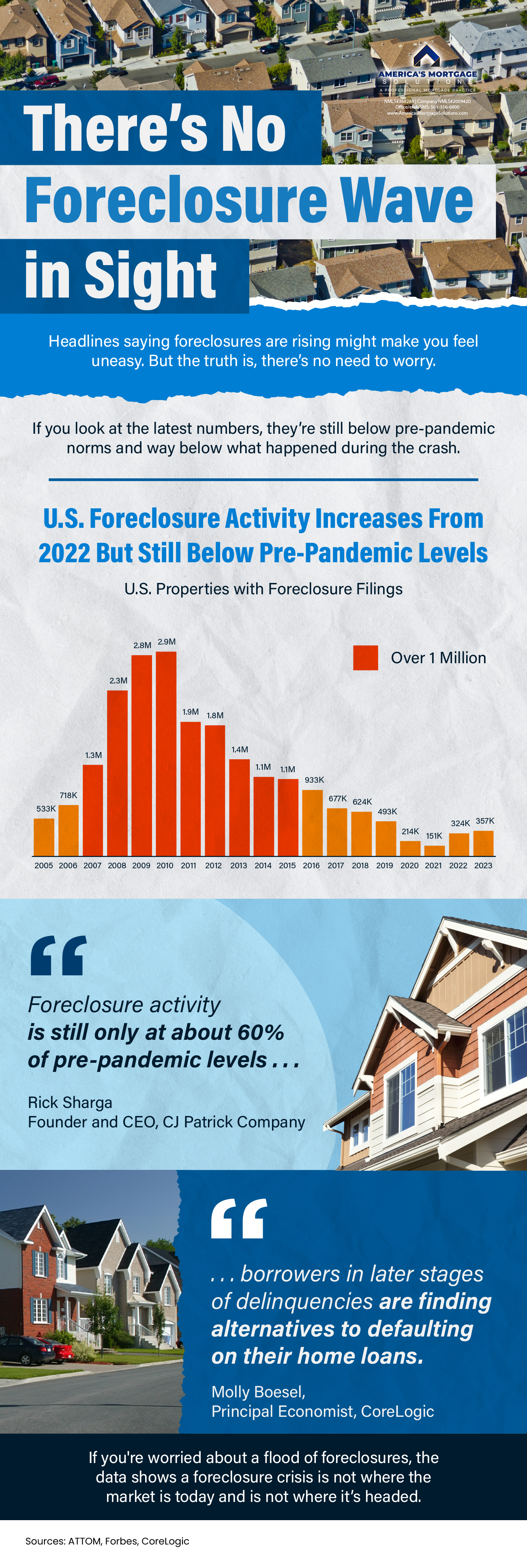

- Headlines saying foreclosures are rising might make you feel uneasy. But the truth is, there’s no need to worry.

- If you look at the latest numbers, they’re still below pre-pandemic norms and way below what happened during the crash.

- If you’re worried about a flood of foreclosures, the data shows a foreclosure crisis is not where the market is today and is not where it’s headed.

Riding the Calm: The Absence of a Foreclosure Tsunami

In the ever-evolving landscape of real estate, the term foreclosure can send shivers down the spine of homeowners and industry pundits alike. Memories of the 2008 foreclosure crisis linger like a ghost, haunting discussions and predictions about the market’s future. However, a careful analysis of the current real estate climate suggests that the anticipated flood of foreclosures is, at present, nowhere in sight.

The Foreclosure Landscape: A Detailed Exploration

Understanding the Foreclosure Crisis

To comprehend the current state of affairs, let’s revisit the not-so-distant past. The foreclosure crisis of 2008 was akin to an economic earthquake, with the epicenter located in the housing market. A surge of home loan defaults cascaded into a broader financial meltdown, leaving a trail of economic devastation.

Foreclosures became synonymous with financial ruin, and the term itself carried a weight that still influences perceptions today. It’s crucial to acknowledge that the factors contributing to the 2008 crisis were multi-faceted, involving predatory lending practices, subprime mortgages, and a speculative bubble that burst with resounding consequences.

The Post-2008 Era: Recovery and Regulation

Post-2008, the real estate landscape underwent substantial changes. Stricter lending regulations, increased oversight, and a collective industry-wide commitment to avoid past mistakes became the new norm. The recovery from the aftermath of the foreclosure crisis was gradual, marked by a cautious optimism.

Current Trends: A Deep Dive

Pandemic’s Impact on Real Estate

Fast forward to the present day, where the global landscape has been reshaped by an unprecedented event—the COVID-19 pandemic. One might assume that such a seismic shift would trigger a new foreclosure crisis. Surprisingly, the reality appears to defy conventional expectations.

The pandemic-induced economic turmoil did cause financial hardships for many, leading to concerns about a potential surge in foreclosures. Government interventions, however, played a pivotal role in averting an immediate catastrophe. Moratoriums on evictions and foreclosures provided a crucial buffer, preventing a sudden influx of distressed properties flooding the market.

Unpacking the Foreclosure Numbers

As we assess the current data, the expected flood of foreclosures seems more like a distant thunderstorm than an imminent deluge. Mortgage delinquency rates, while fluctuating, do not paint a picture of a market on the brink.

It’s essential to recognize that delinquency rates alone do not equate to foreclosures. Borrowers facing financial hardships may navigate through forbearance programs, loan modifications, or alternative arrangements, mitigating the traditional path to foreclosure.

Factors Mitigating a Foreclosure Onslaught

Government Intervention and Stimulus Measures

One of the primary factors preventing a foreclosure surge is the robust government response. Stimulus packages and targeted financial assistance programs injected a lifeline into households grappling with economic uncertainties. The aim was clear: prevent a repeat of the 2008 debacle by addressing financial vulnerabilities at their roots.

Shift in Lender Strategies

Lenders have also adapted their strategies in the aftermath of the foreclosure crisis. A more cautious approach to lending, coupled with increased empathy toward borrowers facing difficulties, has become the new norm. Lenders now prioritize sustainable homeownership over aggressive lending practices that proved disastrous in the past.

Evolving Work Dynamics

The shift towards remote work, accelerated by the pandemic, has altered the dynamics of homeownership. With the newfound flexibility to work from anywhere, individuals have migrated to areas that align with their lifestyle preferences rather than proximity to traditional job hubs. This shift has contributed to a more resilient housing market, reducing the risk of localized foreclosure spikes.

Conclusion: Navigating Calm Waters

In conclusion, the apprehensions surrounding an impending flood of foreclosures appear, for now, to be more speculative than substantiated. The scars left by the 2008 foreclosure crisis have instilled a collective determination to learn from past mistakes and build a more resilient real estate ecosystem.

While challenges persist, the current landscape reflects a far cry from the storm that ravaged the housing market in the not-so-distant past. Government interventions, lender adaptability, and shifting societal dynamics all contribute to a real estate market that, at present, seems to be navigating relatively calm waters. As we continue to monitor the ebb and flow of the market, the specter of a foreclosure tsunami remains, for the time being, a distant echo rather than an imminent threat.

Navigating the Future: Sustaining Stability Amid Uncertainties

Ongoing Vigilance: The Importance of Continuous Monitoring

While the current landscape appears reassuring, the real estate market is inherently dynamic. Vigilance remains paramount, and stakeholders must stay attuned to evolving economic indicators and market trends.

Economic Indicators: A Barometer of Stability

Monitoring economic indicators such as employment rates, inflation, and interest rates provides crucial insights. These factors influence the financial health of households and, consequently, their ability to meet mortgage obligations. As the saying goes, an ounce of prevention is worth a pound of cure.

Market Trends: Adapting to Changing Tides

Real estate is not immune to trends, and staying ahead of the curve is essential. The ongoing shift towards sustainable and eco-friendly housing, coupled with advancements in technology influencing property valuation and transactions, shapes the market’s trajectory. Adapting to these trends enhances the market’s resilience, mitigating potential pitfalls.

The Role of Financial Literacy: Empowering Homeowners

Empowering homeowners with financial literacy is a cornerstone of preventing foreclosures. Educating individuals on budgeting, prudent financial management, and the implications of various mortgage options fosters a culture of informed decision-making. Informed homeowners are better equipped to weather financial storms and navigate challenges without succumbing to the threat of foreclosure.

Regulatory Landscape: Safeguarding Stability

The regulatory framework governing the real estate and financial sectors plays a pivotal role in maintaining stability. Regular evaluations and updates to regulations ensure that the industry evolves in tandem with the ever-changing economic landscape. Striking a balance between consumer protection and industry growth is paramount to preventing the recurrence of a foreclosure crisis.

Regional Variances: A Mosaic of Real Estate Realities

It’s crucial to acknowledge the regional nuances that contribute to the overall real estate narrative. While the macro-level data might point to a stable national market, localized factors can create pockets of vulnerability. Understanding the unique challenges faced by different regions allows for targeted interventions and ensures a comprehensive approach to preventing foreclosures.

The Role of Technology: Innovations Shaping Tomorrow’s Landscape

In the age of digitization, technology serves as a catalyst for positive change. Innovations such as blockchain in property transactions, AI-driven risk assessments, and smart home technologies contribute to a more efficient and secure real estate ecosystem. Embracing these advancements fosters a resilient market that can withstand external shocks.

Final Thoughts: A Proactive Approach to a Stable Future

As we navigate the currents of the real estate landscape, it’s imperative to maintain a proactive stance. The absence of a visible flood of foreclosures should not breed complacency but rather inspire a collective commitment to sustaining stability. By fostering financial literacy, adapting to market trends, and embracing technological advancements, we can collectively fortify the foundations of the real estate market.

The echoes of the 2008 foreclosure crisis serve as a constant reminder of the repercussions of unchecked practices. However, the lessons learned from that tumultuous period have catalyzed positive changes, creating a real estate environment better equipped to weather uncertainties.

As we peer into the future, the key lies in a collaborative effort from government bodies, financial institutions, industry stakeholders, and individual homeowners. By working together to address challenges, monitor economic indicators, and adapt to emerging trends, we can collectively ensure that the specter of a foreclosure tsunami remains a distant and unlikely scenario. In the realm of real estate, the horizon appears promising, guided by the lessons of the past and a commitment to a stable and resilient future.

Embracing Resilience: Sustaining a Robust Real Estate Ecosystem

Crisis Preparedness: Building Financial Safeguards

In the pursuit of long-term stability, it’s essential to consider the importance of crisis preparedness. Establishing financial safeguards and contingency plans can serve as a bulwark against unforeseen economic downturns. Homeownership education programs that emphasize financial planning for unexpected circumstances empower individuals to weather financial storms with resilience.

Emergency Funds: A Shield Against Uncertainty

Encouraging homeowners to establish emergency funds provides a safety net in times of crisis. These funds can cover mortgage payments during job loss or unexpected medical expenses, reducing the risk of falling into the foreclosure trap. Financial institutions can play a proactive role in promoting the creation of such funds as part of responsible lending practices.

Sustainable Homeownership: Beyond the Immediate Horizon

Sustainable homeownership extends beyond the immediate challenges of the present moment. It involves fostering a mindset that views homeownership as a long-term commitment, requiring ongoing financial responsibility. Lenders, in collaboration with housing counseling agencies, can guide individuals on the path of sustainable homeownership, ensuring that they are well-equipped to navigate the complexities of property ownership.

Loan Modification Programs: Adapting to Changing Circumstances

In times of economic turbulence, loan modification programs become instrumental in preventing foreclosures. These programs allow for adjustments to mortgage terms, providing relief to homeowners facing financial hardships. Implementing and promoting such programs demonstrates a commitment to supporting homeowners through challenging times.

Community Collaboration: Strength in Unity

The strength of a real estate ecosystem lies in the unity of its community. Local governments, nonprofits, and community organizations play a pivotal role in creating a supportive environment. Initiatives that foster community collaboration, such as neighborhood revitalization projects and shared resources, contribute to a collective resilience that transcends individual vulnerabilities.

Community-Led Support Networks: A Pillar of Stability

Establishing community-led support networks enhances the fabric of neighborhoods. These networks can provide assistance to those facing financial challenges, whether through job placement services, financial counseling, or community-sponsored events. By fostering a sense of collective responsibility, communities can effectively mitigate the risk of localized foreclosure clusters.

Future-Proofing Real Estate: A Holistic Approach

As we contemplate the trajectory of the real estate market, a holistic approach to future-proofing becomes imperative. It requires a multifaceted strategy that encompasses financial literacy, regulatory diligence, technological innovation, and community empowerment. By addressing vulnerabilities at every level, we can create a real estate landscape that not only withstands external shocks but also thrives in the face of uncertainty.

Research and Development: A Catalyst for Innovation

Investing in research and development within the real estate sector sparks innovation. Whether it’s exploring alternative financing models, leveraging sustainable construction practices, or embracing cutting-edge technologies, a commitment to R&D positions the industry at the forefront of positive change. Embracing innovation is key to adapting to evolving economic landscapes.

A Resilient Future: Charting the Course

In conclusion, the narrative surrounding foreclosure risks should not be one of impending doom but rather an exploration of proactive measures to sustain a robust real estate ecosystem. The lessons from history, combined with a forward-thinking mindset, position the industry to navigate challenges with resilience.

As we continue on this journey, the commitment to responsible lending, financial literacy, crisis preparedness, and community collaboration will be the compass guiding the real estate market. The absence of a visible flood of foreclosures serves as a testament to the collective efforts to build a more stable and secure future.

In the tapestry of real estate, each stakeholder plays a crucial role. From policymakers shaping regulations to lenders extending a helping hand, and from communities fostering support networks to individuals embracing financial responsibility—every thread contributes to a resilient fabric that withstands the test of time. The road ahead may have twists and turns, but with a collaborative spirit and a commitment to sustainable practices, the real estate market can confidently navigate towards a future marked by stability and prosperity.

Bottom Line:

In the ever-evolving realm of real estate, the specter of a foreclosure crisis reminiscent of 2008 seems, at present, to be a distant concern. The absence of a visible flood of foreclosures is not a signal for complacency but rather an opportunity to fortify the foundations of a more resilient market.

By embracing financial literacy, crisis preparedness, sustainable homeownership practices, and community collaboration, stakeholders can collectively steer the real estate ecosystem towards a future marked by stability. As we chart this course, a commitment to responsible lending, technological innovation, and ongoing vigilance against economic uncertainties will be the compass guiding the industry.

In the grand tapestry of real estate, each thread—whether it be the actions of policymakers, lenders, communities, or individuals—contributes to the overall resilience of the market. The road ahead may hold challenges, but with a collaborative spirit and a dedication to sustainable practices, the real estate landscape can navigate towards a future where stability and prosperity define the bottom line.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today