Why a Foreclosure Wave Isn’t on the Horizon

Even though data shows inflation is cooling, a lot of people are still feeling the pinch on their wallets. And those high costs on everything from gas to groceries are fueling unnecessary concerns that more people are going to have trouble making their mortgage payments. But, does that mean there’s a big wave of foreclosures coming?

Here’s a look at why the data and the experts say that’s not going to happen.

There Aren’t Many Homeowners Who Are Seriously Behind on Their Mortgages

One of the main reasons there were so many foreclosures during the last housing crash was because relaxed lending standards made it easy for people to take out mortgages, even when they couldn’t show they’d be able to pay them back. At that time, lenders weren’t being as strict when looking at applicant credit scores, income levels, employment status, and debt-to-income ratio.

But since then, lending standards have gotten a whole lot tighter. Lenders became much more diligent when assessing applicants for home loans. And that means we’re seeing more qualified buyers who have less of a risk of defaulting on their loans.

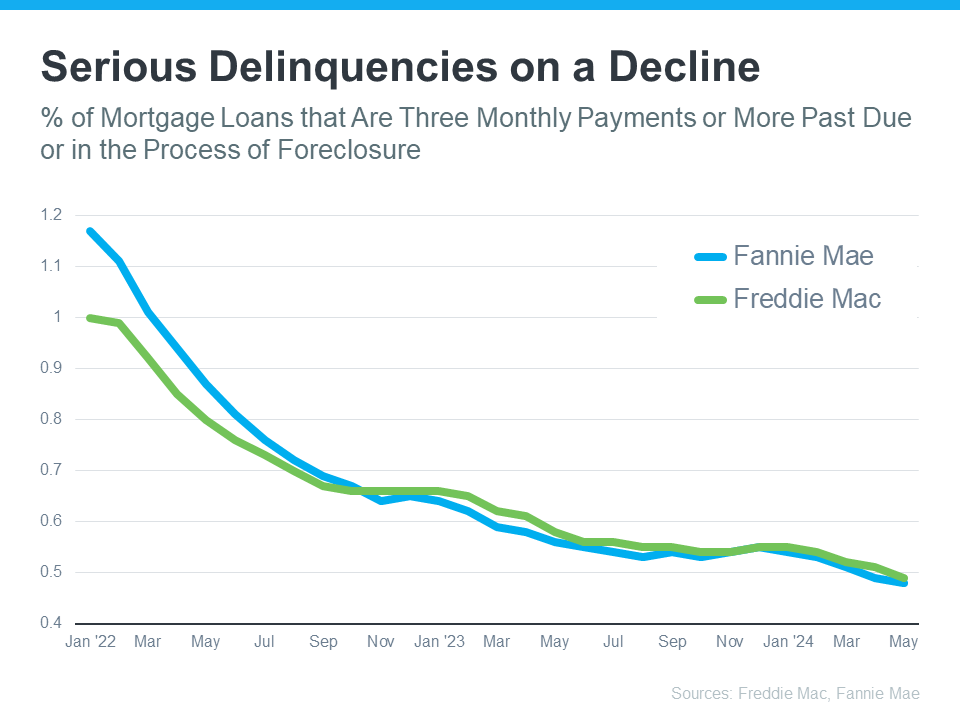

That’s why data from Freddie Mac and Fannie Mae shows the number of homeowners who are seriously behind on their mortgage payments (known in the industry as delinquencies) has been declining for quite some time. Take a look at the graph below:

What this means is that, not only are borrowers more qualified, but they’re also finding ways to navigate through their challenges, exploring their repayment options, or maybe even using the record amount of equity they have to sell and avoid foreclosure entirely.

The Answer Is: There’s No Sign of a Wave Coming

Before there can be a significant rise in foreclosures, the number of people who can’t make their mortgage payments would need to rise significantly. But, since so many buyers are making their payments today and homeowners have so much equity built up, a wave of foreclosures isn’t likely.

Take it from Bill McBride of Calculated Risk – an expert on the housing market who, after closely following the data and market leading up to the crash, was able to see the foreclosure crisis coming in 2008. McBride says:

“We will NOT see a surge in foreclosures that would significantly impact house prices (as happened following the housing bubble) for two key reasons: 1) mortgage lending has been solid, and 2) most homeowners have substantial equity in their homes.”

If you’re worried about a potential foreclosure crisis, know there’s nothing in the data to suggest that’ll happen. Buyers are more qualified now, and that’s one reason why they’re not falling seriously behind on their mortgage payments.

Why a Foreclosure Wave Isn’t on the Horizon

The specter of a new foreclosure wave has haunted the housing market for years. Memories of the 2008 housing crash linger, and the echoes of economic uncertainty can stir fears of a repeat performance. But is this apprehension justified? Let’s dive into the details.

A Different Era of Mortgage Lending

A cornerstone of the 2008 crisis was the laxity of lending standards. Lenders were handing out home loans with reckless abandon, often to applicants with questionable credit scores and insufficient income. The result was a market saturated with homeowners who were fundamentally unable to sustain their mortgage payments.

Today, the landscape is dramatically different. Lenders have learned their lesson. Rigorous underwriting guidelines are the norm. Credit scores are scrutinized, income is verified, and debt-to-income ratios are calculated with precision. This means that buyers are more qualified now than ever before. The days of subprime lending are, thankfully, behind us.

The Equity Cushion

Another crucial factor mitigating the risk of a foreclosure crisis is the substantial equity homeowners have built up in recent years. House prices have soared, granting property owners a financial safety net. This equity serves as a buffer against economic downturns and unexpected financial challenges. It provides homeowners with the ability to sell their homes and pay off their mortgages without resorting to foreclosure.

A Robust Economy

While economic conditions are never entirely predictable, the current economic climate is far more stable than it was leading up to the 2008 crash. Unemployment rates are relatively low, consumer confidence is generally positive, and wage growth is steady. These factors contribute to a healthier housing market and reduce the likelihood of widespread financial distress among homeowners.

Government Interventions

The government has also taken steps to prevent a recurrence of the foreclosure crisis. Programs aimed at helping homeowners avoid foreclosure, such as loan modifications and forbearance plans, have been implemented. These initiatives provide a safety net for those who may face temporary financial difficulties.

In Conclusion

While it’s essential to remain vigilant and monitor economic indicators, the evidence suggests that a big wave of foreclosures is unlikely in the near future. The combination of stricter lending standards, increased homeowner equity, a relatively stable economy, and government support measures creates a significantly different landscape than the one that existed during the 2008 crisis.

If you’re considering buying a home in West Palm Beach and are concerned about potential risks, don’t hesitate to reach out to a local mortgage expert. A qualified professional can provide personalized guidance and help you navigate the home buying process with confidence.

West Palm Beach offers a vibrant real estate market with a wide range of options to suit different lifestyles and budgets. Whether you’re a first-time home buyer or looking to refinance your existing mortgage, there are affordable West Palm Beach home loans and competitive mortgage rates available.

By understanding the factors that contribute to market stability and working with experienced professionals like a West Palm Beach mortgage broker, you can make informed decisions and achieve your homeownership goals.

Remember, while the past can offer valuable insights, it’s essential to focus on the present and future when making real estate decisions.

Would you like to delve deeper into a specific aspect of the housing market or explore other real estate topics?

The Myth of the Impending Foreclosure Wave

The specter of a looming foreclosure wave casts a long shadow over the minds of many homeowners and investors alike. However, a closer examination of the current housing market reveals a stark contrast to the conditions that precipitated the 2008 crisis. While it’s prudent to maintain a watchful eye on economic indicators, the likelihood of a repeat performance is significantly diminished.

A Fortress of Equity

One of the most potent safeguards against foreclosure is the substantial equity homeowners have amassed in recent years. The meteoric rise in house prices has transformed homes into veritable gold mines, providing a substantial financial cushion for many. This newfound wealth serves as a bulwark against economic headwinds and unexpected life events. Moreover, the ability to tap into home equity through refinancing or home equity lines of credit offers homeowners additional financial flexibility.

The Underwriting Uprising

The subprime lending debacle of the mid-2000s was a catalyst for sweeping changes in the mortgage industry. Lenders have tightened their belts, implementing stringent lending standards to mitigate risk. Credit scores, income verification, and debt-to-income ratios are now subjected to rigorous scrutiny. The result is a pool of qualified buyers far less susceptible to financial hardship. While these measures may have made it more challenging for some to secure a mortgage, they have undoubtedly contributed to a more stable housing market.

Economic Underpinnings

The current economic landscape, while not without its challenges, is considerably more robust than the precipice that preceded the 2008 crash. A relatively low unemployment rate, steady wage growth, and improving consumer confidence paint a portrait of a resilient economy. These factors collectively bolster homeowners’ ability to meet their financial obligations, including mortgage payments.

Government Intervention: A Safety Net

Recognizing the devastating consequences of the foreclosure crisis, policymakers have implemented safeguards to prevent a recurrence. Programs designed to assist homeowners facing financial difficulties, such as loan modifications and forbearance plans, offer a lifeline to those on the brink. While these interventions cannot entirely eliminate the risk of foreclosure, they significantly reduce its likelihood.

A Regional Perspective: West Palm Beach

The West Palm Beach real estate market, like many other regions, has experienced substantial growth in recent years. While local economic conditions and market dynamics can vary, the fundamental factors supporting a stable housing market apply equally to this region. For those considering purchasing a home in West Palm Beach, exploring options such as first-time home buyer loans and taking advantage of competitive mortgage rates can make homeownership more attainable.

West Palm Beach mortgage brokers can provide invaluable guidance throughout the home buying process, helping clients navigate the complexities of the mortgage market and find the best loan options to suit their needs.

Conclusion

The specter of a new foreclosure wave is largely a product of fear and historical memory. While it’s essential to approach the housing market with a degree of caution, the evidence suggests that the risk of a widespread crisis is minimal. A confluence of factors, including increased homeowner equity, stricter lending standards, a relatively stable economy, and government interventions, has created a significantly more resilient housing market.

For those seeking to purchase a home in West Palm Beach or explore refinancing options, consulting with a local mortgage expert can provide the knowledge and support needed to make informed decisions.

Would you like to explore specific aspects of the West Palm Beach real estate market or delve deeper into a particular mortgage-related topic?

Navigating the West Palm Beach Housing Market

The West Palm Beach real estate market has undergone a transformative journey in recent years. While the specter of a national foreclosure wave may have receded, local market dynamics merit careful consideration.

A Shifting Market

The once red-hot West Palm Beach housing market has shown signs of cooling. Factors such as rising interest rates and an inventory surplus have contributed to a more balanced market. While this shift may initially spark concerns among sellers, it presents opportunities for buyers. With fewer bidding wars and more negotiating power, potential homeowners can find attractive deals.

The Allure of West Palm Beach

Despite market fluctuations, West Palm Beach continues to be a desirable destination for both residents and investors. Its enviable climate, thriving economy, and proximity to world-class amenities make it a compelling location. This underlying demand provides a solid foundation for the market, mitigating the risk of a significant downturn.

The Role of Mortgage Financing

Securing the right mortgage is paramount to successful homeownership. Whether you’re a first-time home buyer or looking to refinance, understanding your options is crucial. West Palm Beach mortgage brokers can provide invaluable guidance, helping you compare mortgage rates, explore different loan programs, and determine the best financing structure for your needs.

Building Equity and Financial Stability

As previously discussed, equity is a powerful tool for financial security. In West Palm Beach, where property values have historically shown appreciation, building equity over time can be a strategic investment. By making consistent mortgage payments and avoiding unnecessary debt, homeowners can increase their stake in their property.

The Importance of Local Expertise

Navigating the complexities of the West Palm Beach real estate market requires local knowledge. A seasoned West Palm Beach mortgage broker can provide insights into market trends, property values, and neighborhood dynamics. Their expertise can help you make informed decisions and achieve your homeownership goals.

Conclusion

While the West Palm Beach housing market has experienced fluctuations, its underlying strength and appeal remain intact. By understanding market dynamics, securing appropriate financing, and working with local experts, buyers and sellers can navigate this evolving landscape with confidence.

Would you like to delve deeper into specific aspects of the West Palm Beach real estate market, such as investment opportunities, luxury properties, or affordable housing options?

West Palm Beach: A Hotbed for Real Estate Investment

West Palm Beach has undeniably transformed into a magnet for real estate investors. Its strategic location, coupled with a thriving economy and an upscale lifestyle, has propelled it to the forefront of the investment landscape.

Unlocking Investment Opportunities

-

Luxury Properties: The demand for high-end residences in West Palm Beach remains robust. As a haven for affluent individuals and celebrities, the city boasts a thriving luxury market. Investing in luxury properties can yield substantial returns, particularly in prime locations with waterfront views or proximity to world-class amenities.

-

Rental Properties: Given the influx of both residents and tourists, West Palm Beach offers a promising rental market. Whether it’s traditional long-term rentals or short-term vacation rentals, there’s potential for consistent cash flow. Understanding local regulations and tenant demand is crucial for maximizing returns.

-

Commercial Real Estate: The city’s economic growth has fueled demand for commercial spaces. Offices, retail establishments, and hospitality venues are in high demand. Investing in commercial real estate can provide stable income and long-term appreciation.

Navigating the West Palm Beach Market

While West Palm Beach presents lucrative investment opportunities, it’s essential to approach the market with a strategic mindset. Conduct thorough market research, analyze property values, and consider factors such as location, rental yields, and potential appreciation. Collaborating with a knowledgeable West Palm Beach real estate agent or commercial mortgage broker can provide invaluable insights and guidance.

Mitigating Risks

Like any investment, real estate carries inherent risks. To protect your investment, consider the following:

- Diversification: Spreading your investment across different property types or locations can help mitigate risk.

- Due Diligence: Thoroughly investigate properties before purchasing, including conducting property inspections and reviewing financial records.

- Risk Management: Develop a comprehensive investment plan that outlines your goals, risk tolerance, and exit strategy.

Conclusion

West Palm Beach offers a compelling investment landscape for those seeking to capitalize on real estate opportunities. By understanding market trends, conducting thorough research, and implementing sound investment strategies, you can position yourself for success in this dynamic market.

Would you like to explore specific investment strategies or discuss potential challenges in the West Palm Beach real estate market?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice