Why Moving to a More Affordable Area Makes Sense

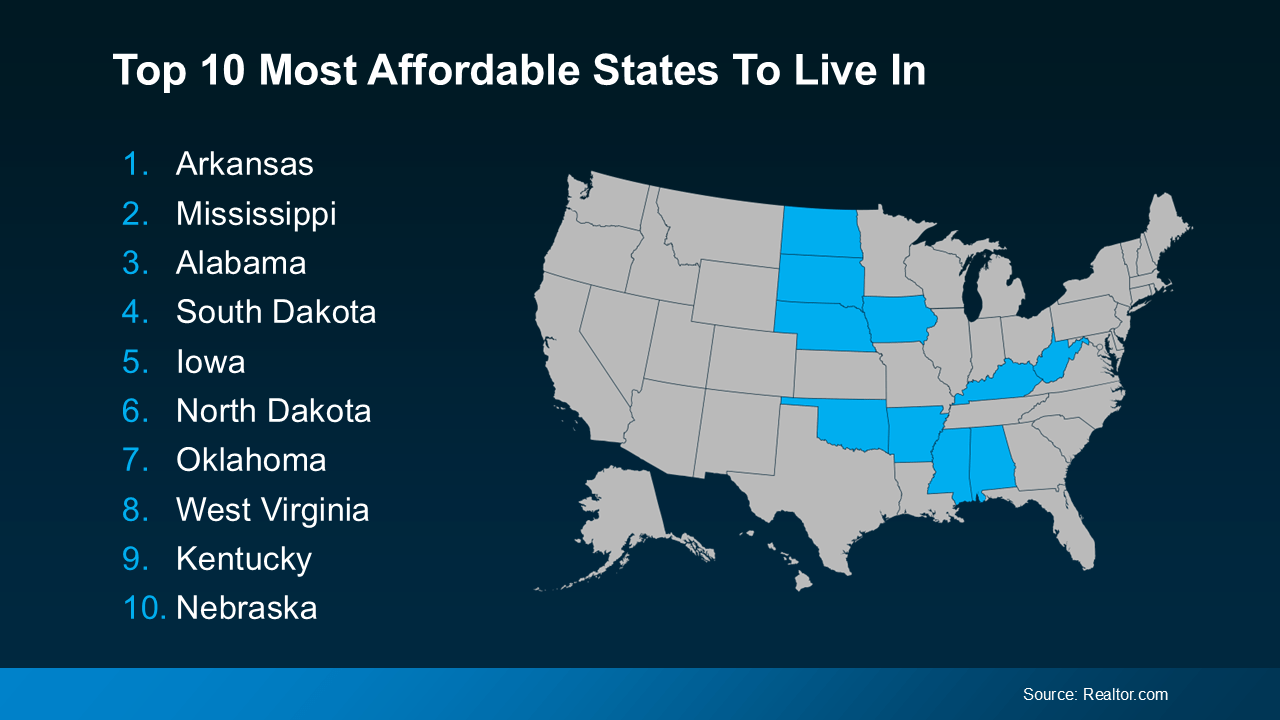

Moving to a more affordable area could be the fresh start you need to get ahead financially. While some markets are certainly more affordable than others, know that working with a trusted real estate agent to find what fits your budget and your desired location – no matter where you want to be – is always the best plan. And with the rising cost of living, many people are rethinking where they live and looking for ways to cut expenses. If that sounds like you, here’s a greatplace to start (see visual below):

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you’re open to relocating, you might discover the savings you’re looking for.

These states are well known for lower housing costs, reduced insurance premiums, and more budget-friendly daily living expenses – but they’re not the only places to find a hidden gem. If you’re open to relocating, you might discover the savings you’re looking for.

Why Move to a Lower-Cost Area?

Life is getting more expensive by the day. From rising home prices to higher grocery bills, it feels like everything costs more than it used to. Housing, the largest expense for most people, has become especially costly.

In fact, according to data from Case-Shiller, home prices increased 3.9% from September 2023 to September 2024. And data from GOBankingRates shows insurance costs are up too, with home insurance premiums averaging $2,151 annually – a significant jump compared to recent years.

These rising costs can feel like a lot to handle. That’s why more people are considering lower-cost areas. An article from the National Association of Realtors (NAR) says:

“With the past decade of rising home prices, buyers are looking for more affordable areas . . . As housing affordability continues to shape migration patterns, these areas may provide an opportunity . . . for those looking for more cost-effective alternatives to the nation’s larger, pricier metropolitan areas.”

