How Changing Mortgage Rates Impact You

Some Highlights

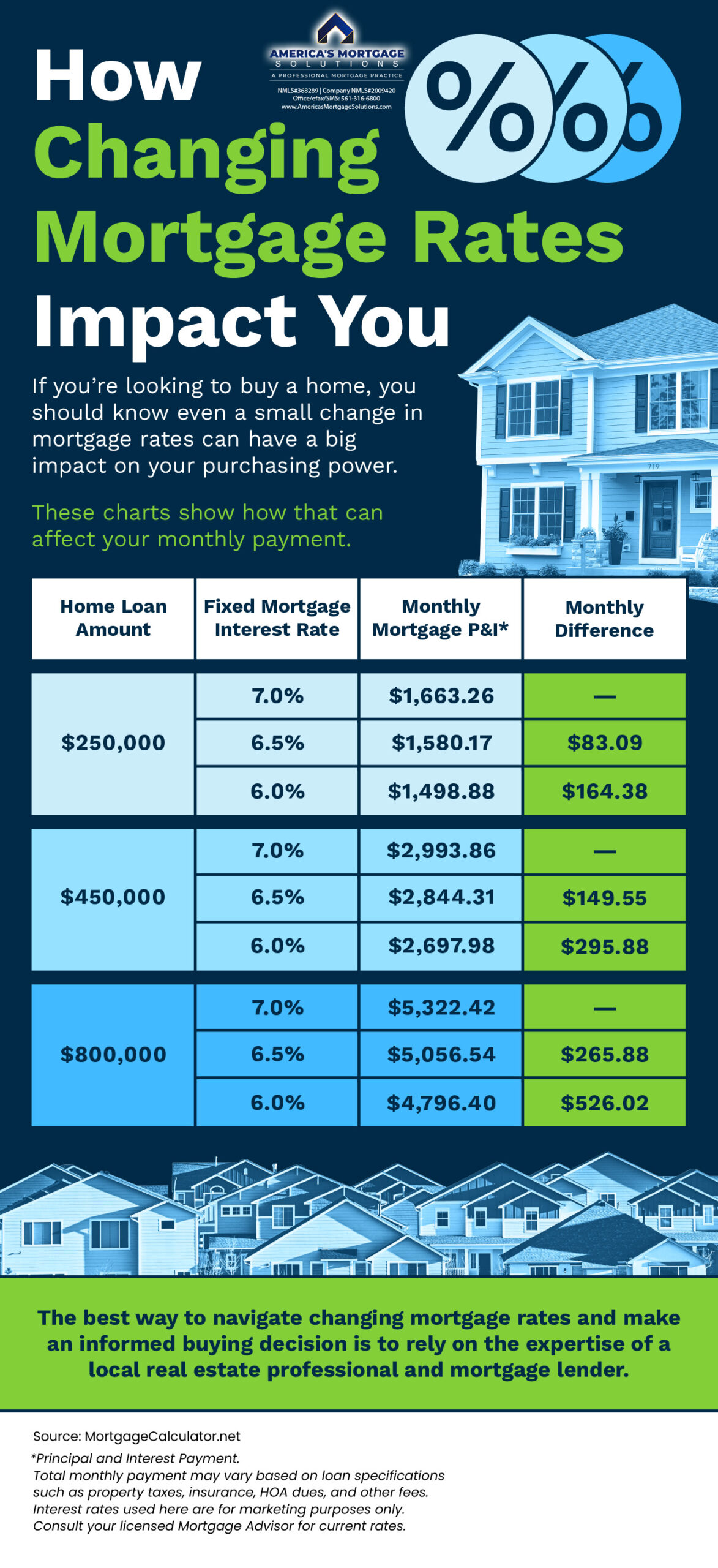

- If you’re looking to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month.

- That’s because even a small change in mortgage rates can have a big impact on your purchasing power.

- The best way to navigate changing mortgage rates and make an informed buying decision is to rely on the expertise of a local real estate professional and mortgage lender.

In the ever-evolving landscape of real estate, one of the most pivotal factors influencing both the market and the individual buyer’s journey is the fluctuation of Mortgage Rates. Understanding how these rates impact your financial standing and purchasing capabilities is not just a matter of cursory knowledge; it’s about making an informed buying decision that aligns with your long-term goals and financial health. This discussion aims to unpack the intricacies of mortgage rates and their significant impact on your purchasing power, offering insights from industry expertise to guide you through the maze of looking to buy a home.

The Mechanics of Mortgage Rates

At its core, a mortgage rate is the interest rate charged on a loan used to purchase a home or property. This rate can be either fixed, maintaining the same rate of interest for the duration of the mortgage, or variable, fluctuating with the market trends. The rate at which you borrow has a profound big impact on your purchasing power, essentially determining the cost of your home over time and the monthly payments you’ll make.

The Ripple Effect of Changing Mortgage Rates

When mortgage rates experience a shift, even a minor one, the ripple effects can be felt across the board. For potential homeowners looking to buy a home, an increase in rates means higher monthly payments, which could limit the price range of homes you can afford. Conversely, when rates drop, your purchasing power strengthens, allowing you to explore homes that may have been out of reach financially.

How Mortgage Rates Impact What You Can Afford

The direct relationship between mortgage rates and what you can afford is an essential consideration for anyone in the market for a new home. As rates decrease, you’re able to borrow more money without seeing a significant increase in your monthly payments. This enhanced borrowing capacity can open up a broader market of homes, potentially allowing you to buy into neighborhoods or property sizes that were previously beyond your budget.

Engaging with a Real Estate Professional

Navigating the complexities of mortgage rates and their implications on your buying power necessitates a partnership with those who wield the expertise in the field. A real estate professional can offer invaluable guidance, helping you to understand the current market trends and how they affect your buying capabilities. They can also assist in strategizing the best time to buy, leveraging their knowledge to your advantage.

The Role of a Mortgage Lender

A mortgage lender plays a pivotal role in your home buying journey, offering the financial lifeline needed to secure your property. This entity will evaluate your financial health, including your income, debt, and credit score, to determine the mortgage rate you’re eligible for. Given the significant impact on your purchasing power, selecting the right lender is a decision that requires careful consideration and, ideally, should be made with the advice of a real estate professional.

Making an Informed Buying Decision

In the realm of real estate, knowledge is power. The more informed you are about the factors affecting your ability to buy a home, including mortgage rates, the better positioned you are to make a decision that benefits your financial future. It’s about weighing your options, understanding the market, and moving forward with a plan that meets your needs and budget.

In conclusion, the interplay between mortgage rates and your ability to purchase a home is a dynamic that requires both understanding and strategy. Whether you’re looking to buy a home now or in the future, being equipped with the knowledge of how these rates affect your purchasing power is crucial. Engaging with expertise from real estate professionals and mortgage lenders can provide the support and guidance needed to navigate this landscape effectively. Ultimately, an informed buying decision is your best defense against the unpredictability of the market, ensuring that when you do buy, you do so with confidence and clarity.

In the journey of homeownership, the path is often illuminated by the insights and guidance provided by real estate professionals and mortgage lenders. Their expertise not only demystifies the process but also empowers potential buyers to make informed buying decisions. This part of the discussion delves deeper into the nuances of mortgage rates, offering a comprehensive understanding that helps in looking to buy a home.

The Importance of Timing

Timing plays a crucial role in the housing market, especially in relation to mortgage rates. These rates are influenced by a variety of factors including economic indicators, Federal Reserve policies, and global financial trends. An astute buyer, guided by seasoned real estate professionals, can leverage timing to their advantage. For instance, locking in a rate during a dip can result in significant long-term savings, enhancing your purchasing power.

Fixed vs. Variable Rates: A Strategic Decision

Choosing between a fixed and variable mortgage rate is a strategic decision that impacts your financial landscape for years to come. Fixed rates offer stability, allowing for consistent budgeting without the worry of future rate hikes. Variable rates, however, can offer lower initial rates with the potential for both decreases and increases over time, depending on market conditions. The choice between these two options should be made with a deep understanding of your financial stability and risk tolerance, areas where a mortgage lender can provide critical expertise.

The Effect of Mortgage Rates on Market Dynamics

Mortgage rates don’t just affect individual purchasing decisions; they influence the broader real estate market. Low rates can lead to a bustling market, with more people looking to buy a home, driving up demand and potentially prices. High rates might cool down the market, making it a buyer’s market where negotiation becomes a more prominent aspect of the buying process. Recognizing these market dynamics can help you make a more informed buying decision, determining the right moment to enter the market.

Long-term Financial Planning and Mortgage Rates

Understanding the long-term impact of mortgage rates on your financial health is crucial. A rate that might seem manageable in the short term could lead to financial strain over the life of the loan. This is where expertise from a mortgage lender becomes invaluable. They can help you calculate potential future scenarios, ensuring that your decision to buy aligns with your long-term financial goals and stability.

The Power of Pre-approval

Getting pre-approved by a mortgage lender is a powerful step in the home-buying process. It not only provides clarity on what you can afford but also strengthens your position when making an offer on a house. Pre-approval is based on your actual financial data, giving you a realistic understanding of your purchasing power and how mortgage rates affect your buying potential.

Navigating Rate Changes After Locking In

Once you’ve locked in a mortgage rate, it might seem like your financial equation is set. However, the market is always in flux, and rates can change. Some lenders offer a rate lock with a float-down option, meaning if rates decrease during your lock period, you can access the lower rate. This flexibility can be a significant advantage, emphasizing the importance of discussing all options with your mortgage lender.

Conclusion: The Path Forward

The relationship between mortgage rates and home purchasing is intricate, with many moving parts. Armed with the right expertise, prospective buyers can navigate this complex terrain, making informed buying decisions that align with both their immediate and long-term financial goals. Whether you’re just starting to explore the possibility of homeownership or you’re actively looking to buy a home, understanding the role of mortgage rates in shaping your purchasing power is essential. By partnering with knowledgeable real estate professionals and mortgage lenders, you can approach the home-buying process with confidence, ready to make the most of the opportunities the market presents.

As we delve further into the intricacies of navigating the real estate market, it becomes clear that a deep understanding of mortgage rates and their implications is not just beneficial—it’s imperative for anyone looking to buy a home. The journey to homeownership is filled with decisions that have long-lasting financial impacts, making the need for expertise and an informed buying decision more critical than ever. This segment explores additional facets of the mortgage landscape, offering further insights to prospective buyers.

The Psychological Impact of Mortgage Rates

Beyond the numbers and financial strategies lies the psychological aspect of dealing with mortgage rates. The prospect of rates increasing can create a sense of urgency, pushing buyers to make quick decisions to lock in lower rates. Conversely, declining rates can lead to indecision, as buyers might wait for rates to drop further. Understanding these psychological triggers and consulting with a real estate professional can help temper hasty decisions, ensuring that your choice to buy is based on sound financial planning and not just market pressures.

Mortgage Rates and Refinancing Opportunities

For existing homeowners, changes in mortgage rates present opportunities for refinancing. Refinancing can lead to lower monthly payments, reduced term lengths, or the ability to cash out equity. However, it’s essential to consider closing costs, the length of time you plan to stay in your home, and the break-even point when considering refinancing. Mortgage lenders can offer valuable expertise in this area, helping homeowners make a decision that aligns with their financial objectives.

The Global Perspective on Mortgage Rates

Mortgage rates are not isolated phenomena; they’re influenced by global economic trends, such as inflation rates, trade policies, and foreign investment flows. A savvy buyer should be aware of these broader economic indicators as they can have a big impact on your purchasing power. Engaging with real estate professionals who have a global perspective can provide a more nuanced understanding of when might be the best time to buy or sell.

Technology’s Role in Understanding Mortgage Rates

In today’s digital age, technology offers tools and platforms that provide real-time data on mortgage rates, affordability calculators, and market trends. These resources can be invaluable in making an informed buying decision. However, while technology can offer insights, the human element of expertise provided by real estate professionals and mortgage lenders cannot be underestimated. They can interpret this data in the context of your personal financial situation and the local real estate market.

Building Your Team: The Importance of Expertise

The journey to homeownership is rarely a solo endeavor. Building a team of trusted advisors, including a knowledgeable real estate professional, a reputable mortgage lender, and possibly a financial planner, can provide a comprehensive support system. This team can guide you through the nuances of mortgage rates, tax implications, and long-term planning, ensuring that your decision to buy a home is both informed and strategic.

Conclusion: A Strategic Approach to Home Buying

In conclusion, the landscape of mortgage rates and home buying is complex, with various factors influencing what you can afford. The decision to buy a home requires a strategic approach, one that considers current mortgage rates, market trends, and your personal financial situation. By leveraging the expertise of real estate professionals and mortgage lenders, prospective buyers can navigate this landscape with confidence, making informed buying decisions that resonate with their lifestyle and financial goals.

Whether you’re in the early stages of contemplating homeownership or actively looking to buy a home, the importance of understanding mortgage rates and their impact on your purchasing power cannot be overstated. In a journey filled with significant decisions, knowledge is not just power—it’s empowerment, enabling you to step into the real estate market with clarity and confidence.

Bottom Line

The bottom line in understanding how changing mortgage rates impact you is recognizing their profound influence on your purchasing power and the overall affordability of buying a home. In a fluctuating market, armed with expertise from real estate professionals and mortgage lenders, you can navigate these changes to make an informed buying decision. Whether you’re looking to buy a home now or in the future, staying informed about mortgage rates and how they affect what you can afford is crucial. It enables you to time your purchase strategically, potentially saving thousands over the life of your loan and ensuring that your investment aligns with your financial goals and lifestyle aspirations.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

|

|

|

|

|

|

|

|

|

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

|

We Specialize in All Types of Financing, Mortgage Loans and Real Estate Deals.

We have been in the Mortgage and Real Estate Business since 1997!

Personal Profiles:

American Dream TV Show | Mortgage Process Steps | Homebot Videos | Traditional Loan Programs | NON-QM & Portfolio Loan Programs

HomeBot: Build more wealth with your home

Our goal for you is to help you to minimize your tax liability and maximize your cash flow. In today’s market, a mortgage loan is more than ever a financial instrument that must be tied into your long and short-term personal financial plan. This will allow you to create a debt strategy that will help you to build long-term wealth for you and your family.

Check Our Reviews:Residential Financing Options:

Most all loan options are available in just about every state in the country : VA | FHA | USDA | Fannie/Freddie Conventional Loans |Reverse Mortgages | Jumbo Reverse Mortgages | Self Employed Loans | Bank Statement Loans | Investor DSCR Loans | Private Hard Money Loans | Fix & Flip Loans | Bridge Loans | No Ratio | No Income Primary Residence Loans | Jumbo & Super Jumbo loans to $50M.

Temporary Interest Rate Buy-downs on a fixed-rate conventional | FHA | VA loans: 3-2-1, 2/1 or 1/0.

Luxury Sales & Epic Loan Options:

We work with all types of Real Estate Sales & Financing options for Residential & Commercial Real Estate | Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Real Estate Closings | Residential & Commercial Insurance.

Commercial Financing Options:

Our commercial division and can do business in any state in the country for all types of Commercial Loans for owner occupied properties or for business purposes from $50k to $500M | bridge loans | new construction loans for both owner occupied & for investors for individual single family Developer or Builder Spec Homes Loans | Townhomes | Condos | Real Estate Projects for Single Family Home Communities | Townhome Communities | Ground up new construction condominium buildings | Commercial Buildings | Apartment Complex’s | Mixed-Use Projects | SBA loans for new businesses | new construction | acquisition | Refinancing an exciting Loan | business purpose loans for A/R | inventory or cash flow | Doctor Loans for Business Acquisition & Commercial Real Estate with LTV’s as high as 100% LTV

We are your One-Stop Brokerage for all your Personal Residential Mortgage Financing & Sales | Commercial Real Estate Mortgage Financing & Sales | Commercial Real Estate Developments | Yachts | Aircrafts | RVs | Collector & Exotic Cars | Roof & Solar Financing Packages | Homeowners insurance | Business Purpose personal and commercial needs.

Keep in mind we shop more than 250 residential and over 10K Commercial banks, lenders & mortgage companies to give you amazingly low rates and the largest product line in the country!

If you have any questions or if you have friends, family or clients, that are buying a home & need a mortgage or want to chat about a scenario just contact us right away:

1) 📅To schedule a time to talk with me just click here: 🔗 Schedule an Appointment with me: Click Here (pick the calendar that fits your specific situation)

2) 🏦 Apply for a mortgage now at www.ChristianPennersLoanApp.com

If you apply, please text me your full name and email address 📱561-373-0987 or

3) 📞Call me directly ☎️561-373-0987

Helping You Achieve The American Dream Of Home Ownership.

#AmericasMortgageSolutions #christianpenner #onestopbrokershop #mortgagebrokerwestpalmbeach #epicrealeststedeals #luxuryhomes #LuxurySales&EpicLoanOptions #TheChristianPennerMortgageTeam #buildwealth #mortgagebrokerflorida #theamericandream #finacingtheamericandream #realestate #mortgage #mortgagebroker #thanks #mortgagetips #mortgageadvice #RealEstateJourney #realtor #realestateexpert #realestatelife #realestategoals #realestatetips #realtorlifestyle #realtorsoffacebook #realtorforlife #businesspupose #mortgageloans #HouseHunting #DreamHome #homeownership #vacationhome #secondhome #homebuyer #interestrates #HousingMarket #stoprenting #commercialloans #ResidentialRealEstateDevelopments #CommercialRealEstateDevelopments #Yachts #Aircrafts #RVs #CollectorCars #ExoticCars #roofsolar #solar #roofSolarFinancingPackages #buildequity #planforyourfuture #buildyoufuture #television #host #tvproduction #streaming #travel #amazon #motivational #Agentmastermindclass #HorseFarms #EquestrianCenters #Vineyards #FruitandVegetableFarms #HobbyFarms #RealEstateInvestment #LuxuryRealEstate #PropertyManagement #RealEstateDevelopment #RealEstateAdvice #HomeStaging #RealEstateGoals #PropertyListing #EcoFriendlyHomes #RealEstatePhotography #UrbanRealEstate #SuburbanHomes #RuralProperties #RealEstateMarket #RealEstateForSale #RealEstateBrokerage #HomeRenovation #RealEstateTech #SmartHomeTechnology #GreenRealEstate #RealEstateNetworking #RealEstateSeminars #RealEstateLaw #RealEstateFinance #LuxuryApartments #CommercialProperties #RealEstateAuctions #HistoricHomes #WaterfrontProperties #CondoLiving

🔍 Whether you’re looking for financing 💰 or to BUY 🏡, SELL 🔄, LEASE 📝, INVEST 💹 or BUILD YOUR DREAM HOME 🏗️ or OFFICE 🏢 on Residential Properties 🏘️, Commercial Real Estate 🏬, or Development Commercial Real Estate 🏗️, Yachts 🛥️, Aircrafts ✈️, RVs 🚐, or Exotic Cars 🚗 – call us TODAY 📞. No matter the NEED 🎯 or GOAL 🏆 – let’s make CONFIDENT decisions together 👥💼.

Christian Penner, CMA

President | CEO | Mortgage Broker

NMLS#368289

America’s Mortgage Solutions, Inc NMLS#2009420

Cell/SMS: 561-373-0987

Direct/efax/SMS: 561-316-6800

Christian Penner712 U.S. Highway 1 North #300, North Palm Beach, FL 33408 |