Why Today’s Foreclosure Numbers Won’t Trigger a Crash

With everything feeling more expensive these days, it’s natural to worry about how rising costs might impact the housing market. Many people are concerned that high prices and tighter budgets could cause more homeowners to fall behind on their mortgage payments, leading to a wave of foreclosures.

But before you start worrying about a housing market crash, here’s a look at what’s really happening. And the good news is: the latest foreclosure data shows there’s no wave on the horizon.

How Today’s Market Is Different from 2008

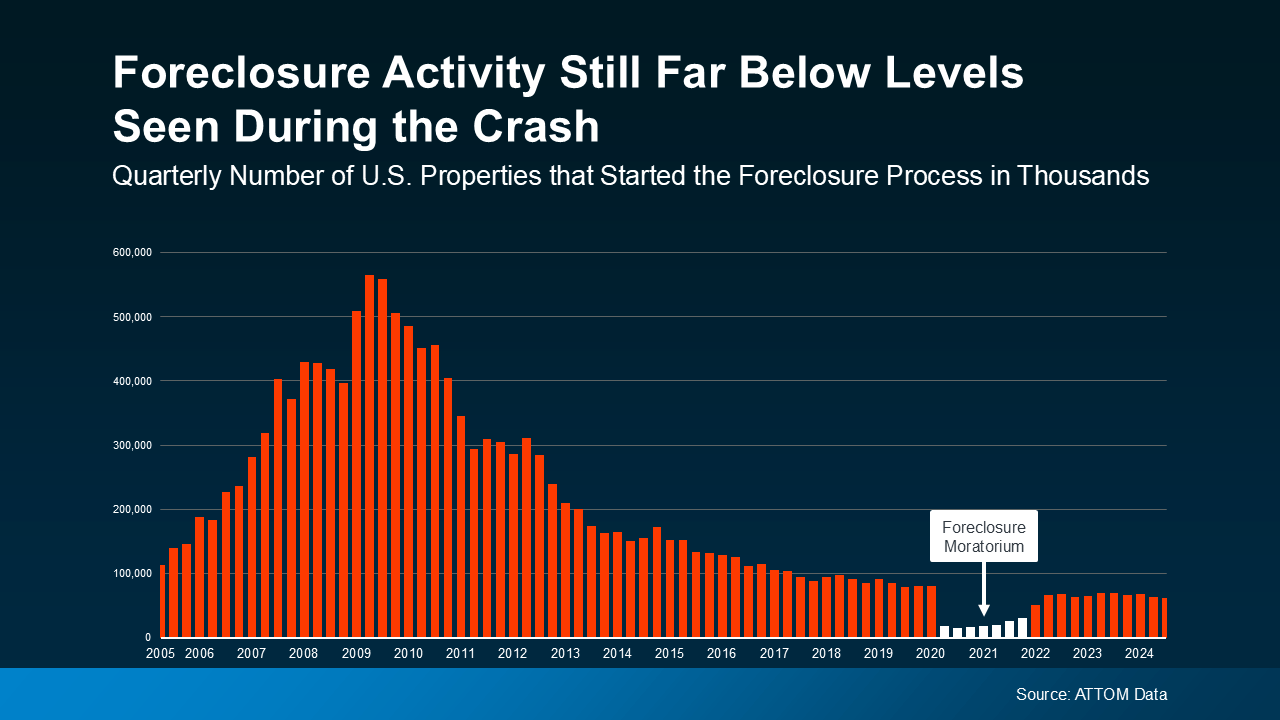

Let’s ease those fears by looking at the bigger picture. The graph below uses research from ATTOM, a property data provider, to show that the number of homeowners starting the foreclosure process is nowhere near what we saw coming out of 2008. Back then, there was a big spike in how many foreclosures were happening. Today, the number is much lower – it’s even dropped some in the latest report. There’s a big difference between what’s happening now, and what happened when the housing market crashed (see graph below):

Just in case you’re wondering why the number of foreclosure filings has ticked up slightly since 2020 and 2021, here’s what you need to know. During those years, there was a moratorium (shown in white) designed to help millions of homeowners avoid foreclosure in challenging times. That’s why the numbers for just a few years ago were so incredibly low. If you look further back, it’s clear overall foreclosure filings are down significantly.

Just in case you’re wondering why the number of foreclosure filings has ticked up slightly since 2020 and 2021, here’s what you need to know. During those years, there was a moratorium (shown in white) designed to help millions of homeowners avoid foreclosure in challenging times. That’s why the numbers for just a few years ago were so incredibly low. If you look further back, it’s clear overall foreclosure filings are down significantly.

And if you’re wondering: how are there fewer foreclosures today, even when the cost of living has gotten so pricey? Here’s your answer. One of the main reasons is that homeowners today have a lot more equity built up in their homes than they did back in 2008. As an article from Bankrate explains:

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.”

This equity acts like a safety net and is allowing many homeowners to avoid going into foreclosure if they’re facing financial hardships. Even if someone is struggling to make their monthly payments, they may be able to sell their home and avoid foreclosure altogether. This is a far cry from the conditions during the crash when homeowners owed more on their mortgages than their homes were worth.

What’s Ahead for the Housing Market

It’s true that today’s higher cost of living across the board is a challenge for many people right now. But this doesn’t mean we’re heading for a surge in foreclosures.

The equity cushion that people have is helping to keep foreclosure filings low. Today’s homeowners have more options to avoid going into foreclosure.

Yes, everyday costs for gas and food have gotten more expensive—but that doesn’t mean the housing market is on the brink of another foreclosure crisis. Data shows the market is far from a foreclosure wave. Homeowners today are in a much stronger financial position than they were during the 2008 crash, thanks to significant equity.

Why Today’s Foreclosure Numbers Won’t Trigger a Crash

In a world where everything seems to cost more every day, it’s only natural to wonder what impact rising costs could have on the housing market. With gas, groceries, and utilities eating away at budgets, homeowners might feel the pinch, causing concerns about a potential foreclosure crisis. However, before jumping to conclusions about a housing market crash, let’s explore the data, trends, and underlying factors that show why today’s foreclosure numbers are not signaling disaster.

The bottom line? Despite the financial hardships many are facing, the latest foreclosure data shows that we’re far from the chaos of 2008. In fact, the housing market today is built on a sturdier foundation of equity, stronger lending practices, and more options for homeowners to avoid foreclosure.

A Different Market Than 2008

It’s hard to think about foreclosures without revisiting the infamous 2008 housing crash. Back then, a wave of foreclosure filings hit the market, causing home prices to plummet. The housing market crashed because so many homeowners owed more on their homes than they were worth, with little to no equity to cushion the blow. However, today’s story is fundamentally different.

According to Attom (property data provider), the number of foreclosure filings today is nowhere near what it was in the aftermath of the Great Recession. While some upticks in foreclosures have been reported, it’s essential to understand the context. Between 2020 and 2021, a moratorium (2020-2021) on foreclosures was in place, halting many foreclosure processes temporarily. Naturally, some numbers have risen since then, but they remain far below crisis levels.

What’s keeping the housing market steady this time? One major factor is that homeowners now have more equity than they did in the past. As equity acts like a safety net, homeowners facing financial hardships are in a stronger position—they can either refinance or sell home to avoid foreclosure.

The Role of Equity: A Game-Changer

The current housing market is underpinned by robust equity levels, which act as a powerful buffer against a foreclosure wave. During the 2008 housing crash, many homeowners found themselves “underwater,” meaning they owed more on their mortgage payments than their property was worth. With no equity cushion to rely on, foreclosure became the only option for millions.

Today’s situation couldn’t be more different. The majority of homeowners are sitting on a comfortable amount of equity, giving them multiple avenues to navigate financial challenges. For instance, someone in West Palm Beach struggling with rising costs could turn to affordable West Palm Beach home loans or West Palm Beach refinancing options to stay afloat. This flexibility helps prevent a sudden spike in foreclosures.

Furthermore, homeowners can leverage mortgage preapproval in West Palm Beach to explore better rates or adjust their loan terms. This approach wasn’t as widespread or accessible in 2008, making today’s borrowers much more prepared for unforeseen challenges.

No Foreclosure Wave in Sight

Despite widespread concerns, the latest foreclosure data shows that a foreclosure wave isn’t looming. Many experts agree that the number of foreclosure filings will remain manageable, largely thanks to the equity-driven safety net. Additionally, more homeowners are now working with local mortgage lenders in West Palm Beach or seeking guidance from a West Palm Beach mortgage broker to ensure they stay on top of their finances.

Even for first-time buyers, options such as first-time home buyer loans in West Palm Beach are designed to ease the financial burden. Property loan advice in West Palm Beach also empowers homeowners and buyers to make informed decisions, reducing the likelihood of missed payments or defaults.

Unlike the freewheeling lending practices that contributed to the housing market crash of 2008, today’s borrowers undergo more rigorous vetting. Mortgage calculators in West Palm Beach are used to assess realistic loan terms, helping homeowners budget effectively. This creates a much more stable environment and reduces the risk of widespread foreclosures.

Managing Financial Hardships Without Foreclosure

Of course, the cost of living has risen across the board, and many families are feeling the pressure. However, that doesn’t automatically translate into a foreclosure crisis. The presence of more equity ensures that even if homeowners fall behind on their mortgage payments, they still have options.

One of the most common strategies is to sell home to avoid foreclosure. With property values remaining relatively high, homeowners in financial trouble can cash out their equity cushion by selling their homes before things spiral out of control. This prevents them from falling into foreclosure while avoiding the lasting damage to their credit.

Additionally, West Palm Beach residents can seek help from a commercial mortgage broker in West Palm Beach if they need assistance with refinancing or restructuring their loans. Solutions like West Palm Beach refinancing options provide breathing room for those grappling with rising expenses. These steps ensure that homeowners remain in a stronger financial position, even when faced with financial hardships.

Why Today’s Market Will Stay Resilient

When looking about a housing market crash, the data is clear: the conditions today are worlds apart from the circumstances that led to the housing market crashed in 2008. Beyond the equity cushion that supports homeowners, lending practices are now far more responsible. Banks and lenders prioritize affordability, which is why West Palm Beach mortgage calculators and preapproval processes are now standard practice.

Additionally, the government and lenders have learned from past mistakes. Programs designed to help homeowners avoid foreclosure, such as refinancing options and first-time buyer loans, ensure that fewer people fall behind on their payments. This proactive approach further reduces the chance of a foreclosure wave taking shape.

A Positive Outlook Despite Rising Costs

Yes, the cost of living is undeniably higher today, and many families are feeling the strain. But the presence of more equity and accessible financial solutions make all the difference. The housing market has evolved, offering homeowners the tools and support they need to weather financial storms. From West Palm Beach refinancing options to local mortgage lenders in West Palm Beach, there are countless ways to stay ahead of challenges.

Even in the face of adversity, today’s homeowners are in a stronger financial position than those in 2008. The combination of equity and sound lending practices ensures that the housing market will remain stable. In short, the latest foreclosure data shows no signs of a repeat of the past crisis.

Final Thoughts

While it’s natural to be concerned about a housing market crash, the data and trends tell a different story. The presence of more equity, better loan structures, and smarter financial planning ensures that homeowners have the resources to avoid foreclosure. In West Palm Beach, for example, options like affordable West Palm Beach home loans and first-time home buyer loans in West Palm Beach provide essential support to homeowners, even during tough times.

In conclusion, while the number of foreclosure filings may tick up slightly due to rising costs, there’s no indication that we’re headed toward a foreclosure crisis. Homeowners today are equipped with better tools, knowledge, and resources than ever before. With equity acts like a safety net, the modern housing market is more resilient, ensuring that today’s foreclosure numbers won’t trigger a crash.

Long-Term Stability in the Housing Market

When discussing whether the housing market is in jeopardy, it’s crucial to consider how much has changed since 2008. The financial safeguards that are now in place, coupled with better-informed borrowers, create a system built to endure market fluctuations. Today, even with rising costs, lenders offer a variety of solutions—like West Palm Beach refinancing options—that can adjust loan terms and reduce monthly mortgage payments, helping borrowers maintain stability during tough times.

Furthermore, many homeowners who bought within the last decade benefitted from historically low interest rates. These locked-in, lower rates mean that many homeowners aren’t as vulnerable to financial hardships stemming from economic shifts. Even if unexpected events cause temporary strain, options such as property loan advice in West Palm Beach or working with a West Palm Beach mortgage broker help homeowners remain financially nimble.

Preapproval and Loan Tools Bolster Financial Planning

Gone are the days of reckless borrowing that led to the housing market crashed in 2008. Modern tools like West Palm Beach mortgage calculators and mortgage preapproval in West Palm Beach empower borrowers with a clear understanding of what they can afford. These practices promote healthy borrowing habits, ensuring that buyers don’t overextend themselves.

This shift in lending practices also benefits homeowners who are refinancing. The best mortgage rates in West Palm Beach are accessible to those who work with reputable lenders, while local mortgage lenders in West Palm Beach offer personalized advice to keep homeowners on track. These proactive measures minimize the risk of delinquency, further preventing a foreclosure wave from forming.

Stronger Financial Position Means More Flexibility

The strength of today’s housing market lies in the fact that homeowners are in a stronger financial position than ever. Those with significant equity cushions can draw upon their home’s value if needed, through refinancing or strategic sales. For example, a homeowner dealing with rising costs could leverage their equity by working with a commercial mortgage broker in West Palm Beach to adjust loan terms or free up cash flow.

Moreover, first-time home buyer loans in West Palm Beach are structured to reduce financial stress, offering lower interest rates and better repayment terms. These types of loans help build a sustainable housing ecosystem where both buyers and homeowners can thrive without contributing to a foreclosure crisis.

The key takeaway is that today’s housing market provides far more flexibility than in 2008. Back then, many homeowners were trapped with limited options because they owed more on their homes than the property’s value. Now, with equity acts like a safety net, selling a home or refinancing is often a viable alternative to foreclosure.

West Palm Beach: A Unique Example of Stability

In regions like West Palm Beach, the housing market remains particularly resilient. Homeowners here benefit from diverse lending opportunities, including affordable West Palm Beach home loans and competitive products from local mortgage lenders in West Palm Beach. Access to these resources ensures that borrowers can maintain their financial footing even when faced with rising living expenses.

With rising interest rates across the nation, it’s essential to secure the best mortgage rates in West Palm Beach. Many homeowners have already taken advantage of refinancing opportunities to lock in favorable terms. Those who haven’t can still explore West Palm Beach refinancing options or seek assistance from a West Palm Beach mortgage broker to manage rising mortgage payments proactively.

The availability of multiple financing tools ensures that homeowners can remain in control of their financial situation, keeping foreclosure filings low. Additionally, the area’s lending community is focused on providing tailored solutions, such as property loan advice in West Palm Beach, which equips borrowers with the knowledge they need to avoid foreclosure.

Why a Foreclosure Crisis Is Unlikely

Despite economic headwinds, a foreclosure crisis remains unlikely. The main difference between now and the 2008 housing crash is the widespread presence of more equity. This equity cushion gives homeowners alternatives to foreclosure, such as selling their property, refinancing, or negotiating better loan terms.

Additionally, today’s market participants have learned from the past. Lenders, borrowers, and policymakers are more cautious, working proactively to prevent another housing market crash. Foreclosure numbers remain manageable, with the latest foreclosure data showing only slight increases, primarily due to the expiration of the moratorium (2020-2021). However, this temporary rise does not signal an impending wave of foreclosures.

Even when homeowners encounter financial hardships, they have more options at their disposal. Rather than falling into foreclosure, many can sell home to avoid foreclosure and use the proceeds to start fresh without incurring lasting damage to their credit. This dynamic stands in sharp contrast to the 2008 scenario, where many homeowners found themselves locked into properties with negative equity and no way out.

The Future of Foreclosure Numbers

While it’s possible that foreclosure numbers may continue to rise incrementally, there’s no evidence to suggest that a foreclosure wave is on the horizon. In fact, with lenders offering flexible solutions and homeowners equipped with more equity, the market is positioned to weather economic challenges.

Programs like West Palm Beach refinancing options and first-time home buyer loans in West Palm Beach will continue to play an essential role in supporting the housing market. Meanwhile, tools like West Palm Beach mortgage calculators and mortgage preapproval in West Palm Beach will guide future buyers toward sustainable financing decisions.

Ultimately, the combination of equity acts like a safety net and sound financial planning means that today’s housing market is far better prepared to handle economic uncertainty. As homeowners remain in a stronger financial position, the chance of a widespread foreclosure crisis is minimal.

Conclusion

In today’s economic environment, it’s easy to be concerned about a housing market crash. However, the reality is far more optimistic. Thanks to higher levels of equity, homeowners have the flexibility to avoid foreclosure even when confronted with financial hardships. The latest foreclosure data shows that while there may be slight increases in foreclosure filings, they are nowhere near the levels seen during the 2008 housing crash.

Moreover, with proactive lending solutions such as affordable West Palm Beach home loans and West Palm Beach refinancing options, homeowners have the tools they need to remain stable. The days of reckless borrowing are behind us, and today’s homeowners benefit from responsible lending practices, personalized support from local mortgage lenders in West Palm Beach, and sound financial advice.

As the market adapts to higher cost of living expenses, homeowners can rely on their equity cushion and refinancing options to stay ahead. With equity acts like a safety net, the housing market is fortified against a foreclosure crisis. Whether through refinancing, selling, or restructuring loans, today’s borrowers are equipped to navigate challenges without triggering a crash. The housing market has evolved, and while challenges remain, it is clear that foreclosure numbers alone won’t bring it down.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice