What Homebuyers Need To Know About Credit Scores

Some Highlights

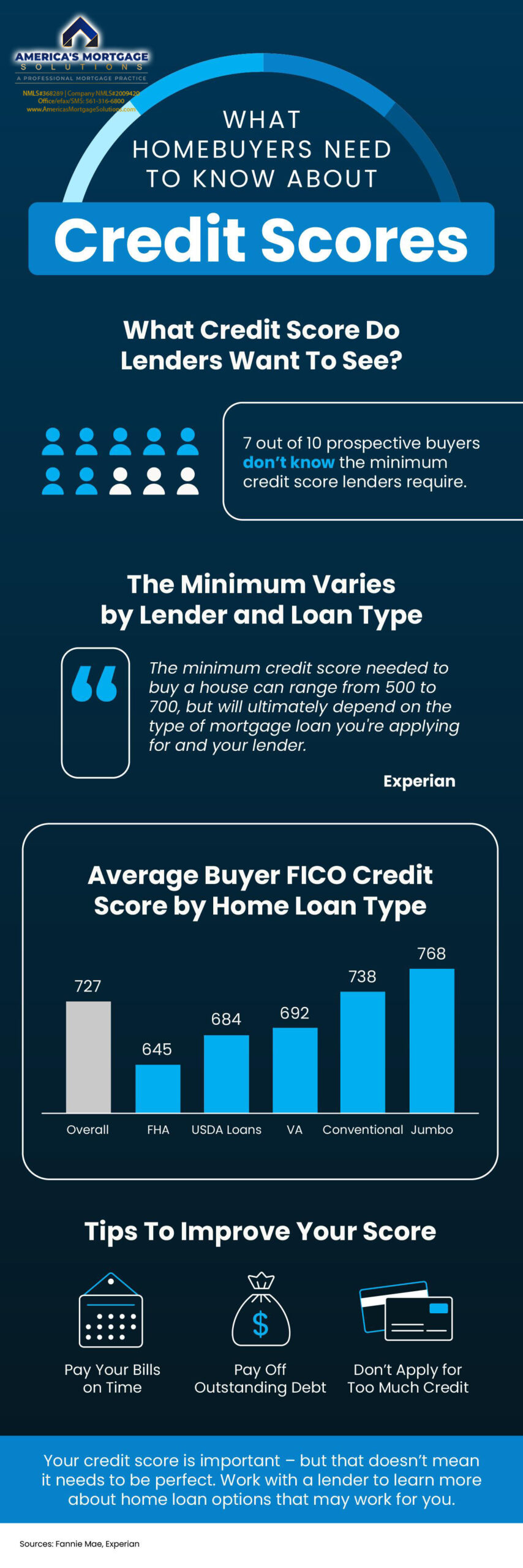

- Data shows 7 out of 10 prospective homebuyers don’t know the minimum credit score required by lenders or that it varies by lender and loan type.

- According to Experian, the range is anywhere from 500 to 700 for the minimum credit score. That means you don’t need perfect credit to buy a home.

- Your credit score is important – but that doesn’t mean it needs to be perfect. Work with a lender to learn more about home loan options that may work for you.

What Homebuyers Need to Know About Credit Scores

When you’re ready to buy a home, your credit score becomes one of the most critical factors in the process. Whether you’re a first-time homebuyer or an experienced real estate investor, understanding how credit scores impact your options can save you time, money, and stress. Here’s everything you need to know about navigating your credit journey, with insights designed to guide you toward success.

The Role of Credit Scores in Home Buying

Your credit score acts as a financial report card, telling lenders how trustworthy you are when it comes to repaying debts. This three-digit number is the gateway to homeownership, as it directly impacts your ability to secure a loan and the terms of that loan. Prospective homebuyers often underestimate how much their credit scores affect the type of financing they can receive.

What Is a Minimum Credit Score?

One of the most common questions is: “What is the minimum credit score I need to buy a home?” The answer is not one-size-fits-all. It varies by lender and loan type. According to Experian, minimum credit scores typically range from 500 to 700, depending on the type of mortgage.

For example:

- FHA loans may require a minimum credit score of 500 to 580, depending on the down payment.

- Conventional loans often demand scores above 620.

- VA loans might not have a specific minimum but still expect good creditworthiness.

The key takeaway? You don’t need perfect credit to become a homeowner. However, improving your score can unlock better loan terms and save you money over time.

Exploring Loan Types and Home Loan Options

Different loan types cater to different financial situations. Understanding your options is essential:

FHA Loans

FHA loans are popular among first-time home buyers in West Palm Beach. These government-backed loans allow lower minimum credit scores and smaller down payments, making them ideal for those with limited savings.

Conventional Loans

If your credit score is solid, conventional loans might offer the best terms. While the requirements are stricter, these loans often come with lower interest rates, especially if you’ve worked hard to maintain a high score.

VA Loans

Designed for veterans, VA loans feature no down payment and no private mortgage insurance. These loans provide an exceptional opportunity for those who qualify.

Local Mortgage Options

For residents in Florida, a West Palm Beach mortgage broker can help tailor financing to your specific needs. From affordable West Palm Beach home loans to specialized products like West Palm Beach refinancing options, local experts can offer competitive solutions.

Why Credit Scores Vary by Lender

It’s important to know that not all lenders are created equal. The requirements and terms for loans often vary by lender. For example, some local mortgage lenders in West Palm Beach might specialize in niche products like commercial mortgage broker services or property loan advice in West Palm Beach.

When shopping for the best mortgage rates in West Palm Beach, take time to compare offers. Use tools like West Palm Beach mortgage calculators to estimate costs and identify the loan that aligns with your budget.

Steps to Improve Your Credit Score

If your credit score isn’t where you’d like it to be, don’t worry. There are actionable steps you can take:

- Check Your Credit Report: Errors on your report can drag your score down. Request a free copy and dispute any inaccuracies.

- Pay Down Debt: Reducing your credit utilization rate (the ratio of your credit card balances to your credit limits) can significantly improve your score.

- Avoid New Credit Applications: Each new inquiry temporarily lowers your score.

- Work With a Lender: A seasoned professional can guide you through improving your score while exploring home loan options that align with your goals.

Mortgage Preapproval: A Game-Changer

Before you start house hunting, securing a mortgage preapproval in West Palm Beach can set you apart as a serious buyer. Preapproval gives you a clear picture of your budget and shows sellers that you’re financially prepared to close the deal. It’s also a chance to understand what your credit score qualifies you for in terms of loan products and interest rates.

The Importance of Local Expertise

Navigating the real estate market can be daunting, but working with professionals familiar with your area can make all the difference. A West Palm Beach mortgage broker offers valuable insights tailored to local trends. Whether you’re looking for affordable West Palm Beach home loans, first-time home buyer loans in West Palm Beach, or refinancing opportunities, local expertise ensures you’re getting the best advice and products available.

Don’t Let Perfect Be the Enemy of Good

Many prospective homebuyers mistakenly believe they need perfect credit to buy a home. This simply isn’t true. While a higher credit score does open the door to more favorable terms, there are plenty of options for those still building their credit. From FHA loans to local programs, the dream of homeownership is within reach for most people.

Key Takeaways for Prospective Homebuyers

- Your credit score is a major factor, but not the only one. Income, debt, and savings also play critical roles.

- The minimum credit score required to buy a home varies by lender and loan type.

- Use tools like West Palm Beach mortgage calculators to plan your budget.

- Work with professionals, such as a West Palm Beach mortgage broker, to explore your options and secure favorable terms.

Buying a home is one of the most significant financial decisions you’ll make. By understanding how your credit score impacts the process and leveraging local expertise like property loan advice in West Palm Beach, you can make informed choices that set you up for long-term success.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice