Why a Condo Could Be Your Perfect First Home

If you’re looking to break into homeownership but the price of single-family homes has you second-guessing, you might want to consider a condominium (condo) or townhome. These types of homes often come with a lower barrier to entry – and that can help you start to build equity and enjoy the benefits of owning a home sooner.

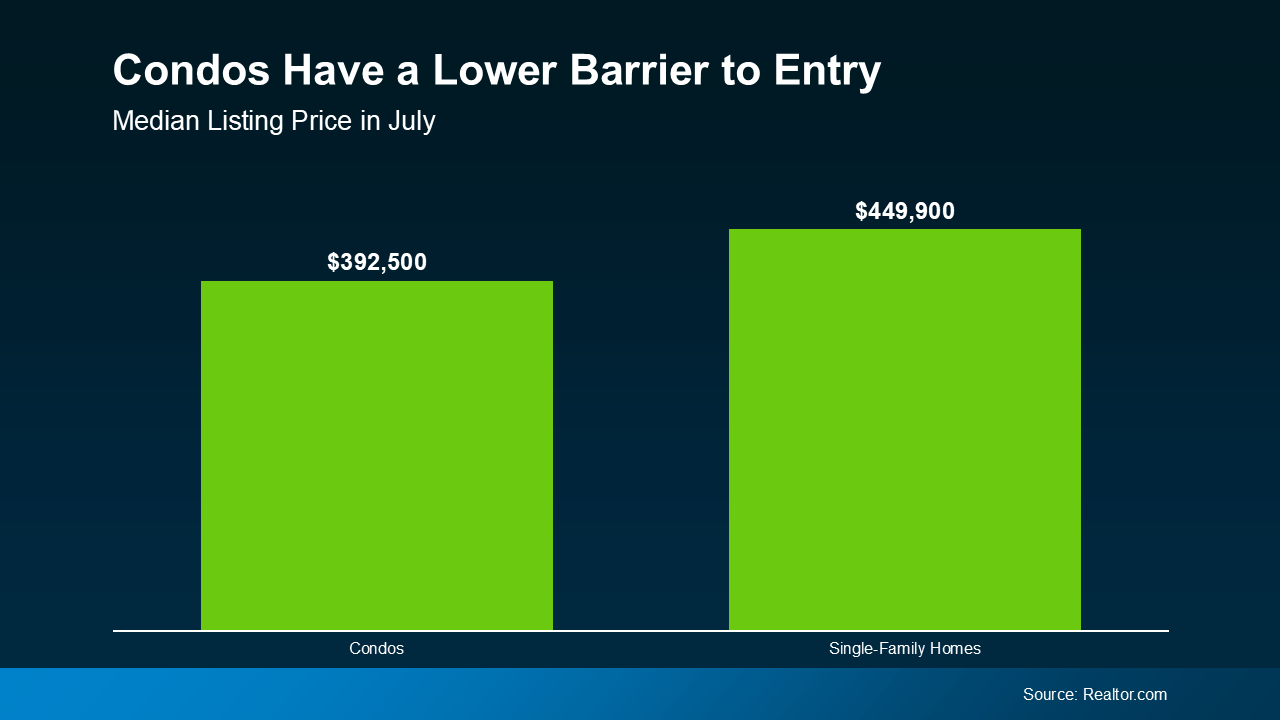

Since they’re usually smaller than single-family homes, they can be easier on your wallet. While it’s not always the case, smaller square footage usually comes with a smaller price tag too. As a result, according to the latest data from Realtor.com, condos typically have a lower asking price than single-family homes (see graph below):

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

And here’s some exciting news: builders are focusing more on homes like these. The National Association of Home Builders (NAHB) says:

“The share of townhomes being built is at an all-time high.”

That means there’s a good number of options to add to your home search if you broaden it to include condos and townhomes. And you may even find something that works better for your budget.

So, if you’re comfortable with a smaller space and want to buy your first home before the spring rush, adding these types of homes to your search might be your answer.

The Perks of a Condo Lifestyle

Living in a condo has a bunch of other perks, too. Let’s look closer at why condos are appealing for first-time buyers:

- They help you start building equity. When you buy a condo or townhome, you build equity and your net worth as you make your mortgage payments and as your condo’s value goes up over time.

- They can be low maintenance. Condos are great if you want to own your place but don’t want to mow the lawn, shovel snow, or fix the roof. Your real estate agent can help explain any associated fees and details for the condos you’re interested in.

- They usually come with a range of amenities. Your condo might come with access to a pool, dog park, or parking. And the best part? You don’t have to take care of any of them.

- They create a sense of community. Buying a condo means you’ll be living close to other people, which is nice if you want a more close-knit feel. Many communities like these hold fun events such as barbecues and parties to help create that sense of connection among residents.

Remember, your first home doesn’t have to be the one you stay in forever. The important thing is to get your foot in the door as a homeowner so you can start to gain home equity. Later on, that equity can help you buy another place if you want something different.

Ultimately, owning and living in a condo or townhome is a lifestyle choice. If you want to see if it makes sense for you, talk to a local real estate agent.

Ready to find a home that suits your goals? A condo might be the perfect fit for your first home purchase. Let’s connect today to start your search.

HERE’S MORE OF!

Why a Condo Could Be Your Perfect First Home

Purchasing your first home is one of the most exciting steps toward personal freedom and financial growth. However, navigating the world of real estate can feel overwhelming. With various types of homes available—such as single-family homes, condos, and townhomes—it’s essential to find the right fit for your lifestyle and budget. For many first-time buyers, buying a condo offers an ideal combination of affordability, convenience, and investment opportunity. If you’ve ever wondered why a condo could be your perfect first home, let’s explore what makes it an appealing choice.

1. Condos Are Great for First-Time Buyers

The process of a first home purchase can feel daunting. Between the home search, securing financing, and finding the right location, it’s easy to feel overwhelmed. This is where condos are great. They often come with a lower price tag compared to single-family homes, making them a budget-friendly option for young professionals, couples, or anyone taking that first step toward homeownership.

Condos usually have lower maintenance demands because shared amenities, like swimming pools or gyms, are maintained by a homeowners’ association (HOA). So, if you want to find a home with modern features but without the headache of constant repairs and yard work, living in a condo could be the perfect solution.

2. Build Equity: Why Condos Are Appealing for First-Time Buyers

One of the main benefits of buying a condo is that it allows you to start to build equity—the difference between what your home is worth and what you owe on your mortgage. When you make mortgage payments, part of the amount goes toward reducing the loan’s principal, which helps you start to gain home equity over time. This is a major reason people prefer owning and living in a condo or townhome over renting.

Every payment on your condo helps you build financial security and opens the door to future opportunities. You can leverage the equity you’ve accumulated to buy a larger home later or use it as a safety net during life’s unexpected moments. Your condo’s value also tends to increase with time, providing another avenue for wealth growth.

3. Townhomes Being Built and Other Affordable Options

The current real estate landscape offers exciting options for first-time buyers. New townhomes being built often come with energy-efficient designs and smart-home technology. But for those who want to buy a condo or townhome, older buildings in great locations offer charm and affordability. In places like West Palm Beach, for example, you can explore a variety of condos and townhomes that match your needs.

Speaking of location, first-time home buyer loans in West Palm Beach are designed to help buyers secure their first home purchase without a hefty down payment. Local resources, such as a West Palm Beach mortgage broker or local mortgage lenders in West Palm Beach, offer competitive financing options that can make buying a condo in the area an attractive choice.

4. Benefits of Owning a Home: The Perks of Condo Living

The benefits of owning a home extend beyond financial returns. Living in a condo offers lifestyle perks that many homeowners appreciate, especially when compared to larger homes with yards to maintain. For example, condo communities often feature shared amenities like fitness centers, swimming pools, or rooftop lounges—perks that can rival luxury resorts.

Condos also foster a strong sense of community. Social activities and shared spaces encourage neighbors to connect, creating a lifestyle that blends privacy with camaraderie. Many buyers appreciate these perks when deciding whether to buy your first home in a condo or opt for other types of homes.

5. Financing Made Easy: Talk to a Local Real Estate Agent

When you’re ready to buy your first home, working with your real estate agent can help streamline the process. A good agent will guide you through the home search, explain market trends, and connect you with the right mortgage providers. In cities like West Palm Beach, a West Palm Beach mortgage broker can help you explore affordable West Palm Beach home loans tailored to your needs.

If you’re unsure about your financing options, you can use West Palm Beach mortgage calculators to estimate your monthly payments. These tools help you understand how much home you can afford and determine whether buying a condo makes sense for your budget. Additionally, mortgage preapproval in West Palm Beach allows you to secure financing before house hunting, giving you a competitive edge when you find a home you love.

6. Your Perfect First Home: Is a Condo Right for You?

Choosing between types of homes—whether a condo, single-family home, or townhome—requires careful thought. Each comes with its own advantages. Buying a condo makes sense for those looking to build a financial foundation while enjoying a low-maintenance lifestyle. And because condos are great for first-time buyers, they remain popular in urban centers and vacation destinations alike.

In areas like West Palm Beach, buying a condo can be especially appealing due to proximity to beaches, vibrant nightlife, and year-round sunshine. Whether you need commercial mortgage broker in West Palm Beach services for an investment property or want to explore West Palm Beach refinancing options for better interest rates, there’s a wealth of local expertise to guide you.

7. Condos vs. Single-Family Homes: Which is the Better Investment?

For many buyers, the choice between a condo and a single-family home boils down to lifestyle preferences and long-term goals. Condos are easier to maintain, and the HOA takes care of most of the upkeep. On the other hand, single-family homes offer more privacy and land but often come with higher costs and more responsibilities.

If your priority is to start to build equity quickly, buying a condo is a smart move. Condos also tend to appreciate steadily over time, meaning your condo’s value can grow while you enjoy the benefits of homeownership. Plus, when the time comes, you can sell your condo and use the equity as a down payment on your next home.

8. Your Mortgage Payments: Managing Costs and Growing Your Investment

When you purchase your first condo, your mortgage payments play a crucial role in building your financial future. Each payment reduces the principal loan amount and increases your home equity. Over time, your investment grows, and you gain more options—whether it’s refinancing for a lower interest rate or selling to upgrade to a larger property.

Using tools like West Palm Beach mortgage calculators, you can better plan your finances and understand how affordable West Palm Beach home loans fit into your budget. West Palm Beach refinancing options also provide opportunities to lower your interest rate, making your mortgage even more manageable.

Conclusion: Why a Condo Could Be Your Perfect First Home

Buying a condo offers a balance of affordability, convenience, and growth potential—making it an excellent choice for those starting their journey into homeownership. Whether you want to buy a condo or townhome, the right property will give you a chance to start to gain home equity while enjoying a low-maintenance lifestyle.

If you’re considering buying a condo in West Palm Beach, talk to a local real estate agent for guidance. With access to the best mortgage rates in West Palm Beach and help from a West Palm Beach mortgage broker, your dream of owning your first home can become a reality. Your real estate agent can help you every step of the way—from finding the perfect property to securing the best financing options available.

A condo could be your perfect first home, offering not just a place to live but also an investment in your future. Start your journey today and take the first steps toward a life of stability, security, and satisfaction.

9. How Owning a Condo Sets the Stage for Future Investments

Investing in real estate is often considered a stepping stone toward long-term wealth. Owning and living in a condo or townhome can be your launchpad into the world of real estate investment. With each mortgage payment, your equity grows, giving you leverage for future ventures. For example, you could use the equity from your condo to secure a down payment on a single-family home or even invest in multiple types of homes later.

Many first-time buyers eventually upgrade from their condo to a larger property once their financial situation improves or their family expands. However, instead of selling, you could consider renting your condo to generate passive income. This is where partnering with a local mortgage lender in West Palm Beach becomes invaluable—they can guide you through options like rental property loans or even help with West Palm Beach refinancing options to unlock additional funds.

In high-demand markets, such as West Palm Beach, condos are great for rental income. Vacationers and seasonal residents are always on the lookout for well-located properties, which can make your condo a profitable investment even after you move on to your next home.

10. The Role of Homeowner’s Associations in Condo Living

One unique aspect of living in a condo is the presence of a homeowners’ association (HOA). While some see HOA fees as a drawback, they are, in fact, an asset. These fees cover essential services, such as building maintenance, landscaping, and shared amenities, allowing you to enjoy a hassle-free lifestyle. This makes buying a condo appealing to individuals who prefer convenience over the demands of owning a larger property.

Before you buy a condo, make sure to review the HOA’s rules and financial standing. A well-managed HOA adds value to the property by ensuring the building is well-maintained, which in turn contributes to your condo’s value over time. This is where your real estate agent can help—they can guide you through the HOA documents to ensure you’re making a sound investment.

11. Choosing the Right Mortgage for Your First Condo

When buying your perfect first home, selecting the right financing plan is critical. Exploring the best mortgage rates in West Palm Beach will help you secure a loan that matches your financial goals. Many first-time home buyer loans in West Palm Beach offer lower interest rates and require minimal down payments, making it easier to step into homeownership.

Working with a West Palm Beach mortgage broker ensures you have access to the most competitive loan packages. If you want to assess your options yourself, West Palm Beach mortgage calculators are great tools for estimating monthly payments and interest rates. You’ll also want to seek property loan advice in West Palm Beach, especially if you are considering refinancing later to reduce your mortgage payments.

Preapproval is another key step in the process. With mortgage preapproval in West Palm Beach, you’ll know exactly how much you can borrow before you start your home search. This makes your offer more attractive to sellers, especially in competitive markets where multiple buyers are vying for the same property.

12. Buying a Condo or Townhome: Flexibility in Lifestyle

Another reason condos and townhomes appeal to first-time buyers is the flexibility they offer. Unlike single-family homes, which often come with large yards and extensive upkeep, condos provide a low-maintenance lifestyle, perfect for those who prioritize leisure and travel.

Whether you’re a young professional, a small family, or someone seeking a vacation home, buying a condo provides the ideal balance of comfort and convenience. The flexibility of condo living allows you to focus on what matters most—whether it’s advancing your career, traveling, or simply enjoying the amenities your building offers.

Many people who buy a condo or townhome also appreciate the safety and security these properties provide. Gated entrances, 24-hour security, and concierge services are common features in condo complexes, giving residents peace of mind.

13. Partnering with the Right Real Estate Professionals

The journey to buy your first home is smoother when you have the right team on your side. A knowledgeable West Palm Beach mortgage broker or local mortgage lender in West Palm Beach can connect you with affordable financing solutions. Meanwhile, your real estate agent can help you find the perfect property that aligns with your goals.

If you’re planning to invest in a commercial property down the road, it’s also wise to develop a relationship with a commercial mortgage broker in West Palm Beach. They can provide insight into real estate trends and help you expand your portfolio when the time is right.

In a dynamic market like West Palm Beach, it’s crucial to stay informed. Keep an eye on West Palm Beach refinancing options, especially if interest rates drop. Refinancing can significantly reduce your mortgage payments, freeing up cash for future investments or personal expenses.

14. Condos Offer Community and Convenience

One of the lesser-known perks of living in a condo is the sense of community it fosters. Many condo residents enjoy social events organized by the HOA, from holiday parties to fitness classes. If you’re moving to a new city, like West Palm Beach, owning and living in a condo or townhome offers an easy way to meet new people and make friends.

Condos are also strategically located near urban centers, making it easy to enjoy restaurants, shopping, and entertainment. Whether you’re seeking a quiet retreat or an active social life, finding a home in a condo community lets you tailor your lifestyle to fit your needs.

15. Start Building Your Future with Your Perfect First Home

Taking the leap into homeownership is a milestone worth celebrating. Choosing a condo as your first home not only provides a place to live but also sets you on a path to financial growth. As you start to build equity, each mortgage payment becomes a step toward a brighter, more secure future.

In vibrant markets like West Palm Beach, condos are great investments that offer both lifestyle benefits and long-term value. Whether you’re drawn by the sunny beaches or the thriving job market, buying a condo in this area gives you the opportunity to plant roots in a place you love. With the right team by your side—from your real estate agent to a trusted West Palm Beach mortgage broker—you’ll have the support you need to make the best decisions.

Remember, your perfect first home doesn’t have to be a sprawling estate or a fixer-upper. A cozy condominium can be the ideal starting point—a place where you can grow, thrive, and build the life you’ve always dreamed of.

So, if you’re ready to take the next step, start your home search today. Talk to a local real estate agent, explore West Palm Beach mortgage calculators, and get preapproved for a loan. With the right planning and a little guidance, buying a condo could be the key to unlocking your future.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today