Lower-cost areas typically offer more affordable housing, less expensive home insurance, and reduced costs for daily living like groceries and gas. Transportation expenses and car insurance premiums also tend to be lower. For anyone feeling stretched thin, moving to a less expensive area can provide meaningful financial relief.

Planning Your Big Move

Whether it’s finding a home that fits your budget or cutting down on other expenses, making the right move in any market can bring significant financial relief. Of course, moving isn’t a decision to take lightly.

Whether you’re moving just a few towns over or to a completely different state, there’s a lot to consider. From job opportunities, to schools, to local amenities – it all has an impact on finding the right home for you.

This is where a knowledgeable local real estate agent can be your best resource. Not only can they help you navigate the housing market in your new or desired area, but they’ll also guide you to neighborhoods that balance affordability with your needs.

And don’t worry if none of the states on the affordability list seem like the right fit for you. An agent can still help you identify budget-friendly options wherever you need to be.

If the rising cost of living has you feeling stuck, know that you have options. Moving to a more affordable area could be the fresh start you need to get ahead financially and improve your quality of life.

But don’t try to tackle the process alone. With the help of a real estate agent who knows the area, you’ll be well-prepared to make a move. When you’re ready to take the first step, let’s connect.

Why Moving to a More Affordable Area Makes Sense

Life’s journey often calls for pivotal decisions, and where you choose to live is one of the most significant. In today’s economic climate, with the rising cost of living pressing on households across the nation, many are looking for solutions that balance their financial well-being and quality of life. One of the most impactful steps you can take is relocating to a more affordable area. Let’s explore why this move can be a game-changer and how it opens doors to fresh opportunities.

The Financial Appeal of Lower Housing Costs

For many, housing costs are the single largest expense. The combination of escalating home prices and home insurance premiums makes staying in expensive cities an unsustainable choice. According to recent data, housing expenses in major metropolitan areas have skyrocketed, leaving families stretched thin.

In contrast, moving to a more affordable area offers immediate financial relief. Lower housing costs translate to reduced monthly mortgage payments, allowing you to allocate money toward other goals, such as savings, education, or travel. If you’re considering purchasing a home in a city like West Palm Beach, working with a West Palm Beach mortgage broker can help you access affordable West Palm Beach home loans tailored to your needs.

Moreover, relocating to an area with more affordable housing doesn’t just mean cheaper mortgages. Other related expenses, like property taxes and utility bills, often decrease as well. Whether you’re a first-time buyer or an experienced homeowner, the financial benefits of living in a cost-effective community are undeniable.

Additionally, cities with lower housing costs often provide opportunities to build equity faster. By investing in areas with upward growth potential, homeowners can enjoy increased property values over time while maintaining affordable monthly payments.

Daily Living Expenses and Quality of Life

Moving isn’t just about cutting down on your mortgage; it’s also about trimming daily living expenses. Groceries, gas, healthcare, and entertainment costs can vary widely depending on where you live. In a more affordable area, these everyday expenses typically see a significant reduction, which means more disposable income for you and your family.

Lower expenses don’t have to mean sacrificing your quality of life. Many regions offer incredible local amenities that cater to families, professionals, and retirees alike. From parks and recreation centers to cultural festivals and farm-to-table dining experiences, you’ll find that some of the best places to live also happen to be budget-friendly.

For example, suburban towns or smaller cities often provide a sense of community that larger metropolitan areas might lack. Access to high-quality schools, well-maintained public spaces, and reduced traffic congestion are just some of the benefits that contribute to an enhanced lifestyle.

Unlocking Housing Affordability With Expert Guidance

Finding the right home for you in a more affordable area requires careful planning and the expertise of a trusted real estate agent. These professionals know how to navigate local markets and ensure you’re getting the best deal possible. Whether you’re looking for first-time home buyer loans in West Palm Beach or simply want guidance on mortgage preapproval in West Palm Beach, the right professional can make a world of difference.

By working with a trusted real estate agent, you’ll gain insights into neighborhoods that balance affordability with convenience. They’ll help you prioritize what matters most to you—whether that’s proximity to job opportunities, access to quality schools, or vibrant social hubs.

In addition, real estate agents often have access to exclusive listings and can negotiate on your behalf, ensuring that you get the best value for your investment.

The Practicality of Relocating to a More Affordable Area

One of the primary drivers for relocation is economic sustainability. As the cost of living surges, many households are finding it increasingly difficult to keep up with their financial obligations. From inflated housing costs to climbing home insurance premiums, the financial burden can be overwhelming.

Relocating to a more affordable area not only alleviates these pressures but also provides an opportunity to reassess your financial priorities. The potential savings extend beyond the obvious. For example:

- Transportation costs: Living in a smaller city or suburban area often means shorter commutes and lower fuel expenses.

- Healthcare costs: Certain regions have access to high-quality medical care at significantly lower rates.

- Childcare and education expenses: Some areas boast excellent public schools, reducing the need for costly private education.

For those considering West Palm Beach as a destination, engaging with local mortgage lenders in West Palm Beach can provide tailored advice on finding affordable homes in the area. The availability of West Palm Beach refinancing options also means you can rework your current mortgage for better terms.

Beyond financial benefits, relocating often brings new opportunities for personal growth. A fresh start in a new community can help you build a stronger support network, explore new hobbies, and pursue career advancements.

Beyond Finances: The Lifestyle Benefits

Lower costs aren’t the only reason to consider a move. Often, more affordable housing comes with lifestyle perks that enhance your overall well-being. Smaller communities or suburban areas typically offer:

- Safer neighborhoods with tight-knit communities.

- Access to outdoor activities, such as hiking trails, lakes, and community gardens.

- Slower-paced living, which promotes mental health and work-life balance.

Additionally, the presence of diverse local amenities, such as farmers’ markets, art galleries, and boutique shops, can enrich your daily life without breaking the bank. When paired with the expertise of a commercial mortgage broker in West Palm Beach, even entrepreneurs can find affordable spaces to start businesses in these growing areas.

Smaller towns often have unique cultural identities and traditions, creating a sense of belonging that’s hard to replicate in larger cities. These intangible qualities can make a big difference in your overall happiness.

Planning Your Move: How to Get Started

Making the leap to a more affordable area isn’t a decision to take lightly. Here are some steps to ensure a smooth transition:

- Assess Your Financial Goals: Understand what you hope to achieve by moving. Are you looking to save on daily living expenses, reduce debt, or invest in a larger home?

- Research Potential Areas: Look into regions known for lower housing costs and weigh the pros and cons of each. Consider factors like climate, job opportunities, and lifestyle.

- Engage a Trusted Professional: Partner with a West Palm Beach mortgage broker or trusted real estate agent to gain expert guidance on housing options and financing.

- Use Mortgage Tools: Leverage resources like West Palm Beach mortgage calculators to determine what you can afford before making an offer.

- Plan Logistically: Consider moving costs, job transitions, and school changes to minimize disruptions.

By taking these steps, you’ll position yourself for a successful and fulfilling relocation.

Why West Palm Beach Could Be Your Next Home

If you’re exploring specific areas, West Palm Beach deserves serious consideration. Known for its vibrant culture, sunny weather, and relatively affordable housing, it’s an attractive destination for families, young professionals, and retirees. Here’s why:

- Best mortgage rates in West Palm Beach: Competitive rates make it easier to finance your dream home.

- Affordable West Palm Beach home loans: Tailored options ensure affordability for buyers at every stage.

- First-time home buyer loans in West Palm Beach: Programs specifically designed to help newcomers enter the market.

- West Palm Beach refinancing options: Opportunities to renegotiate existing loans for better terms.

- Property loan advice in West Palm Beach: Expert insights into navigating the local market.

With the support of local mortgage lenders in West Palm Beach and access to a wealth of housing resources, finding the right home for you in this area is more attainable than ever.

West Palm Beach also offers a unique blend of coastal living and urban amenities. Its growing job market, excellent schools, and family-friendly neighborhoods make it a versatile choice for people at all life stages.

Final Thoughts

Relocating to a more affordable area isn’t just about cutting costs—it’s about embracing a lifestyle that aligns with your values and financial goals. From reduced daily living expenses to enhanced quality of life, the benefits are far-reaching.

Whether you’re drawn to the appeal of lower housing costs, the promise of greater financial freedom, or the charm of new surroundings, taking the leap to a more affordable area could be the fresh start you’ve been searching for. With the help of a trusted real estate agent and guidance from a West Palm Beach mortgage broker, the path to your dream home is closer than you think.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice