Home Prices Are Climbing in These Top Cities

Thinking about buying a home or selling your current one to find a better fit? If so, you might be wondering what’s going on with home prices these days. Here’s the scoop.

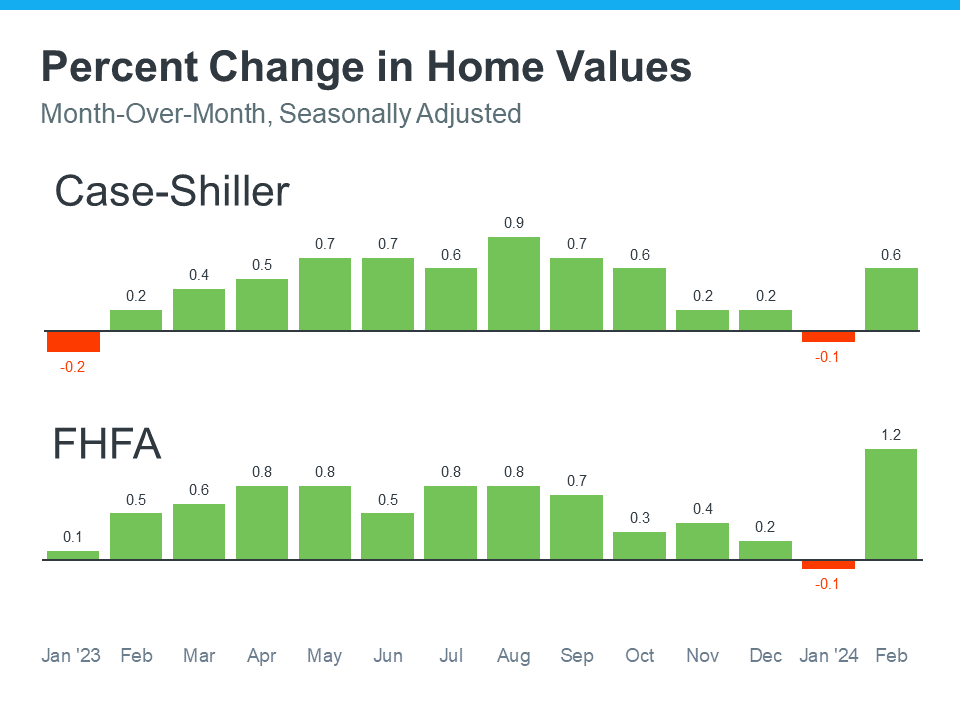

The latest national data from Case-Shiller and the Federal Housing Finance Agency (FHFA) shows they’re going up (see graphs below):

As you can see, home prices were rising for most of 2023. But over the course of December and January, they were virtually flat – which is pretty normal for that time of year.

But here’s what you need to know now. As of February, when the spring market kicked off, prices were on the rise again.

Home Prices Are Going Up in Most of America’s Top Cities

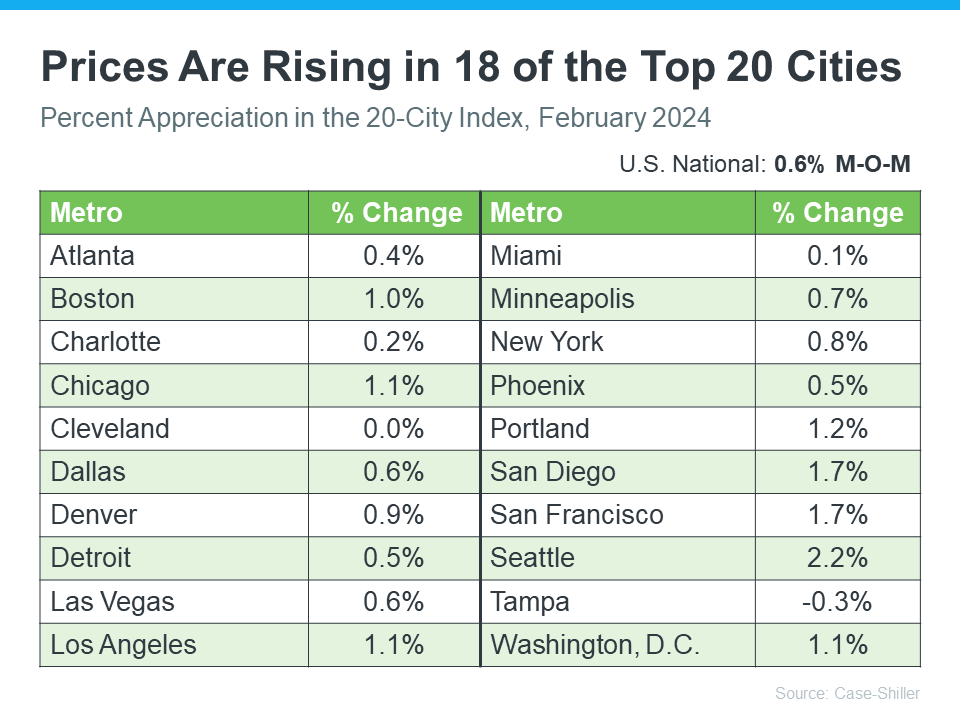

After seeing a jump in home prices nationally in February, you might be wondering if they’re going up in your area, too. While it depends on where you live, prices are rising in 18 of the top 20 cities Case-Shiller reports on in the monthly price index (see chart below):

Most experts also think home prices will keep rising and end the year on a high note. Forbes explains why:

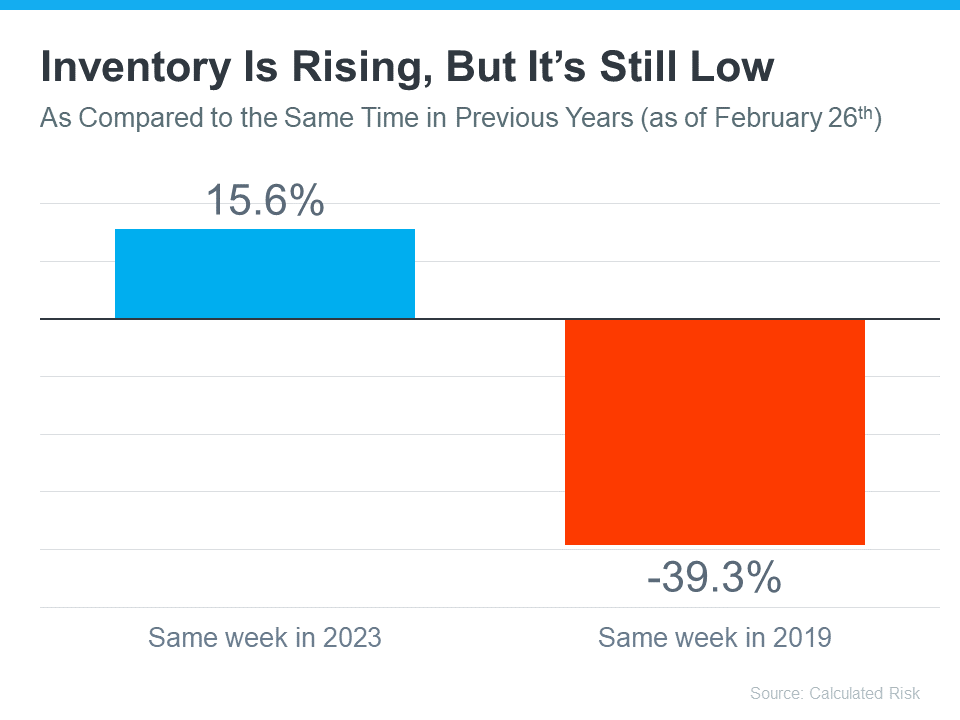

“Even as mortgage rates have reached their highest level since November, persistent demand coupled with limited housing supply are key drivers pushing home values upward.”

How This Impacts You

- For Buyers: If you’re ready, willing, and able to buy a home, purchasing before prices go up even more might be a smart choice, since home values are expected to keep climbing.

- For Sellers: Prices are going up because there still aren’t enough homes available for sale right now compared to today’s buyer demand. So, if you work with an agent to price your house right, you might receive multiple offers and sell quickly.

The data shows home prices are increasing nationally. Let’s chat to see exactly what’s going on with prices in our neighborhood.

Home Prices Are Climbing in These Top Cities

In today’s dynamic real estate market, home prices are skyrocketing in several key cities across the United States. Whether you’re looking to buy a home or considering selling, understanding the trends and factors driving these increases can be incredibly beneficial. Let’s take a closer look at some of the top cities where home values are on the rise and what this means for both buyers and sellers.

West Palm Beach: A Coastal Gem with Rising Home Values

West Palm Beach, a vibrant city known for its beautiful coastline and luxurious lifestyle, is experiencing a significant surge in home prices. The allure of sun-soaked beaches, cultural amenities, and a burgeoning downtown area is attracting more buyers than ever. For those looking to buy a home here, the market offers a mix of opportunities and challenges.

Mortgage rates play a crucial role in determining home prices. With interest rates fluctuating, prospective buyers need to stay informed. Luckily, the West Palm Beach mortgage broker community is robust, offering a variety of Affordable West Palm Beach home loans and Best mortgage rates in West Palm Beach. First-time buyers can find First time home buyer loans in West Palm Beach to ease their entry into the market.

For those seeking to refinance, West Palm Beach refinancing options are plentiful. Local expertise is invaluable, and Local mortgage lenders in West Palm Beach provide personalized service, often utilizing West Palm Beach mortgage calculators to help clients understand their financial commitments. Whether you need Property loan advice in West Palm Beach or are exploring Commercial mortgage broker in West Palm Beach services, the options are comprehensive.

Austin: The Tech Hub with a Booming Real Estate Market

Austin, Texas, has earned its reputation as a tech hub, and with this growth comes a booming real estate market. The influx of tech giants and startups has driven demand for housing, causing home prices to soar. This city’s unique blend of vibrant music, tech innovation, and an ever-expanding culinary scene makes it a magnet for young professionals and families alike.

The increasing demand has strained the housing supply, with fewer homes available for sale. Consequently, sellers are in a favorable position to price your house right and sell quickly. Working with a local agent who understands the nuances of Austin’s market is essential. Buyers need to be prepared with Mortgage preapproval in West Palm Beach, even if they’re not purchasing in Florida, as it sets a precedent for securing competitive mortgage rates.

Seattle: High Demand and Limited Supply

Seattle continues to be a hotspot for real estate, driven by the presence of major corporations like Amazon and Microsoft. The city’s natural beauty and cultural attractions add to its appeal. However, the demand for housing far exceeds the housing supply, leading to an upward trend in home prices.

For those looking to buy a home in Seattle, the competition is fierce. Securing the Best mortgage rates in West Palm Beach can be an excellent strategy to ensure affordability. Although it might seem counterintuitive, working with a West Palm Beach mortgage broker can provide insights into national mortgage trends and help buyers in any city navigate the complex lending landscape.

Nashville: Music City Hits High Notes in Home Prices

Nashville, renowned for its music scene, is also making headlines for its rising home values. The city’s charm, combined with economic growth and a strong job market, has made it a desirable place to live. This surge in popularity is driving up home prices, making it a competitive market for buyers.

For sellers, this is an opportune time to price your house right and sell quickly. Buyers should consider exploring Affordable West Palm Beach home loans to finance their purchase, as these loans often offer competitive terms that can be advantageous even outside of Florida. Consulting with a Local mortgage lender in West Palm Beach can provide valuable insights into the best financing options available.

Denver: The Mile-High City’s Real Estate Ascent

Denver’s real estate market is climbing to new heights, much like its famous Rocky Mountains. With its outdoor lifestyle, booming economy, and vibrant cultural scene, Denver attracts a diverse array of homebuyers. This increased demand has led to a significant rise in home prices.

Prospective buyers in Denver should be ready to move quickly. Getting Mortgage preapproval in West Palm Beach can give buyers a competitive edge by demonstrating financial readiness. Sellers in Denver are in a prime position to capitalize on the market conditions, ensuring they can sell quickly and at a favorable price.

San Francisco: The Ever-Expensive Bay Area

San Francisco has long been known for its exorbitant home prices, and this trend shows no signs of slowing down. The tech industry’s continuous growth fuels demand, while the limited housing supply exacerbates the situation. This combination keeps home values at a premium.

For those determined to buy a home in San Francisco, working with a seasoned real estate agent is crucial. Securing the Best mortgage rates in West Palm Beach can offer a financial advantage, helping buyers manage the high costs associated with this market. Sellers can benefit from the high demand, making it a prime time to sell quickly.

Miami: A Hotspot for Real Estate Investment

Miami’s real estate market is as hot as its climate. With its international appeal, cultural diversity, and bustling nightlife, Miami attracts investors and homebuyers from around the globe. The demand for homes available for sale continues to rise, pushing home prices higher.

Buyers looking to invest in Miami’s market should consider the various financing options available. Affordable West Palm Beach home loans can be a strategic choice, offering favorable terms that might be more beneficial than local Miami options. Sellers in Miami are in a strong position to take advantage of the increasing home values, ensuring a quick and profitable sale.

Boston: Historic Charm with Modern Appeal

Boston, with its rich history and modern amenities, is experiencing a surge in home prices. The city’s prestigious universities, thriving job market, and cultural attractions make it a desirable location. However, this desirability has led to a limited housing supply, increasing competition among buyers.

For those aiming to buy a home in Boston, securing Mortgage preapproval in West Palm Beach can streamline the buying process, showcasing financial preparedness. Sellers can benefit from the high demand, making it an excellent time to price your house right and sell quickly.

Chicago: The Windy City’s Real Estate Winds of Change

Chicago’s real estate market is witnessing notable growth, with home prices on the rise. The city’s diverse neighborhoods, strong economy, and cultural attractions draw a wide range of buyers. However, the increasing demand has put pressure on the housing supply, driving home values higher.

Buyers in Chicago should explore various financing options, including those available in West Palm Beach, to secure favorable terms. Consulting with a West Palm Beach mortgage broker can provide insights into national mortgage trends and help buyers navigate the complex market. Sellers can capitalize on the favorable conditions to sell quickly and at a premium price.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice