How Do Presidential Elections Impact the Housing Market?

Some Highlights

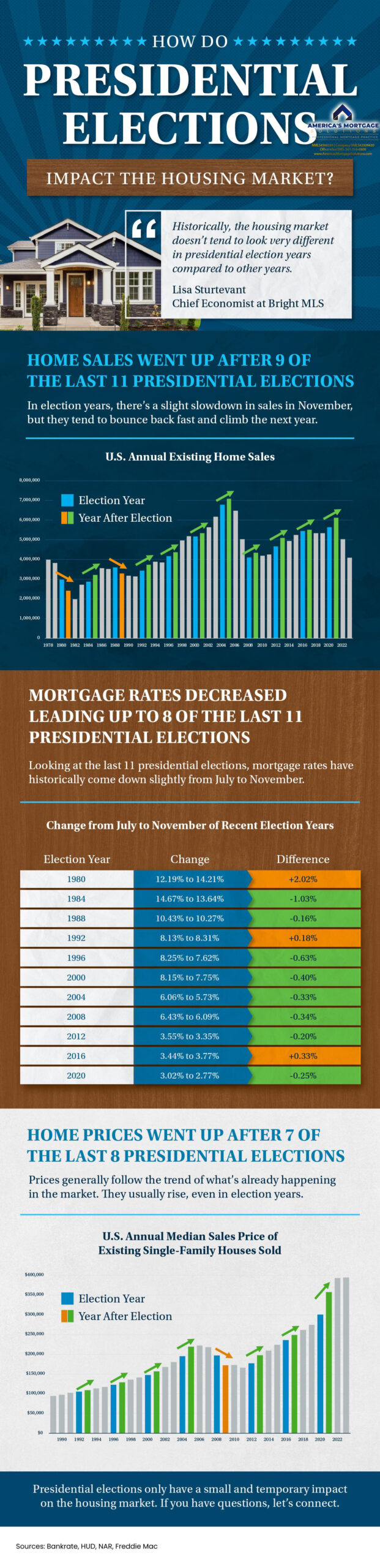

- Are you wondering if the upcoming election will have an impact on the housing market? Here’s what history tells us you need to know if you’re considering a move.

- Data shows home sales slow in November but quickly bounce back and rise the following year. Prices usually keep climbing. And mortgage rates typically come down slightly.

- Presidential elections have only a small and temporary impact on the housing market. If you have questions, let’s connect.

How Do Presidential Elections Impact the Housing Market?

The quadrennial spectacle of a presidential election grips the nation, igniting fervent debates and sparking an undercurrent of anticipation. While the outcome hinges on policies, promises, and personalities, its reverberations extend far beyond the political arena, subtly influencing the intricate tapestry of the economy. One such domain, profoundly affected by the electoral cycle, is the Housing Market.

The Election Year Enigma

The prospect of a new administration inevitably breeds uncertainty, a sentiment that can percolate through various sectors. For those contemplating the monumental step of Buying A Home, an election year can introduce an element of hesitation. Will policies tilt in favor of homeownership? Will Mortgage Rates ascend or descend? These are questions that loom large in the minds of potential homeowners.

Historically, the months preceding a presidential election often witness a slight lull in Existing Home Sales. Buyers and sellers alike may adopt a wait-and-see approach, their decisions tempered by the desire to understand the potential implications of a new administration. This cautious stance can temporarily depress market activity, causing fluctuations in Median Home Price and Median Sales Price.

Economic Policies: The Bedrock of the Housing Market

Presidential candidates frequently tout their economic platforms, and these blueprints can significantly impact the housing landscape. Tax policies, in particular, hold immense sway. Deductions for mortgage interest and property taxes can render Buying A Home more financially attractive. Conversely, alterations to these deductions might influence homeownership decisions.

Infrastructure initiatives, another cornerstone of economic platforms, can indirectly impact the housing market. Investments in transportation, utilities, and public amenities can enhance a region’s desirability, potentially driving up property values. Conversely, neglect of infrastructure can deter buyers and depress prices.

Mortgage Rates: A Delicate Balance

While the Federal Reserve, an independent entity, primarily determines Mortgage Rates, presidential administrations can indirectly influence them through economic policies. For instance, policies that stimulate economic growth may lead to higher interest rates as the Federal Reserve attempts to curb inflation. Conversely, policies aimed at economic stabilization might result in lower interest rates to stimulate borrowing and spending.

For those seeking to Refinancing their homes or exploring First time home buyer loans, fluctuations in mortgage rates can be pivotal. A decline in rates can translate into substantial savings over the life of a loan, making homeownership more attainable. Conversely, rising rates can increase monthly payments, potentially deterring some buyers.

The Local Impact: West Palm Beach Mortgage Market

While national trends undeniably influence the Housing Market, regional factors also play a crucial role. In a vibrant city like West Palm Beach, a diverse economy, coupled with a desirable lifestyle, can insulate the local market from some of the broader economic headwinds.

For those seeking Affordable West Palm Beach Home Loans or exploring West Palm Beach refinancing options, a reputable West Palm Beach mortgage broker can provide invaluable guidance. By understanding the intricacies of the local market and offering a range of products, these professionals can help borrowers navigate the complexities of the mortgage landscape.

West Palm Beach mortgage calculators can also be instrumental in making informed decisions. By inputting various loan scenarios, potential homeowners can estimate monthly payments, determine affordability, and explore different mortgage options.

Beyond the Ballot Box

While presidential elections undeniably cast a long shadow over the Housing Market, it’s essential to remember that numerous other factors influence market dynamics. Demographic trends, job growth, inventory levels, and consumer confidence all play pivotal roles.

Ultimately, the Housing Market is a complex ecosystem, shaped by a confluence of forces. While presidential elections offer a dramatic backdrop, the underlying fundamentals of supply, demand, and economic conditions remain the primary drivers of market behavior.

Navigating the Election Year Housing Market

By carefully considering these factors and seeking guidance from seasoned professionals like a West Palm Beach mortgage broker, potential homeowners can make informed decisions. While the allure of political prognostication is undeniable, it’s imperative to remember that the Housing Market is a complex organism, influenced by a myriad of interconnected variables.

Beyond the Headlines: A Deeper Dive

Beneath the surface-level fluctuations induced by election cycles, the fundamental principles of supply and demand continue to shape the housing landscape. A scarcity of existing single-family houses can drive up home prices, irrespective of political rhetoric. Conversely, an oversupply can exert downward pressure on values.

Demographic shifts also play a pivotal role. The preferences and priorities of millennials, a generation often characterized by a penchant for urban living and rental properties, can influence housing trends. As this cohort matures and forms households, the demand for Buying A Home may intensify, potentially impacting home sales and prices.

Local Economic Dynamics: A Powerful Influence

While national economic indicators undoubtedly impact the Housing Market, local economic conditions can be equally influential. A thriving job market, coupled with robust wage growth, can fuel demand for housing. Conversely, economic downturns can lead to job losses and reduced purchasing power, dampening market activity.

In a city like West Palm Beach, a diverse economy, anchored by sectors such as finance, healthcare, and tourism, can provide a degree of resilience to economic fluctuations. A steady influx of retirees seeking a luxurious lifestyle also contributes to the region’s robust housing market.

The Role of Mortgage Lenders

The availability of credit is a critical component of the home buying process. Local mortgage lenders play a pivotal role in facilitating homeownership by offering a variety of loan products tailored to different borrower profiles. From First time home buyer loans to Commercial mortgage broker services, these lenders provide the financial underpinnings of the housing market.

By offering competitive mortgage rates and flexible terms, lenders can stimulate home buying activity. Conversely, restrictive lending standards can impede market growth. It’s essential for potential homeowners to shop around and compare offers from multiple lenders to secure the most favorable terms.

Conclusion: A Long-Term Perspective

While the allure of short-term predictions is tempting, a long-term perspective is often more prudent when investing in real estate. While presidential elections can introduce volatility into the market, fundamental economic principles and demographic trends ultimately shape housing prices and sales.

By understanding the interplay of these factors and seeking guidance from knowledgeable professionals, individuals can make informed decisions about Buying A Home. Whether you’re a first-time buyer or a seasoned investor, a well-crafted strategy, coupled with a realistic outlook, can increase your chances of success in the dynamic world of real estate.

Remember, homeownership is a significant financial commitment, and it’s essential to conduct thorough research and seek professional advice before making any decisions.

The Human Element in Real Estate

While economic indicators and market trends undoubtedly shape the housing landscape, it’s the human element that truly breathes life into the real estate world. The emotional connection to a home, the dream of ownership, and the aspiration for a better life are the driving forces behind countless housing decisions.

Presidential elections may influence policies and economic conditions, but it’s the individual stories of homebuyers and sellers that truly resonate. The joy of a first-time homebuyer unlocking their front door for the first time, the satisfaction of retirees downsizing to a more manageable abode, and the entrepreneurial spirit of investors seeking profitable opportunities all contribute to the vibrant tapestry of the housing market.

Navigating the Path to Homeownership

For many, Buying A Home is a lifelong aspiration. It represents stability, security, and the foundation of a family. However, the journey to homeownership can be fraught with challenges. Rising home prices, stringent lending requirements, and the complexities of the mortgage process can create hurdles.

This is where the expertise of a West Palm Beach mortgage broker becomes invaluable. By offering personalized guidance, tailored loan options, and unwavering support, these professionals can help aspiring homeowners navigate the complexities of the mortgage landscape.

The Impact of Technology

Technology has revolutionized the real estate industry, transforming the way homes are bought and sold. Online listings, virtual tours, and digital contracts have streamlined the process, making it more convenient for both buyers and sellers.

However, the human touch remains essential. A knowledgeable real estate agent can provide invaluable insights into local market conditions, negotiate on behalf of clients, and offer expert advice throughout the transaction.

Conclusion: A Symbiotic Relationship

The relationship between the Housing Market and presidential elections is complex and multifaceted. While economic policies and market trends play a significant role, it’s the human element that ultimately drives the market.

By understanding the interplay of these factors and seeking guidance from experienced professionals, individuals can increase their chances of success in the real estate market. Whether you’re a buyer, seller, or investor, a long-term perspective, coupled with a deep understanding of the local market, is essential for navigating the ever-evolving housing landscape.

The Future of the Housing Market

While the past and present offer valuable insights into the dynamics of the Housing Market, it’s essential to consider the potential trajectory of the industry. Several emerging trends and challenges will shape the housing landscape in the years to come.

The Impact of Climate Change

Climate change is an undeniable force, and its effects are increasingly evident in the real estate sector. Rising sea levels, extreme weather events, and shifting climate patterns pose significant risks to property values and insurance costs. Coastal regions, including West Palm Beach, may experience heightened vulnerability.

As awareness of climate change grows, buyers and sellers will likely prioritize properties with resilience features, such as elevated construction, flood insurance, and energy-efficient systems. This shift in preferences could reshape the housing market, with properties located in high-risk areas potentially facing decreased value.

Technological Advancements

Technology continues to revolutionize the real estate industry, with innovations such as artificial intelligence, virtual and augmented reality, and blockchain making significant inroads. These advancements promise to enhance efficiency, transparency, and accessibility in the housing market.

For instance, AI-powered tools can analyze vast amounts of data to identify market trends, predict property values, and streamline the home buying process. Virtual and augmented reality can create immersive property tours, allowing buyers to explore homes remotely. Blockchain technology has the potential to revolutionize real estate transactions by providing secure and transparent record-keeping.

Affordability Challenges

The persistent challenge of housing affordability is a pressing issue in many regions. Rising home prices coupled with stagnant wages have made it increasingly difficult for first-time buyers to enter the market. This trend is exacerbated by limited inventory and competition from investors.

To address affordability concerns, policymakers and industry stakeholders must explore innovative solutions, such as increasing housing supply, expanding affordable housing options, and providing financial assistance to first-time buyers.

The Role of Remote Work

The rise of remote work has reshaped the housing landscape, as people are no longer tethered to traditional office locations. This trend has led to increased demand for housing in suburban and rural areas, as well as second homes.

As remote work becomes more prevalent, the traditional boundaries between urban, suburban, and rural living may blur, creating new opportunities and challenges for the housing market.

Conclusion: A Dynamic and Evolving Landscape

The Housing Market is a complex and dynamic ecosystem, influenced by a myriad of factors. While presidential elections can create short-term fluctuations, long-term trends such as climate change, technology, affordability, and remote work will shape the industry’s future.

By staying informed about these trends and seeking expert advice, individuals can make informed decisions about buying, selling, or investing in real estate. The Housing Market is likely to remain a cornerstone of the economy, offering opportunities and challenges for years to come.

A Spotlight on Local Markets: The Case of West Palm Beach

While the national and global housing market trends paint a broad picture, it’s essential to delve into specific regions to gain a more nuanced understanding. West Palm Beach, a thriving metropolis in South Florida, offers a compelling case study of a dynamic and resilient housing market.

West Palm Beach: A Prime Location

Renowned for its pristine beaches, world-class amenities, and a growing economy, West Palm Beach has experienced significant population growth and economic expansion in recent years. This influx of residents and businesses has fueled demand for housing, driving up property values and creating a competitive market.

Local Economic Drivers

The local economy in West Palm Beach is diversified, with a strong presence in finance, healthcare, and tourism. This economic stability has contributed to the housing market’s resilience, even during periods of national economic uncertainty. Additionally, the city’s proximity to major metropolitan areas like Miami and Fort Lauderdale has made it an attractive destination for both residents and businesses.

Challenges and Opportunities

Despite its overall strength, the West Palm Beach housing market faces challenges such as affordability and inventory shortages. Rising home prices have made it increasingly difficult for first-time buyers to enter the market, while limited housing supply has contributed to upward pressure on prices.

However, these challenges also present opportunities for investors and developers. The demand for affordable housing creates a niche for developers to build rental units and mixed-use projects. Additionally, the growing population and economic expansion can drive demand for commercial real estate, such as office space and retail centers.

Conclusion: A Bright Outlook

West Palm Beach’s housing market exhibits a promising outlook, driven by a robust economy, desirable lifestyle, and increasing demand. While challenges such as affordability and inventory shortages persist, the city’s fundamental strengths position it for continued growth and development.

By carefully analyzing local market trends, understanding the interplay of economic factors, and seeking expert advice, individuals can make informed decisions about buying, selling, or investing in West Palm Beach real estate.

Would you like to explore a specific aspect of the West Palm Beach housing market in more detail, such as luxury properties, condo market trends, or investment opportunities?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice