The Real Story Behind What’s Happening with Home Prices

If you’re wondering what’s going on with home prices lately, you’re definitely not the only one. With so much information out there, it can be hard to figure out your next move.

As a buyer, you might be worried about paying more than you should. And if you’re thinking of selling, you might be concerned about not getting the price you’re aiming for.

So, here’s a quick breakdown to help clear things up and show you what’s really happening with prices—whether you’re thinking about buying or selling.

Home Price Growth Is Slowing, but Prices Aren’t Falling Nationally

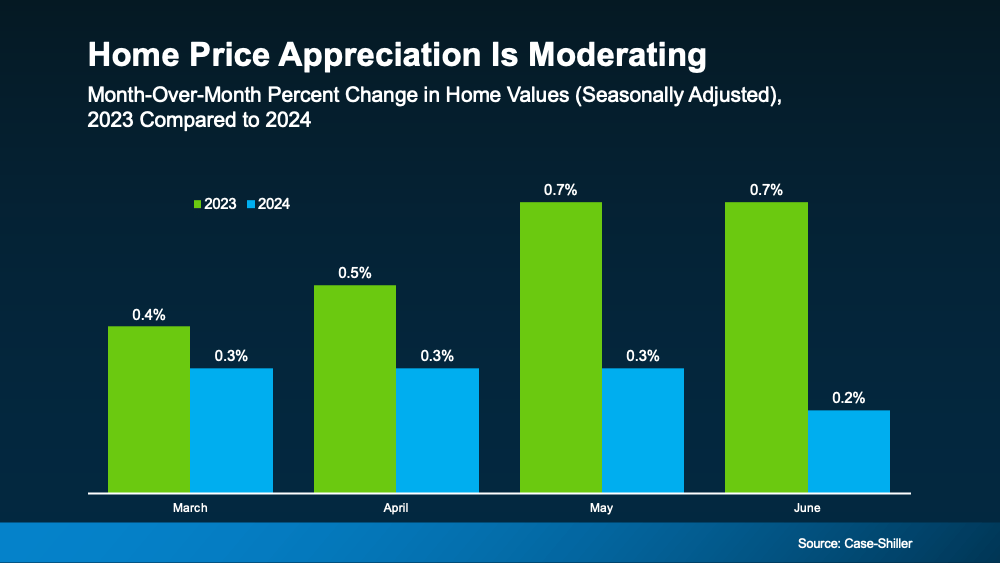

Throughout the country, home price appreciation is moderating. What that means is, prices are still going up, but they’re not rising as quickly as they were in recent years. The graph below uses data from Case-Shiller to make the shift from 2023 to 2024 clear:

But rest assured, this doesn’t mean home prices are falling. In fact, all the bars in this graph show price growth. So, while you might hear talk of prices cooling, what that really means is they’re not climbing as fast as they were when they skyrocketed just a few years ago.

But rest assured, this doesn’t mean home prices are falling. In fact, all the bars in this graph show price growth. So, while you might hear talk of prices cooling, what that really means is they’re not climbing as fast as they were when they skyrocketed just a few years ago.

What’s Next for Home Prices? It’s All About Supply and Demand

You might be curious where prices will go from here. The answer depends on supply and demand, and it’s going to vary by local market.

Nationally, the number of homes for sale is going up, but there still aren’t enough of them to meet today’s buyer demand. That’s keeping upward pressure on prices – even though recent inventory growth has caused that home price appreciation to slow. Danielle Hale, Chief Economist at Realtor.com, said:

“. . . today’s low but quickly improving for-sale inventory has ushered in more market balance than would otherwise be expected . . . This should help home prices maintain a slower pace of growth.”

And here’s one other thing you may not have considered that could play a role in where prices go from here. Since experts say mortgage rates should continue to decline, it’s likely more buyers will re-enter the market in the months ahead. If demand picks back up, that could make prices climb a bit further.

Why You Should Work with a Local Real Estate Agent

While national trends give a big-picture view, real estate is always local – especially when it comes to prices. What’s happening in your neighborhood might be different from the national average based on what supply and demand look like in your market. That’s why it’s crucial to get local insights from a knowledgeable real estate agent.

As your go-to source for everything related to home prices, a local agent can provide the most current data and trends specific to your area.

So, if you’re planning to sell, they can help you price your house accurately. And when you’re ready to buy, they can find the right home that fits your budget and your needs.

Home prices are still rising, just not as quickly as before. Whether you’re thinking about buying, selling, or just curious about what your house is worth, let’s connect so you have the personalized guidance you need.

The Real Story Behind What’s Happening with Home Prices

As the world continues to evolve, so does the landscape of the real estate market. Home prices are not just fluctuating numbers that seem arbitrary; they tell a deeper story of shifting economic winds, market dynamics, and the aspirations of millions of people. Whether you’re buying or selling, understanding what’s really happening with home prices is crucial to making informed decisions. But where do these prices come from, and why do they change?

If you’re tuned into the real estate scene or just casually browsing through listings, you might be wondering why prices have changed so much in recent years. Spoiler alert: it’s not just one factor. It’s a multifaceted situation that intertwines mortgage rates, housing demand, and local market dynamics. So let’s pull back the curtain and explore everything related to home prices—from the broader national trends to the intimate local flavors shaping your neighborhood’s market.

Home Prices: National Trends or Local Phenomena?

First things first, it’s important to note that real estate is always local. That means the price of a home in Los Angeles is unlikely to mirror the price of a home in West Palm Beach. Yet, national trends do exist, and they can often serve as a compass to guide us through the tumultuous world of real estate pricing.

Over the past decade, we’ve witnessed consistent home price appreciation across most parts of the country. This upward trajectory, for the most part, has been fueled by a strong economy, historically low mortgage rates, and high demand for homes. More recently, though, we’ve seen some disruptions. So what’s going on?

The Influence of Mortgage Rates

Ah, mortgage rates—the heartbeat of home buying. These rates determine how much it costs to borrow money to purchase a home. Over the last few years, we’ve seen historically low interest rates, which created a surge of buyers in the market. When borrowing is cheap, more people jump into the game, creating competition that drives home prices up. As you can imagine, that’s great if you’re planning to sell, but tougher if you’re trying to buy.

Recently, however, there has been chatter about rising interest rates. Higher rates mean higher monthly payments, which can reduce the pool of potential buyers. In turn, this cools down the market and can lead to a slower pace of home price appreciation, or in some cases, even a decline. This trend is especially apparent in areas where the number of available homes is high, but demand is slowing down.

If you’re considering West Palm Beach mortgage brokers or even exploring West Palm Beach refinancing options, now might be the time to lock in a deal before rates climb higher. Finding the best mortgage rates in West Palm Beach can be the difference between paying an extra few thousand dollars over the course of a loan or keeping that money in your pocket.

Supply and Demand: A Simple Equation, Complicated Reality

Anyone who remembers their Economics 101 class knows that price is driven by supply and demand. This holds true in real estate as well. The fewer homes there are for sale, the higher home prices will go. Why? Because everyone wants a piece of the limited pie. Conversely, when the number of homes for sale increases, buyers have more options, and sellers might have to compete a little harder by lowering prices or offering concessions.

If you’re living in an area with a limited housing inventory, you’re likely seeing some strong home price appreciation. On the flip side, markets with a high saturation of homes might experience softer prices or even a slight decline. But remember, real estate is always local, so don’t assume national trends apply to your specific city. For the most accurate picture, it’s essential to get local insights from a knowledgeable real estate agent.

This is where working with a local agent becomes invaluable. They understand the microtrends that are invisible on a national scale. They know why a certain neighborhood is suddenly in demand or why a particular street is seeing a lot of price cuts. A local real estate agent will not only help you price your house accurately but will also guide you on when to sell, what offers to entertain, and how to make your property more attractive to potential buyers.

Local Markets: The Pulse of Real Estate

Let’s dive into the nitty-gritty of local markets because, again, real estate is always local. The homes that are listed in your neighborhood are influenced by local employment trends, population shifts, and even specific zoning laws. In regions where job markets are booming, such as West Palm Beach, there’s a higher demand for homes, which inevitably pushes prices up.

For anyone eyeing the West Palm Beach market, there’s a lot to unpack. The city has become a hot spot for buyers, thanks to its coastal charm and vibrant culture. However, with increased popularity comes increased competition, and as a result, home prices have seen significant gains in recent years.

If you’re a first-time buyer in the area, it’s crucial to explore first-time home buyer loans in West Palm Beach. These specialized loan programs can make it more affordable to break into a competitive market. In tandem with that, finding the best mortgage rates in West Palm Beach can help lower your overall costs.

The Role of Local Mortgage Brokers and Lenders

Securing a mortgage is one of the biggest steps when purchasing a home, and working with the right people can make all the difference. If you’re looking to buy or refinance, a West Palm Beach mortgage broker can help you navigate the process and connect you with the right financial products. They understand the ins and outs of the local market, including access to affordable West Palm Beach home loans and lenders who offer competitive rates.

Remember, it’s not just about finding a loan; it’s about finding the best mortgage rates in West Palm Beach and ensuring that the terms align with your financial situation. Using West Palm Beach mortgage calculators can help you get a better understanding of your borrowing capacity and how much home you can afford. Whether you’re exploring West Palm Beach refinancing options or trying to get mortgage preapproval in West Palm Beach, a solid game plan with local professionals can make a world of difference.

Commercial real estate is also part of this puzzle. A commercial mortgage broker in West Palm Beach can assist business owners and investors in securing loans for properties like office buildings or retail spaces. While residential properties are often the focus of attention, commercial properties also contribute to the overall housing market. Businesses bring jobs, and jobs bring people, which further fuels demand for homes.

Navigating the Market if You’re Thinking of Selling

Now, let’s shift gears. What if you’re on the other side of the transaction and planning to sell your home? The stakes are high, and the current market can feel both exhilarating and overwhelming. You want to maximize your sale price, but pricing too high can scare away potential buyers, while pricing too low might leave money on the table.

This is where it becomes essential to price your house accurately. When you work with a local real estate agent, they’ll conduct a comparative market analysis (CMA) to gauge how your home compares to others in the area. It’s all about striking the right balance. The agent will also have insights into what buyers are looking for right now, which can help in staging and marketing your home.

What’s Next for Home Prices?

The future of home prices is a question on many minds, and the truth is, it’s difficult to predict with certainty. There are so many moving parts: the economy, interest rates, and the overall demand for housing. That being said, most experts agree that we’re unlikely to see the double-digit growth we experienced in recent years continue indefinitely.

Rising mortgage rates may temper the housing market, especially in areas where affordability is already a concern. However, the fundamental demand for homes—driven by a growing population and limited housing stock in many areas—suggests that home prices are unlikely to plummet. Instead, we may see a more gradual and steady rise, which could benefit both buyers and sellers by creating a more stable market.

For now, anyone involved in the real estate market should stay informed and keep their ear to the ground. Whether you’re buying or selling, the local nuances of your market will determine your best course of action. With the guidance of a local agent or a West Palm Beach mortgage broker, you can make decisions that align with your financial goals and the realities of the market.

The road ahead may have twists and turns, but armed with knowledge and the right team, you’ll be well-prepared to navigate the exciting world of real estate!

The Subtle Dance Between Supply and Demand

As we journey deeper into the intricacies of home prices, let’s revisit the supply and demand conundrum. It’s easy to say, “Oh, fewer houses mean higher prices,” but what does that actually look like on the ground?

In certain neighborhoods, where new construction is rare or zoning restrictions limit expansion, the supply of homes can be incredibly tight. Think about historical districts or areas with high aesthetic or cultural value—these places are magnets for buyers. The result? Home price appreciation that seems to defy gravity. However, in regions where developers have been aggressively building, supply might outpace demand. If there are more homes on the market than there are buyers, prices stagnate or even drop.

Now, let’s zoom in on the West Palm Beach area. This sun-kissed city has experienced a surge in demand, but the availability of homes hasn’t kept pace. New developments are popping up, but there’s still fierce competition for desirable homes near the waterfront or in chic, revitalized neighborhoods. This is great news if you’re thinking of selling because the competition among buyers helps keep home prices high.

But what if the pendulum swings the other way? What if the influx of new homes starts to surpass demand? Well, that’s when having a keen understanding of your local market comes into play. Working with a local real estate agent who has a pulse on upcoming developments and buyer trends can give you the upper hand. They’ll help you read the market tea leaves, so to speak, allowing you to strategize your sale to match the local demand curve.

How Mortgage Rates Shape Buyer Behavior

Mortgage rates not only impact how much buyers can afford but also influence how fast or slow homes move off the market. In times of low interest rates, buyers often feel empowered. The affordability of borrowing creates a sense of urgency as people want to capitalize on favorable loan terms. That’s why markets boom when rates drop—demand skyrockets, which in turn drives home prices up.

However, as mortgage rates rise, we see the opposite effect. Buyers start to reassess their purchasing power. They might delay their plans or opt for smaller homes within their budget. This shift can cool off the market, resulting in slower price growth or, in some cases, price declines. Sellers in such a market need to adjust their expectations accordingly. If you’re planning to sell, pricing your home with precision is more important than ever.

To combat higher mortgage costs, buyers in the West Palm Beach area might turn to affordable West Palm Beach home loans or search for West Palm Beach refinancing options to manage their budgets effectively. While rate fluctuations may seem daunting, a savvy West Palm Beach mortgage broker can help buyers secure the best mortgage rates in West Palm Beach, making homeownership still an achievable dream despite rising rates.

The First-Time Buyer Dilemma

For first-time buyers, navigating a market with climbing prices and fluctuating interest rates can feel like a double-edged sword. The dream of homeownership is still alive and well, but the path is often more complex than it appears. The key to success lies in preparation—financial and emotional.

Many first-timers are opting for first-time home buyer loans in West Palm Beach, which can offer more favorable terms, including lower down payments and reduced interest rates. With home prices in the area continuing to climb, getting pre-approved for a mortgage is an essential step in staying competitive. By seeking mortgage preapproval in West Palm Beach, buyers signal to sellers that they’re serious and financially prepared, which can make all the difference in a multiple-offer situation.

Additionally, using a West Palm Beach mortgage calculator can help buyers stay within their financial comfort zone. It allows them to understand their monthly payment breakdown, factoring in taxes, insurance, and those all-important interest rates. This way, first-time buyers can avoid the common pitfall of getting in over their heads financially, ensuring their home purchase is a stepping stone, not a burden.

The Art and Science of Pricing Your Home

If you’re a seller, there’s an undeniable art to pricing your home—one that involves a delicate balance of market conditions, buyer psychology, and timing. The real estate market is in constant flux, and understanding how to price your house accurately can be the difference between a quick sale and a lingering listing.

In a booming market, sellers are often tempted to push their luck and list at a higher price, expecting buyers to engage in a bidding war. And while this tactic may have worked during peak times of home price appreciation, it’s riskier when market conditions are cooling or plateauing. Overpricing a home can lead to it sitting on the market longer, which often necessitates price reductions that could have been avoided with an initial accurate listing.

A local agent plays a pivotal role here. They bring invaluable local insights and understand the price trends of specific neighborhoods, ensuring that your home is priced competitively. An experienced agent won’t just look at what homes are selling for—they’ll dig deeper, analyzing comparable sales, current market trends, and the psychological impact of pricing. Is $499,999 more appealing than $500,000? Yes. And a good agent will know that subtle differences like this can affect a buyer’s perception of value.

In regions like West Palm Beach, where certain homes and neighborhoods are in high demand, the stakes are even higher. By aligning with a local professional, sellers can ensure they price their home to attract qualified buyers without leaving money on the table.

West Palm Beach: A Hotspot for Investment

If we narrow our lens to West Palm Beach, it’s clear that this region offers more than just beautiful weather. For investors, it’s a city filled with opportunity, both in the residential and commercial real estate markets. The growing economy, tourism, and influx of new residents make it a prime location for those looking to invest in property.

Commercial real estate, in particular, is becoming an attractive option. With the help of a commercial mortgage broker in West Palm Beach, investors can secure financing for everything from retail spaces to office buildings. As the business landscape of West Palm Beach expands, so does the demand for commercial properties. And while residential real estate is often in the spotlight, commercial properties play a critical role in driving the overall economy of the region. More businesses equal more jobs, which equals more demand for homes—a full-circle effect that reinforces the strength of the local housing market.

Property Loan Advice: The Key to Smart Home Financing

As we continue to explore the different facets of home prices and the housing market, one thing becomes crystal clear: financing is a cornerstone of any real estate transaction. Whether you’re a seasoned investor or a first-time home buyer, understanding your loan options is crucial to making the best financial decision.

For buyers in West Palm Beach, securing expert property loan advice in West Palm Beach is a critical step. Working with local mortgage lenders in West Palm Beach who understand the intricacies of the area can give you an advantage. These professionals offer tailored advice based on the specific financial landscape of the region, ensuring that you’re making well-informed decisions.

What Sellers Should Know About Working with a Local Agent

If you’re a seller in West Palm Beach, partnering with a local real estate agent is one of the smartest moves you can make. Not only will they provide you with an accurate valuation of your home, but they’ll also offer strategic advice on how to market your property effectively.

Local agents are embedded in the community. They understand the nuances of West Palm Beach’s neighborhoods, the types of buyers looking in specific areas, and how certain factors—such as proximity to schools, waterfront views, or local amenities—can influence pricing. With this knowledge, they’ll craft a marketing plan that highlights your home’s best features, ensuring it stands out in a crowded market.

Moreover, your agent can help you identify the best timing for your sale. By studying market trends, they can advise whether it’s best to list immediately or wait for a time when the number of homes for sale decreases, giving your property more exposure to eager buyers.

Final Thoughts: Where Do Home Prices Go From Here?

So, what’s the bottom line? Are home prices going up, down, or staying the same? The answer is—it depends. The real estate market is fluid, influenced by local dynamics, economic factors, and buyer behavior. While broad national trends give us a glimpse into the future, real estate is always local.

In West Palm Beach, the story continues to evolve. With the area’s increasing popularity, combined with fluctuating mortgage rates and shifting demand, home prices will likely remain robust, but not without some ebb and flow. Whether you’re looking to buy, sell, or invest, now is the time to lean on experts—whether that’s a local real estate agent, a West Palm Beach mortgage broker, or even an experienced lender offering West Palm Beach refinancing options.

As we move forward, staying informed and working with professionals who know your local market intimately will help you make the right choices. Whether you’re buying or selling, the housing market is a living, breathing entity, and your ability to navigate it depends on knowing where you stand and where it’s heading.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today