2 Reasons Why Today’s Mortgage Rate Trend Is Good for Sellers

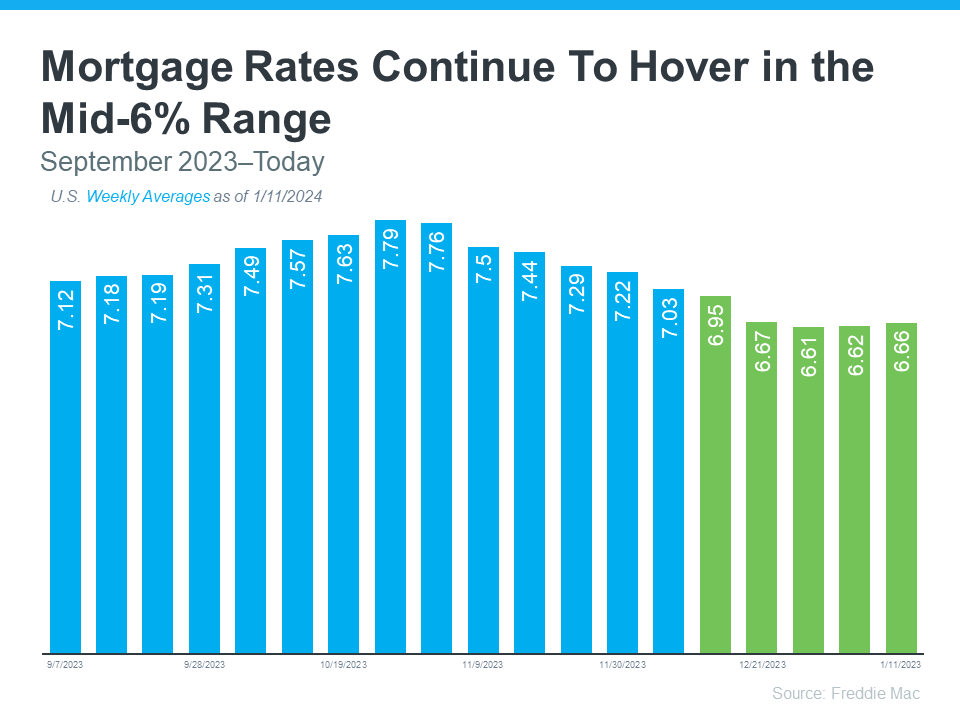

If you’ve been holding off on selling your house to make a move because you felt mortgage rates were too high, their recent downward trend is exciting news for you. Mortgage rates have descended since last October when they hit 7.79%. In fact, they’ve been below 7% for over a month now (see graph below):

And while they’re not going back to the 3% we saw during the ‘unicorn’ years, they are expected to continue to go down from where they are now in the near future. As Dean Baker, Senior Economist at the Center for Economic Research, explains:

“It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

Here are two reasons why this recent trend, and the expectation it’ll continue, is such good news for you.

You May Not Feel as Locked-In to Your Current Mortgage Rate

With mortgage rates already significantly lower than they were just a few months ago, you may feel less locked-in to the current mortgage rate you have on your house. When mortgage rates were higher, moving to a new home meant possibly trading in a low rate for one up near 8%.

However, with rates dropping, the difference between your current mortgage rate and the new rate you’d be taking on isn’t as big as it was. That makes moving more affordable than it was just a few months ago. As Lance Lambert, Founder of ResiClub, explains:

“We might be at peak “lock-in effect.” Some move-up or lifestyle sellers might be coming to terms with the fact 3% and 4% mortgage rates aren’t returning anytime soon.”

More Buyers Will Be Coming to the Market

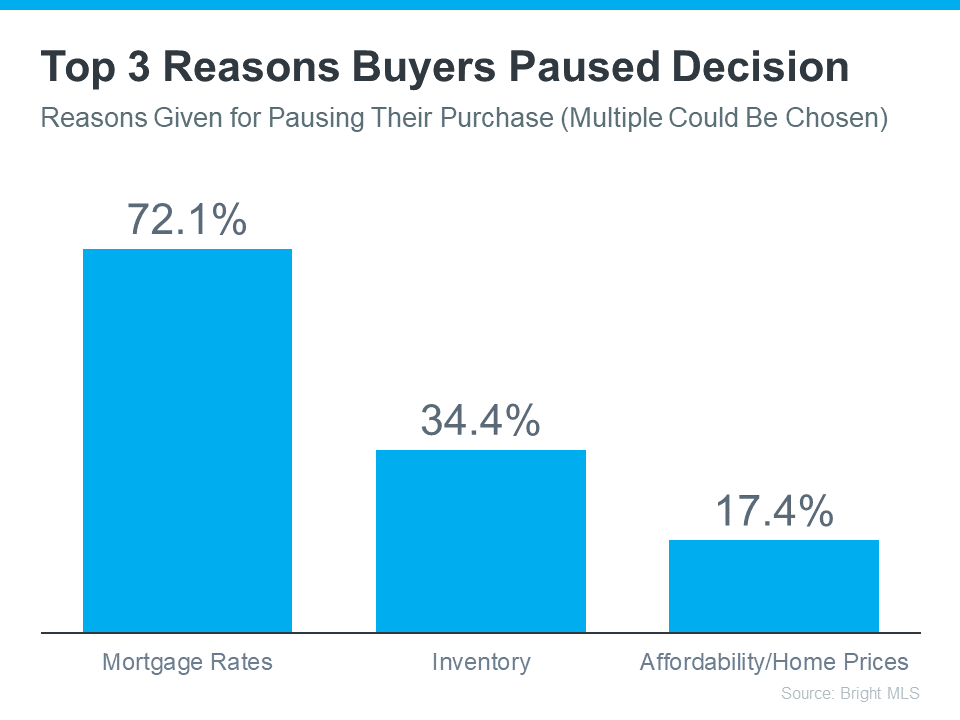

According to data from Bright MLS, the top reason buyers have been waiting to take the plunge into homeownership is high mortgage rates (see graph below):

Lower mortgage rates mean buyers can potentially save money on their home loans, making the prospect of purchasing a home more attractive and affordable. Now that rates are easing, more buyers are likely to feel they’re ready to jump back into the market and make their move. And more buyers mean more demand for your house.

If you’ve been waiting to sell because you didn’t want to take on a larger mortgage rate or you thought buyers weren’t out there, the recent decline in mortgage rates may be your sign it’s time to move. When you’re ready, let’s connect.

Unveiling the Fortuitous Current Mortgage Rate Landscape: A Boon for Sellers

In the dynamic realm of real estate, where the tides of financial fluctuations often shape the destiny of homeownership dreams, today’s landscape presents an intriguing narrative. The heartbeat of this narrative is synchronized with the pulse of current mortgage rates, orchestrating a melody that resonates distinctly in the ears of potential homebuyers and, unexpectedly, sellers alike.

Navigating the Waves of Today’s Mortgage Rate Trend

1. Fortuitous Winds for Sellers in Today’s Mortgage Rate Trends

The first ripple in this narrative of favorable circumstances lies in the current ebb and flow of mortgage rates. Picture this – a potential buyer, armed with dreams of homeownership, is scouring the real estate market for their ideal abode. What captures their attention isn’t just the aesthetics or location, but the golden opportunity presented by the prevailing mortgage rates.

Capitalizing on Lower Mortgage Rates

As a seller, understanding the intricate dance of these rates can be the key to unlocking the door to a quicker sale. The allure of lower mortgage rates often translates into increased purchasing power for potential buyers. With more financial wiggle room, these buyers find themselves contemplating more substantial investments and, consequently, looking favorably upon higher-priced homes.

In essence, the serendipity of today’s mortgage rate trend lies in the potential to showcase your property as a valuable investment. The psychological impact of lower rates can be a powerful motivator, propelling buyers towards more significant and lucrative transactions.

2. The Dance of Demand: Today’s Mortgage Rates Fanning the Flames

Beyond the realms of individual transactions, the collective impact of Today’s Mortgage Rate Trend manifests in the broader dynamics of the real estate market. It sets the stage for a surge in demand, a phenomenon that reverberates delightfully in the ears of sellers contemplating the listing of their properties.

Fanning the Flames of Purchasing Enthusiasm

The intricacies of market dynamics reveal an interesting paradox – while lower mortgage rates provide buyers with enhanced purchasing power, they simultaneously ignite a sense of urgency. As the allure of favorable rates permeates the market, an uptick in the number of individuals contemplating purchasing a home ensues.

Herein lies the sweet spot for sellers. The convergence of increased purchasing power and heightened demand creates a scenario where sellers find themselves in a position of strength. The classic economics of supply and demand come into play, with a limited inventory and an abundance of eager buyers contributing to an environment where sellers can command favorable terms.

Embracing the Wave: Strategic Considerations for Sellers

1. Positioning Your Property in the Limelight

In the labyrinth of real estate transactions, visibility is key. With the windfall of today’s mortgage rate trend, sellers must strategically position their properties to capture the attention of discerning buyers.

Showcasing Affordability Amidst Rising Mortgage Rates

Crafting a narrative that highlights the affordability of a property in the context of rising mortgage rates can be a compelling strategy. Utilize your listing descriptions to emphasize not just the physical attributes of your home but also the financial prudence of seizing the opportunity amidst the current mortgage rate climate.

2. Capitalizing on the Sense of Urgency

As demand intensifies with the cadence of Today’s Mortgage Rate Trend, sellers can leverage the resulting sense of urgency to their advantage. Implementing strategic marketing techniques that underscore the scarcity of well-priced homes in the market can trigger a competitive spirit among potential buyers.

Employing Creative Marketing Strategies

Consider the incorporation of phrases like “limited-time opportunity” or “act now to secure the best rates” in your marketing materials. The aim is to create a sense of exclusivity, nudging potential buyers towards quicker decisions and, ultimately, offers that are more favorable for sellers.

Conclusion: Riding the Wave of Opportunity

In the intricate dance of real estate transactions, the rhythm set by current mortgage rates often dictates the tempo of the market. Today’s scenario, with its fortuitous confluence of factors, presents sellers with a unique opportunity to ride the wave of favorable conditions.

As the pendulum of market dynamics swings, sellers must adeptly position themselves to capitalize on the heightened purchasing power and demand generated by Today’s Mortgage Rate Trend. By showcasing the affordability of their properties and leveraging creative marketing strategies, sellers can navigate these currents with finesse, ensuring that their homes stand out in a market brimming with possibilities.

Navigating the Horizon: Embracing the Unpredictability of Mortgage Rates

3. Mitigating Risks with Strategic Planning

While the winds of favorable mortgage rates provide an auspicious tailwind, seasoned sellers understand the importance of meticulous planning to navigate the unpredictability that characterizes real estate. The third facet of today’s narrative involves a strategic approach to mitigating risks associated with the ever-changing landscape of mortgage rates.

Understanding the Volatility of Mortgage Rates

One must acknowledge that current mortgage rates are akin to a compass guiding the market’s direction. However, this compass is not static; it sways with the economic winds, geopolitical shifts, and fiscal policies. Thus, sellers should approach this landscape with a nuanced understanding of the potential for volatility.

Embracing Rate Locks and Fixed-Term Strategies

To shield against the potential fluctuation in mortgage rates, sellers can explore rate lock options and employ fixed-term pricing strategies. A rate lock ensures that the agreed-upon rate remains unchanged for a specified period, providing a degree of financial certainty for both sellers and buyers.

4. Unveiling the Domino Effect on Homeownership Aspirations

As the symphony of Today’s Mortgage Rate Trend continues to play, it casts a wider net, influencing not only immediate transactions but also the broader landscape of homeownership aspirations. Sellers stand to benefit from understanding the domino effect triggered by the prevailing mortgage rate dynamics.

Cascading Impact on Upgrading and Downsizing

The allure of favorable mortgage rates extends beyond first-time homebuyers, creating a cascading effect on existing homeowners contemplating upgrading or downsizing. This ripple effect can translate into a surge in both entry-level and premium real estate transactions, providing sellers across the spectrum with a larger pool of potential buyers.

Capitalizing on Diverse Buyer Profiles

Sellers, attuned to the diverse profiles of potential buyers influenced by Today’s Mortgage Rate Trend, can tailor their marketing strategies accordingly. Highlighting features that appeal to both first-time buyers and those seeking an upgrade can amplify the attractiveness of a property, broadening its appeal in the market.

5. The Paradigm Shift in Selling Your House: A Holistic Approach

As we delve deeper into the nuances of the current mortgage rate narrative, it becomes evident that selling a house in today’s market demands a holistic approach. Beyond the conventional strategies, sellers must embrace a paradigm shift in their outlook to seize the full spectrum of opportunities presented by the prevailing mortgage rate trends.

Elevating Home Presentation and Staging

The visual narrative of a property plays a pivotal role in capturing the imagination of potential buyers. In the context of Today’s Mortgage Rate Trend, where competition might intensify, sellers should invest in professional home staging to elevate the aesthetic appeal of their properties.

Crafting a Visual Story

Utilize every facet of your property to tell a compelling visual story. From capturing the warm ambiance of well-lit living spaces to accentuating the functionality of each room, a meticulously staged home not only attracts attention but also instills a sense of desirability that transcends the constraints of mortgage rates.

Conclusion: Seizing the Momentum in Today’s Mortgage Rate Landscape

As we unravel the layers of opportunity embedded in Today’s Mortgage Rate Trend, sellers find themselves at the nexus of a market poised for growth. The convergence of lower mortgage rates, heightened purchasing power, and a surge in demand sets the stage for a propitious environment.

However, success in this dynamic landscape necessitates a strategic mindset that extends beyond traditional approaches. Sellers must not only capitalize on the immediate advantages of lower mortgage rates but also navigate the unpredictability through strategic planning. Embracing the domino effect on homeownership aspirations and adopting a holistic approach to home presentation further amplifies the potential for success.

In the symphony of real estate, where the melody is composed by the rhythm of current mortgage rates, sellers who adeptly dance to the changing beats find themselves in a position to not only sell their houses but also maximize the value of their real estate assets. The horizon, painted with the strokes of opportunity, awaits those who embrace the nuances of today’s mortgage rate landscape.

Bottom Line: Seizing the Seller’s Advantage in Today’s Mortgage Rate Landscape

In the dynamic world of real estate, where fortunes ebb and flow with the rhythms of current mortgage rates, sellers find themselves at a pivotal juncture. The confluence of factors, propelled by Today’s Mortgage Rate Trend, unveils a landscape ripe with opportunities for those astute enough to seize them.

1. Capitalizing on Lower Mortgage Rates:

- Leverage the allure of lower mortgage rates to showcase your property as a valuable investment.

- Highlight the increased purchasing power of potential buyers, encouraging them to consider higher-priced homes.

2. Riding the Wave of Demand:

- Navigate the surge in demand fueled by Today’s Mortgage Rate Trend by strategically positioning your property.

- Employ creative marketing strategies to capitalize on the sense of urgency among potential buyers.

3. Mitigating Risks with Strategic Planning:

- Understand the volatility of mortgage rates and employ rate lock and fixed-term strategies to mitigate risks.

- Navigate the unpredictable landscape with a nuanced approach to ensure financial certainty for both parties.

4. Unveiling the Domino Effect on Homeownership:

- Recognize the broader impact on homeownership aspirations, catering to diverse buyer profiles.

- Tailor marketing strategies to appeal to both first-time buyers and those contemplating upgrading or downsizing.

5. Embracing a Holistic Approach to Selling Your House:

- Elevate the visual narrative of your property through professional home staging to stand out in a competitive market.

- Craft a compelling visual story that transcends the constraints of mortgage rates, instilling a sense of desirability.

Conclusion: In this symphony of real estate, where the melody is composed by the rhythm of current mortgage rates, sellers stand at the forefront of a burgeoning market. Success lies not only in capitalizing on immediate advantages but also in navigating the uncertainties with strategic planning. By embracing the domino effect on homeownership aspirations and adopting a holistic approach to property presentation, sellers can not only sell their houses but also maximize the value of their real estate assets. The horizon beckons, painted with strokes of opportunity for those who dance to the changing beats of today’s mortgage rate landscape.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice