What’s Next for Home Prices and Mortgage Rates?

If you’re thinking of making a move this year, there are two housing market factors that are probably on your mind: home prices and mortgage rates. You’re wondering what’s going to happen next. And if it’s worth it to move now, or better to wait it out.

The only thing you can really do is make the best decision you can based on the latest information available. So, here’s what experts are saying about both prices and rates.

1. What’s Next for Home Prices?

One reliable place you can turn to for information on home price forecasts is the Home Price Expectations Survey from Fannie Mae – a survey of over one hundred economists, real estate experts, and investment and market strategists.

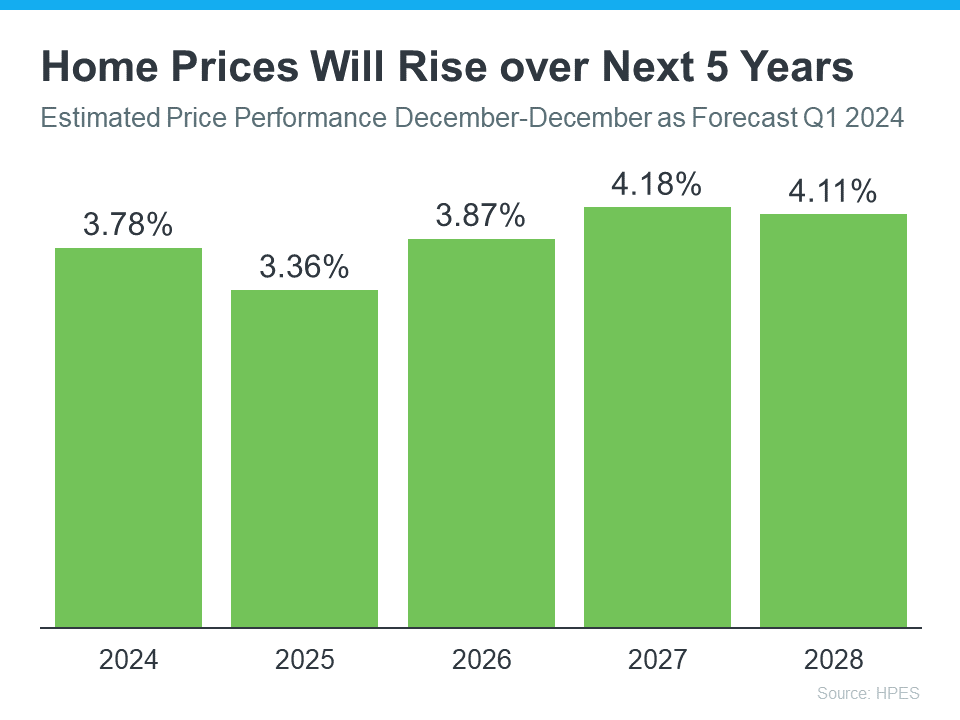

According to the most recent release, experts are projecting home prices will continue to rise at least through 2028 (see the graph below):

While the percent of appreciation varies year-to-year, this survey says we’ll see prices rise (not fall) for at least the next 5 years, and at a much more normal pace.

What does that mean for your move? If you buy now, your home will likely grow in value and you should gain equity in the years ahead. But, based on these forecasts, if you wait and prices continue to climb, the price of a home will only be higher later on.

2. When Will Mortgage Rates Come Down?

This is the million-dollar question in the industry. And there’s no easy way to answer it. That’s because there are a number of factors that are contributing to the volatile mortgage rate environment we’re in. Odeta Kushi, Deputy Chief Economist at First American, explains:

“Every month brings a new set of inflation and labor data that can influence the direction of mortgage rates. Ongoing inflation deceleration, a slowing economy and even geopolitical uncertainty can contribute to lower mortgage rates. On the other hand, data that signals upside risk to inflation may result in higher rates.”

What happens next will depend on where each of those factors goes from here. Experts are optimistic rates should still come down later this year, but acknowledge changing economic indicators will continue to have an impact. As a CNET article says:

“Though mortgage rates could still go down later in the year, housing market predictions change regularly in response to economic data, geopolitical events and more.”

So, if you’re ready, willing, and able to afford a home right now, partner with a trusted real estate advisor to weigh your options and decide what’s right for you.

Let’s connect to make sure you have the latest information available on home prices and mortgage rate expectations. Together we’ll go over what the experts are saying so you can make an informed decision on your move.

Buckle Up, Buttercup: A Wild Ride Through the Housing Market Maze – Home Prices, Mortgage Rates, and You!

Hey there, house hunters and home renovators! Let’s face it, the housing market these days feels like a high-speed rollercoaster – exciting, terrifying, and full of unexpected twists and turns. You’re probably wondering, with a mix of trepidation and starry-eyed optimism: what’s next for home prices and mortgage rates?

Fear not, fellow adventurers! We’re here to navigate this market maze together. Today, we’ll delve into the latest forecasts from industry soothsayers (aka real estate experts and the Home Price Expectations Survey), unpack the economic tea leaves, and explore some savvy strategies to make your dream home a reality.

First, buckle up for the home price forecast. While crystal balls are notoriously unreliable, the Home Price Expectations Survey offers a glimpse into the collective wisdom of over a hundred brainiacs – economists, real estate advisors, and market strategists. They predict a continued rise in home prices, albeit at a more moderate pace than the recent head-spinning years. So, if you can afford a home right now, and you find that perfect match, there’s a good chance it’ll be a solid investment in the long run.

Now, let’s talk about the mortgage rate monster lurking in the shadows. This one’s a bit more unpredictable. The Federal Reserve is grappling with inflation, and their decisions significantly impact mortgage rates. While some experts predict lower mortgage rates later this year, others caution that economic data and geopolitical events can throw a wrench into those predictions.

Here’s the thing: nobody has a magic eight ball for the housing market. But that doesn’t mean you’re powerless! Here are some battle-tested tips to navigate this ever-shifting landscape:

- Team Up with a Real Estate Ninja: A skilled real estate advisor is yourYoda in this market. They’ll have the local intel, negotiation prowess, and market knowledge to guide you through the jungle and snag the perfect property.

- Get Pre-Approved for a Mortgage: Knowledge is power, my friend. Pre-approval from a West Palm Beach mortgage broker gives you a clear picture of your affordability range and makes you a more attractive buyer to sellers.

- Explore All Your Options: Don’t be afraid to think outside the box. Consider affordable West Palm Beach home loans or first-time home buyer loans in West Palm Beach to make that dream home a reality.

- Stay Informed: Knowledge is power! Bookmark resources like West Palm Beach mortgage calculators and keep an eye out for the best mortgage rates in West Palm Beach.

- Consider Refinancing: If you’re already a homeowner, chat with a West Palm Beach refinancing expert. They can help you snag a lower rate and save you money in the long run.

Remember, the housing market may be a maze, but with the right tools and a dash of courage, you can find your way through. Don’t hesitate to connect with local mortgage lenders in West Palm Beach or a savvy commercial mortgage broker in West Palm Beach if you have specific needs.

The key is to be prepared, stay informed, and most importantly, don’t let the fear of the unknown hold you back. With a little planning and the right team by your side, you can conquer the housing market and turn that dream home into your reality!

Now, go forth and find your perfect piece of paradise!

Demystifying the Mortgage Maze: A Decoder Ring for Discerning Homebuyers

Okay, so we’ve established that the housing market is a thrilling yet perplexing adventure. We’ve talked about home prices and the potential for lower mortgage rates on the horizon. But let’s face it, mortgage rates can feel like a cryptic language reserved for financial wizards. Fear not, intrepid explorer! Let’s break down the basics and equip you with a decoder ring to navigate the mortgage maze.

First, understand the different types of mortgages:

- Fixed-Rate Mortgage: This is your steady Eddie, offering a consistent interest rate throughout the loan term. It provides peace of mind knowing your monthly payment won’t fluctuate.

- Adjustable-Rate Mortgage (ARM): This one’s a bit more dynamic. The interest rate adjusts periodically, typically every few years, based on a benchmark index. It can offer a lower initial rate, but comes with the risk of future increases.

Next, decipher the mortgage rate lingo:

- Interest Rate: This is the bread and butter, the percentage of the loan amount you pay each year for the privilege of borrowing the money. Lower rates translate to lower monthly payments.

- Annual Percentage Rate (APR): Consider the APR your “all-inclusive” price tag. It factors in the interest rate, plus any origination points, broker fees, and other charges associated with the loan.

Now, let’s explore some strategies to snag the best mortgage rate:

- Shop Around: Don’t settle for the first lender you encounter. Compare rates and terms from multiple West Palm Beach mortgage lenders. A little legwork can save you a significant chunk of change over the life of your loan.

- Boost Your Credit Score: This magic number significantly impacts your mortgage rate. Aim for a score above 740 to unlock the best rates.

- Consider a Larger Down Payment: Putting down a bigger chunk of cash upfront reduces the loan amount you need to borrow, potentially qualifying you for a lower mortgage rate.

Remember, a good mortgage lender is your partner in this journey. They’ll explain the different options, guide you through the application process, and advocate for you to get the best possible terms. Don’t hesitate to ask questions and express your specific needs.

Here are some bonus tips to sweeten the deal:

- Get Pre-Approved Before House Hunting: A pre-approval letter shows sellers you’re a serious contender and streamlines the offer process.

- Consider Private Mortgage Insurance (PMI): If your down payment is less than 20% of the purchase price, you might be required to pay PMI. However, some lenders offer options to cancel PMI once you reach a certain equity threshold in your home.

- Factor in Closing Costs: Don’t forget about the closing costs – origination fees, appraisals, title insurance, and the like. Factor these into your budget to avoid any surprises.

By understanding the different types of mortgages, deciphering the terminology, and employing these savvy strategies, you can transform yourself from a bewildered borrower to a mortgage master. Remember, knowledge is power in the housing market! So, equip yourself with the decoder ring, and approach your mortgage with confidence.

With the right tools and a dash of financial finesse, you can unlock the door to your dream home!

Beyond the Numbers: The Human Side of Homeownership

We’ve delved deep into the data and decoded the financial jargon, but let’s not forget the human element that makes homeownership so special. Owning a home isn’t just about bricks and mortar; it’s about building a sanctuary, a place to put down roots and create lasting memories.

Here’s how homeownership can enrich your life:

- A Sense of Stability: There’s a comforting feeling that comes with knowing you have your own space, a place to call your own. It fosters a sense of security and belonging.

- Building Equity: As you pay down your mortgage, you’re steadily building equity in your home. This creates a valuable asset that can contribute to your long-term financial well-being.

- A Canvas for Creativity: Your home is your blank canvas – a place to personalize and express your unique style. From weekend DIY projects to crafting a cozy atmosphere, it becomes a reflection of your personality.

- A Hub for Community: Homeownership can foster a sense of belonging to a neighborhood. You might connect with friendly neighbors, participate in local events, and build lasting relationships.

Now, let’s address some of the anxieties that often come with homeownership:

- The Fear of the Unknown: Unexpected repairs or maintenance issues can be daunting. However, with proper budgeting and preventative maintenance, you can minimize these surprises.

- Feeling Overwhelmed by the Process: The process of buying a home can feel overwhelming, from securing financing to navigating inspections and legalities. This is where a real estate advisor becomes invaluable. They’ll guide you through each step and ensure a smooth buying experience.

- The Financial Burden: Let’s be honest, homeownership comes with financial responsibility. However, with careful budgeting and planning, you can manage your mortgage payment and create a comfortable living situation.

Ultimately, the decision of whether or not to buy a home is a personal one. There’s no one-size-fits-all answer. Consider your long-term goals, financial situation, and lifestyle preferences before taking the plunge.

Here are some resources to empower you on your homeownership journey:

- Connect with a local West Palm Beach real estate advisor: They’ll provide invaluable insights into the local market and can help you find your dream home.

- Utilize West Palm Beach mortgage calculators: These online tools can help you estimate your monthly payments and understand the affordability range that aligns with your budget.

- Explore affordable West Palm Beach home loan options: If you’re concerned about affordability, there are government programs and lender options designed to assist first-time homebuyers.

Remember, homeownership is a journey, not a destination. Embrace the process, celebrate the milestones, and don’t be afraid to seek guidance from qualified professionals. With the right preparation and a supportive team by your side, you can turn the dream of homeownership into a beautiful reality.

So, are you ready to embark on this exciting adventure? Buckle up, grab your decoder ring, and let’s navigate the housing market together!

The Final Frontier: Frequently Asked Questions from Future Homeowners

We’ve covered a lot of ground, from deciphering mortgage rates to the emotional rewards of homeownership. But before you set sail on your house-hunting voyage, let’s address some frequently asked questions that might be swirling in your mind:

Q: Is this the right time to buy a home?

A: This is a question with no definitive answer. The “right” time depends on your individual circumstances. If you’ve found a stable job, saved a decent down payment, and interest rates seem manageable, then it might be a good time to explore your options. Remember, the housing market is cyclical, and there will always be ups and downs. Focus on your long-term goals and don’t get caught up in the fear of missing out.

Q: How much house can I afford?

A: Don’t get seduced by the allure of a McMansion if your budget screams “cozy bungalow.” A West Palm Beach mortgage broker can help you determine a comfortable loan amount based on your income, debts, and credit score. Remember, homeownership comes with additional expenses beyond the mortgage payment, so factor in property taxes, insurance, and potential maintenance costs.

Q: What if I’m a first-time homebuyer?

A: Don’t be intimidated! There are numerous resources available to first-time homebuyers. Government programs and affordable West Palm Beach home loan options can ease the financial burden. Additionally, a real estate advisor specializing in first-time buyers can guide you through the process and advocate for your needs.

Q: What are some red flags to watch out for during a home inspection?

A: A thorough home inspection is crucial before finalizing a purchase. Watch out for signs of foundation issues, major roof damage, or outdated electrical wiring. Don’t be afraid to ask the inspector questions and clarify any concerns you have.

Q: Should I consider fixer-upper or a move-in ready home?

A: This depends on your DIY skills and budget. Fixer-uppers can offer a lower initial price point, but be prepared for unexpected repair costs and potential delays. Move-in ready homes come with a premium but offer the convenience of immediate occupancy.

Remember, the key to a successful home buying journey is preparation and education. Utilize the resources available to you, connect with qualified professionals like West Palm Beach mortgage brokers and real estate advisors, and don’t be afraid to ask questions. With a little planning and a lot of excitement, you can transform the dream of homeownership into a cherished reality.

So, what are you waiting for? The perfect home awaits, brimming with possibilities and the promise of lasting memories. Set sail on your house-hunting adventure with confidence, and remember, we’re here to guide you every step of the way!

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today