Unlocking the Benefits of Your Home’s Equity

Some Highlights

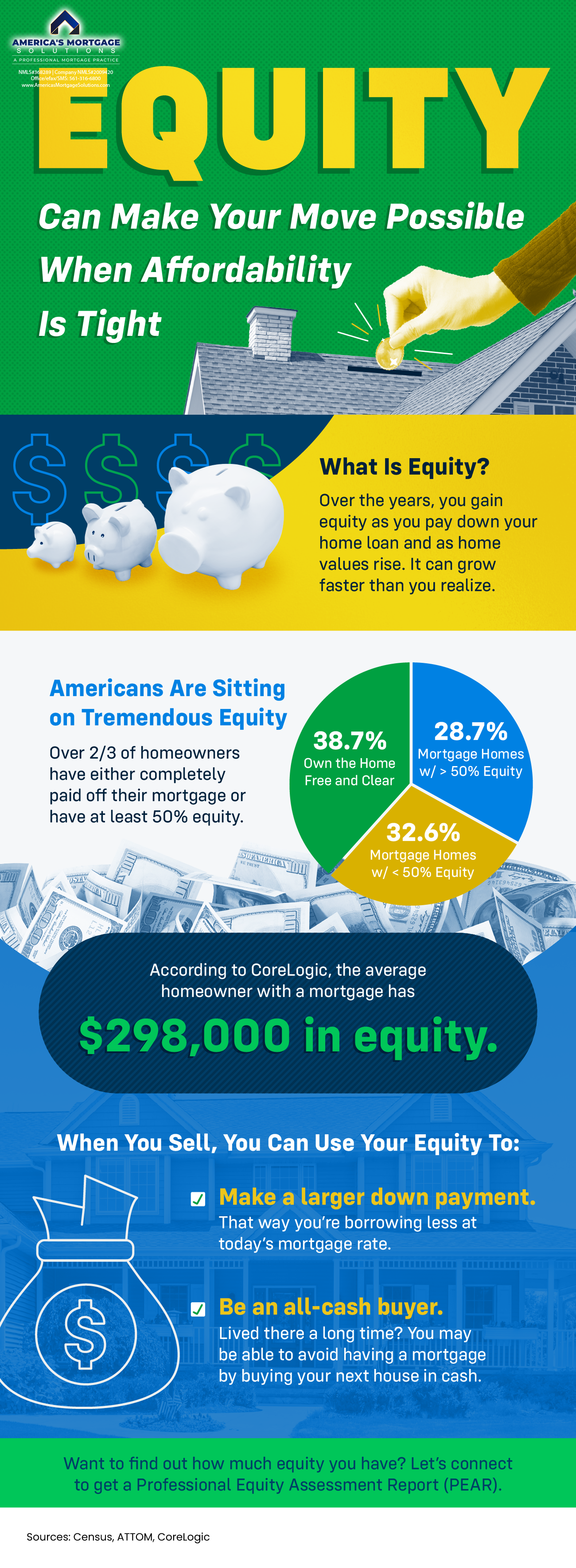

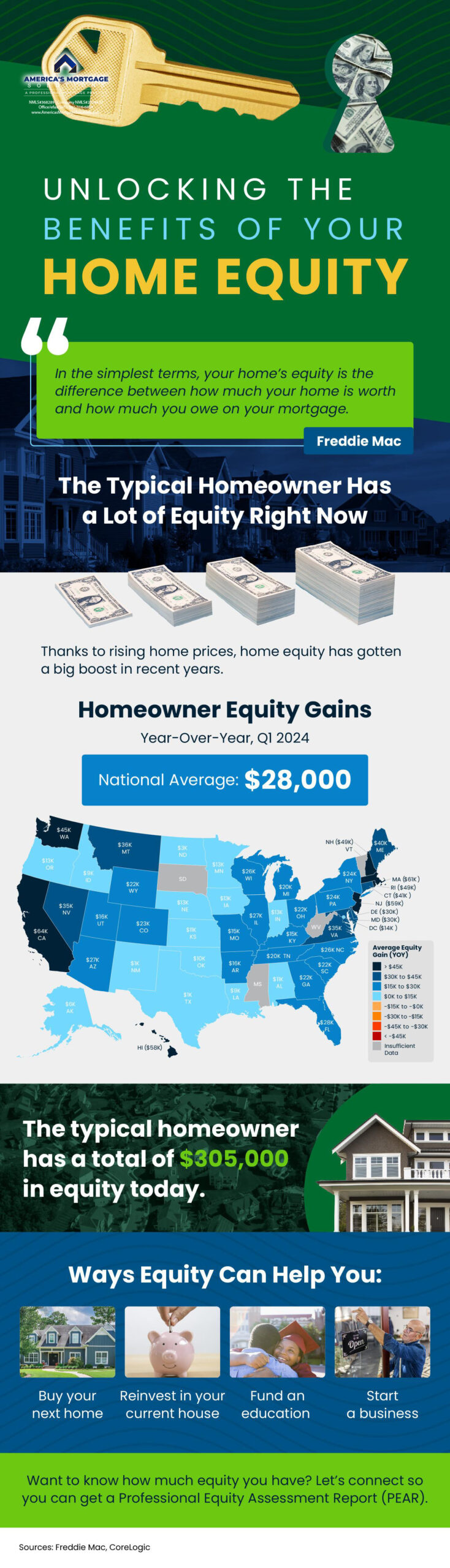

- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- Want to know how much equity you have? Let’s connect so you can get a Professional Equity Assessment Report (PEAR).

Unlocking the Benefits of Your Home’s Equity

Your home, that cozy sanctuary you’ve cultivated with love and care, is more than just bricks and mortar; it’s a potential goldmine. Hidden within its walls lies a valuable asset: equity. But what exactly is equity? And how can you harness its power to achieve your financial goals?

Understanding Your Home’s Equity

Equity is the difference between what your house is worth and the outstanding balance on your mortgage. It’s the portion of your home you truly own. Over time, as you make mortgage payments, your equity grows. Additionally, rising home values can significantly boost your equity.

How much equity you have is a crucial figure to know. It’s like discovering a hidden treasure chest in your backyard. A Professional Equity Assessment Report can illuminate the exact value of this asset.

The Many Faces of Equity

Your home’s equity is a versatile tool that can be employed in numerous ways. Let’s explore some of the most common and advantageous applications.

Home Improvement and Renovation

Dreaming of a gourmet kitchen or a luxurious master suite? Your home’s equity can be the catalyst for these transformations. By tapping into this financial resource, you can enhance your living space, increase your home’s value, and potentially boost your overall quality of life.

Debt Consolidation

Are you burdened by high-interest credit card debt or personal loans? Your home’s equity can be a lifeline. By consolidating multiple debts into a single, lower-interest loan, you can streamline your finances, reduce monthly payments, and achieve financial freedom sooner.

Education Funding

The rising costs of higher education can be daunting. But fear not, homeowner. Your home’s equity can be a powerful ally in funding your child’s college education or your own pursuit of higher learning. Whether it’s tuition, books, or living expenses, these funds can make a significant impact.

Major Purchases

Planning a dream vacation, a new car, or a substantial investment? Your home’s equity can provide the necessary financial backing. By accessing this capital, you can make those big-ticket purchases without depleting your savings or resorting to high-interest loans.

Accessing Your Home’s Equity

There are several avenues to unlock the potential of your home’s equity.

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit secured by your home. It functions similarly to a credit card, allowing you to borrow against your equity as needed. This flexibility makes it a popular choice for homeowners who anticipate fluctuating borrowing needs.

Cash-Out Refinance

With a cash-out refinance, you replace your existing mortgage with a new one for a larger amount. The difference between the new loan amount and the old mortgage balance is paid to you in cash. This option can provide a lump sum of money to address various financial goals.

Important Considerations

While tapping into your home’s equity can be advantageous, it’s essential to proceed with caution. Consider the following factors:

- Interest Rates: Compare interest rates on different loan options to find the most favorable terms.

- Closing Costs: Factor in closing costs associated with HELOCs or cash-out refinances.

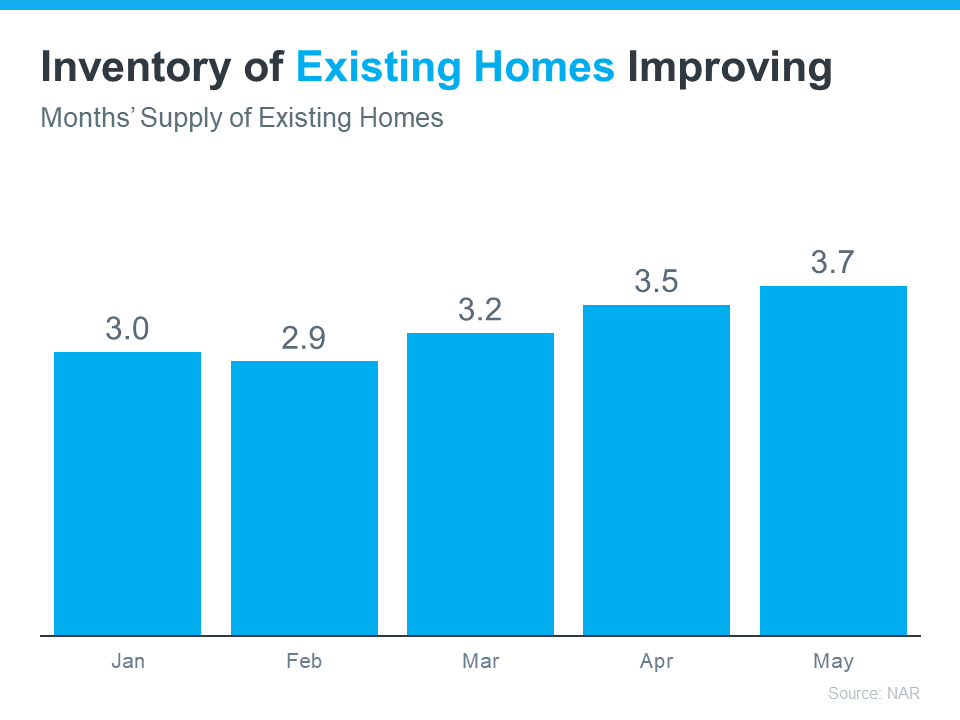

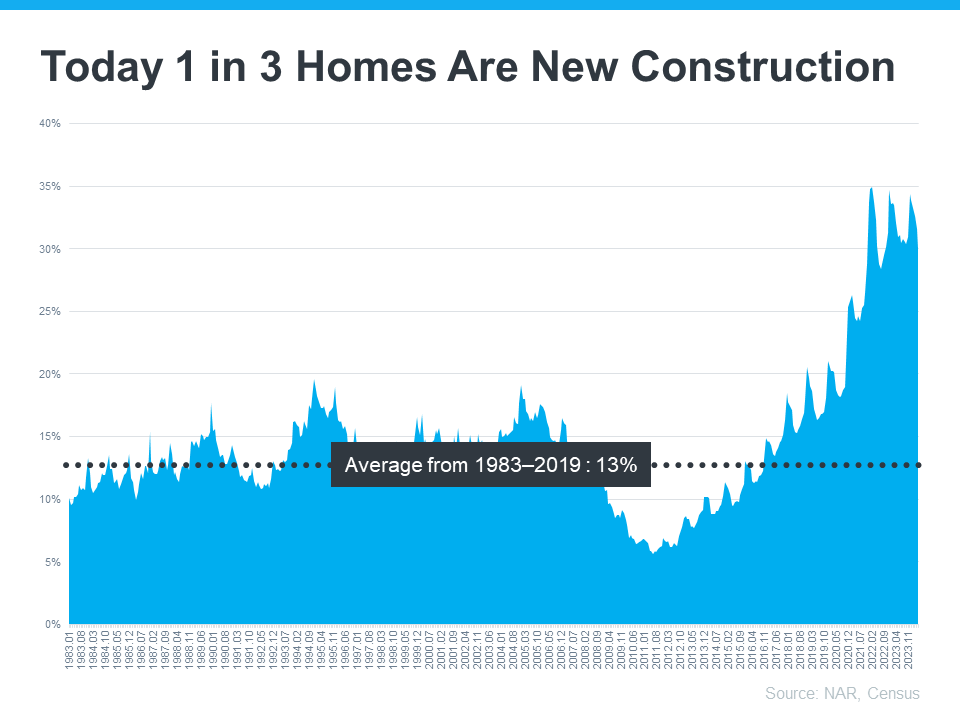

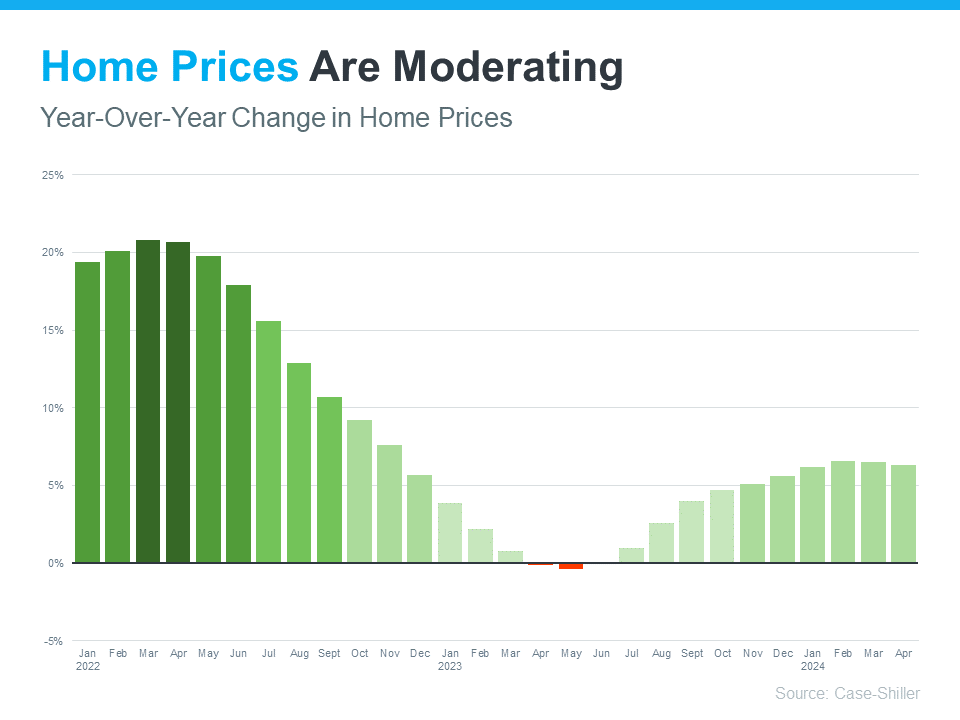

- Market Conditions: Evaluate your local real estate market to ensure your home’s value is stable or increasing.

- Long-Term Financial Goals: Assess how accessing your equity aligns with your overall financial plan.

Partner with a Trusted Lender

Navigating the world of equity and loan options can be overwhelming. That’s where a knowledgeable and experienced lender can make a significant difference. A reputable West Palm Beach mortgage broker can provide expert guidance, tailored solutions, and access to competitive Best mortgage rates in West Palm Beach.

Whether you’re a first time home buyer eager to build equity or a seasoned Homeowner looking to leverage your existing wealth, a local mortgage lender can help you make informed decisions. Explore options like West Palm Beach refinancing options, Local mortgage lenders in West Palm Beach, and West Palm Beach mortgage calculators to streamline your financial journey.

Conclusion

Your home’s equity is a valuable asset that holds the potential to transform your financial landscape. By understanding your options, carefully considering your goals, and partnering with a trusted lender, you can unlock the benefits of this hidden treasure and create a brighter financial future.

Remember, equity is not just about numbers; it’s about empowering yourself to achieve your dreams.

Would you like to explore specific scenarios or delve deeper into a particular aspect of home equity?

Building Wealth Through Your Home’s Equity

Your home, a cornerstone of stability and comfort, is also a substantial financial asset. By understanding and leveraging your home’s equity, you can unlock a world of possibilities.

The Power of Strategic Planning

While accessing your home’s equity can be a powerful financial tool, it’s crucial to approach it with a strategic mindset. Consider your long-term financial goals and how tapping into your equity aligns with your overall plan.

A well-thought-out strategy can help you maximize the benefits of your home’s equity while minimizing risks. Consulting with a financial advisor or a seasoned West Palm Beach mortgage broker can provide valuable insights and guidance tailored to your unique circumstances.

Protecting Your Investment

As you explore ways to leverage your home’s equity, it’s essential to safeguard your investment. Proper insurance coverage is paramount. Consider adding riders to your homeowners insurance policy to protect against specific risks, such as floods, earthquakes, or structural damage.

Regular home maintenance is another key factor in preserving your home’s value. By addressing issues promptly and investing in upgrades, you can enhance your property’s appeal and potentially increase its worth.

Equity and Retirement Planning

Your home can play a pivotal role in your retirement strategy. By converting a portion of your equity into cash, you can bolster your retirement savings. This can provide additional income during your golden years or serve as a safety net for unexpected expenses.

However, it’s essential to weigh the pros and cons carefully. Consider factors such as potential tax implications, market volatility, and the impact on your overall financial security.

Equity and Investment Opportunities

For savvy investors, your home’s equity can be a springboard for new ventures. Whether it’s purchasing investment property, starting a business, or funding other investment opportunities, tapping into your home’s value can provide the necessary capital.

Remember, diversification is key to managing investment risk. Spread your investments across various asset classes to mitigate potential losses.

The Bottom Line

Your home’s equity is a valuable resource that can be harnessed to achieve your financial goals. By understanding your options, carefully considering the implications, and seeking expert advice, you can make informed decisions that benefit you and your family.

Remember, your home is more than just a place to live; it’s a potential wealth-building asset. Treat it with care, and it could reward you handsomely in the years to come.

Would you like to delve deeper into a specific aspect of home equity, such as tax implications, investment strategies, or refinancing options?

Understanding the Tax Implications of Tapping Your Home’s Equity

Navigating the tax landscape when accessing your home’s equity can be complex. Let’s break down some key points.

Tax Deductions on Home Equity Loans

One of the most common questions homeowners have is about the tax deductibility of home equity loan interest. Traditionally, interest paid on home equity loans was tax-deductible if the funds were used to buy, build, or substantially improve the home. However, the Tax Cuts and Jobs Act of 2017 introduced some changes.

- Home Improvement Loans: If you use the funds from a home equity loan to improve your property, the interest paid is generally tax-deductible. This can be a significant benefit, especially for homeowners with substantial mortgage interest and other itemized deductions.

- Other Uses: If you use the funds for purposes other than home improvements, such as debt consolidation or major purchases, the interest may not be tax-deductible. This is where understanding the nuances of tax laws becomes crucial.

Capital Gains Taxes

When you sell your home, you may be subject to capital gains taxes. However, there are significant exemptions available. If you’ve lived in your home for at least two of the past five years, you may qualify for a substantial exclusion from capital gains taxes.

It’s essential to consult with a tax professional to determine your specific situation and potential tax liabilities.

Reverse Mortgages and Taxes

Reverse mortgages offer a way to tap into your home’s equity without making monthly payments. However, they do have tax implications. The interest on a reverse mortgage is generally not tax-deductible. Additionally, when you or your heirs sell the home, any proceeds above the original purchase price and improvements may be subject to capital gains taxes.

Seeking Professional Tax Advice

Given the complexities of tax laws, it’s highly recommended to consult with a qualified tax professional to understand the specific tax implications of accessing your home’s equity. They can provide personalized guidance based on your financial situation and help you optimize your tax strategy.

By understanding the tax implications associated with tapping your home’s equity, you can make informed decisions and maximize the benefits while minimizing potential tax liabilities.

Would you like to explore other aspects of home equity, such as refinancing options or investment strategies?

Refinancing Your Home: A Strategic Move

Refinancing your home can be a strategic way to tap into your home’s equity and achieve your financial goals. Let’s explore the different refinancing options available to you.

Cash-Out Refinance

A cash-out refinance allows you to replace your existing mortgage with a new one for a larger amount. The difference between the new loan amount and your old mortgage balance is paid to you in cash. This option can be beneficial for:

- Consolidating debt: By rolling high-interest debts into your mortgage, you can potentially lower your monthly payments.

- Home improvements: Use the cash to renovate your home, increasing its value and potential resale price.

- Large purchases: Fund significant expenditures like college tuition, a new car, or a down payment on an investment property.

Rate and Term Refinance

If your goal is to lower your monthly mortgage payment, a rate and term refinance might be the right choice. By refinancing into a new loan with a lower interest rate or a longer term, you can reduce your monthly payment. However, keep in mind that extending the loan term will increase the total amount of interest paid over time.

Home Equity Line of Credit (HELOC)

A HELOC is a revolving line of credit secured by your home’s equity. It allows you to borrow against your home’s value as needed, up to a pre-approved limit. HELOCs are ideal for homeowners who need flexible access to funds for unexpected expenses or ongoing projects.

Important Considerations

Before refinancing your home, carefully evaluate the following factors:

- Interest rates: Compare current interest rates to your existing mortgage rate to determine if refinancing is beneficial.

- Closing costs: Factor in the costs associated with refinancing, such as appraisal fees, title insurance, and lender fees.

- Break-even period: Calculate how long it will take to recoup the closing costs through lower monthly payments or additional cash flow.

- Equity position: Ensure you have sufficient equity to qualify for a refinance.

By understanding your options and carefully considering your financial goals, you can make an informed decision about whether refinancing is the right move for you.

Would you like to explore investment strategies using your home’s equity?

Leveraging Your Home’s Equity for Investment

Your home’s equity can be a powerful tool for fueling investment opportunities. Let’s explore some potential strategies.

Real Estate Investment

- Investment Properties: Using your home’s equity as a down payment for an investment property can generate rental income and long-term appreciation.

- Fix-and-Flip: If you have renovation skills, you could purchase a property, renovate it, and sell it for a profit.

- Real Estate Investment Trusts (REITs): Investing in REITs allows you to participate in real estate without direct property ownership.

Business Ownership

- Startup Capital: Your home’s equity can provide the necessary funds to launch your own business.

- Business Expansion: Existing businesses can use the funds to expand operations, hire employees, or develop new products.

Stock Market Investments

- Diversification: Investing in stocks can diversify your portfolio and potentially generate higher returns than traditional savings accounts.

- Long-Term Wealth Building: A well-diversified stock portfolio can be a cornerstone of long-term wealth building.

Important Considerations

Before diving into investments, consider the following:

- Risk Tolerance: Assess your comfort level with investment risk.

- Financial Goals: Determine how these investments align with your long-term financial objectives.

- Diversification: Spread your investments across different asset classes to manage risk.

- Professional Advice: Consult with a financial advisor to create a tailored investment plan.

Remember, investing always involves risk. It’s essential to conduct thorough research and due diligence before making any investment decisions.

Would you like to delve deeper into a specific investment strategy or discuss other ways to leverage your home’s equity?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice