What Every Homeowner Should Know About Their Equity

Curious about selling your home? Understanding how much equity you have is the first step to unlocking what you can afford when you move. And since home prices rose so much over the past few years, most people have much more equity than they may realize.

Here’s a deeper look at what you need to know if you’re ready to cash in on your investment and put your equity toward your next home.

Home Equity: What Is It and How Much Do You Have?

Home equity is the difference between how much your house is worth and how much you still owe on your mortgage. For example, if your house is worth $400,000 and you only owe $200,000 on your mortgage, your equity would be $200,000.

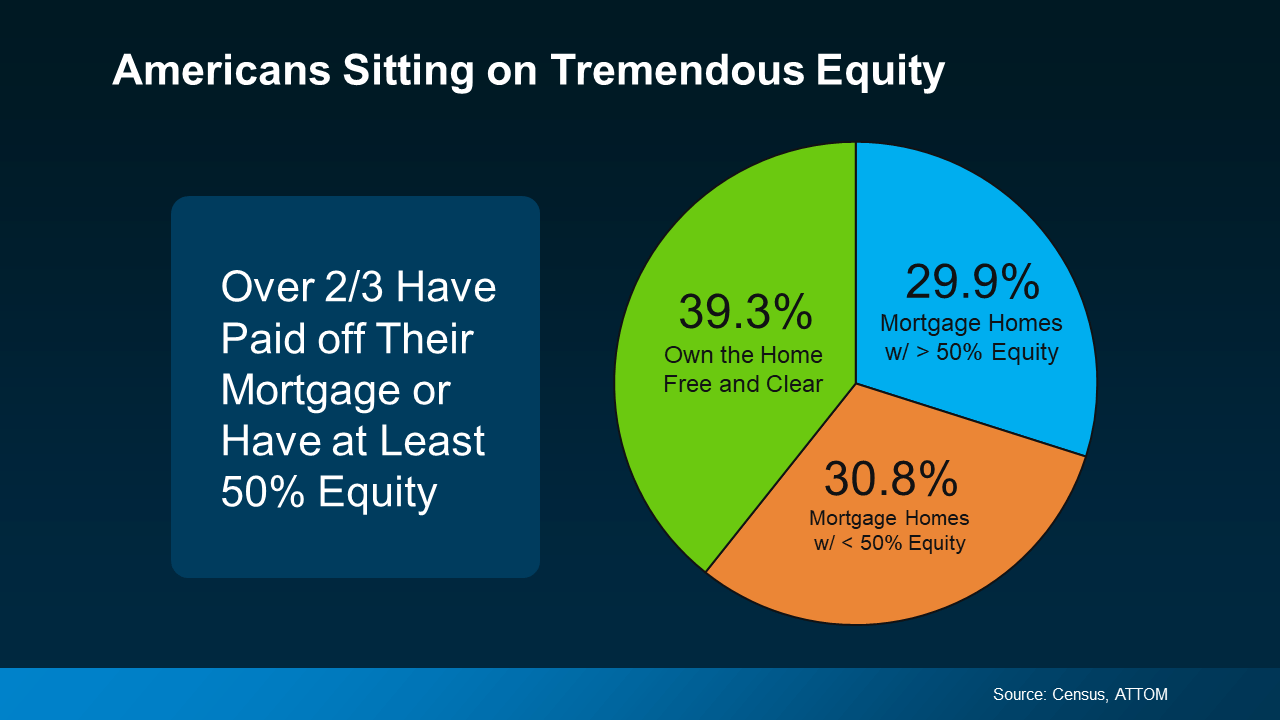

Recent data from the Census and ATTOM shows Americans have significant equity right now. In fact, more than two out of three homeowners have either completely paid off their mortgages (shown in green in the chart below) or have at least 50% equity in their homes (shown in blue in the chart below):

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

Today, more homeowners are getting a larger return on their homeownership investments when they sell. And if you have that much equity, it can be a powerful force to fuel your next move.

What You Should Do Next

If you’re thinking about selling your house, it’s important to know how muchequity you have, as well as what that means for your home sale and your potential earnings. The best way to get a clear picture is to work with your agent, while also talking to a tax professional or financial advisor. A team of experts can help you understand your specific situation and guide you forward.

Home prices have gone up, which means your equity probably has too. Let’s connect so you can find out how much you have in your home and move forward confidently when you sell.

What Every Homeowner Should Know About Their Equity

Owning a home is a monumental achievement, a cornerstone of the American Dream. But beyond the satisfaction of homeownership lies a powerful financial asset: equity. It’s a term often tossed around, but what does it truly mean for every homeowner? Let’s delve into the intricacies of equity.

Understanding Your Home’s Value

At its core, equity is the difference between your home’s current market value and the outstanding balance of your mortgage. It’s your ownership stake in the property. As home prices rise, so does your equity. Conversely, if home prices decline, your equity may shrink.

Determining how much equity you have is crucial. It’s like uncovering a hidden treasure chest in your own home. To calculate this, you’ll need two figures: your home’s appraised value and your mortgage balance. Subtract the latter from the former, and voila! You’ve unearthed your equity.

Building Equity Over Time

Equity is a gradual accumulation, much like watching a garden grow. With every mortgage payment, a portion goes towards paying down the principal, increasing your equity. Additionally, home prices have a tendency to appreciate over time, further boosting your stake.

It’s essential to view your home as an investment. Just as you would monitor your stock portfolio, keep an eye on your home’s value and your equity growth.

Leveraging Your Equity

Your equity is a financial resource, a tool that can be harnessed for various purposes. One popular option is to put your equity toward your next home. If you’re thinking about selling your house and upgrading, the equity you’ve built can serve as a substantial down payment for your new abode.

Home Equity Lines of Credit (HELOCs) and home equity loans are other avenues to explore. These financial products allow you to borrow against your equity. While tempting, proceed with caution. Ensure you have a clear plan for using the funds and understand the associated costs and risks.

Protecting Your Equity

Like any valuable asset, your equity deserves protection. Regular home maintenance is crucial. A well-maintained home is more likely to appreciate in value. Moreover, consider homeowners insurance with adequate coverage to safeguard against unforeseen events.

Selling Your Home and Maximizing Equity

When the time comes to sell your home, understanding your equity is paramount. It influences your asking price and potential profit. A skilled real estate agent can help you determine your home’s market value and devise a strategic selling plan to maximize your equity.

Work with your agent to create a compelling listing that highlights your home’s features and attracts potential buyers. Staging can also significantly impact your home’s appeal and ultimately, its sale price.

The Role of Mortgage Rates

Interest rates play a pivotal role in your equity journey. Lower mortgage rates can accelerate equity growth as more of your monthly payment goes towards the principal. Conversely, higher rates can slow down the process.

If you’re considering refinancing, explore West Palm Beach refinancing options. A West Palm Beach mortgage broker can help you find the best rates and terms to suit your financial goals.

Conclusion

Your home is more than just a place to live; it’s a financial asset. Understanding and maximizing your equity is key to unlocking its full potential. Whether you’re dreaming of a larger home, consolidating debt, or planning for retirement, your equity can be a powerful ally.

By diligently tracking your home’s value, making informed financial decisions, and partnering with trusted professionals like a West Palm Beach mortgage broker, you can harness the power of equity and achieve your homeownership aspirations.

Would you like to add any specific sections or focus on particular aspects of equity?

Leveraging Your Equity for Home Improvements

Your home is more than just a shelter; it’s a canvas for your dreams. And equity is the paintbrush that can transform those dreams into reality. Home improvements are a popular way to leverage your home equity. Whether it’s a kitchen remodel, a bathroom upgrade, or a backyard oasis, these enhancements can significantly increase your home’s value and your enjoyment of your living space.

Weighing the Costs and Benefits

Before diving headfirst into a home improvement project, it’s crucial to assess the potential return on investment (ROI). Not all renovations yield equal returns. A kitchen or bathroom remodel, for instance, often has a higher ROI than a finished basement or swimming pool.

Consider consulting with a local mortgage lender or a real estate agent to gauge the potential impact of your desired improvements on your home’s value. Their expertise can help you make informed decisions.

Financing Your Home Improvement Project

There are several ways to finance your home improvement project using your equity. A home equity loan provides a lump sum upfront, while a HELOC offers a line of credit you can tap into as needed. Both options have their pros and cons, so it’s essential to understand the terms and conditions before choosing.

A cash-out refinance is another avenue to explore. By refinancing your mortgage for a larger amount than your current balance, you can receive the difference in cash. While this option can be beneficial, it’s important to consider the potential impact on your monthly mortgage payment.

Protecting Your Investment

Once you’ve invested in home improvements, it’s essential to protect your investment. Regular maintenance is key to preserving your home’s value. Keep an eye out for signs of wear and tear, and address issues promptly.

Additionally, consider upgrading your homeowners insurance to reflect the increased value of your home. This ensures you’re adequately protected in case of unforeseen events.

Equity and Retirement Planning

Your home can be a strategic component of your retirement plan. As your equity grows, it can provide a financial cushion during your golden years. One option is to downsize to a smaller, more manageable home and use the proceeds from the sale to supplement your retirement income.

Alternatively, a reverse mortgage can allow you to tap into your home’s equity without having to sell. However, it’s crucial to carefully consider the terms and potential implications of a reverse mortgage before making a decision.

The Bottom Line

Your home’s equity is a valuable asset that can be harnessed to enhance your lifestyle and financial security. By understanding your options, carefully planning your projects, and seeking expert advice, you can make the most of this valuable resource.

Remember, every homeowner’s situation is unique. Consulting with a West Palm Beach mortgage broker can provide tailored guidance based on your specific financial goals and circumstances.

Would you like to delve deeper into a specific aspect of home equity or explore another related topic?

Equity and Financial Planning

Your home can be a cornerstone of your overall financial strategy. Building and leveraging equity wisely can significantly impact your long-term financial health. Let’s explore how equity fits into the broader picture of financial planning.

Equity as a Retirement Asset

As mentioned earlier, your home can be a valuable retirement asset. By strategically managing your equity, you can create a more secure financial future. Downsizing to a smaller home can provide a lump sum of cash to supplement your retirement income.

However, it’s essential to consider factors such as housing costs, property taxes, and maintenance when making such a decision. A financial advisor can help you evaluate your options and create a retirement plan that aligns with your goals.

Equity and Estate Planning

Equity also plays a role in estate planning. If you want to leave a legacy for your heirs, your home’s value can be a significant part of that legacy. By understanding how your home fits into your overall estate plan, you can ensure that your assets are distributed according to your wishes.

Consider consulting with an estate planning attorney to explore options such as trusts or beneficiary designations for your home.

Equity and Tax Implications

Understanding the tax implications of your home and equity is crucial for effective financial planning. Let’s break down some key points.

The Mortgage Interest Deduction

One of the most significant tax benefits of homeownership is the mortgage interest deduction. This allows you to deduct the interest paid on your mortgage from your taxable income. However, the rules and limitations for this deduction can be complex, so it’s essential to consult with a tax professional.

Equity and Reverse Mortgages

A reverse mortgage is a specialized loan available to homeowners aged 62 or older. Unlike traditional mortgages where you make monthly payments, a reverse mortgage allows you to convert your home equity into cash.

How Reverse Mortgages Work

A reverse mortgage provides you with a lump sum, a line of credit, or a monthly payment based on your home’s value and your age. You retain ownership of your home, and there’s no obligation to sell. The loan becomes due when you sell the home, move permanently, or pass away.

Advantages and Disadvantages

- Pros: Provides access to cash without selling your home, can help with retirement expenses, and offers flexibility in repayment options.

- Cons: Decreases your estate, interest rates are typically higher than traditional mortgages, and home equity is reduced over time.

It’s crucial to carefully consider the pros and cons of a reverse mortgage before making a decision. Consulting with a financial advisor or a reverse mortgage specialist can help you determine if it’s the right choice for your situation.

Conclusion

Understanding the various ways to leverage your home’s equity is essential for making informed financial decisions. Whether you’re considering home improvements, retirement planning, or debt consolidation, your equity can be a valuable resource.

By carefully weighing your options and seeking professional advice, you can harness the power of equity to achieve your financial goals.

Would you like to explore any other aspects of homeownership or equity?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice