The Benefits of Using Your Equity To Make a Bigger Down Payment

Did you know? Homeowners are often able to put more money down when they buy their next home. That’s because, once they sell, they can use the equity they have in their current house toward their next down payment. And it’s why as home equity reaches a new height, the median down payment has too.

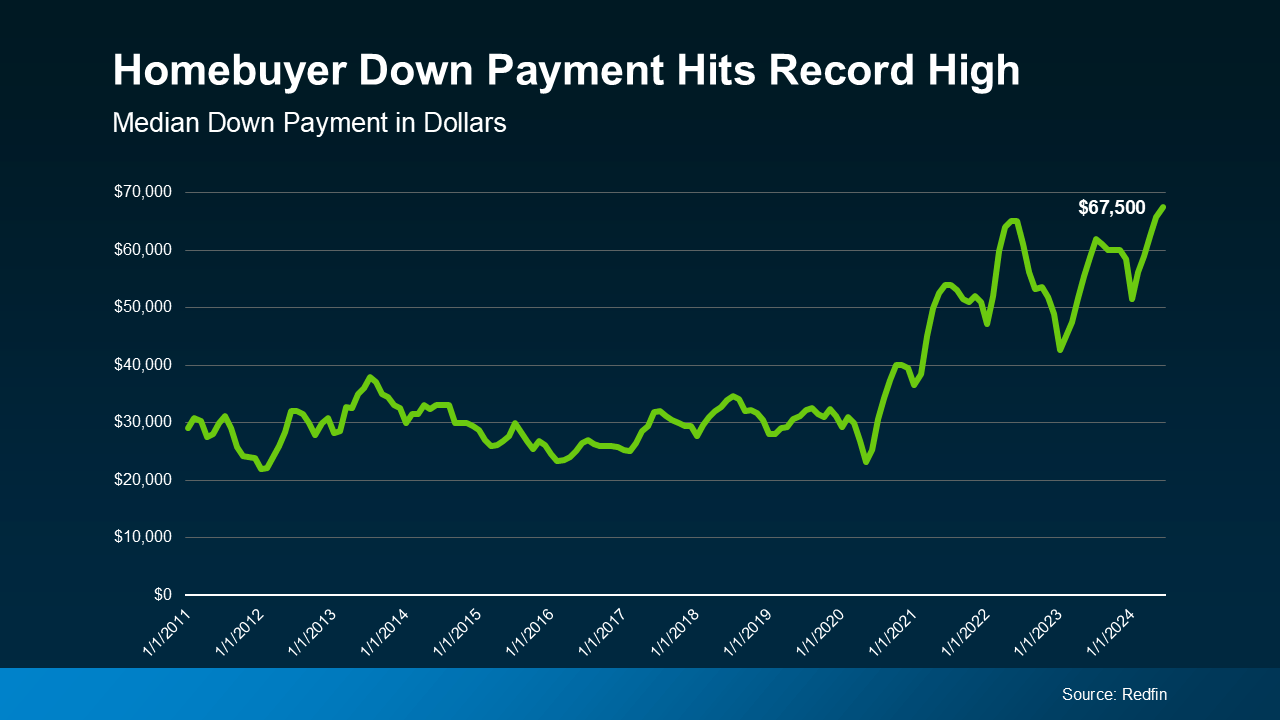

According to the latest data from Redfin, the typical down payment for U.S. homebuyers is $67,500—that’s nearly 15% more than last year, and the highest on record (see graph below):

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability.

Here’s why equity makes this possible. Over the past five years, home prices have increased significantly, which has led to a big boost in equity for current homeowners like you. When you sell your house and move, you can take the equity that gives you and apply it toward a larger down payment on your new home. That’s a major opportunity, especially if you’ve had concerns about affordability.

Now, it’s important to remember you don’t have to make a big down payment to buy your next home—there are loan programs that let you put as little as 3%, or even 0% down. But there’s a reason so many current homeowners are opting to put more money down. That’s because it comes with some serious perks.

Why a Bigger Down Payment Can Be a Game Changer

1. You’ll Borrow Less and Save More in the Long Run

When you use your equity to make a bigger down payment on your next home, you won’t have to borrow as much. And the less you borrow, the less you’ll pay in interest over the life of your loan. That’s money saved in your pocket for years to come.

2. You Could Get a Lower Mortgage Rate

Providing a larger down payment shows your lender you’re more financially stable and not a large credit risk. The more confident your lender is in your credit score and your ability to pay your loan, the lower the mortgage rate they’ll likely be willing to give you. And that amplifies your savings.

3. Your Monthly Payments Could Be Lower

A bigger down payment doesn’t just help you reduce how much you have to borrow—it also means your monthly mortgage payment may be smaller. That can make your next home more affordable and give you a bit more breathing room in your budget.

4. You Can Skip Private Mortgage Insurance (PMI)

If you can put down 20% or more, you can avoid Private Mortgage Insurance (PMI), which is an added cost many buyers have to pay if their down payment isn’t as large. Freddie Mac explains it like this:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner’s insurance. It’s a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

Avoiding PMI means you’ll have one less expense to worry about each month, which is a nice bonus.

Bottom Line

Down payments are at a record high, largely because recent equity gains are putting homeowners in a position to put more money down.

If you’re thinking about selling your current house and moving, let’s work together to figure out how much home equity you have right now, and how it can boost your buying power in today’s market.

The Benefits of Using Your Equity To Make a Bigger Down Payment

If you’re thinking about selling your current house, there’s a powerful financial strategy that can maximize your next real estate investment: using the benefits of using your equity for a larger down payment. Over the past few years, many homeowners have seen a big boost in equity for current homeowners, thanks to recent equity gains driven by rising home prices. Now could be the perfect time to buy your next home by leveraging this equity. A bigger down payment doesn’t just improve your buying power—it also makes homeownership more affordable over the long term. Let’s explore how to tap into this opportunity and why using your equity is a smart move in today’s market.

1. What Is Home Equity, and Why Is It Valuable?

Your equity is the portion of your home’s value that you own outright. As home prices increase and your mortgage balance decreases with every payment, your equity builds up. Think of it as a safety net—and, more importantly, a powerful financial tool.

Using this equity for a bigger down payment allows you to reduce your future mortgage payment and even qualify for better mortgage rates. If you’ve been debating whether to sell your house to upgrade or relocate, this strategy can smooth the transition and ensure your next purchase is more affordable. With West Palm Beach refinancing options and access to local mortgage lenders in West Palm Beach, homeowners in the area have the tools they need to make the most of their equity gains.

2. Boost Your Buying Power with a Larger Down Payment

Making a substantial down payment increases your buying power by opening doors to more favorable loan programs and lower interest rates. It sends a signal to the lender that you’re a low-risk borrower, making it easier to secure one of the best mortgage rates in West Palm Beach.

For instance, first time home buyer loans in West Palm Beach often require a smaller down payment, but if you can use the benefits of using your equity, you may unlock better financing options with your lender. A larger down payment also means lower monthly payments, helping you make your next home more affordable—something every buyer should aim for in a fluctuating market.

3. Avoiding Private Mortgage Insurance (PMI)

PMI can feel like an unnecessary burden. When you make a down payment of less than 20%, lenders typically require PMI to offset the added risk. However, using your equity to make a larger down payment helps you sidestep this expense altogether.

In markets like West Palm Beach, where home prices have steadily risen, many homeowners are now sitting on a goldmine of recent equity gains. Instead of draining your savings, use your equity to push past the 20% threshold and eliminate PMI. With the assistance of a West Palm Beach mortgage broker, you can easily calculate how much you need to avoid PMI using specialized West Palm Beach mortgage calculators.

4. Lower Monthly Payments, Long-Term Savings

One of the most attractive benefits of using your equity is the potential to significantly lower your mortgage payment. By increasing your down payment, you’ll borrow less, which translates to a smaller loan balance and reduced interest over the life of the mortgage.

With affordable West Palm Beach home loans and flexible loan programs, a higher down payment can help align your monthly budget with your financial goals. Whether you’re downsizing, upsizing, or relocating, leveraging equity ensures you’re not overextending yourself financially when you buy your next home.

5. Flexible Loan Programs and Better Mortgage Rates

When you make a larger down payment, you can qualify for more favorable loan programs. Your lender may offer you options with better interest rates, shorter loan terms, or fewer restrictions. This is especially true if you work with a West Palm Beach mortgage broker who has access to multiple local mortgage lenders in West Palm Beach.

Shopping around for the best mortgage rates in West Palm Beach becomes much easier when you have a significant down payment in hand. You might also find that lenders are more inclined to offer perks like discounted fees or expedited mortgage preapproval in West Palm Beach.

6. Take Advantage of Local Expertise in West Palm Beach

Navigating the complexities of mortgage options requires more than just financial knowledge—it requires local insight. A commercial mortgage broker in West Palm Beach or a professional specializing in residential loans can provide property loan advice in West Palm Beach tailored to your specific situation.

If you’re upgrading to a larger home or investing in property, working with local mortgage lenders in West Palm Beach can help you make the most of your equity. They understand the nuances of the local market and can offer specialized products like West Palm Beach refinancing options to suit your needs.

7. When Is the Right Time to Use Your Equity?

Timing is everything in real estate. If you’re thinking about selling your current house, it’s worth evaluating your equity position. The current environment offers a sweet spot for homeowners with recent equity gains, making it a prime opportunity to sell your house and upgrade without stretching your finances.

Using a West Palm Beach mortgage broker ensures that you find the right timing and loan strategy to optimize your purchase. A quick chat with your lender can reveal whether now is the ideal time to capitalize on West Palm Beach mortgage calculators and first time home buyer loans in West Palm Beach.

8. Conclusion: Make Your Next Move a Smart One

The benefits of using your equity are clear: you’ll enjoy better mortgage rates, eliminate PMI, reduce your monthly payments, and increase your buying power. With the real estate market offering favorable conditions for those with recent equity gains, there’s no better time to explore your options.

Whether you’re eyeing a dream home or a strategic investment, using the equity from your current property gives you a head start. Talk to a West Palm Beach mortgage broker or explore West Palm Beach refinancing options to discover how to unlock the full potential of your equity. Make the most of today’s opportunities and buy your next home with confidence.

With access to affordable West Palm Beach home loans, competitive lenders, and the right financial strategy, make your next home more affordable and build a future you’ll love living in.

9. How Equity Transforms Real Estate Opportunities

The power of using your equity goes beyond simply reducing costs—it unlocks new real estate possibilities that may have previously felt out of reach. A larger down payment gives you flexibility, whether you’re aiming to move into a more desirable neighborhood, buy a larger home, or even purchase an investment property.

If you’ve been holding back from making a move because of concerns about affordability or the uncertainty of the market, your equity can serve as a game-changer. In a competitive market like West Palm Beach, where home prices fluctuate and desirable homes sell fast, having the financial edge provided by equity can position you ahead of other buyers.

The local knowledge of a West Palm Beach mortgage broker also plays a critical role in this transformation. They can match you with affordable West Palm Beach home loans and connect you with local mortgage lenders in West Palm Beach who understand how to structure your mortgage to optimize your equity gains. This ensures that the transition to your next home is smooth and financially efficient.

10. Leveraging Equity for Investment Opportunities

Beyond simply buying your next home, tapping into your equity can also open doors to real estate investments. Some homeowners use their equity to purchase rental properties or vacation homes, turning their primary residence into a stepping stone toward financial growth.

West Palm Beach, with its booming tourism sector, offers excellent opportunities for vacation rentals and commercial properties. Working with a commercial mortgage broker in West Palm Beach can help you navigate these options. You could even use West Palm Beach refinancing options to free up additional funds without selling your current home, giving you the flexibility to expand your property portfolio while still living comfortably.

Whether you’re eyeing a short-term rental or a long-term investment, your buying power is enhanced when you strategically use your equity. A well-planned investment could eventually generate income that offsets your mortgage payments, further making your next home more affordable.

11. Equity and Mortgage Refinancing: A Dynamic Duo

For those who aren’t ready to sell, refinancing is another way to unlock your home’s equity. West Palm Beach refinancing options allow you to adjust your mortgage terms, access cash, and lower your interest rate—all while staying in your current property. With mortgage rates constantly fluctuating, refinancing could give you a chance to secure one of the best mortgage rates in West Palm Beach.

Some homeowners refinance to lower their mortgage payment, while others prefer a cash-out refinance to fund a larger down payment on a new home. Refinancing can also eliminate the need for PMI, further reducing monthly costs. Before committing to a refinance, you can use West Palm Beach mortgage calculators to understand how the new terms will impact your budget.

A trusted West Palm Beach mortgage broker will guide you through the refinancing process, helping you evaluate all your options and connect with local mortgage lenders in West Palm Beach. The goal is to maximize the benefits of using your equity in a way that aligns with your financial strategy.

12. First-Time Homebuyers and Equity Advantages

If you’re a first-time homebuyer, you might assume that equity is only relevant to current homeowners. However, some loan programs, like first time home buyer loans in West Palm Beach, allow new buyers to leverage gifts, grants, or other forms of assistance to build instant equity in their home.

Additionally, if you purchase a home below market value or in an area with rising home prices, you may accumulate recent equity gains much faster than expected. In this case, consulting with a West Palm Beach mortgage broker early in the process ensures that you’re aware of all available options, such as mortgage preapproval in West Palm Beach, which can give you an edge when bidding on competitive properties.

13. Tailoring Your Financial Strategy with Local Expertise

Every real estate transaction is unique, and working with local mortgage lenders in West Palm Beach gives you access to personalized advice. Local experts understand the dynamics of the West Palm Beach market—from property values to mortgage trends—and can provide property loan advice in West Palm Beach that fits your financial situation.

For example, if you’ve experienced significant recent equity gains, a West Palm Beach mortgage broker can recommend whether it’s best to sell your house now or explore refinancing. They may also identify loan programs with favorable terms based on your credit score and income.

In today’s market, having local expertise on your side ensures that you’re making informed decisions about your equity. Whether you’re buying, refinancing, or investing, your lender will tailor your mortgage to align with your long-term financial goals.

14. Preparing for a Smooth Transition

If you decide to sell your house and buy your next home, planning ahead will make the transition as seamless as possible. Timing the sale and purchase correctly is crucial, especially if you need the proceeds from your current property to fund your next down payment.

West Palm Beach mortgage calculators can help you estimate how much you’ll need for a down payment and monthly mortgage payments, allowing you to plan your budget accordingly. In competitive markets, getting mortgage preapproval in West Palm Beach gives you a competitive edge by showing sellers that you’re a serious buyer.

Working closely with your lender will ensure that the sale and purchase align smoothly, minimizing the stress that often comes with moving. A West Palm Beach mortgage broker can coordinate with both the buyer and seller to ensure everything goes according to plan.

15. Make the Most of Your Equity Today

The real estate market is constantly evolving, and your equity is a dynamic asset that can help you achieve your financial goals. Whether you’re looking to buy your next home, invest in property, or simply make your current mortgage more manageable, the benefits of using your equity are clear.

With access to affordable West Palm Beach home loans, West Palm Beach refinancing options, and personalized guidance from local mortgage lenders in West Palm Beach, now is the time to make your next move. By increasing your buying power, avoiding PMI, and securing better mortgage rates, you can make your next home more affordable and build a bright financial future.

So, whether you’re upgrading to a new house, exploring investment properties, or refinancing your current mortgage, don’t let this opportunity pass you by. Use your equity wisely, work with a trusted West Palm Beach mortgage broker, and take the first step toward a more secure and prosperous future.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today