Are We Heading into a Balanced Market?

If you’ve been keeping an eye on the housing market over the past couple of years, you know sellers have had the upper hand. But is that going to shift now that inventory is growing? Here’s a breakdown of what you need to know.

What Is a Balanced Market?

A balanced market is generally defined as a market with about a five-to-seven-month supply of homes available for sale. In this type of market, neither buyers nor sellers have a clear advantage. Prices tend to stabilize, and there’s a healthier number of homes to choose from. And after many years when sellers had all the leverage, a more balanced market would be a welcome sight for people looking to move. The question is – is that really where the market is headed?

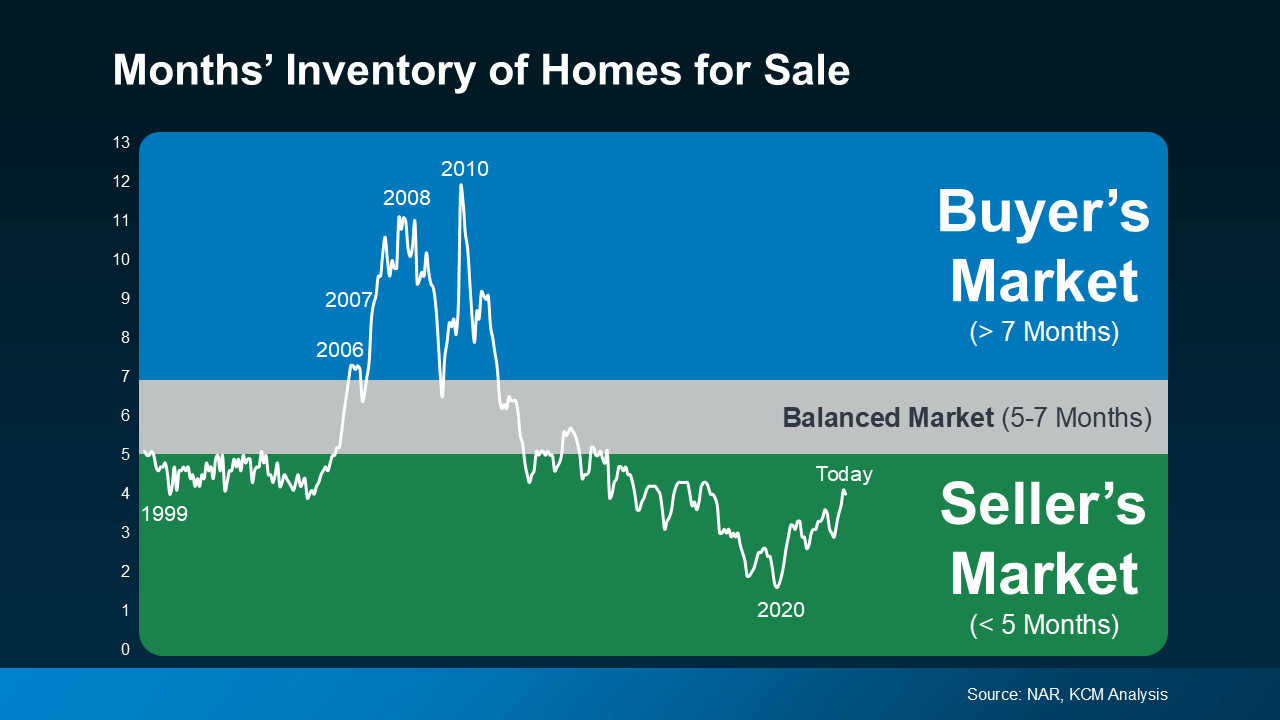

After starting the year with a three-month supply of homes nationally, inventory has increased to four months. That may not sound like a lot, but it means the market is getting closer to balanced – even though it’s not quite there yet. It’s important to note this increase in inventory is not leading to an oversupply that would cause a crash. Even with the growth lately, there’s still nowhere near enough supply for that to happen.

The graph below uses data from the National Association of Realtors (NAR) to give you an idea of where inventory has been in the past, and where it’s at today:

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:

For now, this is still seller’s market territory – it’s just not as frenzied of a seller’s market as it’s been over the past few years. As Mark Fleming, Chief Economist at First American, says:

“The faster housing supply increases, the more affordability improves and the strength of a seller’s market wanes.”

What This Means for You and Your Move

Here’s how this shift impacts you and the market conditions you’ll face when you move. Lawrence Yun, Chief Economist at NAR, explains:

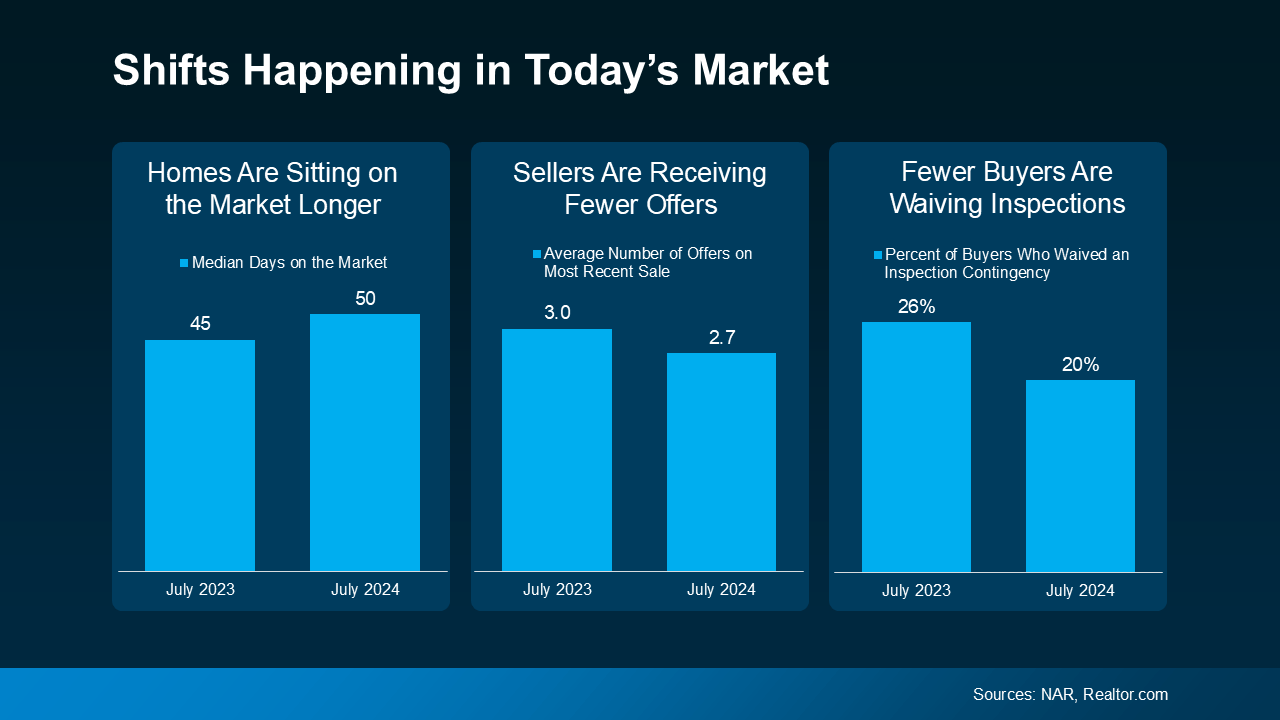

“Homes are sitting on the market a bit longer, and sellers are receiving fewer offers. More buyers are insisting on home inspections and appraisals, and inventory is definitively rising on a national basis.”

The graphs below use the latest data from NAR and Realtor.com to help show examples of these changes:

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

Homes Are Sitting on the Market Longer: Since more homes are on the market, they’re not selling quite as fast. For buyers, this means you may have more time to find the right home. For sellers, it’s important to price your house right if you want it to sell. If you don’t, buyers might choose better-priced options.

Sellers Are Receiving Fewer Offers: As a seller, you might need to be more flexible and willing to compromise on price or terms to close the deal. For buyers, you could start to face less intense competition since you have more options to choose from.

Fewer Buyers Are Waiving Inspections: As a buyer, you have more negotiation power now. And that’s why fewer buyers are waiving inspections. For sellers, this means you need to be ready to negotiate and address repair requests to keep the sale moving forward.

How a Real Estate Agent Can Help

But this is just the national picture. The type of market you’re in is going to vary a lot based on how much inventory is available. So, lean on a local real estate agent for insight into how your area stacks up.

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights, so you know exactly what’s happening and how to navigate it.

The real estate market is always changing, and it’s important to stay informed. Whether you’re buying or selling, understanding this shift toward a balanced market can help. If you have any questions or need expert advice, don’t hesitate to reach out.

Are We Heading into a Balanced Market?

The Housing Market has always been a dynamic dance between buyers and sellers. Sometimes it sways heavily in favor of sellers, driving up prices, creating bidding wars, and reducing the time it takes to get a home off the market. Other times, buyers hold the cards, choosing from a vast number of homes to choose from, waiting for just the right moment to make their move. But where do we stand today? Are we truly heading into a Balanced Market? And what does that mean for those who are buying or selling?

What is a Balanced Market?

Before diving into whether we’re heading there, it’s crucial to define what a Balanced Market really is. A Balanced Market exists when the supply of homes available for sale equals buyer demand. In this scenario, neither buyer nor seller holds a significant advantage. Homes sell at a reasonable pace, typically at or near the listing price, and the market conditions feel steady. There’s no frenzy, no panic—just a steady rhythm.

In contrast, a Seller’s Market leans heavily in favor of those selling. In such conditions, buyers are often scrambling, competing with others, and may have to offer above asking price to snag a home. On the flip side, a buyer’s market favors those looking to purchase, with an abundance of homes to choose from and often the ability to negotiate prices down.

So, are we moving towards balance, or is the scale still tipped?

Analyzing the Current Supply of Homes Nationally

In recent years, we’ve seen wild swings in the real estate market. The pandemic fueled a surge in demand as people re-evaluated their living situations, seeking more space, suburban living, or even vacation homes. This sudden spike in demand led to a sharp decline in the supply of homes available for sale.

But as interest rates have risen and inflation concerns loom, there’s been a noticeable shift. Sellers who once had the upper hand are starting to see longer listing times, fewer multiple offers, and more negotiation. The supply of homes nationally is slowly creeping back up, and with that comes the question: Are we inching closer to that coveted balance?

Pricing Your House Right

For those considering selling in this shifting environment, understanding where the market is headed is crucial. One of the most significant challenges is to price your house right. In a Seller’s Market, pricing aggressively often works in your favor. But as balance approaches, overpricing can lead to stagnation. You don’t want your home lingering on the market, signaling to buyers that something might be wrong.

Pricing right isn’t just about looking at comparables in your area; it’s about anticipating where the market is going. A local real estate agent can be an invaluable asset here. They have their finger on the pulse of the Housing Market and can help you navigate these waters with precision.

How a Real Estate Agent Can Help

Whether you’re buying or selling, leaning on a local real estate agent is one of the smartest moves you can make. They offer insights into market conditions, the supply of homes available for sale, and even local nuances that could affect the value of your property.

For sellers, an agent can guide you in staging your home, conducting inspections, and navigating home inspections and appraisals. These are critical steps to ensure that your home is presented in the best possible light to potential buyers. Moreover, they’ll help you price your house right, a delicate balance that requires a keen understanding of the Housing Market.

For buyers, especially first-timers, agents can help find the right home in a market that may still feel tight. They know where to look, what to negotiate, and how to avoid potential pitfalls.

The Role of Mortgage Brokers in a Balanced Market

If you’re considering buying, especially in places like West Palm Beach, now is the time to explore your financing options. With interest rates fluctuating, finding the Best mortgage rates in West Palm Beach can make a significant difference in your purchasing power. West Palm Beach mortgage brokers are experts at navigating this complex landscape. They can guide you through the various options available, from Affordable West Palm Beach home loans to more specialized products like First time home buyer loans in West Palm Beach.

For those already owning a home, West Palm Beach refinancing options might be worth exploring as well. With the market evolving, refinancing can offer a chance to lock in a lower rate, reduce your payments, or even tap into your home’s equity. Working with Local mortgage lenders in West Palm Beach gives you a personalized touch, understanding your needs and goals.

And let’s not forget the importance of Mortgage preapproval in West Palm Beach. In a market that’s balancing out, preapproval gives you an edge. It shows sellers that you’re serious and financially ready to make a move, which can be the difference between securing your dream home or losing it to another buyer.

Commercial Real Estate and Local Expertise

The shifting market isn’t just affecting residential buyers and sellers. Commercial real estate is also undergoing changes. For those interested in investment properties or expanding their business, a Commercial mortgage broker in West Palm Beach can provide insights tailored to your unique needs. Whether you’re looking to invest in retail space, office buildings, or industrial properties, having the right financing is crucial.

Moreover, tools like West Palm Beach mortgage calculators can help you estimate your monthly payments and better understand your financial situation. Armed with this information, you can make more informed decisions, whether you’re buying a commercial property or refinancing an existing one.

The Importance of Home Inspections and Appraisals

In a Balanced Market, the importance of home inspections and appraisals cannot be overstated. Inspections provide buyers with peace of mind, ensuring that they aren’t walking into a money pit filled with unexpected repairs. Meanwhile, appraisals are essential for both buyers and sellers to ensure that the home’s value is in line with the purchase price.

For sellers, preparing for these steps is crucial. Ensuring your home is in good condition, addressing any known issues beforehand, and being transparent with potential buyers can prevent deals from falling through at the last minute. Again, this is where a seasoned real estate agent can offer guidance, helping you navigate these often nerve-wracking stages of the selling process.

Navigating Market Conditions with Local Expertise

The market conditions in a Balanced Market require both buyers and sellers to be more strategic. In West Palm Beach, for example, the market can fluctuate depending on neighborhood trends, local amenities, and even seasonal shifts. A West Palm Beach mortgage broker can offer insights into how financing options may vary depending on the timing of your purchase or sale.

Furthermore, Property loan advice in West Palm Beach is more critical than ever. Whether you’re looking for Affordable West Palm Beach home loans or specialized commercial financing, getting the right advice can save you thousands in the long run.

Looking Ahead: Are We Really Heading Towards Balance?

The million-dollar question remains: Are we truly heading into a Balanced Market? The signs are there. The supply of homes nationally is slowly increasing, and buyers are no longer facing the frantic conditions of the past few years. But the road to balance isn’t a straight line. Economic factors, interest rates, and even global events can push the market in one direction or another.

For now, it’s essential to remain informed and strategic. Whether you’re looking to find the right home, explore West Palm Beach refinancing options, or invest in commercial real estate, having the right team behind you makes all the difference. Lean on a local real estate agent, work with experienced mortgage brokers, and stay attuned to the ever-evolving real estate market.

In conclusion, as we edge closer to a Balanced Market, the key is preparation. Whether you’re a buyer looking to make a smart investment or a seller aiming to get the most out of your property, understanding the changing landscape is crucial. Stay informed, seek expert advice, and be ready to adapt as the market continues to evolve.

Adapting to the Shifts: What Buyers Should Know

As we inch closer to a Balanced Market, buyers must be equipped with a fresh set of strategies. Unlike the frenzied environment of a Seller’s Market, where buyers often rushed to make decisions, a more balanced atmosphere allows for careful consideration, strategic offers, and the potential to negotiate better terms. However, this doesn’t mean you can be complacent.

One of the most significant advantages of a balanced market is the increased number of homes to choose from. Buyers no longer need to feel pressured to jump on the first available property they see. But even with more options, buyers should still do their homework and understand that not all homes are created equal. Some may appear appealing but could hide costly issues revealed during home inspections.

Getting a home inspection is an absolute must in a balanced market. It ensures you’re not buying a home that requires significant repairs, which could offset any perceived savings. In a market that’s no longer dominated by sellers, buyers have the power to negotiate repairs or request concessions based on the results of an inspection. This is where working with a real estate agent becomes invaluable. They can help you navigate the process, ensuring that any issues uncovered don’t turn your dream home into a financial burden.

Moreover, buyers should keep a close eye on financing options. While Mortgage preapproval in West Palm Beach is still a critical step, especially when competition does arise, buyers now have the luxury of shopping around for the best deals. This is where engaging with a West Palm Beach mortgage broker can make all the difference. Brokers have access to a range of lenders and can help you secure Affordable West Palm Beach home loans that match your financial situation.

And for those looking to maximize their savings, utilizing West Palm Beach mortgage calculators can provide a clear picture of what your monthly payments might look like, factoring in interest rates, taxes, and insurance. Having this information at your fingertips allows you to make a more informed decision, helping you avoid overextending yourself in an uncertain economy.

Sellers: Preparing for the Shift

On the flip side, sellers must adjust their strategies as we move toward a Balanced Market. Gone are the days when simply listing your home resulted in multiple offers above asking price. Now, it’s about showcasing your property in the best possible light and pricing it competitively.

For sellers, the key to success lies in the details. Home inspections and appraisals become even more important in a balanced market. Ensuring that your home passes inspection with flying colors can prevent deal-breaking surprises. Additionally, accurate appraisals are crucial because buyers in a balanced market are less likely to pay over the appraised value. Pricing your home too high can lead to stagnation, where potential buyers move on to more competitively priced properties.

Sellers should also consider the power of curb appeal and staging. A well-presented home can make a significant difference in a balanced market. This is where leaning on your real estate agent comes into play. They know what buyers are looking for and can guide you on how to make your property stand out. Whether it’s recommending minor updates, decluttering, or even suggesting professional staging services, your agent’s insights can help you attract the right buyers.

And remember, pricing isn’t just about looking at what other homes in your area sold for. It’s about understanding the current market conditions and where things are headed. An agent with local expertise will help you price your house right so it sells within a reasonable timeframe without leaving money on the table.

The West Palm Beach Advantage: Local Expertise Matters

For buyers and sellers in West Palm Beach, understanding the local market is critical. West Palm Beach has its own unique trends, and what happens nationally doesn’t always reflect what’s happening locally. The importance of working with a local real estate agent who understands these nuances cannot be overstated.

For buyers, West Palm Beach offers a range of housing options, from waterfront properties to suburban homes. Whether you’re a first-time homebuyer looking for First time home buyer loans in West Palm Beach or a seasoned investor exploring West Palm Beach refinancing options, having a local expert who knows the area’s ins and outs will give you a significant advantage.

Similarly, sellers can benefit from agents who understand what buyers are looking for in West Palm Beach. These agents know how to position your home to attract the right kind of attention. They’re also in tune with local trends, such as which neighborhoods are hot and which ones might be cooling off.

Beyond just buying and selling, financing options are crucial to consider. Local mortgage lenders in West Palm Beach offer personalized service that national lenders may not provide. They understand the specific needs of West Palm Beach buyers, including the local economy, property values, and the best financing options available. Whether you’re looking for the best mortgage rates in West Palm Beach or exploring options for a commercial property, working with a local lender ensures you’re getting advice tailored to your situation.

For investors or business owners looking to expand, a Commercial mortgage broker in West Palm Beach can be a game-changer. Commercial real estate is a different beast compared to residential properties, and having a broker who understands the local commercial market can help you secure the right property and financing.

Navigating Refinancing in a Balanced Market

If you’re a homeowner considering refinancing, a Balanced Market can offer unique opportunities. With interest rates fluctuating, now could be the right time to explore West Palm Beach refinancing options. Refinancing allows you to adjust your loan terms, potentially lowering your monthly payments or shortening the term of your loan. It can also be an opportunity to tap into the equity you’ve built in your home, giving you extra cash for home improvements or other investments.

However, refinancing isn’t a decision to take lightly. The key is to work with Local mortgage lenders in West Palm Beach who can help you understand the true cost of refinancing. While lowering your interest rate might seem like a no-brainer, it’s essential to consider the closing costs and how long you plan to stay in your home. A good lender will walk you through these calculations, helping you determine if refinancing makes sense for your specific situation.

For those considering more significant investments or expansions, a Commercial mortgage broker in West Palm Beach can help you navigate refinancing options for your commercial properties as well. Commercial loans often have different terms and requirements, and a broker with local expertise can help you find the best financing solutions to meet your business goals.

The Road Ahead: Staying Informed and Ready to Act

As we approach what appears to be a Balanced Market, the key to success lies in staying informed and being ready to act when the time is right. For buyers, this means working closely with a real estate agent to find the right home and securing financing that meets your needs through a West Palm Beach mortgage broker. For sellers, it’s about pricing strategically, preparing your home for sale, and making sure you have the right team behind you to navigate this new market landscape.

No one can predict the future with absolute certainty, but by staying attuned to the market conditions and seeking expert advice, both buyers and sellers can position themselves for success. Whether you’re exploring Affordable West Palm Beach home loans, considering refinancing options, or simply trying to understand where the real estate market is headed, having the right information and the right professionals by your side will make all the difference.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice