How the Economy Impacts Mortgage Rates

As someone who’s thinking about buying or selling a home, you’re probably paying close attention to mortgage rates – and wondering what’s ahead.

One thing that can affect mortgage rates is the Federal Funds Rate, which influences how much it costs banks to borrow money from each other. While the Federal Reserve (the Fed) doesn’t directly control mortgage rates, they do control the Federal Funds Rate.

The relationship between the two is why people have been watching closely to see when the Fed might lower the Federal Funds Rate. Whenever they do, that’ll put downward pressure on mortgage rates. The Fed meets next week, and three of the most important metrics they’ll look at as they make their decision are:

- The Rate of Inflation

- How Many Jobs the Economy Is Adding

- The Unemployment Rate

Here’s the latest data on all three.

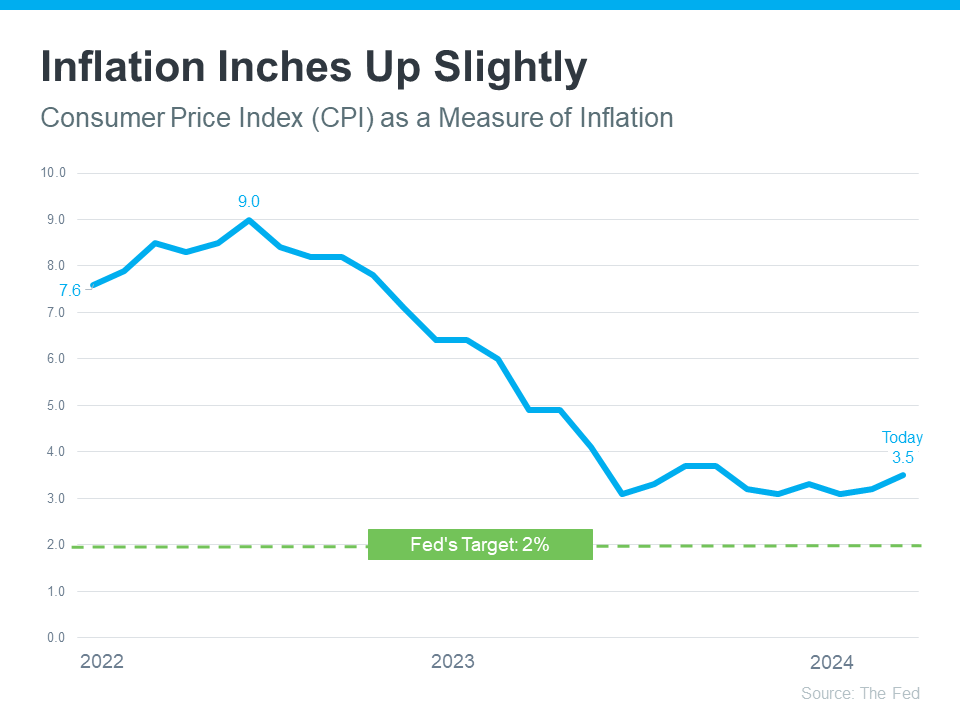

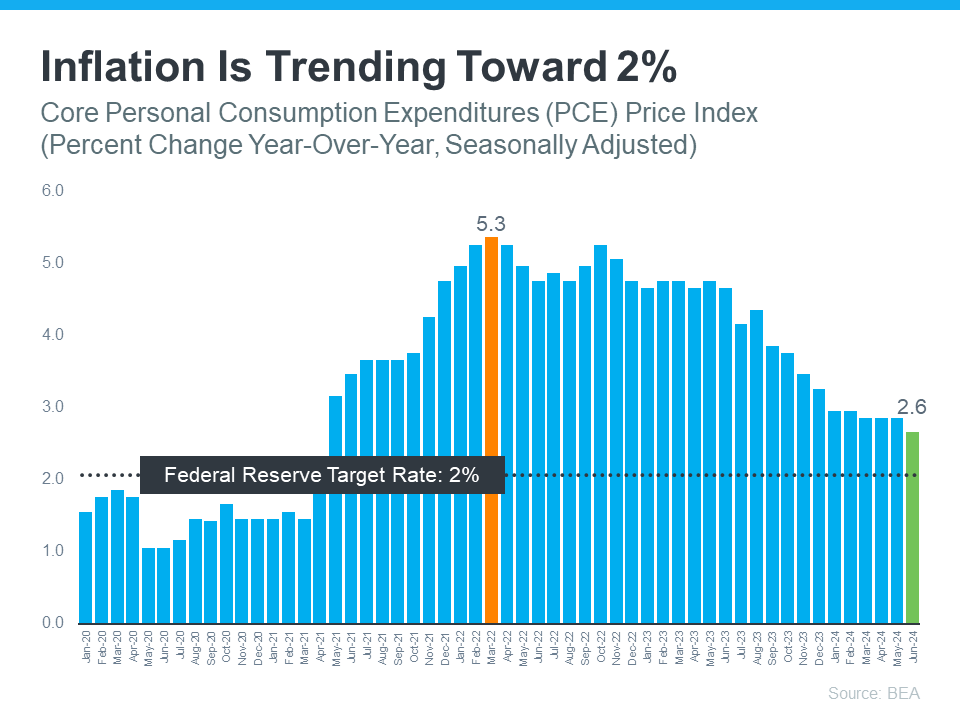

1. The Rate of Inflation

You’ve probably heard a lot about inflation over the past year or two – and you’ve likely felt it whenever you’ve gone to buy just about anything. That’s because high inflation means prices have been going up quickly.

The Fed has stated its goal is to get the rate of inflation back down to 2%. Right now, it’s still higher than that, but moving in the right direction (see graph below):

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

The Fed is also watching how many new jobs are created each month. They want to see job growth slow down consistently before taking any action on the Federal Funds Rate. If fewer jobs are created, it means the economy is still strong but cooling a bit – which is their goal. That appears to be exactly what’s happening now. Inman says:

“. . . the Bureau of Labor Statistics reported that employers added fewer jobs in April and May than previously thought and that hiring by private companies was sluggish in June.”

So, while employers are still adding jobs, they’re not adding as many as before. That’s an indicator the economy is slowing down after being overheated for quite some time. This is an encouraging trend for the Fed to see.

3. The Unemployment Rate

The unemployment rate is the percentage of people who want to work but can’t find jobs. So, a low rate means a lot of Americans are employed. That’s a good thing for many people.

But it can also lead to higher inflation because more people working means more spending – which drives up prices. Right now, the unemployment rate is low, but it’s been rising slowly over the past few months (see graph below):

What Does This Mean Moving Forward?

While mortgage rates are going to continue to be volatile in the days and months ahead, these are signs the economy is headed in the direction the Fed wants to see. But even with that, it’s unlikely they’ll cut the Federal Funds Rate when they meet next week. Jerome Powell, Chair of the Federal Reserve, recently said:

“We want to be more confident that inflation is moving sustainably down toward 2% before we start the process of reducing or loosening policy.”

Basically, we’re seeing the first signs now, but they need more data and more time to feel confident that this is a consistent trend. Assuming that direction continues, according to the CME FedWatch Tool, experts say there’s a projected 96.1% chance the Fed will lower the Federal Funds Rate at their September meeting.

Remember, the Fed doesn’t directly set mortgage rates. It’s just that whenever they decide to cut the Federal Funds Rate, mortgage rates should respond.

Of course, the timing of when the Fed takes action could change because of new economic reports, world events, and other factors. That’s why it’s usually not a good idea to try to time the market.

Recent economic data may signal that hope is on the horizon for mortgage rates. Let’s connect so you have an expert to keep you up to date on the latest trends and what they mean for you.

How the Economy Impacts Mortgage Rates: A Deep Dive

The intricate dance between the economy and mortgage rates is a captivating spectacle for those immersed in the world of buying or selling a home. It’s a complex interplay of forces, where seemingly disparate economic indicators intertwine to shape the cost of borrowing for your dream abode. Let’s unravel this enigma.

Understanding the Economic Underpinnings

At the heart of this economic ballet lies the Federal Funds Rate, the interest rate at which banks lend reserves to each other overnight. While it might sound esoteric, this rate is a powerful conductor of the economic orchestra. When the Federal Reserve, the nation’s central bank, decides to increase this rate, it’s akin to tightening the purse strings of the economy. The goal? To curb inflation, the insidious creep of rising prices.

Now, here’s where it gets interesting. As the Federal Reserve attempts to tame inflation by raising the Federal Funds Rate, it influences the broader cost of borrowing. This includes mortgage rates. Lenders aren’t immune to these economic currents. To offset the increased cost of funds, they often adjust their mortgage rates upward. It’s a domino effect, with each piece impacting the next.

The Unemployment Rate: A Key Player

The unemployment rate is another pivotal character in this economic drama. When the job market is robust and unemployment is low, consumer confidence tends to soar. People feel more secure financially, and the allure of buying a home becomes increasingly enticing. This surge in demand for homes can push mortgage rates upward as lenders respond to the heightened competition.

Conversely, when the economy falters and unemployment rises, the housing market can experience a slowdown. To entice borrowers, lenders may offer more competitive mortgage rates. It’s a classic case of supply and demand at work.

Inflation’s Impact on Mortgage Rates

Inflation casts a long shadow over the mortgage landscape. When prices are rising rapidly, lenders become wary of lending money over extended periods. They worry that the value of the money they’ll receive back in the future will be eroded by inflation. To compensate for this risk, they often increase mortgage rates. This protects their bottom line while reflecting the diminished purchasing power of future dollars.

Finding Your Way Through the Mortgage Maze

Navigating the complex world of mortgage rates can be daunting, especially for first-time home buyers. But fear not! There are resources available to help you make informed decisions. A West Palm Beach mortgage broker can provide invaluable guidance, helping you find the best mortgage rates in West Palm Beach to suit your financial situation.

Whether you’re exploring West Palm Beach refinancing options or seeking Affordable West Palm Beach home loans, a knowledgeable broker can assist you. They can also help you with mortgage preapproval and provide insights into property loan advice.

For those looking to delve deeper into the numbers, West Palm Beach mortgage calculators can be a powerful tool. These digital wizards can help you estimate your monthly payments, compare different loan options, and understand the impact of mortgage rates on your overall budget.

The Broader Economic Picture

While we’ve focused on the relationship between the economy and mortgage rates, it’s essential to consider the broader economic context. Factors such as government policies, geopolitical events, and investor sentiment can all influence interest rates.

For instance, if the government implements policies that stimulate economic growth, it can lead to increased demand for loans, including mortgages. This heightened demand can push mortgage rates higher. Conversely, if there’s economic uncertainty due to geopolitical tensions or other factors, investors may flock to safer assets like government bonds. This can drive down bond yields, which in turn can lead to lower mortgage rates.

Conclusion

The interplay between the economy and mortgage rates is a dynamic and ever-evolving relationship. By understanding the key factors that influence this relationship, you can make more informed decisions about buying or selling a home.

Whether you’re a seasoned investor or a first-time home buyer, seeking guidance from a West Palm Beach mortgage broker can be a wise move. They can help you navigate the complexities of the mortgage market and find the best financing options to suit your needs.

Remember, the economy is a living organism, constantly adapting and evolving. Stay informed, stay flexible, and consult with experts to make the most of your mortgage journey.

Would you like to focus on a specific aspect of the economy and mortgage rates?

The Mortgage Market: A Delicate Ecosystem

The mortgage market is a complex ecosystem, intricately linked to broader economic conditions. While Federal Funds Rate adjustments and inflation rates are the primary drivers, other factors also play a crucial role. For instance, government housing policies can significantly impact mortgage rates and overall market dynamics. Subsidized loan programs, tax deductions for homeowners, and regulations governing the housing industry can all influence the cost of borrowing.

Moreover, the availability of credit is a cornerstone of the mortgage market. When lending standards are relaxed, more people qualify for home loans, increasing demand and potentially pushing mortgage rates upward. Conversely, stricter lending criteria can dampen demand, leading to downward pressure on rates.

The Role of Local Economic Conditions

While national economic trends undoubtedly shape the mortgage landscape, local economic conditions also wield considerable influence. A thriving job market, robust economic growth, and a desirable lifestyle can make a city like West Palm Beach a magnet for homebuyers. This increased demand can put upward pressure on mortgage rates as lenders respond to the heightened competition for borrowers.

Conversely, economic challenges in a particular region can lead to a slowdown in the housing market. This can result in lower mortgage rates as lenders compete for a smaller pool of borrowers.

The Impact of Investor Behavior

Investors play a pivotal role in the mortgage market. When investors are optimistic about the housing market, they tend to purchase mortgage-backed securities. This increased demand for these securities can drive down mortgage rates. However, if investor sentiment turns sour, it can lead to a decline in demand for mortgage-backed securities, pushing mortgage rates higher.

Fixed vs. Adjustable-Rate Mortgages

The choice between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is influenced by interest rate expectations. When mortgage rates are relatively low and expected to rise, a fixed-rate mortgage may be the preferred option, locking in a low rate for the life of the loan. However, if mortgage rates are expected to decline or remain stable, an ARM could offer initial savings.

It’s crucial to carefully consider your financial situation and long-term plans when choosing between these two mortgage types. A West Palm Beach mortgage broker can provide valuable insights to help you make an informed decision.

The Bottom Line

Understanding the intricate relationship between the economy and mortgage rates is essential for anyone considering buying or selling a home. By staying informed about economic indicators and consulting with knowledgeable professionals, you can make well-informed decisions about your mortgage financing.

Remember, the mortgage market is dynamic, and mortgage rates can fluctuate. It’s essential to monitor market trends and be prepared to adjust your plans accordingly.

Would you like to focus on a specific type of borrower, such as first-time homebuyers or those looking to refinance?

The First-Time Homebuyer’s Journey

For first-time homebuyers, navigating the complexities of the housing market can be overwhelming. Understanding how the economy impacts mortgage rates is crucial to making informed decisions. With Affordable West Palm Beach home loans available, there’s an opportunity to turn dreams into reality.

However, it’s essential to remember that mortgage rates are just one piece of the puzzle. Factors like income, credit score, and down payment size also play a significant role in determining homeownership affordability.

To help first-time homebuyers overcome these challenges, many lenders offer programs specifically designed to assist with down payment assistance and loan qualification. These programs, combined with competitive mortgage rates, can make homeownership more accessible.

The Refinancing Decision

For existing homeowners, refinancing can be a strategic move to capitalize on favorable economic conditions. If mortgage rates have declined since you obtained your current loan, refinancing could potentially save you money on your monthly payments.

However, it’s essential to weigh the potential savings against the closing costs associated with refinancing. A West Palm Beach mortgage broker can help you determine if refinancing is the right decision for your financial situation.

The Role of Technology

Technology has transformed the mortgage industry, making it easier for borrowers to access information and compare rates. West Palm Beach mortgage calculators are invaluable tools for estimating monthly payments and exploring different loan options. Online applications and digital document verification have streamlined the mortgage process, making it more convenient for borrowers.

Conclusion

The relationship between the economy and mortgage rates is a complex one, with far-reaching implications for both homeowners and prospective buyers. By understanding the key factors that influence mortgage rates and seeking guidance from experienced professionals, you can make informed decisions that align with your financial goals.

Whether you’re a first-time homebuyer eager to step onto the property ladder or a seasoned homeowner looking to optimize your mortgage, the right strategy can make a significant difference.

Would you like to explore a specific type of mortgage, such as jumbo loans or FHA loans?

Jumbo Loans vs. FHA Loans: A Comparative Analysis

Understanding the nuances of different mortgage types is essential for making informed decisions. Let’s delve into two common loan options: jumbo loans and FHA loans.

Jumbo Loans: For High-End Properties

Jumbo loans are designed for borrowers purchasing properties that exceed the conventional loan limit. These loans often come with stricter qualification criteria, requiring higher credit scores and larger down payments. However, they also typically offer more competitive interest rates than conventional loans.

If you’re eyeing a luxury property in a high-cost area like West Palm Beach, a jumbo loan might be your best bet. It’s essential to work with a West Palm Beach mortgage broker experienced in jumbo loans to navigate the complexities of this loan type.

FHA Loans: A Gateway to Homeownership

FHA loans are government-insured mortgages that offer more lenient qualification requirements compared to conventional loans. They allow for lower down payments and credit scores, making homeownership more accessible to a broader range of borrowers, including first-time homebuyers.

While FHA loans generally come with higher mortgage insurance premiums, they can be a viable option for those seeking Affordable West Palm Beach home loans. It’s important to weigh the benefits of lower upfront costs against the ongoing expense of mortgage insurance.

Choosing the Right Loan

Selecting the right mortgage depends on your individual financial situation and goals. Here are some factors to consider:

- Property value: If you’re purchasing a high-end property, a jumbo loan might be necessary.

- Down payment: FHA loans require a lower down payment, making them accessible to more borrowers.

- Credit score: Both loan types have credit score requirements, but FHA loans are generally more lenient.

- Income: Your income will determine your eligibility for both loan types.

- Long-term financial goals: Consider your plans for the property and how mortgage insurance might impact your overall costs.

A West Palm Beach mortgage broker can help you evaluate your options and determine the best loan type for your needs. They can also provide guidance on property loan advice and assist with the mortgage preapproval process.

Conclusion

The mortgage market offers a variety of options to suit different borrowers. Understanding the intricacies of jumbo loans and FHA loans is crucial for making informed decisions. By working with a knowledgeable West Palm Beach mortgage broker, you can find the perfect loan to finance your dream home.

Remember, the housing market is constantly evolving, and mortgage rates can fluctuate. Staying informed and seeking expert advice will help you navigate this complex landscape successfully.

Would you like to explore other mortgage options or delve deeper into a specific aspect of homeownership?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice