This Is the Sweet Spot Homebuyers Have Been Waiting For

After months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for buyers—and it’s one that may not last long.

So, if you’ve put your own move on the back burner, here’s why maybe you shouldn’t delay your plans any longer.

As you weigh your options and decide if you should buy now or wait, ask yourself this: What do you think everyone else is going to do?

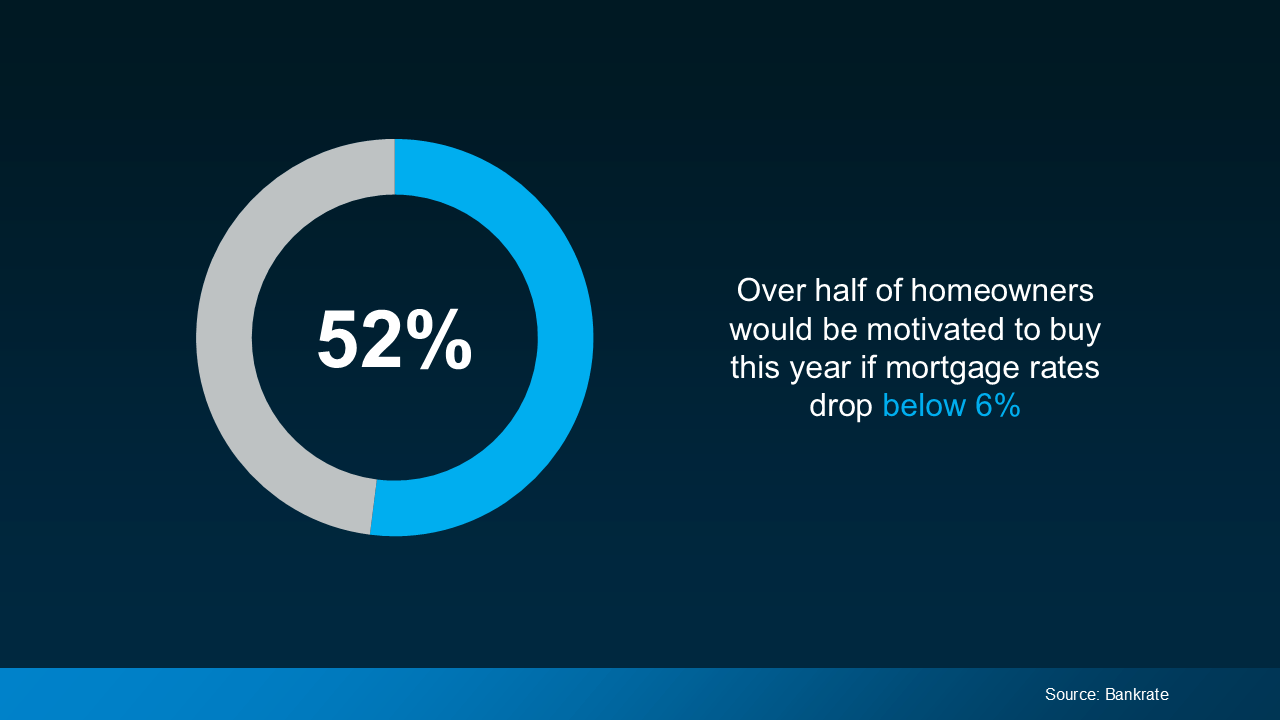

The truth is, if mortgage rates continue to ease, as experts project, more buyers will jump back into the market. A survey from Bankrate shows over half of homeowners would be motivated to buy this year if rates drop below 6% (see graph below):

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

That increased demand will likely push home prices up, which could potentially take away from some of the benefits you’d gain from a slightly lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains:

“The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.”

So, while waiting to buy may seem like a smart move, it could backfire if rising prices outpace your savings from slightly lower rates.

What This Means for You

Right now, you’ve got the chance to get ahead of all of that. Today’s market is a buyer sweet spot. Why? Because a lot of other buyers are waiting – which means not as many people are actively looking for homes. That means less competition for you.

At the same time, affordability has already improved quite a bit. Recent easing in mortgage rates has made homeownership more accessible. As Mike Simonsen, Founder of Altos Research, says:

“Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.”

And while the supply of homes for sale is still low, it’s also higher than it’s been in years. According to Ralph McLaughlin, Senior Economist at Realtor.com:

“The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.”

This means you now have more options to choose from than you’ve had in quite a while.

With fewer buyers in the market, improving affordability, and more homes to choose from, you have the chance to find the right one before the competition heats up.

Why Waiting Could Cost You

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible. The longer you wait, the higher the risk that market conditions will shift—and not necessarily in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.”

Don’t wait until you have to deal with more competition and higher prices – you already have the chance to buy a home while we’re in the sweet spot today. Let’s connect to make sure you’re taking advantage of it.

This Is the Sweet Spot Homebuyers Have Been Waiting For

The housing market has been a whirlwind over the past few years, swirling with unpredictability and rapid changes. Many aspiring homeowners found themselves standing on the sidelines, waiting for the right moment to jump in. If you’ve been looking for homes, and wondering when the stars will align, this is it. Now is the sweet spot homebuyers have been waiting for.

A rare combination of favorable conditions is setting the stage for homeownership more accessible than it has been in recent times. If you’ve been eyeing the market, considering your next move, or waiting for a break in the frenetic pace of home prices, let’s dive into why now may be your golden opportunity to finally buy a house.

The Perfect Market Mix: Where Supply Meets Opportunity

For years, the housing market was defined by a critical imbalance. Housing shortages plagued nearly every corner of the country, as demand outpaced supply by a wide margin. Buyers were faced with limited options, skyrocketing prices, and frenzied bidding wars. But here’s the good news: we are starting to see a shift.

The supply of homes for sale has been gradually increasing. There are now more homes to choose from, and sellers are more motivated than they’ve been in years. This doesn’t mean that inventory levels have completely corrected, but they’ve reached a point where buyers can breathe a little easier. Instead of hurriedly making decisions or compromising on key features, today’s homebuyers can be more selective, exploring multiple options before pulling the trigger. Homes actively for sale are offering more variety and less urgency—exactly the combination that creates a sweet spot for savvy buyers.

Lower Mortgage Rates: A Game Changer for Buyers

Mortgage rates, like the wind, have been blowing in many different directions lately. In recent years, buyers have had to contend with rising interest rates that pushed monthly mortgage payments to uncomfortable levels. But we’re seeing some welcome relief on that front now. Lower mortgage rates have returned, breathing fresh life into buyer affordability.

For example, if you’ve been hesitant about entering the market because of high mortgage payments, the current mortgage rates make homes more attainable. They reduce the overall cost of borrowing and stretch your budget further, making the idea of purchasing a typical-price home more realistic than ever before. With these lower mortgage rates, buyers are able to lock in favorable terms and enjoy payments that fit more comfortably within their financial framework.

For those in specific regions like West Palm Beach, the stakes are even higher. With access to some of the best mortgage rates in West Palm Beach, now is an excellent time to connect with a West Palm Beach mortgage broker who can help you explore financing options that match your individual needs. These professionals are well-versed in the Affordable West Palm Beach home loans that are currently available, and they can help you find the perfect mortgage package, from first time home buyer loans in West Palm Beach to savvy refinancing solutions.

More Negotiation Power Than Ever Before

When the market was red-hot, buyers had little leverage. Sellers held the upper hand, and many homes sold well above asking price. But as the market stabilizes, this is no longer the case. Sellers are more open to negotiations, whether that means agreeing to cover closing costs, offering price reductions, or even being flexible with contingencies.

For buyers, this translates to more than just savings; it’s about having options and finding value. Now that there are more homes to choose from, buyers can play the field a little, comparing properties and looking for the best deal.

In West Palm Beach, for example, you’ll find local expertise ready to help you navigate the buying process. Whether you need advice on property loans in West Palm Beach or want insights into current market conditions, consulting with a local mortgage lender in West Palm Beach can give you a significant advantage. They know the lay of the land and can provide tailored insights to ensure you’re making the best decision for your financial future.

Housing Shortages Easing, but Opportunities Abound

Even though housing shortages haven’t been completely eradicated, the market has reached a delicate equilibrium. The availability of homes is better than it’s been in recent years, but it’s important to remember that this might not last forever. As more buyers become aware of these favorable conditions, demand could pick up, putting pressure on prices once again.

This period of relative calm presents a rare opportunity for buyers to capitalize on the current availability without the frenetic pace that has defined the market in the past. If you’re considering entering the market, acting sooner rather than later could ensure you capitalize on today’s number of homes available, before inventory starts to tighten once more.

First-Time Buyers, This Is Your Moment

First-time homebuyers are in a uniquely advantageous position right now. Historically, buying a first home is one of the most financially daunting steps a person can take, but current conditions are tilting the scales in favor of the first-timer. Lower mortgage rates, improved supply, and better negotiating conditions all create a more welcoming environment for new buyers.

In places like West Palm Beach, there are specialized programs and first time home buyer loans in West Palm Beach designed specifically to help you get your foot in the door. These loans often come with lower down payment requirements, and you may even qualify for state or local incentives that can reduce your out-of-pocket costs. A West Palm Beach mortgage broker can walk you through your options and help secure Affordable West Palm Beach home loans that match your financial situation.

First-timers can also use tools like West Palm Beach mortgage calculators to get a realistic sense of what their payments will look like, ensuring that they enter the market with confidence and clarity.

Refinancing Opportunities for Current Homeowners

For those who already own a home, now is also a great time to explore West Palm Beach refinancing options. As interest rates fluctuate, homeowners who bought at a higher rate can take advantage of lower mortgage rates to reduce their monthly payments or even shorten the term of their loan.

Refinancing offers the dual benefit of saving money on interest over the life of the loan and potentially providing cash out to fund other projects. With a local mortgage lender in West Palm Beach, you can explore all of your refinancing options, including whether it makes sense to roll other debts into your mortgage or leverage your home’s equity for renovations or investments.

Commercial Real Estate and Broader Investment Opportunities

It’s not just residential buyers who are finding opportunity in this market. If you’re looking to invest in commercial properties, now might be the perfect time to act. Commercial properties, like their residential counterparts, have also seen shifts in pricing and availability. Working with a commercial mortgage broker in West Palm Beach could open the door to significant investment opportunities, whether you’re eyeing office spaces, retail locations, or mixed-use developments.

In the commercial sphere, lower mortgage rates and more negotiable terms offer the same kind of value buyers are seeing in the residential market. If you’re considering expanding your real estate portfolio or diving into commercial property for the first time, the current conditions are ideal for making a move.

Mortgage Preapproval: A Key to Success in the Current Market

Even with more homes available and sellers more open to negotiation, it’s still essential to be prepared when entering the housing market. One of the best steps you can take is to secure a mortgage preapproval in West Palm Beach. This gives you a competitive edge by showing sellers you’re serious and ready to act when the right home comes along.

Mortgage preapproval streamlines the buying process, helping you understand exactly how much house you can afford and ensuring you’re shopping within your means. By working with a West Palm Beach mortgage broker, you’ll be able to gather the necessary paperwork, secure the preapproval, and hit the ground running when you find that perfect property.

Final Thoughts: Seize the Sweet Spot

The housing market is always changing, but right now, it’s offering a unique window of opportunity for those ready to take action. Whether you’re a first-time buyer, looking to move up, or even considering an investment in commercial real estate, the current combination of more homes to choose from, lower mortgage rates, and improved negotiating conditions creates the sweet spot that many buyers have been waiting for.

Don’t miss out on this chance to buy a house on your terms. Whether you’re navigating the market with a West Palm Beach mortgage broker or exploring West Palm Beach refinancing options, now is the time to take that next step toward homeownership or expanding your real estate investments. The conditions may not stay this favorable for long, so make sure you strike while the iron is hot.

Why This Sweet Spot May Not Last

As tempting as the current conditions are, there’s a strong likelihood that this sweet spot won’t last forever. Market cycles are inherently unpredictable, and even though buyers have the upper hand now, the balance could shift again in the near future. The rise and fall of mortgage rates is notoriously difficult to predict, and small economic changes can have a significant impact on the housing market.

There are already indicators that the pool of homes actively for sale could shrink as we head into the next year. This could be driven by a number of factors: a resurgence in buyer demand, changes in lending policies, or economic shifts that slow down new construction projects. If you’ve been looking for homes, now is the moment to seriously consider moving forward before these conditions begin to change. The window of opportunity is open, but it’s unclear how long it will stay that way.

Moreover, as more buyers recognize this favorable environment, competition could begin to heat up once again, especially in desirable regions like West Palm Beach. Home prices could start to climb as multiple offers become more common and inventory begins to shrink.

That said, for buyers who act now, there’s a distinct advantage. Not only can you take advantage of the favorable conditions today, but you also lock in your costs before the market potentially tightens again. The current number of homes available means you can shop with less pressure, but waiting too long could mean entering a more competitive landscape in the near future.

Location Spotlight: Why West Palm Beach Shines

While the current national market trends favor buyers, specific areas like West Palm Beach are especially attractive right now. This vibrant coastal city offers a dynamic real estate market, with options ranging from starter homes to luxury estates, as well as a growing market for commercial properties.

What makes West Palm Beach so appealing isn’t just its sunny beaches and cultural attractions; it’s also the availability of Affordable West Palm Beach home loans. Paired with lower mortgage rates, these loans create an unprecedented level of affordability for a city that’s traditionally been seen as more exclusive. Whether you’re a first-time buyer or looking to invest in a larger property, West Palm Beach is teeming with opportunity.

Additionally, the range of West Palm Beach refinancing options provides current homeowners with ways to adjust their finances to today’s favorable interest rates. Whether you want to free up equity for renovations, consolidate debts, or simply lower your monthly mortgage payments, there are numerous refinancing options available, especially through local mortgage lenders in West Palm Beach who are familiar with the unique dynamics of this area.

The city also has a vibrant commercial market that’s worth considering for investors. With the help of a commercial mortgage broker in West Palm Beach, you can tap into opportunities in retail spaces, office buildings, or even multifamily residential developments. Commercial real estate in West Palm Beach is seeing a renaissance as the city continues to grow and attract new businesses and residents.

The Power of Personalized Mortgage Advice

No two homebuyers are the same, and that’s why personalized property loan advice in West Palm Beach is so critical. A West Palm Beach mortgage broker can provide tailored guidance that takes into account your financial situation, your long-term goals, and the specific features of the local market. Whether you’re navigating the complexities of first-time home buyer loans in West Palm Beach or considering refinancing, a broker will help you find the best products and rates to fit your needs.

Working with local mortgage lenders in West Palm Beach ensures that you’re not only getting competitive rates but also that you’re leveraging insights into the local market. These lenders are tapped into the pulse of the region and can offer solutions that national lenders might not be able to provide. They can also help you use tools like West Palm Beach mortgage calculators to get a better understanding of your borrowing capacity and the long-term impact of your loan decisions.

For buyers and investors alike, access to property loan advice in West Palm Beach could be the difference between securing a great deal and missing out. The local expertise available from brokers and lenders in the area ensures that you’re making decisions with the best possible information in hand.

Your Next Move: Securing the Sweet Spot

If you’re in a position to buy a house, the time is ripe. The rare combination of lower mortgage rates, an increase in the supply of homes for sale, and a cooling-off period in home prices creates a moment of opportunity that’s well worth seizing.

Here are a few key steps to take advantage of this sweet spot:

- Get Preapproved: Securing a mortgage preapproval in West Palm Beach is an essential step in the current market. It not only strengthens your position as a buyer but also provides clarity on your budget. This allows you to act quickly when you find the right home.

- Work with a Local Expert: A West Palm Beach mortgage broker can guide you through the process, helping you find the best loan products, negotiate rates, and navigate the intricacies of the local market. With local mortgage lenders in West Palm Beach, you’ll gain a competitive edge by working with professionals who know the ins and outs of the region.

- Use Mortgage Calculators: Before you start making offers, use a West Palm Beach mortgage calculator to get a clear picture of what your monthly payments will look like. This will ensure you stay within your financial comfort zone and avoid surprises later on.

- Explore Refinancing: If you already own a home, consider West Palm Beach refinancing options. With lower mortgage rates, refinancing could reduce your monthly payments or help you tap into your home’s equity for other financial goals.

- Consider Investment Properties: The commercial real estate market in West Palm Beach is ripe with opportunity. Whether you’re looking to invest in a rental property, a retail space, or an office building, a commercial mortgage broker in West Palm Beach can help you find financing options that make sense for your investment goals.

A Final Call to Action: Don’t Let This Opportunity Slip Away

The housing market is in a unique phase that won’t last forever. Whether you’re in the market for your first home, looking to upgrade, or seeking new investment opportunities, this is the moment you’ve been waiting for. Lower mortgage rates and an expanded supply of homes for sale are giving buyers the chance to find their perfect property without the frenetic competition of recent years.

But, like all sweet spots, this moment is temporary. As the market continues to adjust, conditions could shift back in favor of sellers, with rising home prices and shrinking inventory making it harder for buyers to get a good deal. For now, though, the stars have aligned, and it’s time to take action.

If you’re considering buying a house, don’t hesitate to explore the range of financing options available. Whether you’re eyeing a typical-price home or exploring West Palm Beach refinancing options, take advantage of this unique market moment. Connect with a West Palm Beach mortgage broker, get your mortgage preapproval, and start the journey toward homeownership while the conditions are still in your favor. This is the sweet spot homebuyers have been waiting for—make it yours.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice