What Will It Take for Prices To Come Down?

You may be wondering if home prices are going to crash. And believe it or not, some people might even be hoping this happens so they can finally purchase a more affordable home. But experts agree that’s not what’s in the cards – and here’s why.

There are more people who want to buy a home than there are homes available to purchase. That’s what drives prices up.

Let’s break that down and explore why, nationally, home prices aren’t going to be coming down anytime soon.

Prices Depend on Supply and Demand

The housing market works like any other market – when demand is high and supply is low, prices rise.

According to the latest estimates, the U.S. is facing a housing shortfall of several million homes. That means there are far more people looking to buy (demand) than there are homes for sale (supply). That mismatch is the key reason why prices won’t fall at the national level. As David Childers, President of Keeping Current Matters (KCM), puts it:

“The main driving force on pricing is the limited amount of inventory in most markets across the country. That issue is not going to be solved overnight or in the next twelve months.”

How Did We Get Here?

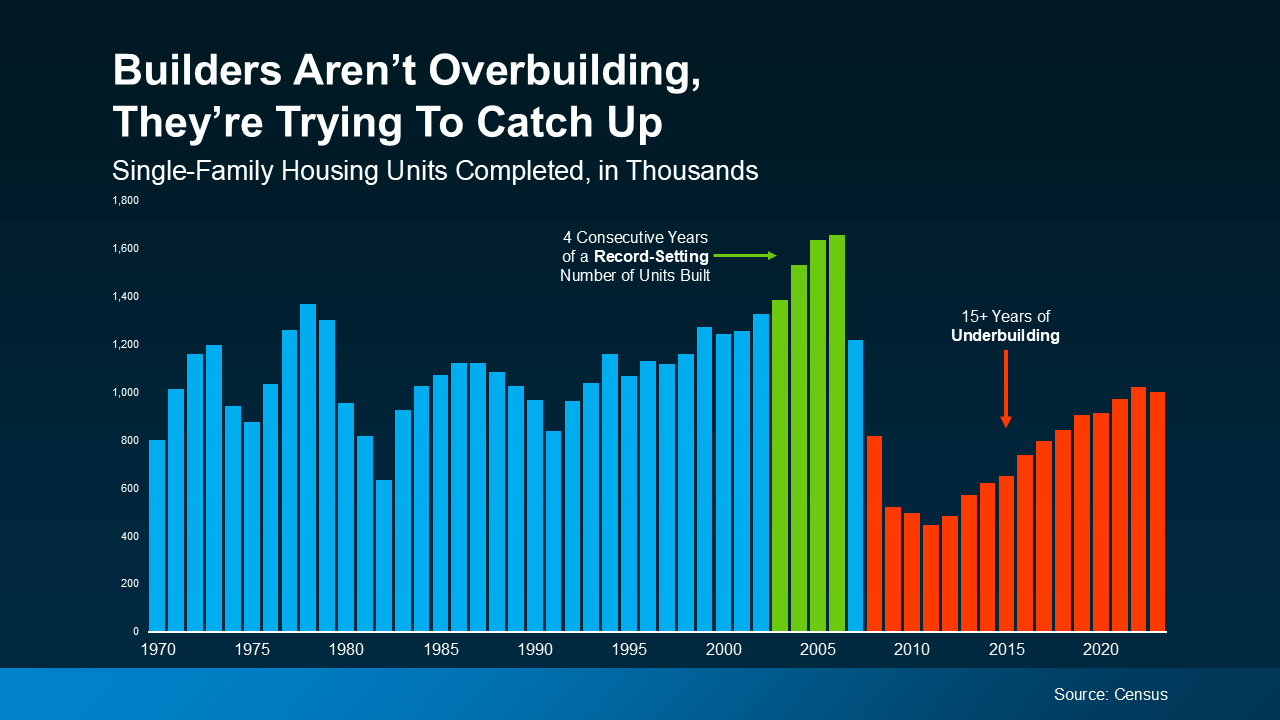

For over 15 years, homebuilders haven’t been building enough homes to keep up with buyer demand. After the 2008 housing crisis, homebuilding slowed significantly, and it’s only recently started to recover (see graph below):

Even with new construction on the rise over the past few years, builders are playing catch-up. And according to AmericanProgress.org, they’re still not even keeping up with today’s demand, let alone making up for years of underbuilding.

Even with new construction on the rise over the past few years, builders are playing catch-up. And according to AmericanProgress.org, they’re still not even keeping up with today’s demand, let alone making up for years of underbuilding.

And as long as there’s a housing shortage, home prices will remain steady or increase in most areas.

What About Next Year?

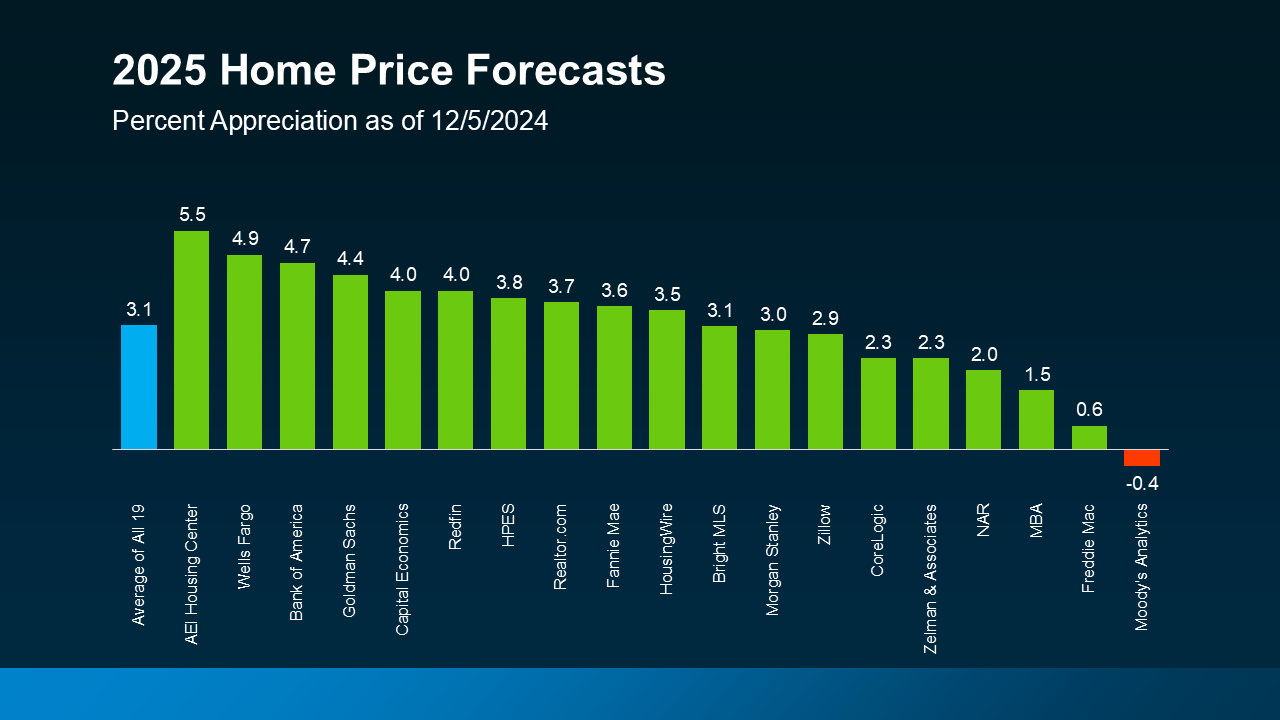

The majority of experts agree prices will keep rising next year, but at a much slower, healthier pace (see graph below):

But it’s important to note home prices vary by market. What happens nationally might not reflect exactly what’s happening in your area. If your local market has more inventory available, prices could grow more slowly or even decline slightly. But in areas where inventory remains tight, prices will keep climbing – and that’s what’s happening throughout most of the country. That’s why it’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

But it’s important to note home prices vary by market. What happens nationally might not reflect exactly what’s happening in your area. If your local market has more inventory available, prices could grow more slowly or even decline slightly. But in areas where inventory remains tight, prices will keep climbing – and that’s what’s happening throughout most of the country. That’s why it’s crucial to work with a local real estate expert who understands your market and can explain what’s going on where you live.

If you’re wondering what it’ll take for prices to come down, it all goes back to supply and demand. With inventory still limited in most markets, prices are likely to remain steady or rise.

To see what’s happening with home prices where we live, let’s connect. That way you’ll have help understanding our market and making a plan that works for you.

What Will It Take for Prices To Come Down?

The question on everyone’s mind is this: will home prices ever go down? With so much chatter about the current state of the housing market, it’s easy to see why people are wondering when, or if, they can purchase a more affordable home. The answer, however, lies in the age-old principle of supply and demand. While it may seem straightforward, the intricate web of factors contributing to the rise of home prices is anything but simple. Let’s dive deep into what it will truly take for prices to come down.

The Role of Supply and Demand

In any market, including the housing market, the balance of supply and demand is the main driver of pricing. Right now, there are simply not enough homes to keep up with buyer demand. The number of homes available to purchase has been outpaced by the sheer volume of people who want to buy a home. This imbalance creates a scenario where competition among buyers drives prices higher, leaving many prospective homeowners feeling stuck.

According to David Childers, President of Keeping Current Matters, “The main driving force on pricing is the limited amount of inventory in most markets across the country.” His observation underscores the critical issue: we’re facing a significant housing shortage that shows no signs of resolving overnight.

The Shadow of the 2008 Housing Crisis

To understand how we got here, we must look back at the aftermath of the 2008 Housing Crisis. This devastating event had a ripple effect on the homebuilding industry. For years, builders pulled back significantly, slowing down the production of new homes. The resulting housing shortfall has compounded over time, creating a backlog of unmet demand that builders are only now starting to address.

Even with new construction ramping up in recent years, the pace hasn’t been enough to close the gap. Decades of underbuilding have left us playing catch-up, and the effects are felt most acutely in markets with tight inventory.

Housing Shortage: A Nationwide Dilemma

The United States is short by several million homes. This housing shortage means there simply aren’t enough homes for sale to meet the needs of prospective buyers. As long as this scarcity exists, home prices will remain elevated. In some regions, like West Palm Beach, the situation is particularly acute, with inventory remaining stubbornly low.

The West Palm Beach Market

Take a closer look at your local market in West Palm Beach, and you’ll see a perfect example of the nationwide trend. For buyers seeking affordable West Palm Beach home loans or the best mortgage rates in West Palm Beach, the challenge often lies in finding properties within their budget. Local experts, including West Palm Beach mortgage brokers, note that competitive bidding wars have become the norm, further inflating prices.

The need for first-time home buyer loans in West Palm Beach is growing, but limited inventory keeps driving demand higher. Despite attractive West Palm Beach refinancing options, many homeowners are holding onto their properties, unwilling to sell in a market where finding a replacement home is equally challenging.

Local Solutions Require Local Expertise

When it comes to navigating this competitive environment, turning to a local real estate expert can make all the difference. A professional who knows your local market can provide invaluable insights into where opportunities exist and how to structure competitive offers. In West Palm Beach, working with local mortgage lenders and accessing tools like West Palm Beach mortgage calculators can help you make informed decisions about affordability and financing.

What Needs to Change?

So, what will it actually take for prices to come down? Several critical factors must align:

Increased Homebuilding

One of the most important steps is a significant increase in homebuilding. Builders must not only meet today’s demand but also make up for the years of underproduction that have left the market in its current state. However, challenges such as rising material costs, labor shortages, and regulatory hurdles continue to slow progress.

Boosting Inventory

Bringing more homes available to purchase onto the market is another key step. This can happen through new construction, but also by encouraging existing homeowners to sell. Programs that incentivize downsizing or relocation could help free up inventory in high-demand areas.

Addressing Affordability

For many buyers, accessing affordable homes remains a distant dream. Policies aimed at reducing barriers to entry, such as expanding access to first-time home buyer loans in West Palm Beach or offering subsidies for lower-income families, could help level the playing field. Collaboration between government agencies, private developers, and community organizations will be essential.

The Role of Financing

Financing also plays a major role in determining affordability. With interest rates fluctuating, many buyers are turning to West Palm Beach mortgage brokers for advice on securing the best mortgage rates in West Palm Beach. Options like mortgage preapproval in West Palm Beach or consulting a commercial mortgage broker in West Palm Beach can help both residential and commercial buyers navigate a competitive market.

Addressing Regional Disparities

While national statistics paint a broad picture, local dynamics can vary dramatically. In some areas, an influx of new residents has put unprecedented pressure on the housing supply, while other regions might experience slower growth. Addressing these regional disparities requires tailored solutions.

For example, states and cities can consider zoning reform to allow for higher-density developments. This approach can be especially impactful in urban areas like West Palm Beach, where land is scarce. Additionally, public-private partnerships can fund affordable housing projects that cater to middle-income earners who often fall through the cracks of traditional housing assistance programs.

Educating Future Buyers

Another critical element in easing the tension in the housing market is equipping future buyers with the tools and knowledge they need to succeed. Property loan advice in West Palm Beach and workshops on navigating the mortgage process can empower first-time buyers to make informed decisions. Resources like West Palm Beach mortgage calculators offer a practical way for individuals to understand their borrowing potential and avoid overextending their budgets.

Exploring Technological Innovations

In addition to traditional solutions, technological advancements can also help bridge the gap in the housing market. Platforms that connect buyers directly with sellers, virtual tours, and AI-driven property valuation tools can streamline the home-buying process. These tools can make it easier for buyers to identify opportunities in competitive markets like West Palm Beach. Similarly, advancements in construction technology, such as 3D-printed homes, have the potential to revolutionize homebuilding, making it faster and more cost-effective to produce new housing units.

Community Involvement in Housing Solutions

Communities themselves can play a vital role in addressing housing challenges. Local initiatives that bring together developers, city planners, and residents can ensure that new housing developments meet the needs of the community. In West Palm Beach, for instance, partnerships between civic organizations and developers could focus on creating mixed-income housing developments that provide options for various income levels.

Moreover, fostering a culture of housing education within communities can empower residents to advocate for policies that promote affordability and accessibility. Workshops, town hall meetings, and community forums can provide a platform for residents to voice concerns and collaborate on solutions.

The Road Ahead

Looking forward, the path to a balanced housing market will require effort from all sides. Policymakers, builders, lenders, and buyers must work together to address the factors contributing to high home prices. In the meantime, buyers should stay proactive by seeking advice from local real estate experts and exploring creative financing solutions. Whether it’s through West Palm Beach refinancing options or leveraging tools like mortgage preapproval in West Palm Beach, having a plan can make a significant difference.

Final Thoughts

The road to lower home prices isn’t a short one. The interplay between supply and demand, the lingering effects of the 2008 Housing Crisis, and the persistent housing shortfall all contribute to the complexity of the issue. However, with strategic planning, policy changes, and the guidance of local real estate experts, there is hope for a more balanced market in the future.

If you’re navigating the West Palm Beach housing scene, remember that there are resources available to help. From affordable West Palm Beach home loans to advice from property loan experts in West Palm Beach, taking proactive steps can make all the difference. Together, we can tackle the challenges of the current housing market and pave the way for a brighter future.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice