Mortgage Rates Down a Full Percent from Recent High

Mortgage rates have been one of the hottest topics in the housing market lately because of their impact on affordability. And if you’re someone who’s looking to make a move, you’ve probably been waiting eagerly for rates to come down for that very reason. Well, if the past few weeks are any indication, you may be getting your wish.

Mortgage Rates Trend Down in Recent Weeks

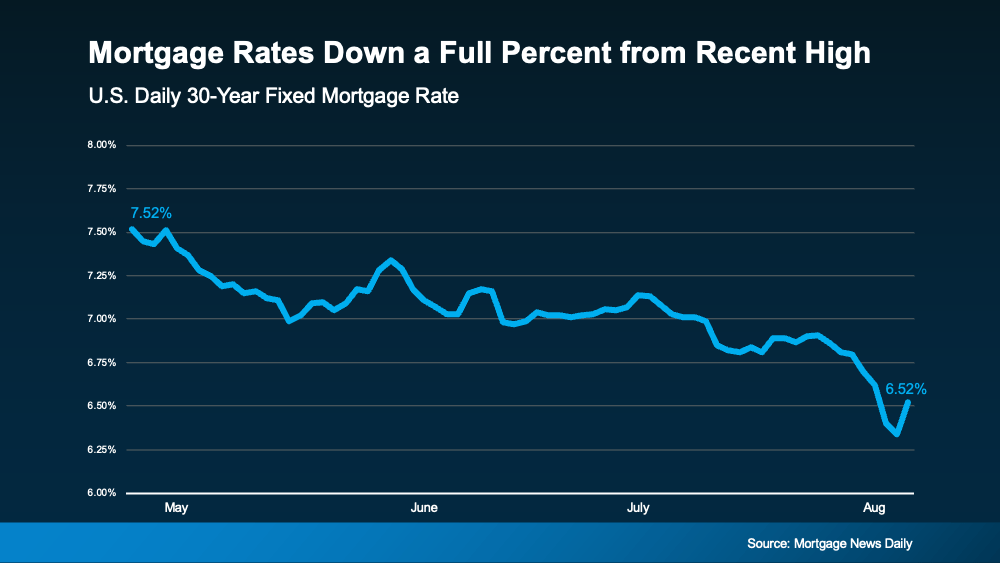

There’s big news for mortgage rates. After the latest reports on the economy, inflation, the unemployment rate, and the Federal Reserve’s recent comments, mortgage rates started dropping a bit. And according to Freddie Mac, they’re now at a level we haven’t seen since February. To help show the downward trend, check out the graph below:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

Maybe you’re seeing this and wondering if you should ride the wave and see how low they’ll go. If that’s the case, here’s some important perspective. Remember, the record-low rates from the pandemic are a thing of the past. If you’re holding out hope to see a 3% mortgage rate again, you’re waiting for something experts agree won’t happen. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“The hopes for lower interest rates need the reality check that ‘lower’ doesn’t mean we’re going back to 3% mortgage rates. . . the best we may be able to hope for over the next year is 5.5 to 6%.”

And with the decrease in recent weeks, you’ve got a big opportunity in front of you right now. It may be enough for you to want to jump back in.

The Relationship Between Rates and Demand

If you wait for mortgage rates to drop further, you might find yourself dealing with more competition as other buyers re-ignite their home searches too.

In the housing market, there’s generally a relationship between mortgage rates and buyer demand. Typically, the higher rates are, the lower buyer demand is. But when rates start to come down, things change. Buyers who were on the fence over higher rates will resume their searches. Here’s what that means for you. As a recent article from Bankrate says:

“If you’re ready to buy, now might be the time to strike. Home prices have been rising primarily because of a longstanding shortage of homes for sale. That’s unlikely to change, and if mortgage rates do fall below 6%, it’s possible buyers would enter the market en masse, further pushing up prices and resurrecting bidding wars.”

If you’ve been waiting to make your move, the recent downward trend in mortgage rates may be enough to get you off the sidelines. Rates have hit their lowest point in months, and that gives you the opportunity to jump back in before all the other buyers do too.

If you’re ready and able to start the process, reach out and let’s get started.

Mortgage Rates Down a Full Percent from Recent High: A Golden Opportunity for Homebuyers

Introduction

The housing market is a capricious beast, its moods shifting with the mercurial nature of mortgage rates. Recently, this tempestuous market has offered a glimmer of hope for potential homeowners: mortgage rates have plummeted by a full percentage point from their recent zenith. This dramatic decline has ignited a spark of optimism, casting a long-awaited spotlight on affordability and rekindling the dreams of countless homebuyers.

The Impact of Lower Mortgage Rates

A percentage point may seem inconsequential, a mere decimal in the grand scheme of finance. Yet, in the realm of homeownership, this seemingly minuscule shift can reverberate with profound implications. Lower mortgage rates translate to more affordable monthly payments, freeing up precious dollars for other financial obligations or discretionary spending. This newfound financial flexibility can be a game-changer, empowering individuals to step onto the property ladder with renewed confidence.

For those already ensconced in their homes, the allure of West Palm Beach refinancing options has become increasingly enticing. By refinancing at a lower mortgage rate, homeowners can potentially reduce their monthly payments, shorten their loan term, or tap into their home’s equity for significant financial endeavors.

A Resurgence of Home Searches

The tantalizing prospect of lower mortgage rates has spurred a resurgence in home searches. Potential buyers, once relegated to the sidelines by exorbitant costs, are now re-engaging with the market, their hopes rekindled by the prospect of attainable homeownership. The inventory of homes for sale may still be constrained in some areas, but the increased demand generated by declining mortgage rates is undoubtedly exerting upward pressure on property values.

Nonetheless, this upward trajectory in home prices is tempered by the overarching impact of lower mortgage rates. While the cost of purchasing a home may be escalating, the reduced financial burden imposed by lower monthly payments can offset these increases to a certain extent.

The West Palm Beach Housing Market

The West Palm Beach housing market has not been immune to the fluctuations of mortgage rates. Local real estate agents have reported a noticeable uptick in home searches as buyers capitalize on the opportunity to secure more favorable loan terms. The availability of Affordable West Palm Beach home loans has played a pivotal role in stimulating market activity.

For first-time homebuyers, the prospect of purchasing a home in West Palm Beach is becoming increasingly attainable. Programs such as First time home buyer loans in West Palm Beach have been instrumental in helping aspiring homeowners overcome the formidable hurdle of securing a down payment.

The Role of Mortgage Professionals

Navigating the complex landscape of mortgage rates and homeownership can be daunting. This is where the expertise of a qualified West Palm Beach mortgage broker proves invaluable. These professionals possess an in-depth understanding of the market, enabling them to tailor loan options to the specific needs and financial circumstances of their clients.

By leveraging their knowledge of Best mortgage rates in West Palm Beach, mortgage brokers can help clients secure the most favorable terms possible. Additionally, they can provide guidance on a wide range of mortgage-related matters, including mortgage preapproval, loan processing, and closing.

Conclusion

The decline in mortgage rates represents a significant opportunity for both prospective and current homeowners. By understanding the intricacies of the market and working with experienced mortgage professionals, individuals can maximize the benefits of this favorable lending environment.

Whether you’re a first-time homebuyer eager to embark on your property ownership journey or a seasoned homeowner seeking to optimize your financial situation, the current market conditions offer a compelling case for taking action.

Remember, while mortgage rates may have dipped, the housing market remains dynamic. To make informed decisions, it is essential to stay abreast of market trends and consult with qualified professionals. By doing so, you can increase your chances of achieving your homeownership goals.

Harnessing the Power of Lower Mortgage Rates

The current dip in mortgage rates presents an extraordinary opportunity to reshape financial futures. For those grappling with the exorbitant costs of renting, the allure of homeownership has never been more compelling. With lower monthly payments within reach, the dream of owning a piece of the American Dream is now a tangible reality for many.

The Importance of Financial Preparedness

While lower mortgage rates undeniably enhance affordability, it’s crucial to approach homeownership with a strategic mindset. Prospective buyers should conduct a thorough assessment of their financial health, including credit scores, savings, and income stability. A strong financial foundation is essential for securing favorable loan terms and navigating the complexities of the homebuying process.

To aid in this endeavor, West Palm Beach mortgage calculators can be invaluable tools. By inputting relevant financial data, potential homebuyers can estimate their potential monthly mortgage payments and adjust their home search accordingly.

The Role of Local Mortgage Lenders

When embarking on the homebuying journey, the support of a knowledgeable Local mortgage lender in West Palm Beach can make all the difference. These lenders possess an intimate understanding of the local market and can provide tailored advice based on individual circumstances.

Moreover, building a relationship with a local lender can streamline the loan approval process. By establishing trust and rapport, borrowers can expedite the mortgage application and increase their chances of securing the best possible terms.

Commercial Mortgage Opportunities

The decline in mortgage rates has also piqued the interest of commercial property investors. Lower borrowing costs can enhance the profitability of commercial real estate ventures, making this an opportune time to expand portfolios or acquire new properties.

For those considering commercial investments, consulting with a Commercial mortgage broker in West Palm Beach is essential. These experts can assess investment goals, analyze market trends, and identify suitable financing options.

Navigating the Homebuying Process

Purchasing a home is a complex undertaking that requires careful planning and execution. From conducting thorough property inspections to understanding closing costs, the process can be overwhelming for first-time buyers.

To ensure a smooth transition, seeking Property loan advice in West Palm Beach is highly recommended. Experienced mortgage professionals can provide guidance on every step of the homebuying journey, from loan application to closing day.

Conclusion

The current decline in mortgage rates has injected a much-needed dose of optimism into the housing market. By understanding the intricacies of the lending landscape and working with qualified mortgage professionals, homebuyers and investors can capitalize on this favorable market environment.

Whether you’re a first-time homebuyer, a seasoned homeowner looking to refinance, or a commercial property investor seeking new opportunities, the time to act is now. Embrace the potential of lower mortgage rates and embark on your path to homeownership or investment success.

Seizing the Moment: Additional Considerations for Homebuyers

While lower mortgage rates undoubtedly present a golden opportunity, it’s essential to approach homeownership with a strategic mindset. Factors beyond mortgage rates influence the overall affordability of housing. Economic conditions, employment stability, and personal financial goals should be carefully considered.

The Importance of Location

The decision to purchase a home is deeply intertwined with lifestyle preferences and future aspirations. The desirability of a particular location can significantly impact property values and, consequently, overall affordability. Factors such as proximity to schools, employment centers, and amenities play a crucial role in determining a home’s value.

The Role of Homeowners Insurance

Homeowners insurance is a non-negotiable expense for property owners. While not directly influenced by mortgage rates, it’s essential to factor in the cost of insurance when budgeting for homeownership. Understanding the coverage options available and comparing rates from different insurers can help mitigate unexpected costs.

Long-Term Financial Planning

Purchasing a home is a significant financial commitment that extends far beyond the closing date. Homeownership entails ongoing expenses such as property taxes, homeowners association fees, and maintenance costs. It’s crucial to develop a comprehensive financial plan that encompasses these expenses and ensures long-term financial stability.

The Emotional Aspect of Homeownership

Homeownership is not solely a financial decision; it’s also an emotional one. The process of finding the perfect home can be both exhilarating and overwhelming. It’s important to approach the search with patience and realistic expectations. By focusing on finding a home that aligns with your lifestyle and long-term goals, you’re more likely to experience lasting satisfaction.

Conclusion

The current decline in mortgage rates has created a favorable environment for homebuyers. By carefully considering factors such as location, insurance, financial planning, and personal preferences, individuals can make informed decisions and achieve their homeownership aspirations. Remember, while lower mortgage rates offer a unique opportunity, it’s essential to approach the homebuying process with a long-term perspective.

Navigating the Shifting Housing Market

The housing market is a dynamic entity, subject to the ebb and flow of economic forces. While the recent decline in mortgage rates has undoubtedly spurred optimism, it’s essential to approach the market with a discerning eye. Understanding the broader economic landscape can provide valuable insights into potential market trends.

Economic Indicators and the Housing Market

Factors such as interest rate policies, inflation rates, and employment figures can significantly impact the housing market. By staying informed about these economic indicators, homebuyers and investors can make more informed decisions. For instance, if economic conditions deteriorate, mortgage rates may rise, affecting affordability. Conversely, a robust economy can lead to increased competition among buyers, potentially driving up home prices.

The Importance of Market Research

Thorough market research is indispensable when making real estate decisions. Analyzing trends in property values, inventory levels, and time on market can provide a comprehensive picture of the local housing market. By understanding supply and demand dynamics, buyers can identify potential opportunities and avoid pitfalls.

Building an Effective Homebuying Team

Assembling a skilled team of professionals is crucial for a successful homebuying experience. A knowledgeable real estate agent, a trusted lender, and a qualified home inspector can provide invaluable guidance and support throughout the process. By leveraging their expertise, buyers can navigate the complexities of the market with confidence.

Conclusion

The housing market is a complex ecosystem influenced by a myriad of factors. While lower mortgage rates have created a more favorable environment for homebuyers, it’s essential to maintain a long-term perspective. By staying informed, conducting thorough research, and building a strong support team, individuals can increase their chances of making sound real estate decisions.

Remember, the housing market is cyclical, and conditions can change rapidly. Flexibility and adaptability are key to navigating its challenges and opportunities.

The Psychological Impact of Homeownership

Beyond the financial implications, homeownership can have a profound psychological impact on individuals and families. The sense of security, stability, and autonomy associated with owning a home can contribute to overall well-being. Moreover, building equity in a property can foster a sense of accomplishment and financial security.

Home as a Haven: The Psychological Benefits

Research has shown a correlation between homeownership and increased life satisfaction. The ability to personalize a living space, create a sanctuary, and cultivate a sense of belonging can positively influence mental health and emotional well-being. Additionally, homeownership can provide a foundation for building strong family bonds and creating lasting memories.

Overcoming Challenges

While homeownership offers numerous benefits, it’s essential to acknowledge the potential challenges. Financial setbacks, unexpected repairs, and changing life circumstances can impact homeowners. Developing effective coping mechanisms and seeking support when needed is crucial for maintaining a positive outlook.

Conclusion

The decision to buy a home is a significant one that extends beyond financial considerations. The psychological benefits of homeownership, coupled with careful planning and preparation, can contribute to a fulfilling and enriching lifestyle.

By understanding the emotional and financial aspects of homeownership, individuals can make informed decisions and build a strong foundation for their future. Remember, while the journey may have its ups and downs, the rewards of homeownership can be truly transformative.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice