Achieving Your Homebuying Dreams in 2024

Some Highlights

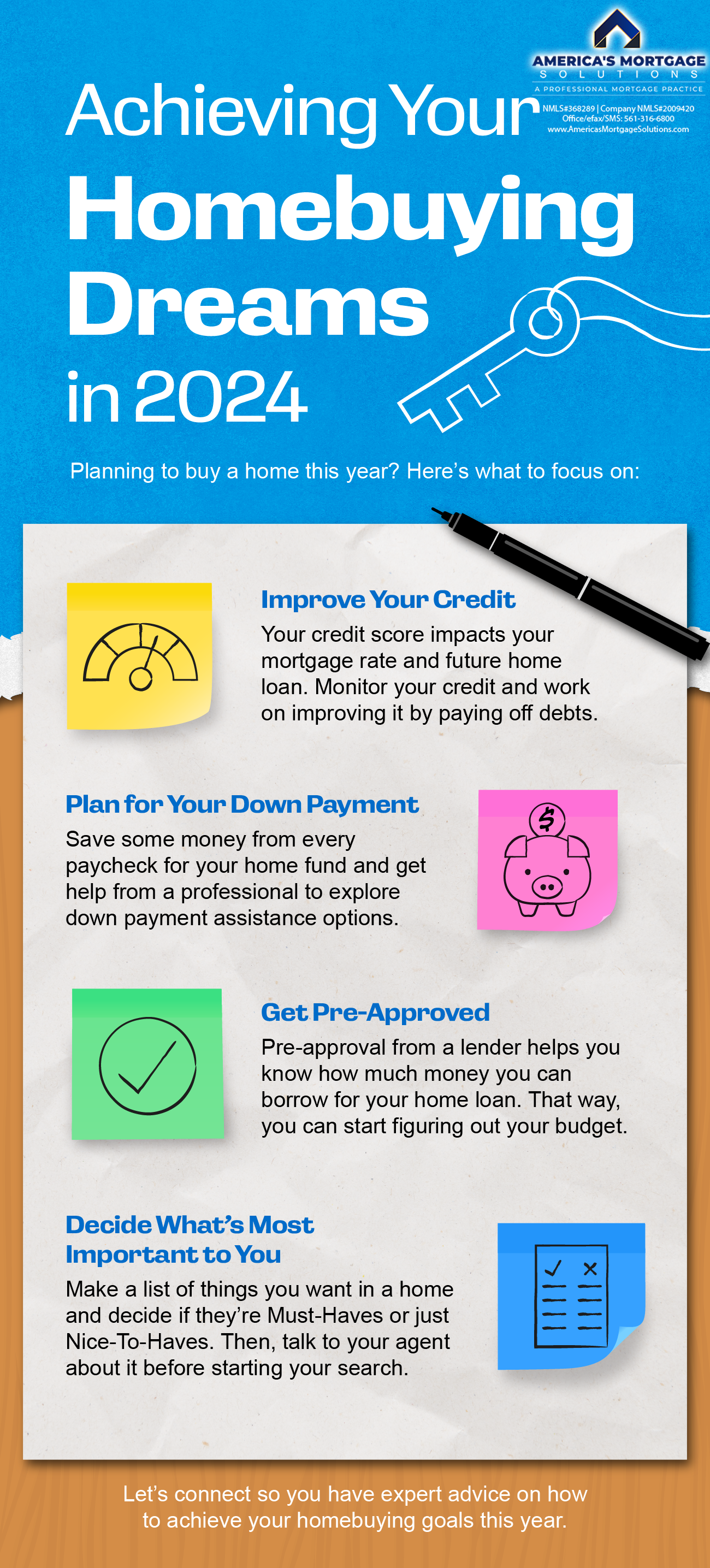

- Planning to buy a home in 2024? Here’s what to focus on.

- Improve your credit score, plan for your down payment, get pre-approved, and decide what’s most important to you.

- Let’s connect so you have expert advice on how to achieve your homebuying goals this year.

Achieving Your Homebuying Dreams in 2024: A Comprehensive Guide

In the ever-evolving landscape of real estate, Homebuying Dreams can transform into reality with strategic planning and informed decision-making. As the year 2024 unfolds, navigating the path to homeownership requires a blend of financial acumen, meticulous research, and a dash of optimism. Let’s delve into the key elements that can pave the way for you to buy a home that aligns seamlessly with your aspirations.

Unveiling the Blueprint for Homebuying Success

Understanding the Power of Your Credit Score

Your credit score serves as the cornerstone in the realm of home financing. This numerical representation of your creditworthiness can significantly influence the interest rates and mortgage options available to you. A higher credit score not only opens doors to favorable loan terms but also enhances your negotiation power in the intricate dance of real estate transactions.

Homebuying Dreams often hinge on a robust credit foundation. Consider this as the launchpad for your homebuying journey, a numerical measure that speaks volumes to potential lenders.

The Prelude: Getting Pre-Approved

Before embarking on the exhilarating quest to buy a home, the savvy homebuyer lays the groundwork by getting pre-approved. This proactive step involves a thorough assessment of your financial health by a lender. The resulting pre-approval not only boosts your confidence but also signals to sellers that you are a serious contender in the competitive real estate arena.

In the mosaic of homebuying, being pre-approved is akin to having a golden ticket. It positions you as a formidable player, ready to turn your Homebuying Dreams into tangible bricks and mortar.

Navigating the Terrain of Homebuying Goals

Setting the Stage with Defined Homebuying Goals

Homebuying goals are the guiding stars that illuminate your path through the real estate cosmos. Whether it’s a cozy suburban dwelling or a chic urban condo, clarity about your preferences and priorities lays the foundation for a successful homebuying expedition.

Consider creating a checklist that encapsulates your non-negotiables and wish list items. This meticulous approach ensures that your journey to buy a home is not a random meandering but a purposeful expedition toward your envisioned domicile.

The Dance of Budgeting: Aligning Finances with Homebuying Dreams

In the symphony of homeownership, the notes of budgeting resonate profoundly. Evaluate your financial landscape, taking into account not only the down payment and mortgage but also the often-overlooked ancillary costs. A holistic financial outlook prepares you for the financial responsibilities that come hand in hand with owning a property.

Remember, the quest to buy a home is not just about acquiring a set of keys; it’s a commitment to a lifestyle and a financial journey. Let your Homebuying Dreams be the muse that shapes your budgetary masterpiece.

Exploring the Kaleidoscope of Neighborhoods

The canvas of your Homebuying Dreams is painted with the hues of diverse neighborhoods. Each locale carries its own charm and character, influencing not just the value of your investment but also your day-to-day living experience.

Engage in a comprehensive exploration of prospective neighborhoods. Consider factors beyond property values, such as schools, amenities, and community vibes. This nuanced approach ensures that your homebuying goals extend beyond the immediate transaction, harmonizing with your long-term vision.

The Art of Negotiation: Crafting Your Homebuying Symphony

Capitalizing on Market Dynamics

In the dynamic landscape of real estate, timing is more than just a cliché—it’s a strategic advantage. Keep a pulse on market trends and leverage fluctuations to your benefit. A buyer’s or seller’s market can influence not only property prices but also the negotiation dynamics.

Flexibility is key. While anchoring your negotiations in the realm of reason, be open to creative solutions that could turn the tide in your favor. The journey to buy a home is as much about adaptability as it is about assertiveness.

Expertise in the Language of Offers

Crafting a compelling offer is an art form. Beyond the numerical figures, inject a personal touch that resonates with the seller. Acknowledge the unique qualities of the property, expressing genuine interest. This personalized approach can create a connection that transcends the transactional nature of real estate.

When submitting your offer, underscore the strength of your pre-approved status. This not only instills confidence in the seller but also positions you as a serious contender in the competitive arena of homebuying.

Conclusion: Turning the Key to Homeownership

As you stand at the threshold of your Homebuying Dreams in 2024, remember that the journey is as significant as the destination. The dance of financial prudence, meticulous research, and strategic negotiation culminates in the turning of the key to your new abode.

Embrace the adventure with a spirit of curiosity and resilience. Your dream home awaits, and with each strategic step, you inch closer to the realization of your homeownership aspirations. May the year 2024 be the chapter where your homebuying goals evolve into a narrative of triumph and fulfillment.

The Homestretch: Navigating Escrow and Closing

Embracing the Intricacies of Escrow

As your Homebuying Dreams materialize, the journey ventures into the realm of escrow—a pivotal phase that involves the coordination of various elements leading up to the finalization of the sale. During this period, the earnest money deposit is held in escrow, inspections are conducted, and any contingencies are addressed.

Stay actively involved in this process, seeking clarity on every nuance. The adage “knowledge is power” rings true, especially in the intricate ballet of real estate transactions. Being well-versed in the dynamics of escrow ensures a smoother transition toward the culmination of your homebuying goals.

The Climax: Closing the Deal

As the chapters of your homebuying saga converge, the grand finale unfolds at the closing table. This ceremonious event involves the signing of documents, the exchange of funds, and the official transfer of property ownership. It’s the crescendo that echoes the realization of your Homebuying Dreams.

Prioritize a meticulous review of the closing documents. This is not a mere formality; it’s your opportunity to ensure that every detail aligns with the terms negotiated. The culmination of this process marks not just the acquisition of a property but the initiation of a new chapter in your life.

Post-Purchase Perspectives: Nurturing Your Investment

Homeownership Maintenance: Beyond the Initial Purchase

The euphoria of acquiring your dream home should not overshadow the responsibilities that come with homeownership. As you step into the realm of property ownership, prioritize ongoing maintenance and care. Regular inspections, addressing repairs promptly, and understanding the nuances of homeownership contribute to the longevity and value of your investment.

Consider this phase as the nurturing of a flourishing garden. Each effort invested in maintenance becomes a thread in the tapestry of your homeownership experience, ensuring that your Homebuying Dreams remain vibrant and enduring.

The Evolving Landscape of Real Estate

The real estate landscape is dynamic, shaped by economic trends, technological advancements, and societal shifts. Stay attuned to these changes, as they can influence not only the value of your property but also the opportunities available for future investment.

Your journey to buy a home is not a solitary expedition; it’s an engagement with an ever-evolving ecosystem. Embrace the evolution, remaining open to possibilities that may enhance the value and potential of your real estate portfolio.

Epilogue: Your Homebuying Odyssey

As we draw the curtains on this exploration of achieving Homebuying Dreams in 2024, reflect on the odyssey you’ve embarked upon. It’s not merely a financial transaction; it’s a transformative experience that shapes the narrative of your life.

In the symphony of homeownership, you are the conductor, orchestrating each note with precision and passion. From the initial chords of assessing your credit score to the triumphant finale of closing the deal, every step is an integral part of the composition.

May your journey be adorned with the fulfillment of your homebuying goals and the joy of settling into a space that resonates with your aspirations. As the key turns in the lock of your newfound abode, savor the moment—the culmination of your Homebuying Odyssey in the remarkable year of 2024.

Sustaining the Dream: A Lifelong Homeownership Symphony

Cultivating a Homeownership Mindset

Beyond the celebratory moments of acquisition, cultivating a homeownership mindset is crucial for the enduring success of your investment. View your property not just as a dwelling but as a canvas for personal expression. This mindset fosters a sense of pride and commitment, ensuring that your home remains a reflection of your evolving lifestyle and aspirations.

Consider exploring home improvement projects that align with your tastes and add value to your property. This ongoing engagement with your space transforms it into a dynamic entity, mirroring the chapters of your life.

Financial Fortitude: A Pillar of Homeownership

As the custodian of your dream home, financial fortitude becomes a pillar of strength. Continue to monitor and enhance your financial health, reinforcing the foundation that supports your homeownership journey. Regularly revisit your budget, explore avenues for additional savings, and consider strategic investments that contribute to your overall financial well-being.

A proactive approach to your finances not only safeguards your property investment but also positions you to capitalize on future opportunities within the real estate landscape.

Community Integration: Weaving the Fabric of Home

Your home isn’t merely a structure; it’s a node within a broader community. Actively engage with your neighbors, participate in local events, and contribute to the communal tapestry. This sense of community integration not only enriches your living experience but also fortifies the value of your property.

Consider joining neighborhood associations, attending community gatherings, and supporting local initiatives. Your home becomes not just a haven but a vibrant node within the social fabric, enhancing the overall texture of your homeownership experience.

Adapting to Market Dynamics: A Continual Symphony

The real estate market is a dynamic ecosystem influenced by myriad factors. Stay attuned to market trends, economic shifts, and emerging opportunities. Periodically reassess the value of your property and explore avenues for enhancement.

In a constantly evolving market, adaptability is a valuable trait. Consider consulting with real estate professionals to gain insights into potential upgrades, renovations, or strategic moves that align with your long-term goals.

Legacy Building: Passing the Baton

As your homeownership journey matures, contemplate the legacy you wish to leave. Your dream home is not just a personal haven; it’s a legacy that can transcend generations. Consider estate planning, explore options for generational wealth transfer, and ensure that the story of your homeownership extends beyond your lifetime.

By adopting a forward-thinking approach, you become the architect of a lasting legacy, weaving a narrative that transcends the confines of time. Your Homebuying Dreams become a foundational chapter in the broader story of your family’s history.

In Retrospect: The Timeless Echo of Homeownership

As we conclude this exploration into achieving Homebuying Dreams in 2024 and beyond, recognize that homeownership is not a finite accomplishment; it’s a perpetual journey. Your dream home, once a distant vision, now stands as a testament to your aspirations, resilience, and financial acumen.

May your homeownership symphony resonate with the timeless echo of fulfillment and contentment. In each room, corridor, and garden, may you find not just the tangible elements of a property but the intangible essence of a place called home—a sanctuary where your dreams unfold, and the melody of your life continues to play.

Bottom Line

In the grand orchestration of achieving your Homebuying Dreams in 2024, remember this: beyond the transactional aspects lies a lifelong journey. From nurturing your credit score to navigating the complexities of escrow and closing, each step contributes to the symphony of homeownership.

Cultivate a mindset that sees your home as a canvas for personal expression and a legacy for future generations. Fortify your financial foundation, integrate with the community, and stay attuned to the evolving real estate landscape.

As the key turns in the lock of your dream home, savor the moment, for this is not just a culmination but the commencement of a timeless echo—a melody that resonates with the fulfillment of your homebuying goals in the remarkable year of 2024 and well into the future.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice