Homeowners Gained $28K in Equity over the Past Year

If you own a home, your net worth has probably gone up a lot over the past year. Home prices have been rising, which means you’re building equity much faster than you might think. Here’s how it works.

Equity is the current value of your home minus what you owe on the loan.

Over the past year, there have still been more people wanting to buy than there are homes available for sale, and that’s pushed prices up. That rise in prices has translated directly into increasing equity for homeowners.

How Much Equity Have You Earned over the Past 12 Months?

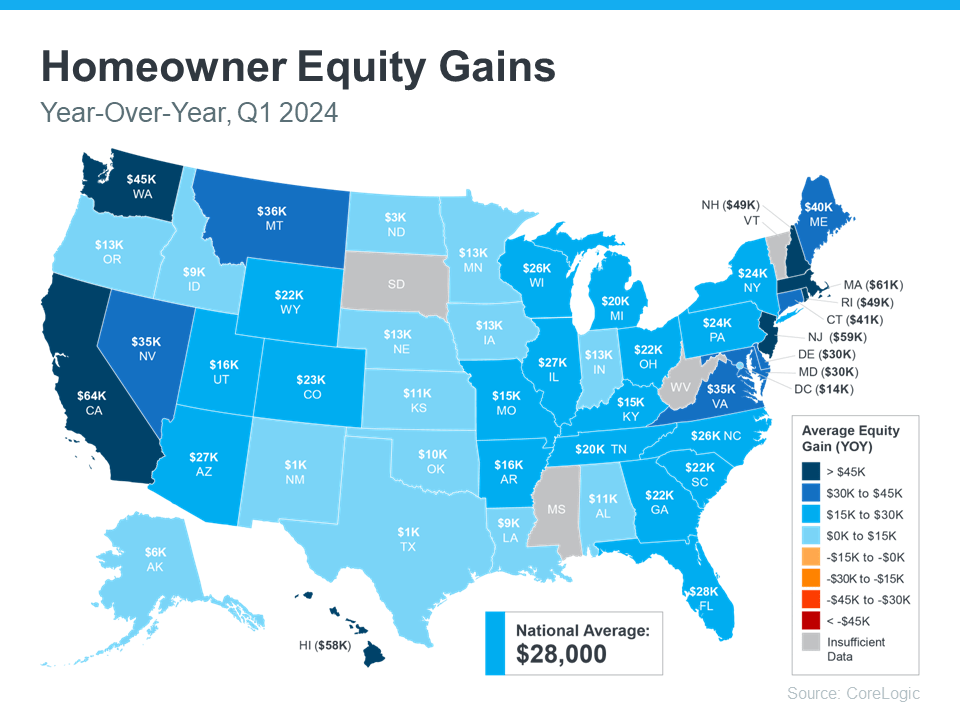

According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $28,000 in the last year alone.

That’s the national average, so if you want to see what’s happening in your state, check out the map below. It uses data from CoreLogic to show how much equity has grown in each state over the past year. You’ll notice every single state with sufficient data saw annual equity gains:

What If You Bought Your House Before the Pandemic?

If you bought your house before the pandemic, the equity news is even better. According to data from Realtor.com, home prices shot up by 37.5% from May 2019 to May 2024, meaning your home’s value has likely increased significantly. Ralph McLaughlin, Senior Economist at Realtor.com, says:

“Homeowners have seen extraordinary gains in home equity over the past five years.”

To give context to how much equity can stack up over time, Selma Hepp, Chief Economist at CoreLogic, explains the total equity the typical homeowner has today:

“With home prices continuing to reach new highs, owners are also seeing their equity approach the historic peaks of 2023, close to a total of $305,000 per owner.”

How Your Rising Home Equity Can Help You

With how prices skyrocketed a few years ago, and the ongoing price growth today, homeowners clearly have substantial equity built up – and that has some serious benefits.

You could use it to start a business, fund an education, or even to help you afford your next home. When you sell, the equity you’ve built up comes back to you, and may be enough to cover a big part – or even all – of your next home’s down payment.

If you’re planning to move, the equity you’ve gained can really help. Curious about how much you have and how you can use it to help pay for your next home? Let’s connect.

Boom! That Home Equity Jackpot You Didn’t Know You Won

Hey there, fellow homeowners! Buckle up, because I’m about to drop some seriously good news on you. According to the latest housing market reports, the average homeowner’s equity has skyrocketed by a whopping $28,000 in the past year alone! That’s right, your home’s value has likely been on a tear, quietly building you a home equity windfall.

Let’s unpack this a bit. Remember equity? It’s the magic number that represents the difference between your home’s current value and what you still owe on your mortgage. Think of it as your ownership stake in your home, constantly growing like a well-tended garden.

So, what’s been causing this equity bonanza? It all boils down to simple supply and demand. There just aren’t enough homes available for sale to meet the surge of eager buyers. This fierce competition has driven home prices upwards, translating directly into increasing equity for homeowners like yourself.

Here’s the kicker: this $28,000 figure is just the national average. Depending on your location and when you bought your home, your gains could be even sweeter. Especially if you snagged your place pre-pandemic, you might be sitting on a home equity goldmine thanks to the phenomenal price appreciation witnessed in recent years.

Now, hold on a sec before you start mentally redecorating your dream mansion. This home equity news is fantastic, but it’s important to understand how it can help you. Here are a few ways this newfound financial firepower can work wonders:

-

Afford Your Next Home: That home equity you’ve built can be a game-changer when it comes to buying your next place. A larger down payment fueled by your equity translates to a smaller mortgage, potentially opening the door to pricier homes or securing a more favorable interest rate.

-

Pay for Your Next Home’s Down Payment: Let’s say you’ve been eyeing a move up the property ladder. That equity you’ve accumulated can be a substantial chunk of your next home’s down payment, significantly reducing the amount you need to borrow. Now, picture yourself strolling into that dream home with a swagger!

-

How Your Rising Home Equity Can Help You – Unlock Renovation Riches: Maybe your current abode is your forever home (lucky you!). But even then, your increasing equity can be a financial springboard for renovations and upgrades. Need a gourmet kitchen or a sparkling new pool? Tapping into your equity through a home equity loan or line of credit can make those home improvement dreams a reality.

-

Not Just for Single-Family Dwellings – Commercial Property Potential: Are you a savvy real estate investor with commercial properties in your portfolio? This home equity surge extends beyond single-family homes. You might be able to leverage the increased equity in your commercial properties to access capital for new ventures or expansions.

Feeling a little overwhelmed by the possibilities? Don’t worry, that’s where your trusty West Palm Beach mortgage broker comes in. They can help you navigate the world of home equity and unlock its full potential.

Here at America’s Mortgage Solutions, we’re a team of passionate mortgage experts dedicated to getting you the best possible deals. Whether you’re a first-time home buyer looking for an affordable loan, or a seasoned investor seeking West Palm Beach refinancing options, we’ve got your back.

We offer a comprehensive suite of services, including:

- Affordable West Palm Beach Home Loans

- Best Mortgage Rates in West Palm Beach

- First-Time Home Buyer Loans in West Palm Beach

- West Palm Beach Refinancing Options

- Local Mortgage Lenders in West Palm Beach

- West Palm Beach Mortgage Calculators

- Property Loan Advice in West Palm Beach

- Commercial Mortgage Broker in West Palm Beach

- Mortgage Preapproval in West Palm Beach

So, don’t let this home equity windfall sit idle. Contact us today for a free consultation and let’s explore how we can help you turn your newfound financial power into reality. Remember, your dream home (or renovation project, or investment opportunity) might be closer than you think!

Equity Empowerment: Beyond the Basics

We’ve established that your home equity has likely been on a growth spurt, but there’s more to this story than meets the eye. Let’s delve a little deeper and explore some strategic ways to leverage this valuable asset:

-

The Art of the Bi-Weekly Mortgage Payment: Most mortgage payments are monthly, but did you know you can split them in half and pay bi-weekly? This seemingly small tweak can shave years off your mortgage term and accelerate building equity much faster. It’s all about the power of compounding interest. Those extra payments early on go towards reducing the principal balance, saving you money on interest in the long run.

-

Befriend Your Escrow Account: An escrow account holds funds for property taxes and homeowner’s insurance. Conduct an annual review to ensure there’s enough in there to cover upcoming bills. If there’s a surplus, you can request a refund and apply it directly towards your mortgage principal, further boosting your equity.

-

Don’t Neglect Those Preventative Measures: Regular maintenance might seem like an expense, but it’s actually an investment in your home’s longevity and value. Taking care of minor issues promptly prevents them from snowballing into expensive repairs down the line. A well-maintained home not only protects your investment but also positions it for better appreciation, leading to even greater equity.

-

Harness the Power of Strategic Renovations: Not all renovations are created equal. Focus on improvements that enhance your home’s functionality, curb appeal, and energy efficiency. These types of upgrades tend to recoup their cost, or even add more value, when it comes time to sell. This translates to a higher selling price and a larger chunk of equity to pocket.

-

Stay Informed, Stay Ahead: The housing market is dynamic, and staying abreast of trends can be hugely beneficial. Partnering with a knowledgeable West Palm Beach mortgage broker like ourselves keeps you in the loop about market conditions, potential interest rate fluctuations, and home equity trends. This empowers you to make informed decisions about your homeownership journey.

Equity: Your Key to Financial Freedom

Home equity is more than just a financial metric; it’s a key that unlocks a treasure trove of possibilities. It can be your springboard to a bigger and better home, a source of funding for dream renovations, or a strategic tool for expanding your investment portfolio.

Don’t let this valuable asset remain untapped. Reach out to the experts at America’s Mortgage Solutions today. Our team of passionate West Palm Beach mortgage brokers is here to guide you through the intricacies of home equity and help you craft a personalized plan to unlock its full potential.

Remember, knowledge is power, and when it comes to home equity, we’re here to equip you with the tools and expertise you need to navigate the exciting financial opportunities that lie ahead. Let’s turn your home equity into a springboard for achieving your dreams!

Equity Esoterica: A Peek for the Savvy Homeowner

Alright, fellow homeowners, we’ve covered the essential strategies for leveraging your home equity. But for those of you who crave a deeper dive, buckle up for a thrilling exploration of some lesser-known equity concepts:

-

House Hacking: Ever considered turning your home into a cash-generating machine? House hacking involves renting out a portion of your property, like a basement apartment or spare room. The rental income can then be used to help cover your mortgage payments, further accelerating equity building. Just remember to research local regulations and ensure your property is suitable for multi-occupancy.

-

HELOC Heroics: A Home Equity Line of Credit (HELOC) is a revolving line of credit secured by your home’s equity. Think of it like a credit card backed by the value of your home. HELOCs can be a great tool for financing unexpected expenses or funding smaller, staged renovations. However, it’s crucial to tread carefully and only borrow what you can comfortably repay.

-

The Mighty Reverse Mortgage: For our senior homeowners out there, a reverse mortgage offers a unique way to tap into your home equity. With a reverse mortgage, you receive a loan based on a portion of your home’s value, which you don’t have to repay monthly. The loan is then repaid through the sale of the home when you move out, leave it to heirs, or pass away. It’s important to seek professional financial guidance before considering this option, as it carries specific implications for estate planning and future housing options.

-

Equity for the Eco-Conscious: Thinking green? Energy-efficient renovations can not only save you money on utility bills but also enhance your home’s value and equity. Government incentives and tax credits are often available for eco-friendly upgrades, making them an even more attractive option.

-

The Art of the Strategic Downsize: Downsizing isn’t for everyone, but for some, it can be a smart way to unlock significant home equity. If your nest has become an empty one, selling your current home and buying a smaller one can free up a substantial amount of equity. This capital can then be used to invest, fund your retirement, or simply enjoy a more carefree lifestyle.

Equity: The Journey Continues

The world of home equity is vast and ever-evolving. By staying informed, exploring strategic options, and partnering with a trusted West Palm Beach mortgage broker, you can ensure your home’s equity works for you, not the other way around.

At America’s Mortgage Solutions, we’re committed to empowering homeowners with the knowledge and tools they need to navigate the exciting landscape of home equity. Contact us today and let’s embark on a journey to unlock the full potential of your most valuable asset. Your dream home, financial security, and a brighter future await!

Equity Enlightened: Frequently Asked Questions

Let’s face it, even with all this talk of home equity, questions are bound to arise. Here, we shed light on some of the most frequently asked queries:

Q: How much equity do I actually have in my home?

A: This can be calculated by subtracting your remaining mortgage balance from your home’s current market value. A qualified appraiser can provide a professional valuation, or you can explore online tools that offer market estimates.

Q: Is it always wise to tap into my home equity?

A: Not necessarily. Home equity represents a significant stake in your home’s ownership. Before using it, carefully consider your financial goals, risk tolerance, and repayment capabilities. Consulting with a financial advisor can be immensely helpful in making informed decisions.

Q: What if my home equity isn’t as high as I’d hoped?

A: Don’t despair! Remember, home equity is constantly evolving. Focus on strategies like consistent mortgage payments, bi-weekly payments if feasible, and smart renovations to accelerate its growth over time.

Q: I’m worried about the housing market taking a downturn. Could that impact my equity?

A: The housing market is cyclical, and downturns are a possibility. However, history suggests that long-term homeownership generally benefits from appreciation. Maintaining your home in good condition and staying informed about market trends can help mitigate risk.

Q: When should I consider contacting a West Palm Beach mortgage broker?

A: The short answer: anytime you have questions about home equity! Our team of experts is here to guide you through the intricacies of equity utilization, loan options, and strategic planning. We can help you leverage your home equity to achieve your financial goals with confidence.

The Takeaway: Knowledge is Power

By demystifying the world of home equity, we hope to empower you, the homeowner, to make informed decisions and unlock the full potential of this valuable asset. Remember, your home equity is a powerful tool, and with the right guidance, it can be your key to achieving financial security and realizing your dreams.

So, don’t hesitate to reach out to the experts at America’s Mortgage Solutions today. Let’s embark on this exciting financial journey together and turn your home equity into a springboard for a brighter future!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice