Expert Forecasts for the 2025 Housing Market

Wondering what’s in store for the housing market this year? And more specifically, what it all means for you if you plan to buy or sell a home? The best way to get that information is to lean on the pros.

Experts are constantly updating and revising their forecasts, so here’s the latest on two of the biggest factors expected to shape the year ahead: mortgage rates and home prices.

Will Mortgage Rates Come Down?

Everyone’s keeping an eye on mortgage rates and waiting for them to come down. So, the question is really: how far and how fast? The good news is they’re projected to ease a bit in 2025. But that doesn’t mean you should expect to see a return of 3-4% mortgage rates. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

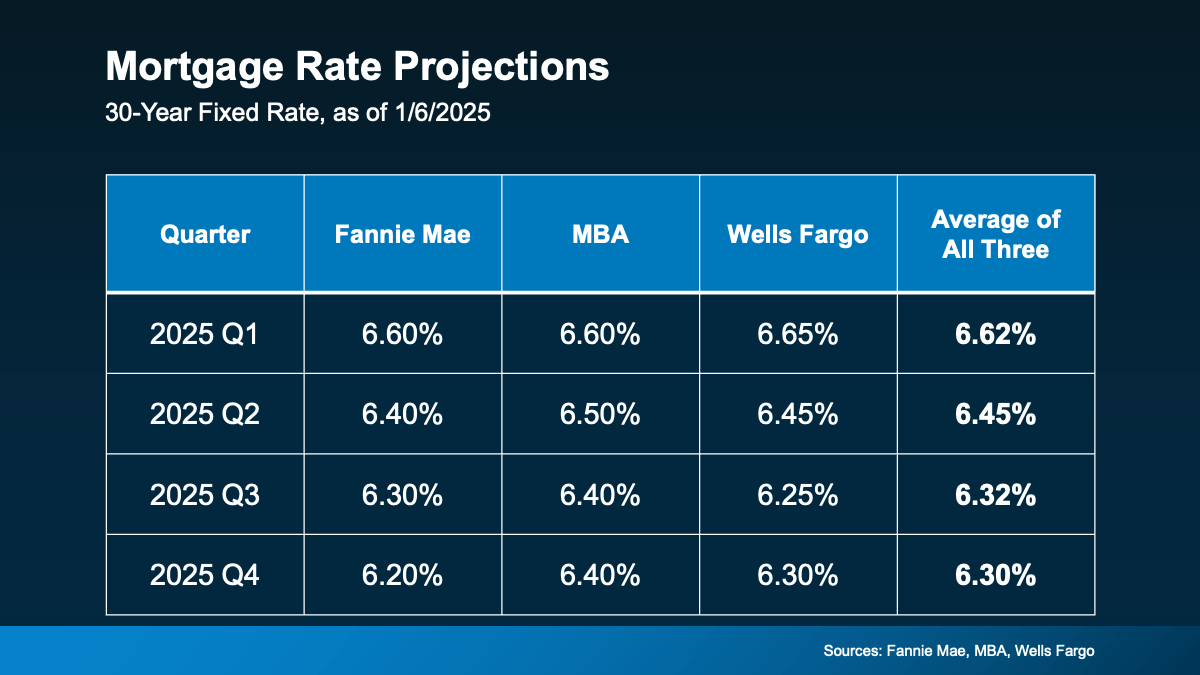

And the other experts agree. They’re forecasting rates could settle in the mid-to-low 6% range by the end of the year (see chart below):

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

But you should remember, this will continue to change as new information becomes available. Expert forecasts are based on what they know right now. And since everything from inflation to economic drivers have an impact on where rates go from here, some ups and downs are still very likely. So, don’t get caught up in the exact numbers here and try to time the market. Instead, focus on the overall trend and on what you can actually control.

A trusted lender and an agent partner will make sure you’ve always got the latest data and the context on what it really means for you and your bottom line. With their help, you’ll see even a small decline can help bring down your future mortgage payment.

Will Home Prices Fall?

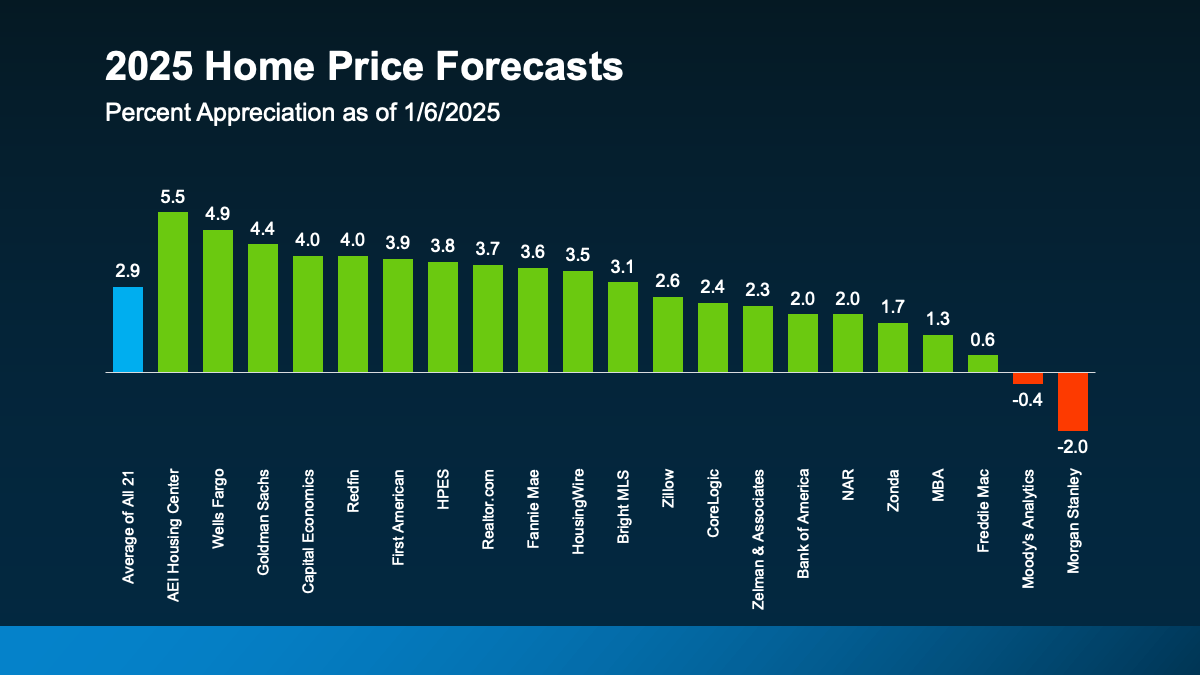

The short answer? Not likely. While mortgage rates are expected to ease, home prices are projected to keep climbing in most areas – just at a slower, more normal pace. If you average the expert forecasts together, you’ll see prices are expected to go up roughly 3% next year, with most of them hitting somewhere in the 3 to 4% range. And that’s a much more typical and sustainable rise in prices (see graph below):

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

So don’t expect a sudden drop that’ll score you a big deal if you’re thinking of buying this year. While that may sound disappointing if you’re hoping prices will come down, refocus on this. It means you won’t have to deal with the steep increases we saw in recent years, and you’ll also likely see any home you do buy go up in value after you get the keys in hand. And that’s actually a good thing.

And if you’re wondering how it’s even possible prices are still rising, here’s your answer. It all comes down to supply and demand. Even though there are more homes for sale now than there were a year ago, it’s still not enough to keep up with all the buyers out there. As Redfin explains:

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

Keep in mind, though, the housing market is hyper-local. So, this will vary by area. Some markets will see even higher prices. And some may see prices level off or even dip a little if inventory is up in that area. In most places though, prices will continue to rise (as they usually do).

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends and what they mean for your plans.

The housing market is always shifting, and 2025 will be no different. With rates likely to ease a bit and prices rising at a more normal and sustainable pace, it’s all about staying informed and making a plan that works for you.

Let’s connect so you can get the scoop on what’s happening in our area and advice on how to make your next move a smart one.

Expert Forecasts for the 2025 Housing Market

The housing market is poised for a dynamic year in 2025, driven by evolving economic drivers, shifting trends, and the collective insights of experts in real estate. Whether you’re planning to buy or sell a home, understanding the forecasts for mortgage rates, home prices, and regional nuances is critical. As the National Association of Realtors (NAR) and other industry leaders weigh in, here’s what lies ahead.

Mortgage Rates: Will They Finally Stabilize?

One of the most debated topics in the housing market is the trajectory of mortgage rates. After the volatile years that followed the pandemic, many are eager for stability. Lawrence Yun, Chief Economist at the National Association of Realtors, anticipates that mortgage rates will edge lower in 2025 but won’t revert to the historically low levels of 3-4%. Instead, experts suggest rates may hover in the mid-to-low 6% range.

As inflation continues to moderate and global economic pressures ease, this modest decline in rates could provide much-needed relief to buyers. For those in areas like West Palm Beach, trusted lender partnerships are pivotal. West Palm Beach mortgage brokers are already tailoring solutions to help clients secure affordable West Palm Beach home loans and lock in the best mortgage rates in West Palm Beach.

If you’re considering purchasing property, early mortgage preapproval in West Palm Beach can help you stay ahead of the competition. First-time home buyer loans in West Palm Beach and property loan advice in West Palm Beach are tailored to meet diverse needs, ensuring a seamless buying experience.

Additionally, refinancing remains a viable option for existing homeowners. Exploring West Palm Beach refinancing options with a trusted lender can help reduce monthly payments or leverage equity for other financial goals. Local mortgage lenders in West Palm Beach often provide personalized advice and competitive terms, ensuring that your financial strategy aligns with your unique situation.

Home Prices: A Sustainable Rise

Unlike the dramatic surges of previous years, home prices in 2025 are expected to grow at a more measured pace. On average, forecasts indicate a sustainable rise of about 3-4%. While this might seem modest, it marks a return to a healthier, more balanced market.

The core driver behind this growth remains supply and demand. Although there are more homes for sale now than a year ago, inventory levels still fall short of meeting buyer demand. Redfin aptly summarizes: “Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

For buyers and sellers, these projections highlight the importance of localized strategies. The hyper-local market in areas like West Palm Beach, for instance, often sees unique trends. By partnering with a trusted lender and a knowledgeable agent partner, individuals can navigate these nuances effectively.

For buyers, this measured increase means less pressure to overbid, creating an environment where thoughtful offers stand a better chance. Meanwhile, sellers can still anticipate appreciation, albeit at a steadier pace. Those considering upgrades or renovations before listing should focus on high-ROI improvements to enhance property value in competitive neighborhoods.

Regional Insights: The Hyper-Local Approach

Real estate is never a one-size-fits-all affair. The housing market in cities like West Palm Beach differs significantly from national averages. Local factors, such as employment growth, population trends, and new developments, play a pivotal role in shaping outcomes.

In 2025, West Palm Beach continues to be a sought-after destination for homeowners and investors. With local mortgage lenders in West Palm Beach offering competitive packages, opportunities abound. Whether you’re eyeing commercial mortgage broker in West Palm Beach services or exploring West Palm Beach refinancing options, the area’s vibrant real estate scene caters to diverse aspirations.

For those unfamiliar with the intricacies of the market, tools like West Palm Beach mortgage calculators can be invaluable. These resources simplify complex decisions, helping individuals estimate your future mortgage payment and assess affordability.

West Palm Beach’s unique appeal lies in its balance of luxury and accessibility. From waterfront properties to affordable suburban neighborhoods, there’s something for every buyer profile. This diversity underscores the importance of understanding the hyper-local market and engaging with a knowledgeable agent partner who can provide tailored insights.

Why Supply and Demand Still Rule the Market

At its core, the housing market operates on the principle of supply and demand. In 2025, this dynamic remains as relevant as ever. While builders ramp up construction to address shortages, the pace is often insufficient to match demand.

In many regions, including West Palm Beach, the availability of more homes for sale now has been a welcome development. However, low inventory levels persist, creating upward pressure on home prices. Sellers benefit from this environment, but buyers may need to act swiftly and strategically.

Leaning on an experienced agent partner ensures you’re equipped to navigate bidding wars and competitive listings. These professionals—alongside trusted lenders offering affordable West Palm Beach home loans—can make all the difference in achieving your real estate goals.

For developers and investors, the imbalance also signals opportunities for targeted construction projects. Identifying underserved segments—such as affordable housing—could yield significant returns while addressing community needs.

The Role of Inflation and Economic Drivers

The interplay of inflation and broader economic drivers continues to influence the housing market. Although inflation has cooled from its pandemic-era highs, it still affects borrowing costs, construction materials, and consumer confidence.

Experts agree that keeping a close eye on these factors is essential. For instance, shifts in employment rates or unexpected economic shocks could disrupt even the most well-laid plans. This underscores the importance of working with a trusted lender and leveraging tools like West Palm Beach mortgage calculators to adapt to changing conditions.

The West Palm Beach market, in particular, benefits from a robust local economy. Industries such as tourism, technology, and healthcare drive steady demand for housing. These economic drivers ensure that the region remains resilient even amidst national fluctuations.

Opportunities for Buyers and Sellers in 2025

For Buyers:

- First-time home buyer loans in West Palm Beach offer tailored solutions to make homeownership accessible.

- Early engagement with a West Palm Beach mortgage broker ensures you’re preapproved and ready to act when opportunities arise.

- Tools like property loan advice in West Palm Beach and mortgage preapproval in West Palm Beach streamline the buying process, enhancing confidence and clarity.

- Use West Palm Beach mortgage calculators to model different financial scenarios and understand your future mortgage payment.

For Sellers:

- Leverage the supply and demand imbalance to command competitive offers.

- Work with an agent partner who understands hyper-local market dynamics and can highlight your property’s unique appeal.

- Stay informed about trends to time your sale for maximum returns.

- Consider minor renovations or staging to attract higher offers and faster sales.

Bottom Line: Stay Informed, Stay Empowered

The housing market in 2025 promises a blend of opportunities and challenges. With mortgage rates stabilizing, home prices rising at a measured pace, and regional nuances shaping outcomes, preparation is key.

By leaning on a trusted lender, partnering with a seasoned agent partner, and utilizing resources like West Palm Beach mortgage calculators, you can navigate the complexities of the market with confidence. Whether you’re exploring affordable West Palm Beach home loans, planning to buy or sell a home, or seeking West Palm Beach refinancing options, the right support makes all the difference.

Remember, 2025 is not just about reacting to market conditions but also about positioning yourself proactively. With the guidance of experts, a strategic approach to the real estate landscape, and the tools at your disposal, this year can be your most successful one yet.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice