Why a Condo May Be a Great Option for Your First Home

Having a hard time finding a first home that’s right for you and your wallet? Well, here’s a tip – think about condominiums, or condos for short.

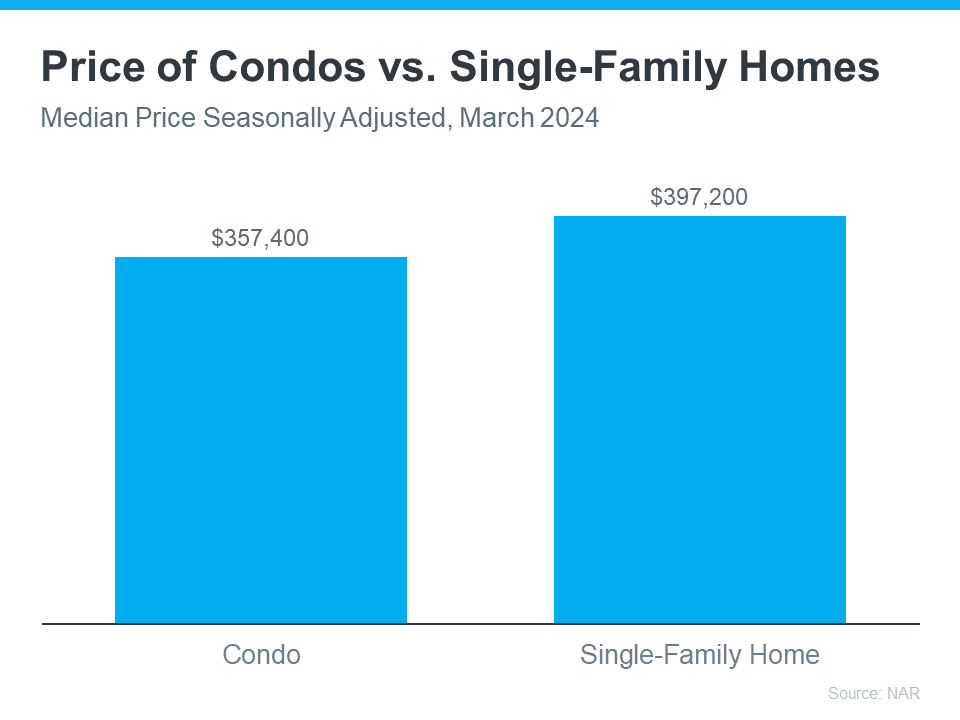

They’re usually smaller than single-family homes, but that’s exactly why they can be easier on your budget. According to the latest data from the National Association of Realtors (NAR), condos are typically less expensive than single-family homes (see graph below):

So, if you’re comfortable with a smaller space and want to buy your first home this year, adding condos to your search might be easier on your wallet.

Besides giving you more options for your home search and maybe fitting your budget better, living in a condo has a bunch of other perks, too. According to Rocket Mortgage:

“From community living to walkable urban areas, condos are great options for first-time home buyers and people looking to enjoy homeownership without extensive upkeep.”

Let’s dive into a few of the draws of condos for first-time buyers from Bankrate:

- They require less maintenance. Condos are great if you want to own your place but don’t want to mow the lawn, shovel snow, or fix the roof. Your real estate agent can help explain any associated fees and details for the condos you’re interested in.

- They allow you to start building equity. When you buy a condo, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

- They often come with added amenities. Your condo might come with access to amenities like a pool, dog park, or parking. And the best part? You don’t have to take care of any of them.

- They provide you with a sense of community. Buying a condo means you’ll be living close to other people, which is nice if you enjoy having neighbors around and making friends. Many condo communities hold fun events like barbecues and parties during holidays for everyone to enjoy.

Remember, your first home doesn’t have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you need something different.

Ultimately, owning and living in a condo is a lifestyle choice. And if it’s one that appeals to you, they could provide the added options you need in today’s market.

It might be a good idea to think about condos in your home search. If you’re ready to see what’s out there, let’s get in touch today.

Here’s More About: Why a Condo May Be a Great Option for Your First Home

Embarking on the journey to buy your first home is a monumental step, filled with anticipation, excitement, and a fair share of daunting decisions. Among the myriad options available, buying a condo presents a unique set of advantages that make it an attractive proposition for many first-time home buyers. Let’s delve into why a condo could be the perfect choice for your first home, and how it might just be the ideal blend of comfort, convenience, and financial savvy you’ve been looking for.

Understanding the Condo Advantage

When considering condos in your home search, it’s crucial to understand what sets them apart from traditional single-family homes. Condos offer a unique blend of community living and personal ownership, providing an excellent balance of privacy and social interaction. In many ways, a condo can serve as a stepping stone in the realm of homeownership, offering a taste of independence without the extensive responsibilities that come with a standalone house.

Affordability and Financial Benefits

Finding a first home that fits within your budget can be challenging, especially in competitive real estate markets. Condos typically come with a lower price tag compared to single-family homes in the same area, making them an affordable entry point into the housing market. Lower purchase prices translate to lower mortgage payments, which can be a significant relief for those just starting their journey toward homeownership.

In West Palm Beach, for example, leveraging the services of a West Palm Beach mortgage broker can help you navigate the financial aspects efficiently. They can assist in securing affordable West Palm Beach home loans and guide you to the best mortgage rates in West Palm Beach. For first-time home buyers, these brokers offer invaluable support, helping you find first time home buyer loans in West Palm Beach that suit your financial situation.

Maintenance and Lifestyle Perks

One of the standout benefits of buying a condo is the reduced maintenance burden. Unlike single-family homes, where you’re responsible for every aspect of upkeep, condos typically include exterior maintenance, landscaping, and common area care as part of the homeowners’ association (HOA) fees. This means you can spend more time enjoying your home and less time worrying about repairs and yard work.

Additionally, many condos come with attractive amenities such as swimming pools, fitness centers, and communal spaces, which would be costly to maintain in a single-family home. These perks can significantly enhance your lifestyle without breaking the bank.

Building Equity and Financial Security

Starting to gain home equity is a fundamental aspect of homeownership. When you purchase a condo, you begin to start building equity with each mortgage payment. Over time, this equity can become a valuable financial asset, providing a foundation for future real estate ventures or other investments.

Moreover, first-time home buyers often find that condos appreciate in value over time, especially in desirable locations. This appreciation can be a boon, enhancing your financial security and offering a solid return on your investment.

Community and Social Aspects

Condos foster a sense of community that is often lacking in single-family homes. Living in a condo complex means you’re part of a community where neighbors are in close proximity, and there’s a greater chance to form social connections. This community aspect can be particularly appealing for first-time home buyers who are new to an area and looking to establish a network of friends and acquaintances.

Location, Location, Location

Condos are often strategically located in urban centers or desirable neighborhoods, offering proximity to work, entertainment, and amenities. This can drastically reduce commute times and provide easy access to city life. For instance, if you’re considering West Palm Beach, condos can offer a slice of paradise close to vibrant downtown areas, beaches, and cultural hotspots.

Financial Tools and Resources

Navigating the financial landscape of buying a condo can be complex, but there are numerous tools and resources available to assist you. In West Palm Beach, for instance, utilizing West Palm Beach mortgage calculators can help you understand your financial commitment. These calculators provide a clear picture of what your monthly mortgage payments will look like, helping you budget effectively.

Engaging with local mortgage lenders in West Palm Beach can also be beneficial. These lenders have a deep understanding of the local market and can offer personalized property loan advice in West Palm Beach. Whether you’re looking for West Palm Beach refinancing options or need assistance with mortgage preapproval in West Palm Beach, these professionals are equipped to guide you through the process.

The Role of Your Real Estate Agent

Your journey to buy your first home doesn’t have to be a solo endeavor. Your real estate agent can help you navigate the complexities of finding a first home that fits your needs and budget. Experienced agents have extensive knowledge of the condo market and can provide insights into the best neighborhoods, upcoming developments, and investment potential.

Mortgage Options in West Palm Beach

For those considering West Palm Beach as their new home, the area offers a plethora of mortgage options. West Palm Beach mortgage brokers can assist in finding affordable West Palm Beach home loans tailored to your financial situation. They have access to a wide range of mortgage products, including first time home buyer loans in West Palm Beach, ensuring you find the best deal possible.

Moreover, local mortgage lenders in West Palm Beach are well-versed in the nuances of the local market. They can provide competitive rates and flexible terms, making the dream of buying a condo more attainable. For those interested in commercial properties, engaging with a commercial mortgage broker in West Palm Beach can open doors to lucrative investment opportunities.

Practical Considerations

When contemplating buying a condo, it’s essential to consider practical aspects such as HOA fees, rules, and regulations. These fees cover maintenance and amenities but can vary widely, so it’s important to factor them into your budget. Understanding the HOA’s policies on things like renovations, pet ownership, and rentals can also influence your decision.

Additionally, considering the long-term resale value of the condo is crucial. While condos in well-maintained complexes and desirable locations tend to appreciate, it’s wise to research market trends and historical data to make an informed decision.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice