The Dramatic Impact of Homeownership on Net Worth

If you’re trying to decide whether to rent or buy a home this year, here’s a powerful insight that could give you the clarity and confidence you need to make your decision.

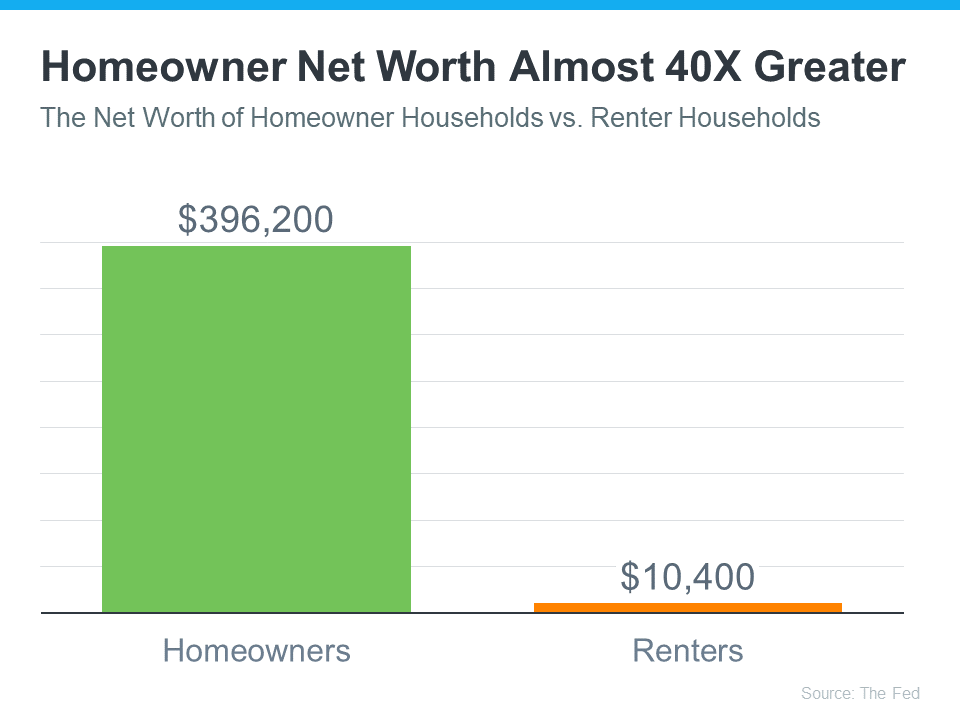

Every three years, the Federal Reserve releases the Survey of Consumer Finances (SCF), which compares net worth for homeowners and renters. The latest report shows the average homeowner’s net worth is almost 40X greater than a renter’s (see graph below):

One reason a wealth gap exists between renters and homeowners is because when you’re a homeowner, your equity grows as your home appreciates in value and you make your mortgage payment each month. When you own a home, your monthly mortgage payment acts like a form of forced savings, which eventually pays off when you decide to sell. As a renter, you’ll never see a financial return on the money you pay out in rent every month. Ksenia Potapov, Economist at First American, explains it like this:

“Renters don’t capture the wealth generated by house price appreciation, nor do they benefit from the equity gains generated bymonthly mortgage payments . . .”

The Largest Part of Most Homeowner Net Worth Is Their Equity

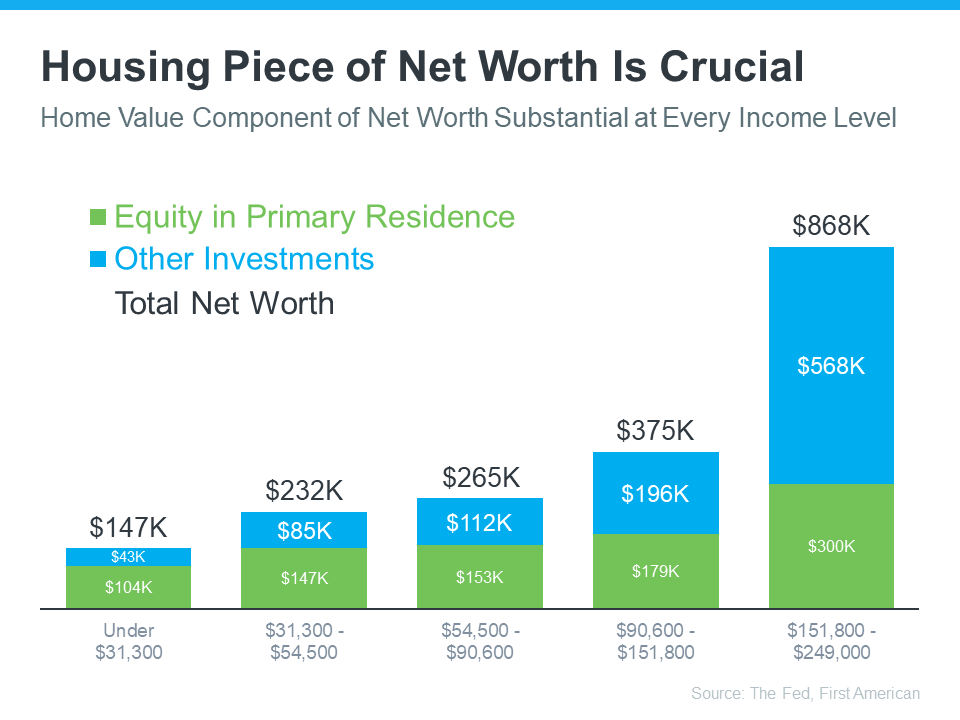

Home equity does more to build the average household’s wealth than anything else. According to data from First American and the Federal Reserve, this holds true across different income levels (see graph below):

The green segment in each bar represents how much of a homeowner’s net worth comes from their home equity. Based on this data, it’s clear no matter what your income level is, owning a home can really boost your wealth. Nicole Bachaud, Senior Economist at Zillow, shares:

“The biggest asset most people are ever going to own is a home. Homeownership is really that financial key that helps unlock stability and wealth preservation across generations.”

If you’re ready to start building your net worth, the current real estate market offers several opportunities you should consider. For example, with mortgage rates trending lower lately, your purchasing power may be higher now than it has been in months. And, with more inventory coming to the market, there are more options for you to consider. A localreal estate agent can walk you through the opportunities you have today and guide you through the process of finding your ideal home.

If you’re unsure about whether to rent or buy a home, keep in mind that owning a home can increase your overall wealth in the long run, no matter your income. To discover more about this and the many other benefits of homeownership, let’s connect.

The Dramatic Impact of Homeownership on Net Worth

In the intricate tapestry of personal finance, homeownership stands as a bold brushstroke, painting a picture of financial stability and wealth accumulation. The decision to buy a home is not merely a transaction; it’s an investment in the future, a journey laden with nuances that ripple through the fabric of one’s net worth.

Unveiling the Canvas: Benefits of Homeownership

Embarking on the quest to find your ideal home is akin to discovering a treasure trove of financial advantages. One of the most prominent jewels in this treasure chest is Home Equity. It’s the golden nugget that separates homeowners from mere occupants.

The Alchemy of Homeownership: Unlocking Equity

Homeownership, beyond its practical aspect of providing shelter, is a formidable force in wealth creation. As you consistently make your monthly mortgage payment, a magical transformation occurs. A portion of this payment goes towards reducing your mortgage balance, thus increasing your equity stake in the property.

This unique process is a dance between debt reduction and wealth accumulation. With each passing month, the homeowner’s equity ascends like a crescendo, creating a financial symphony that resonates for years to come.

The House Price Waltz: A Flourish in Net Worth

While the real estate market may seem like an enigmatic ballroom, the dynamics of house prices add a layer of complexity to the dance of homeownership. The perpetual ebb and flow of the real estate tide significantly influences the trajectory of one’s net worth.

Dancing with Market Fluctuations

The correlation between house price trends and net worth is profound. In a thriving market, homeowners witness the appreciation of their property, infusing their net worth with vitality. Conversely, during downturns, the sag in house prices can momentarily dim the glow.

However, the resilience of real estate markets often plays the long game. History narrates stories of recovery, where property values regain their vigor, and homeowners find themselves back in the spotlight of financial growth.

Mortgage Rates: The Tempo of Financial Harmony

In the symphony of homeownership, mortgage rates compose the tempo. Securing a favorable interest rate is akin to orchestrating a melodious partnership with your financial future.

A Prelude to Financial Harmony

As prospective homeowners contemplate whether to rent or buy a home, the prevailing mortgage rates become a pivotal factor. Low-interest rates not only ease the burden of the monthly mortgage payment but also accelerate the accumulation of equity. It’s a financial overture that sets the stage for a harmonious journey toward increased net worth.

Guiding Lights in the Labyrinth: Local Real Estate Agents

Navigating the labyrinth of the current real estate market can be an overwhelming experience. In this intricate dance, local real estate agents emerge as guiding lights, offering expertise and insights that transform the quest for homeownership into a well-choreographed routine.

The Dance Partners: Homeowners and Real Estate Agents

Collaborating with a seasoned professional can be the difference between stumbling through the steps and executing a flawless routine. Homeowners benefit from the intricate knowledge of local real estate agents, ensuring they make informed decisions that resonate positively in the grand performance of wealth accumulation.

Owning A Home: A Culmination of Financial Artistry

In the grand tapestry of personal finance, the decision to own a home is a culmination of financial artistry. It’s a commitment to building a legacy, where the threads of equity, house prices, and mortgage rates weave together to create a masterpiece of net worth.

The Symphony of Wealth: Owning A Home

As homeowners make their monthly mortgage payments, they contribute not only to the structure that shelters them but also to the orchestration of their financial future. The rhythm of equity growth, the melody of house price appreciation, and the harmonious tempo set by favorable mortgage rates compose a symphony of wealth.

In Conclusion: A Prosperous Finale

In the realm of personal finance, the impact of homeownership on net worth is nothing short of dramatic. The intricacies of equity accumulation, the nuances of house price trends, and the tempo of mortgage rates converge to create a financial masterpiece.

As individuals weigh the decision to buy a home, they embark on a journey where each monthly mortgage payment is a brushstroke, adding depth and richness to their financial canvas. With the guidance of local real estate agents, the dance becomes more refined, and the steps toward increased net worth are guided with expertise.

In the grand theater of personal finance, homeownership is not just a transaction; it’s a performance, a symphony, and an art form that shapes the narrative of financial prosperity.

Sustaining the Momentum: Nurturing Home Equity

The journey of homeownership is not a one-time affair; it’s a continuous performance that requires nurturing. The art of growing Home Equity involves strategic maneuvers and financial acumen.

Strategic Maneuvers in Home Equity Growth

Homeowners keen on amplifying their net worth understand the significance of optimizing equity growth. Some may choose to make additional payments towards the principal, effectively accelerating the pace at which they build equity. Others may leverage home improvements to elevate the market value of their property, consequently boosting equity.

It’s this strategic play with the nuances of homeownership that transforms the journey into a dynamic and evolving process, one that continually contributes to the crescendo of financial success.

The Dance of Homeownership: Benefits Beyond Wealth

While the financial symphony of homeownership resonates prominently, it’s essential to acknowledge the multifaceted benefits that extend beyond the realm of net worth.

A Shelter That Echoes Security

Owning a home is not just an investment; it’s a haven that echoes security. The sense of stability and belonging emanating from homeownership adds a unique dimension to the overall quality of life. This emotional resonance is an intangible benefit that, while challenging to quantify, significantly enriches the homeowner’s experience.

Deciphering the Financial Libretto: Mortgage Payments and Wealth Creation

The language of wealth creation in homeownership is written in the rhythmic cadence of monthly mortgage payments. Unveiling the financial libretto reveals the intricate connection between consistent payments and the crescendo of net worth.

The Compound Effect of Monthly Mortgage Payments

Each payment is a stitch in the financial fabric, weaving together interest and principal repayment. It’s the compound effect in action, where diligence in meeting financial obligations translates into a substantial surge in equity over time.

Understanding this compound nature is like deciphering a musical score, where the repetition of notes leads to the creation of a symphony. In the context of homeownership, the repetitive act of making monthly mortgage payments orchestrates a composition of financial success.

Navigating Crossroads: Rent or Buy a Home

The decision to rent or buy a home is a pivotal crossroads in the journey toward financial prosperity. Renting may provide temporary relief, but the missed opportunity to accumulate equity can cast a shadow over long-term financial goals.

The Opportunity Cost of Renting

While renting offers flexibility, it does little to contribute to the homeowner’s net worth. In the perpetual dance of wealth creation, homeownership emerges as the protagonist, stealing the spotlight from the transient nature of renting.

The Current Real Estate Market: A Dynamic Backdrop

The dance floor of homeownership is set against the backdrop of the ever-evolving current real estate market. Understanding its nuances is akin to mastering the art of navigating through different tempos and rhythms.

Adapting to Market Dynamics

Successful homeowners are astute observers of market trends. They understand that the dynamics of supply and demand, interest rates, and economic factors influence the performance of their property in the market. Adapting to these dynamics is a skill that separates the novice from the seasoned homeowner.

Embracing the Future: Evolution of Homeownership

As the symphony of homeownership continues to play, it’s crucial to acknowledge the evolution of this financial art form. The landscape of real estate, mortgage rates, and societal trends is ever-changing, necessitating a proactive and adaptive approach.

Future-Forward Homeownership

The proactive homeowner is not just a participant in the dance but a choreographer envisioning future moves. Staying informed about emerging trends, leveraging technology for financial insights, and maintaining a symbiotic relationship with a local real estate agent position the homeowner at the forefront of the evolving landscape.

The Final Bow: A Legacy of Prosperity

In the grand finale of homeownership, as the curtains draw to a close, what remains is a legacy of prosperity. The impact on net worth is not just a numerical figure; it’s a testament to the financial journey, the strategic decisions, and the unwavering commitment to building a brighter future.

Beyond the Numbers: The Intangible Legacy

While the numbers speak volumes, the intangible legacy is equally significant. It’s the story of a shelter that transformed into a home, a haven of security, and a stage where the dance of financial success unfolded.

In conclusion, the dramatic impact of homeownership on net worth is a saga of financial artistry. It’s a symphony where each note, each step, and each decision contribute to the creation of a masterpiece. As individuals contemplate the decision to buy a home, they are not just investing in property; they are crafting a legacy, orchestrating a symphony, and embracing the future with open arms. The dance of homeownership is an everlasting performance, leaving an indelible mark on the canvas of personal finance.

The Bottom Line: Homeownership as a Wealth-Building Epic

In the grand narrative of personal finance, the bottom line of homeownership is an epic tale of wealth creation. Beyond the mere transaction of buying a home, it unfolds as a strategic dance where each element – from the monthly mortgage payments to market dynamics and the guidance of local real estate agents – plays a pivotal role in shaping one’s financial destiny.

Homeownership is not just about the benefits of accruing equity or the dance with house prices and mortgage rates. It’s a holistic experience that extends beyond the numerical metrics of net worth. Owning a home is a profound journey, a legacy-building endeavor that goes beyond the tangible, leaving an indelible mark on the financial canvas.

As individuals contemplate the decision to buy a home, they are not just investing in bricks and mortar; they are investing in a lifestyle, in security, and in the promise of a prosperous future. The monthly mortgage payments become the rhythmic beats that compose a symphony of financial success, and the guidance of local real estate agents serves as a compass in the ever-changing market landscape.

So, in the final bow of this homeownership saga, what stands out is not just the numerical increase in net worth but the intangible legacy of prosperity. It’s a legacy crafted through strategic maneuvers, through the decision to own rather than rent, and through an astute understanding of the dynamic interplay of market forces.

In essence, homeownership is a wealth-building masterpiece, an ongoing performance that leaves a lasting imprint on the financial tapestry of individuals and families. It’s not merely a transaction; it’s an epic journey, a symphony of financial well-being that resonates for generations to come.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice