Why It’s More Affordable To Buy a Home This Year

Some Highlights

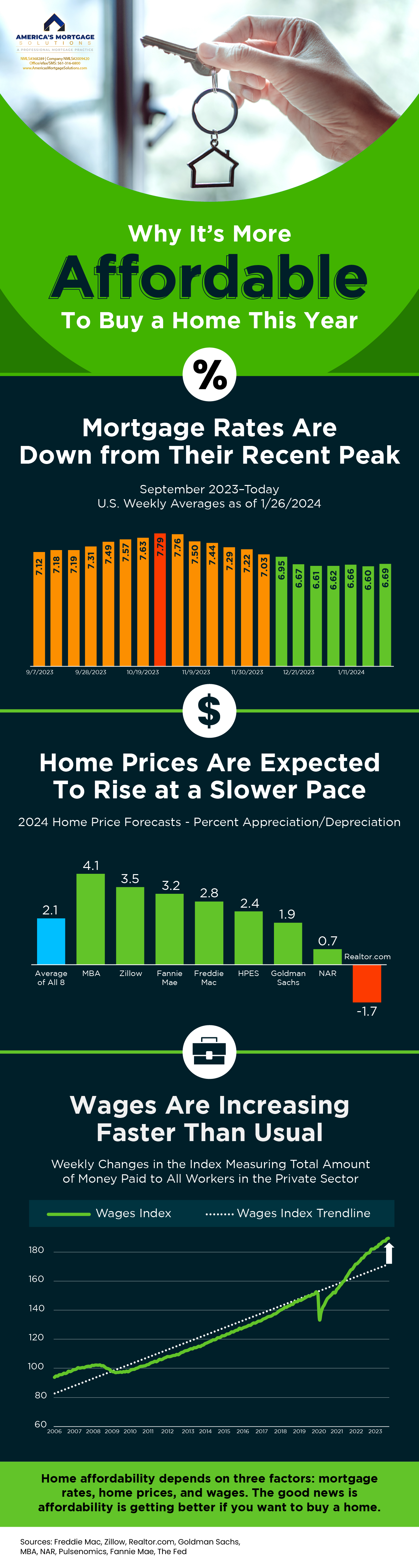

- Home affordability depends on three factors: mortgage rates, home prices, and wages.

- Mortgage rates are down from their recent peak, home prices are expected to rise at a slower pace, and wages are increasing faster than usual.

- That’s good news if you want to buy a home because it means affordability is getting better.

Unveiling the Affordability Enigma: Why It’s the Ideal Time to Buy a Home in 2024

In the intricate tapestry of real estate, prospective homeowners often find themselves navigating the labyrinth of home affordability, an ever-shifting landscape influenced by an array of factors. This year, however, seems to present a unique constellation of circumstances that tilts the scales favorably for those contemplating the monumental decision to buy a home.

The Intricacies of Home Affordability

Let’s unravel the enigma surrounding home affordability in the current market scenario. The amalgamation of several elements has given rise to a paradoxical situation, where dreams of homeownership seem more within reach than ever before.

The Puzzling Dynamics of Home Prices

First and foremost, let’s address the ever-present elephant in the room – home prices. Contrary to conventional wisdom, 2024 has witnessed a rather intriguing dip in the pricing panorama. This unexpected downturn has created a tantalizing window of opportunity for potential homeowners.

Despite the intricacies of the real estate market, the stars seem to have aligned, resulting in a momentary equilibrium where home prices are not skyrocketing as in previous years. This phenomenon, albeit temporary, provides a golden gateway for savvy individuals contemplating the decision to invest in their own piece of the property puzzle.

In the realm of real estate vernacular, this trend can be attributed to a confluence of factors, such as economic recalibrations, regional market dynamics, and a general recalibration of property valuations. The astute observer can seize this juncture to capitalize on the rare serendipity of softened home prices.

Decoding the Cryptic Language of Mortgage Rates

No discourse on home affordability is complete without delving into the cryptic language of mortgage rates. In the grand tapestry of property acquisition, these rates wield a substantial influence on the financial feasibility of taking the homeownership plunge.

2024 has unveiled a remarkable trend in the world of mortgage rates. Financial landscapes, akin to shifting sand dunes, have sculpted an environment where these rates are seemingly more amenable to the aspiring homeowner. The subtle dance of fiscal policies and global economic currents has conspired to create a fortuitous alignment, enabling individuals to secure mortgages at rates that defy the expectations of yesteryears.

As prospective buyers explore the intricacies of securing a mortgage, the current scenario provides a unique window of opportunity. The symbiotic dance between supply and demand, coupled with global economic shifts, has created an environment where mortgage rates are not merely numbers on a screen but gateways to unprecedented affordability.

The Symbiotic Dance of Economic Forces

In the labyrinth of real estate dynamics, the convergence of these factors paints a picture of economic forces engaged in a symbiotic dance, choreographed by unseen hands. The result? An unprecedented juncture where the dream to buy a home becomes not just a whimsical aspiration but a tangible and pragmatic goal.

Navigating the Landscape of Opportunity

For those contemplating the leap into homeownership, it’s crucial to recognize the nuances of this unique landscape. The serendipitous alignment of softened home prices and accommodating mortgage rates is akin to finding the proverbial needle in the haystack – a rare occurrence that demands astute attention.

As you traverse this landscape, consider leveraging the resources at your disposal. Engage with seasoned real estate professionals who can decode the cryptic nuances of the market for you. Arm yourself with knowledge, for in the world of real estate, information is the true currency.

The Verdict: A Moment in Time

In the grand scheme of the real estate saga, 2024 emerges as a moment in time – a juncture where the astute and the visionary can seize the reins of opportunity. The perplexing puzzle of home affordability, with its pieces shaped by home prices and mortgage rates, beckons those with the courage to embrace the prospect of homeownership.

In conclusion, the decision to buy a home this year transcends the realm of mere financial investment. It becomes a strategic move, a calculated dance with the economic forces that shape our world. As the curtain rises on this chapter, the question lingers – will you be a passive spectator, or will you step onto the stage and partake in the grand narrative of homeownership?

Navigating the Terrain: Strategic Considerations for Prospective Homebuyers

As we unravel the layers of the home affordability enigma, it’s imperative to consider the strategic facets that can amplify the benefits of the current market dynamics. The decision to buy a home is not merely a transaction; it’s a journey that demands foresight, meticulous planning, and a nuanced understanding of the economic currents at play.

Embracing the Calculated Risks

In the labyrinth of real estate, risk and reward coexist as inseparable companions. This is particularly true for those contemplating the plunge into homeownership. The current climate, with its softened home prices and accommodating mortgage rates, presents an enticing backdrop for those willing to embrace calculated risks.

Consider this juncture not as a fleeting anomaly but as an opportunity to lay the foundations of long-term financial stability. The strategic acquisition of a property in 2024 can be akin to planting seeds in fertile soil, with the potential to reap bountiful rewards as the real estate landscape evolves.

The Dance of Financial Literacy

In the symphony of real estate, financial literacy emerges as the conductor orchestrating harmonious transactions. As you embark on the journey to buy a home, cultivate a deep understanding of your financial landscape. Evaluate your creditworthiness, explore financing options, and decipher the intricate language of real estate finance.

A nuanced comprehension of your financial standing empowers you to navigate the terrain with confidence. Leverage tools and resources to enhance your financial literacy, transforming the complex choreography of real estate transactions into a dance where you lead with informed decisions.

Seizing the Window of Opportunity

The concept of seizing the moment is not a romantic notion confined to literature; it is a practical strategy in the world of real estate. The current convergence of softened home prices and accommodating mortgage rates constitutes a window of opportunity that beckons to be seized.

As you embark on the journey to buy a home, consider aligning your aspirations with this opportune moment. Explore diverse neighborhoods, assess property values, and engage with local real estate experts who can provide insights into burgeoning pockets of growth. The strategic buyer views this juncture not as happenstance but as a calculated move in the grand chess game of property acquisition.

Future-Proofing Through Location

One of the often-overlooked facets of home affordability is the role of location. Beyond the ephemeral dance of home prices and mortgage rates, the geographical positioning of your investment plays a pivotal role in its long-term viability.

Consider areas poised for growth, where economic development and infrastructure projects signal a promising future. A shrewd investment in a locale with potential appreciation can serve as a hedge against market fluctuations, ensuring that your venture into homeownership is not just a present triumph but a future-proofed legacy.

The Art of Negotiation in Real Estate

In the world of property acquisition, the art of negotiation is an invaluable skill. The softened stance of home prices in 2024 provides a fertile ground for astute negotiators to craft advantageous deals. Whether you’re a first-time homebuyer or a seasoned investor, honing your negotiation skills can be the key to unlocking hidden value in the real estate market.

Approach negotiations with a strategic mindset. Research comparable sales, understand the seller’s motivations, and be prepared to articulate your position with clarity. The ability to navigate the delicate dance of negotiation transforms a potential transaction into a symbiotic agreement, benefiting both parties involved.

The Epiphany of Homeownership

In the grand narrative of life, the decision to buy a home is not merely a financial transaction; it’s an epiphany, a realization of a fundamental human aspiration. As you navigate the intricacies of the current real estate landscape, consider the profound impact of homeownership on your life’s tapestry.

Beyond the economic calculus lies the intangible essence of belonging, security, and the freedom to shape your living space according to your vision. The softened home prices and accommodating mortgage rates of 2024 serve as facilitators, making this epiphany more accessible than ever.

Conclusion: Unveiling the Tapestry of Opportunity

In the intricate mosaic of the real estate market, the year 2024 emerges as a chapter laden with opportunity for those poised to embark on the journey to buy a home. The softened home prices and accommodating mortgage rates constitute not just market dynamics but invitations to partake in a transformative experience.

As you navigate this landscape, consider the strategic dimensions of your decision. Embrace calculated risks, cultivate financial literacy, seize the window of opportunity, and master the art of negotiation. In doing so, you transform the act of homeownership from a mere transaction into a profound chapter in the story of your life.

The tapestry of opportunity awaits – will you be the weaver of your destiny?

Unraveling the Threads: Sustainability and Long-Term Vision in Homeownership

Sustainability in Homeownership: Beyond the Transaction

In the ever-evolving realm of real estate, the pursuit of sustainability has transcended the confines of environmental consciousness to encompass the very fabric of homeownership. As you embark on the endeavor to buy a home in 2024, consider the sustainability not just of the property itself but of the broader community and your long-term financial well-being.

Eco-conscious Investments

The resonance of sustainability echoes through the choices you make as a homeowner. Look for properties that integrate eco-friendly features, from energy-efficient appliances to sustainable building materials. In the tapestry of modern living, the emphasis on environmental stewardship adds a layer of conscientiousness to the act of homeownership.

Furthermore, delve into the community’s commitment to sustainability. Are there green spaces, recycling initiatives, or local environmental projects? Embracing a home within a community that values sustainability contributes not only to your quality of life but also to the enduring value of your investment.

Beyond Market Trends: Crafting a Long-Term Vision

While the allure of softened home prices and accommodating mortgage rates may dominate current market discussions, a seasoned homeowner understands the importance of crafting a long-term vision. The decision to buy a home is an investment not only in the present but in the tapestry of your future.

Adaptable Spaces for Dynamic Lives

Consider the adaptability of the property to the dynamic shifts in your life. Does it accommodate potential expansions, or is it a space that can evolve with your changing needs? The ability of a home to seamlessly integrate with the evolving chapters of your life adds an enduring layer to its value.

In the landscape of modern living, homeowners are not merely inhabitants but curators of their spaces. The softened home prices of 2024 provide an entry point for individuals to explore properties that align with their vision for the long haul. It’s not just about purchasing a dwelling; it’s about investing in a canvas upon which the chapters of your life unfold.

Leveraging Technological Advancements

As the digital age unfolds, the integration of technological advancements into the realm of homeownership becomes an integral consideration. Beyond the dance of home prices and mortgage rates, explore properties that leverage smart home technologies, providing a seamless interface between your lifestyle and the modern conveniences that technology affords.

The interconnectedness of smart home ecosystems not only enhances your daily living experience but also contributes to the long-term efficiency and sustainability of your dwelling. In the grand narrative of homeownership, staying abreast of technological trends becomes a strategic move, ensuring that your investment remains relevant and resilient in the face of advancing innovations.

The Heritage of Homeownership

In the pursuit of home affordability, it’s essential to recognize the heritage embedded within the concept of homeownership. Beyond the tangible aspects of property values and mortgage rates, there exists a legacy that transcends generations.

Community Integration and Legacy Building

Consider the community in which you plant your homeownership roots. Is it a locale where community engagement and legacy building thrive? The softened home prices of 2024 present an opportune moment to not only invest in a property but to become an integral part of a community’s narrative.

Engage with local initiatives, support neighborhood businesses, and foster connections that extend beyond property lines. The enduring value of homeownership lies not only in the bricks and mortar but in the stories woven into the community fabric. As you embark on this journey, recognize the opportunity to contribute to and inherit the rich heritage of homeownership.

The Final Brushstroke: Crafting Your Narrative

In the vast canvas of real estate possibilities, the decision to buy a home in 2024 represents more than a financial transaction; it’s a brushstroke in the masterpiece of your life. The softened home prices and accommodating mortgage rates serve as pigments on this canvas, allowing you to paint a vibrant and enduring narrative.

As you navigate the landscape of home affordability, remember to infuse your journey with sustainability, long-term vision, and an appreciation for the heritage of homeownership. Beyond the transactional nature lies an opportunity to shape not only your dwelling but the legacy you leave for future generations.

In the tapestry of homeownership, you are not merely a spectator; you are the artist, crafting a narrative that resonates through time. Embrace the softened canvas of 2024, and let your homeownership story be a testament to the artistry of intentional living.

Read from source: “Click Me”

Questions, Comments or For more information you can call

Christian Penner Branch Manager at 561-316-6800 or email us at TheMortgageTeam@ChristianPenner.com

Approval Hotline: 561-316-6800

Helping You Achieve the American Dream of Home Ownership

Or You can click “Call Me” below to call Christian Penner directly using Google Voice

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Get Pre-Approved Today