Unlocking Homebuyer Opportunities in 2024

There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt like too much to tackle. You’re not alone in that. A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were:

- They couldn’t find anything in their price range

- They didn’t have any successful offers or had difficulty competing

- They couldn’t find the right home

If any of these sound like why you stopped looking, here’s what you need to know. The housing market is in a transition in the second half of 2024. Here are four reasons why this may be your chance to jump back in.

1. The Supply of Homes for Sale Is Growing

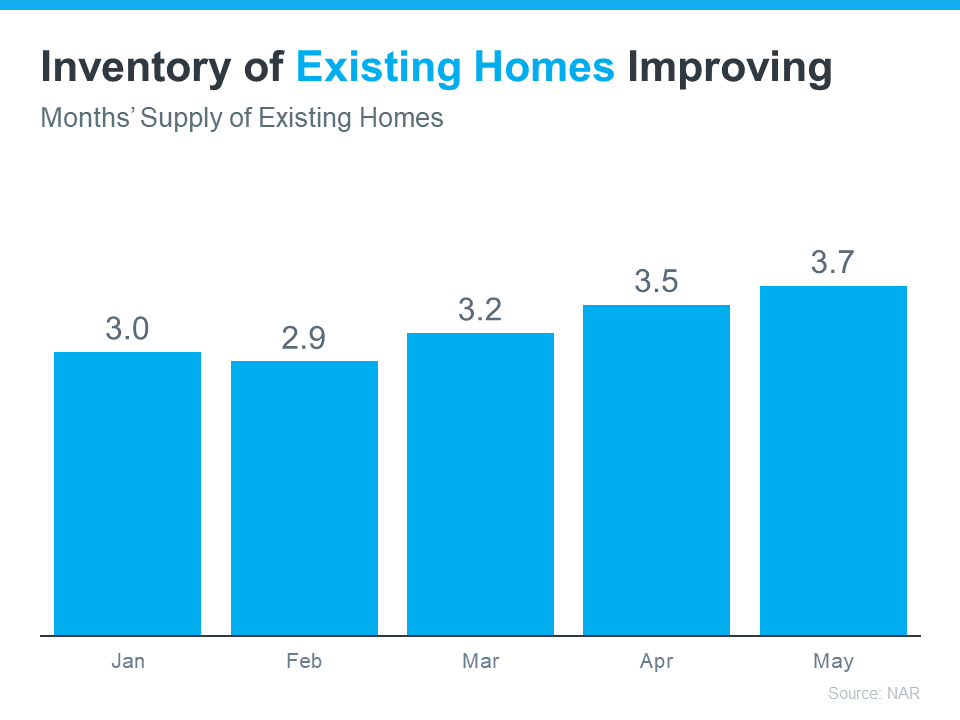

One of the most significant shifts in the market this year is how the months’ supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph below):

This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear.

This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief.

2. There’s More New Home Construction

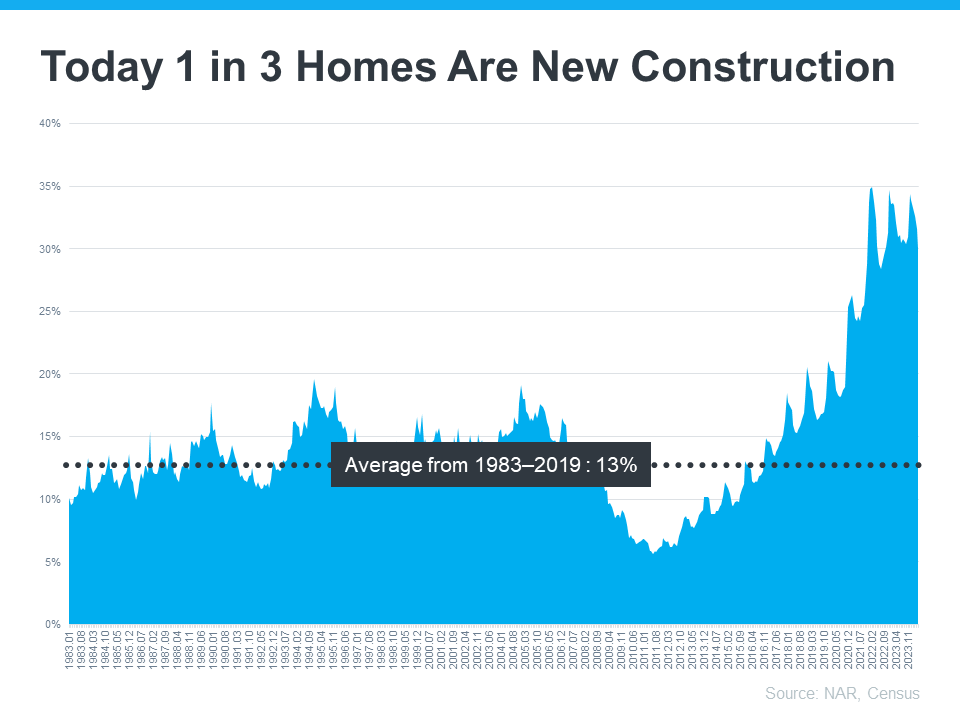

And if you still don’t see an existing home you like, another big opportunity lies in the rise of new home construction. Builders have worked to increase the supply of newly built homes this year. And they’ve turned their attention to crafting smaller, more affordable homes based on what’s most needed in today’s market. This helps address the long-standing issue of housing undersupply throughout the country, and those smaller homes also offset some of the affordability challenges you’re feeling today.

According to data from the Census and NAR, one in three homes on the market is a newly built home (see graph below):

This means, that if you didn’t previously look at newly built homes as part of your search, you may have been cutting your pool of options by a third. Not to mention, some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home that fits their budget.

So, consider talking to your agent about what builders have to offer in your area. Your agent’s expertise on builder reputations, contracts, and more will help you weigh your options.

3. Less Buyer Competition

Mortgage rates are still hovering around 7%, so buyer demand isn’t as fierce as it once was. And when you combine that with more housing supply, you have a better chance of avoiding an intense bidding war. Danielle Hale, Chief Economist at Realtor.com, highlights the positive trend for the latter half of 2024, saying:

“Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”

This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price.

4. Home Prices Are Moderating

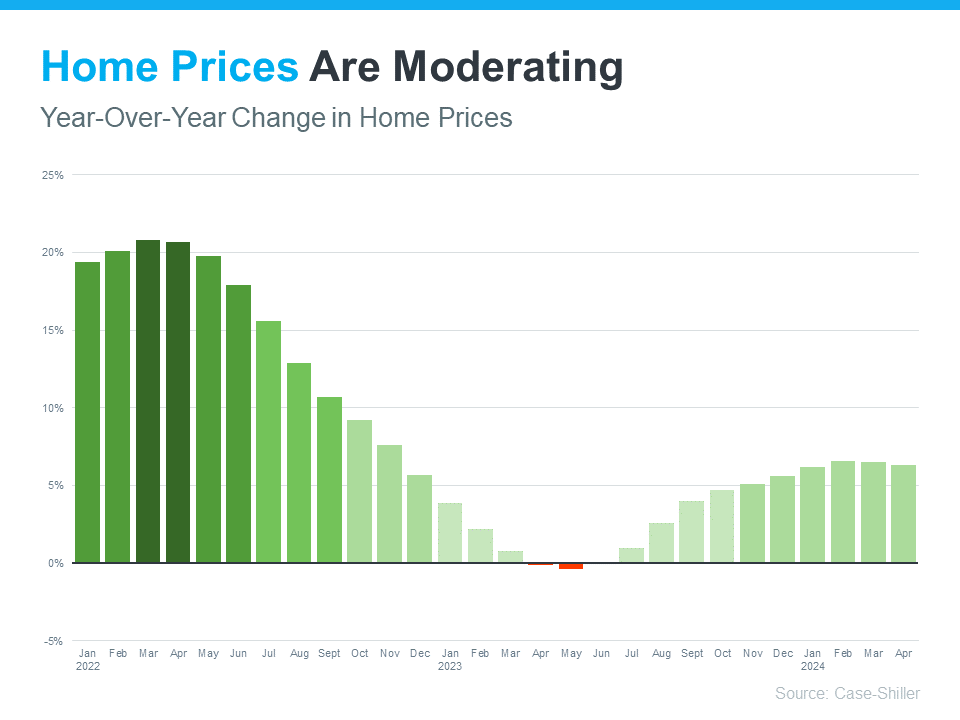

Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below):

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace. You can see this in the graph. The bars are still showing prices increasing, just not as dramatic as it was before.

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago.

The Opportunity in Front of You

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate. There are still challenges, but some of the biggest hurdles you’ve faced are getting better as time wears on.

On the other hand, you could choose to wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers.

Bottom Line

If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Let’s connect to talk more about the opportunities you have in today’s market.

Unlocking Homebuyer Opportunities in 2024

A New Dawn for Homeownership

The housing market, a capricious entity at best, is undergoing a metamorphosis. Gone are the days of frenzied bidding wars and astronomical prices. In its stead, a glimmer of hope for homebuyers is emerging. The year 2024 is shaping up to be a pivotal moment for those harboring your dream of homeownership.

The Shifting Sands of the Housing Market

For far too long, the supply of existing homes has been a paltry offering, fueling a seller’s market of epic proportions. But fear not, for a paradigm shift is afoot. The construction cranes are once again dotting the skyline, signaling a resurgence in new home construction. This burgeoning supply of newly built homes is injecting a much-needed dose of competition into the marketplace, affording homebuyers a broader spectrum of choices.

Moreover, the relentless ascent of home prices appears to be plateauing. While it’s essential to temper expectations, there’s a growing likelihood of discovering more affordable homes nestled within your desired neighborhoods. This nascent affordability, coupled with the expanding inventory, creates a compelling case for embarking on your home search with renewed vigor.

The Mortgage Landscape: A Favorable Climate

Another key factor influencing homebuyer opportunities is the ever-evolving mortgage landscape. While Mortgage Rates have experienced fluctuations, they are generally hovering at levels that are relatively conducive to homeownership. This presents a golden opportunity for prospective buyers to lock in attractive financing terms.

To navigate the complexities of the mortgage world, enlisting the services of a seasoned West Palm Beach mortgage broker is prudent. These financial alchemists possess an intimate knowledge of Affordable West Palm Beach home loans and can tailor mortgage solutions to your specific needs. From First time home buyer loans to West Palm Beach refinancing options, their expertise is invaluable.

Finding Your Perfect Abode

The journey to finding the right home is akin to discovering a hidden gem. It requires patience, perseverance, and a dash of serendipity. Your agent’s expertise is indispensable in this quest. A skilled real estate professional will meticulously curate a selection of properties that align with your preferences, budget, and lifestyle.

Remember, the goal is to find a home that not only meets your present needs but also accommodates your future aspirations. Whether you envision a cozy urban retreat or a sprawling suburban oasis, the key is to identify a property that resonates with your soul.

Seizing the Moment

The confluence of increasing housing supply, moderating home prices, and competitive Mortgage Rates creates a propitious environment for homebuyers. It’s an opportune time to translate your aspirations into reality. However, it’s imperative to approach the homebuying process with a strategic mindset.

Thorough preparation is paramount. This encompasses everything from assessing your financial readiness to defining your ideal home. By arming yourself with knowledge and enlisting the support of qualified professionals, you can confidently navigate the intricacies of the market and unlock the door to your dream of homeownership.

The housing market is a dynamic entity, and conditions can shift. Therefore, it’s essential to stay informed and adaptable. By monitoring market trends and working closely with your agent, you can position yourself to capitalize on emerging opportunities.

In conclusion, the year 2024 holds immense promise for homebuyers. While challenges undoubtedly persist, the prevailing market conditions are undeniably favorable. With careful planning, diligence, and the guidance of trusted advisors, you can transform your house hunting endeavors into a triumphant journey towards homeownership.

Would you like me to continue with another section, such as “Tips for First-Time Homebuyers” or “Overcoming Common Homebuying Challenges”?

Tips for First-Time Homebuyers

Embarking on the exhilarating journey of first-time homeownership can be both thrilling and daunting. To navigate this uncharted territory with confidence, consider these invaluable tips:

- Establish a Solid Financial Foundation: Before diving headfirst into the housing market, it’s imperative to fortify your financial position. Cultivate a robust savings cushion to accommodate a substantial down payment. Moreover, strive to improve your credit score, as a commendable creditworthiness can unlock a wider array of mortgage options and potentially lower interest rates.

- Define Your Homeownership Goals: Envisioning your ideal abode is the cornerstone of a successful home search. Consider factors such as desired location, property size, number of bedrooms, and essential amenities. By crystallizing your preferences, you can streamline the process and avoid wasting precious time on unsuitable properties.

- Leverage the Power of Technology: The digital age has revolutionized homebuying. A plethora of online resources and mobile applications can simplify your home search. Explore virtual tours, property listings, mortgage calculators, and neighborhood information at your fingertips.

- Connect with a Knowledgeable Agent: A seasoned real estate agent is your indispensable ally in the homebuying labyrinth. Their expertise in local market conditions, property values, and negotiation tactics can prove invaluable. A skilled agent will meticulously curate property listings that align with your criteria, sparing you the tedium of endless searches.

- Secure Pre-Approval: Obtaining a pre-approval letter from a lender is a strategic move. It empowers you with a clear understanding of your purchasing power and positions you as a serious buyer in a competitive market. Additionally, sellers are more likely to entertain your offer when you’re armed with pre-approval.

- Thorough Property Inspection: Never underestimate the importance of a comprehensive home inspection. This impartial evaluation uncovers potential structural, electrical, plumbing, or HVAC issues that could lead to costly repairs down the line.

- Embrace Patience and Flexibility: Finding the perfect home is often a journey, not a sprint. Be prepared to encounter setbacks and compromises along the way. Maintain a flexible mindset and remain patient as you navigate the market.

By adhering to these guidelines, you’ll be well-equipped to embark on your homebuying adventure with confidence and enthusiasm. Remember, homeownership is a significant milestone, and with careful planning and preparation, you can unlock a future filled with stability and satisfaction.

Overcoming Common Homebuying Challenges

The path to homeownership is rarely devoid of obstacles. However, with the right strategies, you can surmount even the most formidable challenges. Let’s explore some common hurdles and how to conquer them:

- Limited Inventory: In certain markets, the supply of homes for sale may be scarce, leading to intense competition among buyers. To overcome this challenge, consider expanding your search radius, exploring different property types, or being prepared to make a swift offer when you find the right home.

- Affordability Concerns: Rising home prices can make it difficult to find a property within your budget. To address this issue, explore creative financing options, such as down payment assistance programs or government-backed loans. Additionally, consider purchasing a fixer-upper and investing in renovations to increase the property’s value.

- Home Inspection Nightmares: Discovering significant defects during a home inspection can be disheartening. If faced with such a situation, don’t panic. Negotiate repairs with the seller or adjust your offer accordingly. Alternatively, you may choose to proceed with the purchase and factor in the cost of repairs into your budget.

- Closing Delays: Unforeseen circumstances can sometimes delay the closing process. To mitigate this risk, stay in close communication with your lender, title company, and real estate agent. Proactive follow-up can help identify and resolve potential issues before they escalate.

Remember, every homebuyer encounters challenges along the way. By approaching these obstacles with a proactive and problem-solving mindset, you can increase your chances of a successful homebuying experience.

Would you like me to continue with another section, such as “The Benefits of Homeownership” or “Investing in Your First Home”?

The Benefits of Homeownership

Owning a home is more than just a financial investment; it’s a lifestyle choice brimming with advantages. Let’s delve into the myriad benefits that come with homeownership:

- Building Equity: Every mortgage payment brings you one step closer to owning your property outright. This equity represents a tangible asset that can be leveraged for future financial endeavors, such as home improvements, education, or even a down payment on a second property.

- Tax Advantages: Homeownership often comes with attractive tax benefits. Deductions for mortgage interest and property taxes can significantly reduce your taxable income. However, it’s essential to consult with a tax professional to determine your eligibility and maximize these advantages.

- Stability and Peace of Mind: Unlike renting, where landlords can increase rent or terminate your lease, homeownership provides a sense of stability and security. You have the freedom to customize your living space without seeking permission and the peace of mind that comes with knowing your home is a permanent investment.

- Forced Savings: Mortgage payments can be viewed as a form of forced savings. By consistently allocating funds towards your home, you’re building wealth over time. This disciplined approach can foster financial responsibility and security.

- Community Building: Homeownership often fosters a stronger sense of community. By investing in a neighborhood, you’re more likely to become involved in local activities, build relationships with neighbors, and contribute to the overall well-being of your community.

Investing in Your First Home

Your first home is not merely a place to reside; it’s a foundation for your future. Consider these strategies to maximize your investment:

- Location, Location, Location: The adage holds true. A well-chosen location can significantly impact your property’s value over time. Research neighborhoods with strong schools, convenient amenities, and proximity to employment centers.

- Focus on Long-Term Appreciation: While short-term fluctuations in the housing market are inevitable, focus on the long-term potential for appreciation. Invest in a property that aligns with your lifestyle and has the potential to increase in value over time.

- Prioritize Energy Efficiency: Incorporating energy-efficient features into your home can reduce utility costs and enhance its overall value. Consider upgrades such as insulation, energy-efficient appliances, and renewable energy sources.

- Regular Maintenance: Preventive maintenance is key to preserving your home’s value. Regularly inspect and maintain your property to prevent costly repairs and protect your investment.

- Consider Home Improvements: Strategic home improvements can increase your property’s value and appeal to potential buyers. Focus on upgrades that enhance functionality, curb appeal, and energy efficiency.

By understanding the benefits of homeownership and implementing sound investment strategies, you can lay the groundwork for a prosperous and fulfilling future.

Would you like me to continue with another section, such as “Maintaining Your Home” or “Selling Your Home”?

Maintaining Your Home

A well-maintained home is not only a source of pride but also a sound investment. Regular upkeep can extend the lifespan of your property, prevent costly repairs, and enhance its overall value. Here are some essential maintenance tips:

- Regular Inspections: Schedule routine inspections for your HVAC system, plumbing, electrical wiring, and roof. Early detection of potential issues can save you significant expenses down the line.

- Preventative Maintenance: Perform regular tasks such as changing air filters, cleaning gutters, and sealing cracks to prevent problems from escalating.

- Exterior Care: Protect your home’s exterior by regularly cleaning and sealing your driveway, patio, and deck. Trim trees and shrubs to prevent damage to your roof and foundation.

- Interior Upkeep: Keep your home clean and well-ventilated to prevent mold and mildew growth. Regularly inspect for signs of water damage, such as leaks or stains.

- Emergency Preparedness: Assemble a home emergency kit and create a plan for handling common disasters like fires, storms, or power outages.

Selling Your Home

When the time comes to sell your home, careful preparation is essential to maximize your return on investment. Consider the following strategies:

- Curb Appeal: First impressions matter. Enhance your home’s curb appeal by maintaining a well-manicured lawn, fresh paint, and attractive landscaping.

- Declutter and Depersonalize: Create a clean and spacious interior by decluttering and removing personal items. Potential buyers should be able to envision themselves living in the space.

- Professional Staging: Consider hiring a professional stager to optimize your home’s presentation. Staging can help potential buyers visualize the property’s potential.

- Quality Photos: High-quality photographs are essential for attracting buyers online. Invest in professional photography to showcase your home’s best features.

- Competitive Pricing: Conduct thorough market research to determine a competitive listing price. Overpricing your home can deter potential buyers.

- Effective Marketing: Utilize a variety of marketing channels to reach a wide audience. Work with your real estate agent to develop a comprehensive marketing plan.

- Negotiation Skills: Be prepared to negotiate offers. A skilled real estate agent can guide you through the negotiation process and help you achieve the best possible deal.

Selling your home can be a complex process, but with careful planning and the right guidance, you can achieve a successful outcome.

Would you like me to continue with another section, such as “Common Home Maintenance Mistakes” or “Tips for First-Time Home Sellers”?

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice